Valid Illinois Operating Agreement Template

When forming a limited liability company (LLC) in Illinois, one crucial step is drafting an Operating Agreement. This document serves as the backbone of the LLC, outlining the internal workings and governance of the business. It addresses key aspects such as ownership percentages, management structure, and the distribution of profits and losses among members. By clearly defining roles and responsibilities, the Operating Agreement helps prevent misunderstandings and disputes down the line. Additionally, it can specify procedures for adding new members, handling member exits, and managing day-to-day operations. Having a well-crafted Operating Agreement not only provides clarity for current members but also enhances the LLC's credibility with banks and potential investors. Ultimately, this document is essential for ensuring that all members are on the same page and that the LLC operates smoothly and efficiently.

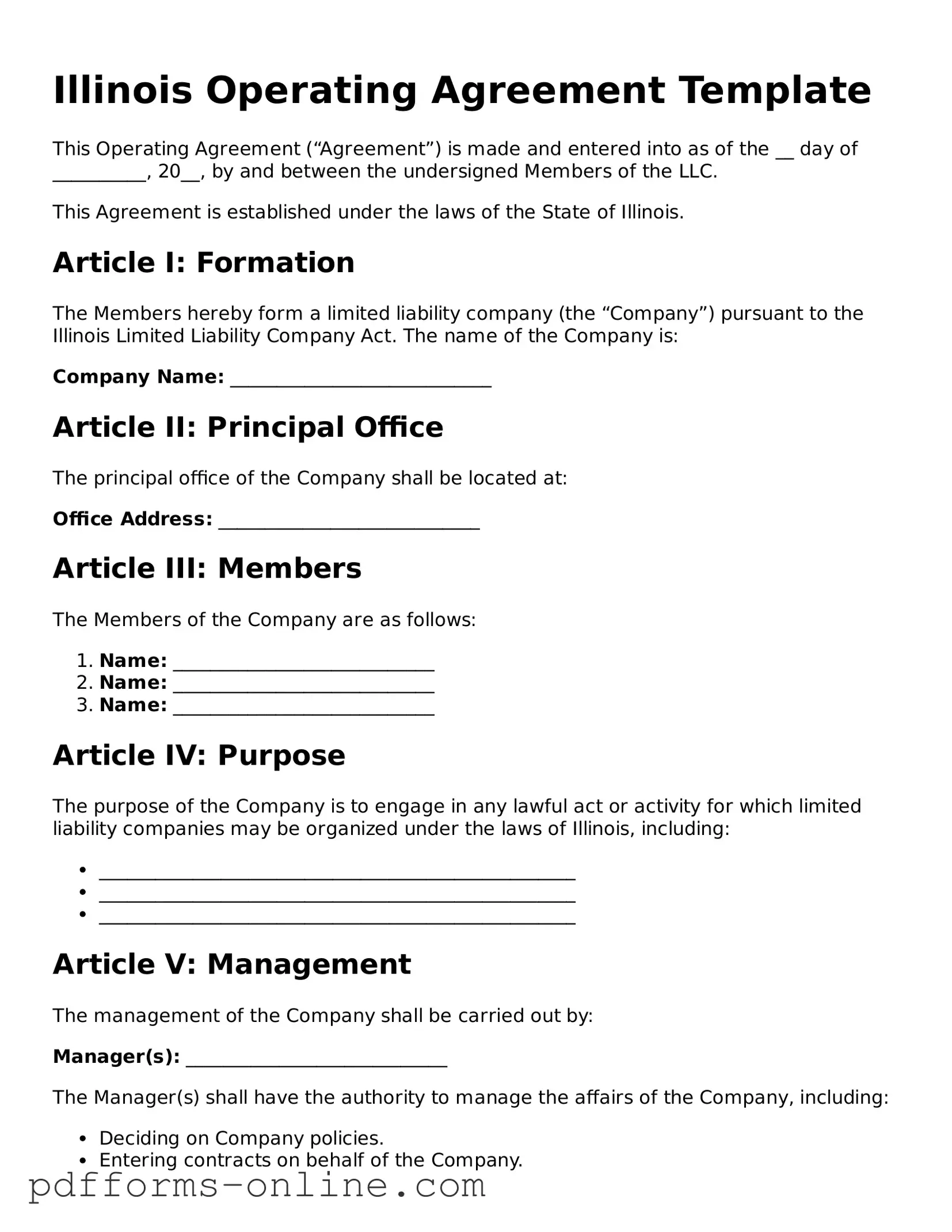

Document Example

Illinois Operating Agreement Template

This Operating Agreement (“Agreement”) is made and entered into as of the __ day of __________, 20__, by and between the undersigned Members of the LLC.

This Agreement is established under the laws of the State of Illinois.

Article I: Formation

The Members hereby form a limited liability company (the “Company”) pursuant to the Illinois Limited Liability Company Act. The name of the Company is:

Company Name: ____________________________

Article II: Principal Office

The principal office of the Company shall be located at:

Office Address: ____________________________

Article III: Members

The Members of the Company are as follows:

- Name: ____________________________

- Name: ____________________________

- Name: ____________________________

Article IV: Purpose

The purpose of the Company is to engage in any lawful act or activity for which limited liability companies may be organized under the laws of Illinois, including:

- ___________________________________________________

- ___________________________________________________

- ___________________________________________________

Article V: Management

The management of the Company shall be carried out by:

Manager(s): ____________________________

The Manager(s) shall have the authority to manage the affairs of the Company, including:

- Deciding on Company policies.

- Entering contracts on behalf of the Company.

- Managing the Company's finances.

Article VI: Ownership and Capital Contributions

The Members agree to make initial capital contributions as follows:

- Member Name: ____________ Amount: $___________

- Member Name: ____________ Amount: $___________

- Member Name: ____________ Amount: $___________

Article VII: Distributions

Distributions shall be made to the Members in accordance with their ownership percentages. Additional provisions regarding distributions can be established as necessary.

Article VIII: Miscellaneous

This Agreement may be amended only by a written agreement signed by all Members. In case any provision hereof is held to be invalid, the remaining provisions shall continue in full force and effect.

IN WITNESS WHEREOF, the Members have executed this Operating Agreement as of the date first above written.

Member Signatures:

_____________________________ Date: __________

_____________________________ Date: __________

_____________________________ Date: __________

Frequently Asked Questions

-

What is an Illinois Operating Agreement?

An Illinois Operating Agreement is a legal document that outlines the management structure and operational procedures of a Limited Liability Company (LLC) in Illinois. This agreement serves as a foundational document that governs the relationship between members, detailing their rights, responsibilities, and the distribution of profits and losses.

-

Is an Operating Agreement required in Illinois?

While Illinois law does not mandate that all LLCs have an Operating Agreement, it is highly recommended. Having an Operating Agreement can help prevent misunderstandings among members and provide clear guidelines for the operation of the business. Without it, the LLC will be governed by default state laws, which may not align with the members' intentions.

-

Who should draft the Operating Agreement?

The Operating Agreement can be drafted by any member of the LLC, but it is advisable to consult with a legal professional. A lawyer can ensure that the agreement complies with Illinois law and adequately reflects the members' wishes. This is particularly important if the LLC has multiple members or complex operational needs.

-

What should be included in the Operating Agreement?

An effective Operating Agreement typically includes the following sections:

- Identification of the members

- Management structure (member-managed or manager-managed)

- Voting rights and procedures

- Distribution of profits and losses

- Procedures for adding or removing members

- Dispute resolution methods

- Amendment procedures

-

Can the Operating Agreement be amended?

Yes, the Operating Agreement can be amended. The process for making amendments should be clearly outlined within the agreement itself. Typically, a specified percentage of members must agree to any changes. It is crucial to document amendments in writing to maintain clarity and avoid future disputes.

-

How does an Operating Agreement protect members?

The Operating Agreement provides a layer of protection for members by clearly defining their roles, responsibilities, and rights. It can help prevent conflicts by establishing procedures for decision-making and profit distribution. Furthermore, having a written agreement may protect members from personal liability in certain situations.

-

What happens if there is no Operating Agreement?

If an LLC does not have an Operating Agreement, it will be governed by the default rules set forth in the Illinois Limited Liability Company Act. These default rules may not align with the specific needs or intentions of the members, potentially leading to disputes and misunderstandings about management and profit-sharing.

-

Is it necessary to file the Operating Agreement with the state?

No, the Operating Agreement does not need to be filed with the state of Illinois. It is a private document that should be kept on file with the LLC’s records. However, members should ensure that all members have access to the agreement and that it is updated as necessary.

-

Can an Operating Agreement be used for other types of business entities?

While the Operating Agreement is specifically designed for LLCs, other business entities may have similar documents. For example, corporations have bylaws, and partnerships may have partnership agreements. Each of these documents serves a similar purpose: to outline the structure and operations of the business.

Misconceptions

Many people have misconceptions about the Illinois Operating Agreement form. Understanding these can help clarify its purpose and importance. Here are eight common misconceptions:

- It is not necessary for all LLCs. Some believe that an operating agreement is optional for all LLCs in Illinois. In reality, while it is not legally required, having one is highly recommended to outline the management structure and operating procedures.

- It is only for multi-member LLCs. Many think that only LLCs with multiple members need an operating agreement. However, even single-member LLCs benefit from having a formal document to clarify ownership and operational guidelines.

- It must be filed with the state. Some assume that the operating agreement needs to be submitted to the Illinois Secretary of State. This is incorrect; the agreement is an internal document and does not need to be filed.

- It cannot be modified. There is a belief that once an operating agreement is created, it cannot be changed. In fact, members can amend the agreement as needed to reflect changes in the business or membership.

- It is the same as the Articles of Organization. Some confuse the operating agreement with the Articles of Organization. The Articles are a public document filed with the state to form the LLC, while the operating agreement is a private document that governs the LLC's operations.

- It only addresses financial matters. Many think the operating agreement solely focuses on finances. In truth, it covers a wide range of topics, including management structure, decision-making processes, and member responsibilities.

- It is a one-size-fits-all document. Some believe that a standard template will suffice for every LLC. However, each business has unique needs, and the operating agreement should be tailored to reflect those specific circumstances.

- It is not enforceable. There is a misconception that an operating agreement holds no legal weight. In reality, it is a binding contract among members and can be enforced in court if disputes arise.

By addressing these misconceptions, LLC owners can better appreciate the value of an Illinois Operating Agreement and ensure they have a comprehensive framework for their business operations.

Common mistakes

-

Failing to include all members' names and addresses. Each member's information should be accurately listed to ensure proper identification.

-

Not specifying the management structure. It is important to clarify whether the company will be managed by members or designated managers.

-

Overlooking the capital contributions. Members must document their initial contributions clearly to avoid future disputes.

-

Neglecting to outline profit and loss distribution. The agreement should detail how profits and losses will be allocated among members.

-

Using vague language. Clear and precise terms help prevent misunderstandings and ensure that all parties are on the same page.

-

Forgetting to include provisions for member withdrawal or addition. Planning for changes in membership is crucial for the company's continuity.

-

Not addressing dispute resolution methods. Including procedures for resolving conflicts can save time and resources in the future.

-

Failing to have the agreement signed and dated. A signed and dated document is essential for legal validity and enforceability.

Find Some Other Operating Agreement Forms for Specific States

Llc in Texas Cost - It allows for the outlining of any restrictions on members’ actions outside of the business.

The USCIS I-134 form, commonly known as the Affidavit of Support, plays a crucial role in the United States immigration process. It serves as a formal agreement where a sponsor pledges financial support to a foreign visitor, ensuring that the visitor will not become a public charge. This form is vital for individuals seeking to support someone's visit or immigration to the United States. For more information, you can visit OnlineLawDocs.com.

How Do I Create an Operating Agreement for My Llc - Members can choose how frequently they want to hold meetings in the Operating Agreement.

Nc Operating Agreement Template - The agreement may outline how amendments can be made.

Nys Llc Operating Agreement Template - This document supports organizational stability and continuity.

PDF Attributes

| Fact Name | Details |

|---|---|

| Purpose | The Illinois Operating Agreement outlines the management structure and operating procedures for a limited liability company (LLC) in Illinois. |

| Governing Law | This agreement is governed by the Illinois Limited Liability Company Act (805 ILCS 180). |

| Flexibility | Members have the flexibility to customize the agreement to suit their specific needs, including profit distribution and decision-making processes. |

| Legal Requirement | While not legally required, having an Operating Agreement is highly recommended to prevent disputes and clarify the roles of members. |

Similar forms

The Illinois Operating Agreement form shares similarities with the Limited Liability Company (LLC) formation documents. Both documents outline the structure and operational guidelines for an LLC. The formation documents typically include the name of the LLC, its registered agent, and the purpose of the business. In contrast, the Operating Agreement focuses on the internal workings, detailing the rights and responsibilities of members, management structure, and procedures for decision-making. This distinction emphasizes the importance of both external and internal governance in an LLC.

The Ohio Lease Agreement form is a vital document that serves to clearly outline the terms between landlords and tenants, helping to prevent any misunderstandings during the rental process. It is essential for both parties to familiarize themselves with this agreement, as it encompasses important details such as rental payments and property maintenance obligations. For those seeking further information, the documentonline.org/blank-ohio-lease-agreement/ provides a valuable resource for understanding this essential legal framework.

Another document that resembles the Illinois Operating Agreement is the Partnership Agreement. While the Operating Agreement is specific to LLCs, a Partnership Agreement governs the relationships between partners in a business partnership. Both documents delineate the roles of the parties involved, profit-sharing arrangements, and procedures for resolving disputes. However, the Partnership Agreement may not provide the same level of liability protection as an Operating Agreement does for LLC members.

The Corporate Bylaws are also comparable to the Illinois Operating Agreement. Bylaws serve as the internal rules for a corporation, outlining the governance structure, responsibilities of officers, and procedures for meetings. Like the Operating Agreement, Bylaws establish how decisions are made and how conflicts are resolved. However, Bylaws pertain specifically to corporations, whereas the Operating Agreement is tailored for LLCs, reflecting the unique needs and characteristics of each business entity type.

Additionally, the Shareholders' Agreement bears resemblance to the Illinois Operating Agreement. This document is utilized by corporations and outlines the rights and obligations of shareholders. It addresses issues such as share transfers, voting rights, and management roles. Similar to the Operating Agreement, the Shareholders' Agreement aims to protect the interests of its members and ensure smooth operations, although it is specifically designed for corporate entities.

The Joint Venture Agreement is another document that aligns with the Illinois Operating Agreement. This agreement is used when two or more parties collaborate on a specific project or business endeavor. Both agreements define the terms of cooperation, including contributions, profit-sharing, and responsibilities. While the Operating Agreement governs ongoing business operations for an LLC, a Joint Venture Agreement is typically more project-specific and temporary in nature.

The Employment Agreement also shares similarities with the Illinois Operating Agreement, particularly in terms of defining roles and responsibilities. An Employment Agreement outlines the terms of employment, including job duties, compensation, and termination conditions. While it focuses on the employer-employee relationship, the Operating Agreement specifies the roles of members and managers within the LLC, ensuring clarity in both contexts.

The Non-Disclosure Agreement (NDA) can be compared to the Illinois Operating Agreement in that both documents protect sensitive information. An NDA prevents parties from disclosing proprietary information, while the Operating Agreement may include confidentiality provisions to safeguard the LLC's internal affairs. Both documents serve to maintain trust and security among parties, although they address different aspects of business operations.

Lastly, the Memorandum of Understanding (MOU) has similarities with the Illinois Operating Agreement. An MOU outlines the intentions and expectations of parties entering into a business relationship. While it is generally less formal than an Operating Agreement, both documents aim to clarify roles and responsibilities. An MOU can serve as a precursor to a more formal agreement, much like how an Operating Agreement formalizes the internal governance of an LLC.