Valid Illinois Motor Vehicle Bill of Sale Template

The Illinois Motor Vehicle Bill of Sale form serves as a crucial document in the transfer of ownership for vehicles within the state. This form captures essential details about the transaction, including the names and addresses of both the seller and the buyer, as well as the vehicle's make, model, year, and identification number. It also outlines the sale price and any conditions related to the sale, ensuring both parties have a clear understanding of the agreement. By documenting the transaction, the Bill of Sale provides legal protection for both the seller and the buyer, offering proof of the sale and helping to prevent future disputes. Additionally, this form is often required when registering the vehicle with the Illinois Secretary of State, making it a vital step in the vehicle transfer process. Understanding the components and significance of this form can facilitate a smoother transaction and ensure compliance with state regulations.

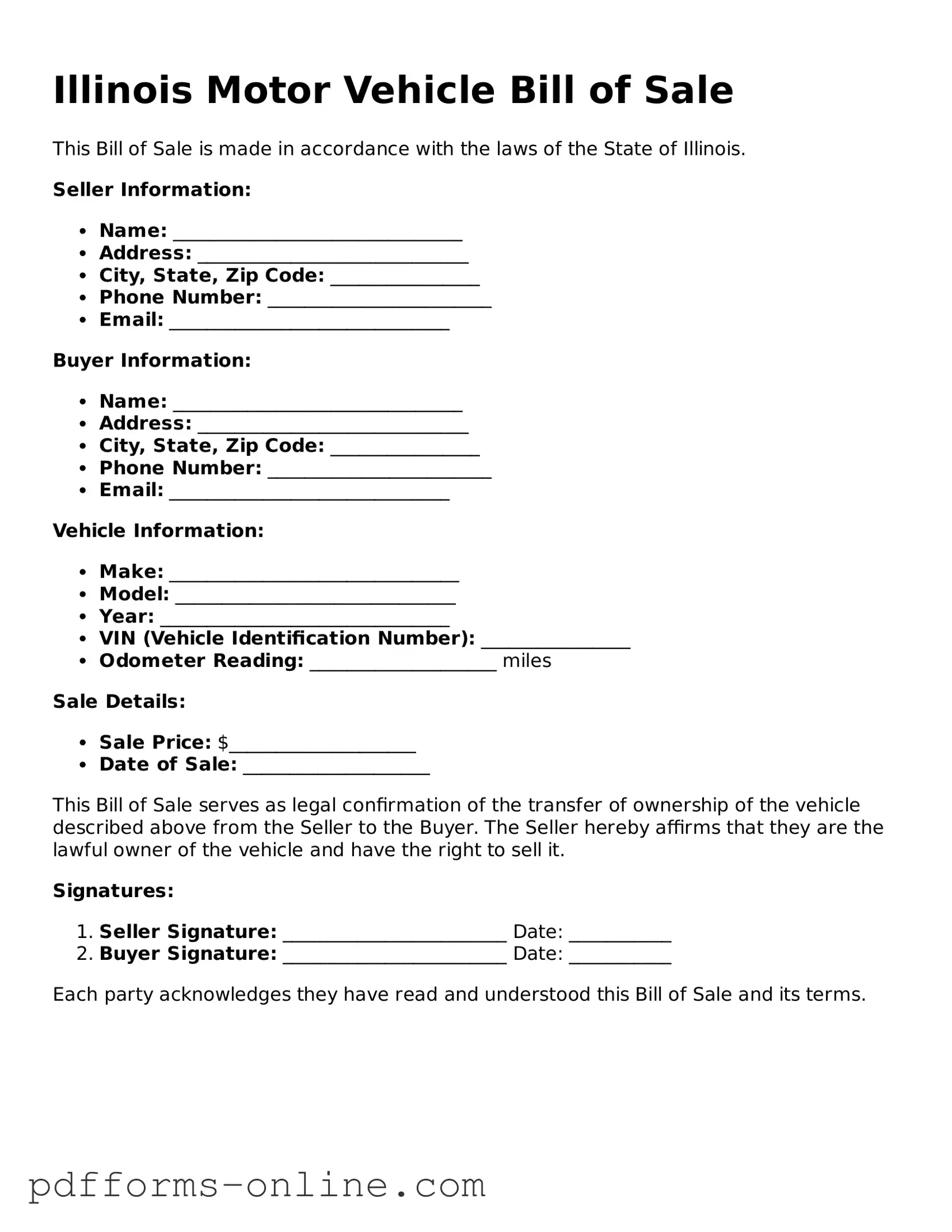

Document Example

Illinois Motor Vehicle Bill of Sale

This Bill of Sale is made in accordance with the laws of the State of Illinois.

Seller Information:

- Name: _______________________________

- Address: _____________________________

- City, State, Zip Code: ________________

- Phone Number: ________________________

- Email: ______________________________

Buyer Information:

- Name: _______________________________

- Address: _____________________________

- City, State, Zip Code: ________________

- Phone Number: ________________________

- Email: ______________________________

Vehicle Information:

- Make: _______________________________

- Model: ______________________________

- Year: _______________________________

- VIN (Vehicle Identification Number): ________________

- Odometer Reading: ____________________ miles

Sale Details:

- Sale Price: $____________________

- Date of Sale: ____________________

This Bill of Sale serves as legal confirmation of the transfer of ownership of the vehicle described above from the Seller to the Buyer. The Seller hereby affirms that they are the lawful owner of the vehicle and have the right to sell it.

Signatures:

- Seller Signature: ________________________ Date: ___________

- Buyer Signature: ________________________ Date: ___________

Each party acknowledges they have read and understood this Bill of Sale and its terms.

Frequently Asked Questions

-

What is the Illinois Motor Vehicle Bill of Sale form?

The Illinois Motor Vehicle Bill of Sale form is a legal document that records the sale of a vehicle between a seller and a buyer. This form serves as proof of the transaction and includes essential details such as the vehicle's identification number (VIN), make, model, year, and the sale price. It is important for both parties to keep a copy for their records.

-

Do I need to have the Bill of Sale notarized?

No, the Illinois Motor Vehicle Bill of Sale does not need to be notarized. However, having it notarized can add an extra layer of security and authenticity to the transaction. While it is not a requirement, some buyers and sellers may prefer this step to ensure that the document is legally binding and recognized by authorities.

-

What information should be included in the Bill of Sale?

When filling out the Bill of Sale, it is essential to include the following information:

- The full names and addresses of both the seller and the buyer.

- The vehicle's make, model, year, and VIN.

- The sale price and the date of the transaction.

- Any disclosures regarding the vehicle's condition or any warranties offered.

Including accurate and complete information helps prevent disputes and ensures a smooth transfer of ownership.

-

Is the Bill of Sale required for vehicle registration?

Yes, when registering a vehicle in Illinois, the Bill of Sale is often required. It acts as proof of ownership and confirms the sale price for tax purposes. Buyers should present the completed Bill of Sale along with other necessary documents, such as the title and proof of insurance, when they go to register the vehicle with the Illinois Secretary of State.

Misconceptions

When dealing with the Illinois Motor Vehicle Bill of Sale form, several misconceptions can lead to confusion. It is important to clarify these misunderstandings to ensure a smooth transaction. Below are five common misconceptions:

-

It is not necessary to have a Bill of Sale for vehicle transactions.

Many people believe that a Bill of Sale is optional when buying or selling a vehicle. In Illinois, while it is not legally required, having a Bill of Sale provides important documentation for both parties. It serves as proof of the transaction and can help resolve any disputes that may arise later.

-

The Bill of Sale must be notarized.

Some individuals think that notarization is mandatory for the Bill of Sale to be valid. However, in Illinois, notarization is not required. The form must be signed by both the buyer and seller, but notarization is not necessary for it to be legally binding.

-

Only the seller needs to sign the Bill of Sale.

This misconception can lead to issues. Both the buyer and seller should sign the Bill of Sale to confirm the agreement. This ensures that both parties acknowledge the terms of the sale and protects their interests.

-

The Bill of Sale serves as a title transfer.

While the Bill of Sale is an important document, it does not transfer the title of the vehicle. To officially transfer ownership, the seller must complete the title transfer process with the Illinois Secretary of State. The Bill of Sale can accompany the title transfer as proof of the sale.

-

Any format for the Bill of Sale is acceptable.

Some believe that any written agreement can serve as a Bill of Sale. In reality, using the official Illinois Motor Vehicle Bill of Sale form is recommended. This ensures that all necessary information is included and meets state requirements.

Understanding these misconceptions can help ensure that both buyers and sellers navigate the vehicle transaction process more effectively. Always seek clarity and confirm that all necessary steps are taken to protect your interests.

Common mistakes

-

Incorrect Vehicle Information: Failing to accurately provide the vehicle's make, model, year, and VIN can lead to complications. Ensure all details match the vehicle's title and registration.

-

Missing Seller and Buyer Information: Omitting the names and addresses of both the seller and buyer can create issues later. Complete contact information is crucial for future reference.

-

Not Including the Sale Price: Leaving the sale price blank or entering an incorrect amount can result in tax discrepancies. Clearly state the agreed-upon price to avoid misunderstandings.

-

Failure to Sign: Both the seller and buyer must sign the form. Neglecting to do so can invalidate the document, making it unenforceable.

-

Not Dating the Document: Forgetting to include the date of the sale can lead to confusion regarding the transaction timeline. Always add the date when the sale occurs.

-

Inaccurate Odometer Reading: Providing an incorrect odometer reading can raise red flags. Ensure the reading is accurate at the time of sale and note it correctly.

-

Ignoring State Requirements: Each state has specific regulations regarding the bill of sale. Not adhering to Illinois requirements can complicate the registration process.

-

Not Keeping Copies: Failing to make copies of the completed bill of sale for both parties can lead to disputes. Retain a copy for your records.

-

Overlooking Additional Terms: If there are any special conditions or warranties associated with the sale, they should be documented. Ignoring these can lead to misunderstandings later.

-

Rushing the Process: Filling out the form in haste can lead to mistakes. Take your time to ensure all information is correct and complete before finalizing the sale.

Find Some Other Motor Vehicle Bill of Sale Forms for Specific States

Reg 256 Dmv - Available in various formats for convenience.

Do I Need a Bill of Sale If I Have the Title in Florida - This document can help prevent disputes regarding ownership and sale conditions.

PDF Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Illinois Motor Vehicle Bill of Sale serves as a legal document to transfer ownership of a vehicle from the seller to the buyer. |

| Governing Law | This form is governed by the Illinois Vehicle Code, specifically 625 ILCS 5/3-202. |

| Required Information | The form must include details such as the vehicle identification number (VIN), make, model, year, and the names and addresses of both the buyer and seller. |

| Notarization | While notarization is not required for the Bill of Sale in Illinois, it is recommended to provide additional proof of the transaction. |

Similar forms

The Illinois Motor Vehicle Bill of Sale form shares similarities with the general Bill of Sale, which is a document used to transfer ownership of personal property. Like the motor vehicle version, a general Bill of Sale outlines the details of the transaction, including the buyer and seller's names, a description of the item being sold, and the sale price. Both documents serve as proof of ownership transfer and can be used for various types of property, not just vehicles.

Another document akin to the Illinois Motor Vehicle Bill of Sale is the Vehicle Title. The Vehicle Title is a legal document that establishes ownership of a vehicle. While the Bill of Sale provides evidence of the transaction, the title is a formal acknowledgment from the state that the buyer is now the owner. Both documents are essential in the process of transferring ownership, but the title is often required for registration and licensing purposes.

The Odometer Disclosure Statement is also similar to the Motor Vehicle Bill of Sale. This document is required by federal law when selling a vehicle and must be filled out to disclose the vehicle's mileage at the time of sale. Like the Bill of Sale, it protects both the buyer and seller by ensuring transparency in the transaction. Both documents help prevent fraud and misrepresentation regarding the vehicle's condition and history.

A Purchase Agreement is another document that resembles the Illinois Motor Vehicle Bill of Sale. This agreement outlines the terms and conditions of the sale, including payment details, delivery terms, and any warranties. While the Bill of Sale serves as a final record of the transaction, the Purchase Agreement often precedes it, detailing the mutual understanding between the buyer and seller before the sale is completed.

The Affidavit of Ownership is a document that may also be compared to the Motor Vehicle Bill of Sale. This affidavit is often used when the seller cannot provide a title or when the vehicle is older and does not have a title. It allows the seller to affirm their ownership of the vehicle, similar to how the Bill of Sale acts as proof of the transaction. Both documents help clarify ownership and facilitate the transfer process.

The Release of Liability form is similar in function to the Illinois Motor Vehicle Bill of Sale, as it protects the seller from future liabilities related to the vehicle after the sale. This document is typically submitted to the state’s motor vehicle department to inform them that the seller is no longer responsible for the vehicle. Both documents serve to finalize the transaction and ensure that the seller is no longer associated with the vehicle.

The Warranty Deed, while primarily used for real estate transactions, shares the characteristic of transferring ownership. Like the Bill of Sale for vehicles, a Warranty Deed provides a legal declaration of the transfer of property rights from one party to another. Both documents require clear identification of the parties involved and the property being transferred, ensuring that ownership is legally recognized.

Finally, the DMV Application for Title is another document that relates closely to the Illinois Motor Vehicle Bill of Sale. This application is submitted to obtain a new title after a vehicle has been purchased. It often requires the Bill of Sale as part of the documentation, linking the two forms in the ownership transfer process. Both documents are crucial for establishing legal ownership and ensuring compliance with state regulations.