Valid Illinois Loan Agreement Template

The Illinois Loan Agreement form is a crucial document for anyone looking to formalize a loan arrangement in the state. This form outlines the terms and conditions of the loan, ensuring that both the lender and borrower understand their rights and responsibilities. Key aspects include the loan amount, interest rate, repayment schedule, and any applicable fees. The agreement also specifies the consequences of default, providing clarity on what happens if the borrower fails to meet their obligations. By detailing the duration of the loan and the method of repayment, this form helps to prevent misunderstandings and disputes down the line. Furthermore, it may include provisions for collateral, which can protect the lender's investment. Understanding this form is essential for anyone involved in a loan transaction, as it serves as the foundation for a transparent and legally binding agreement.

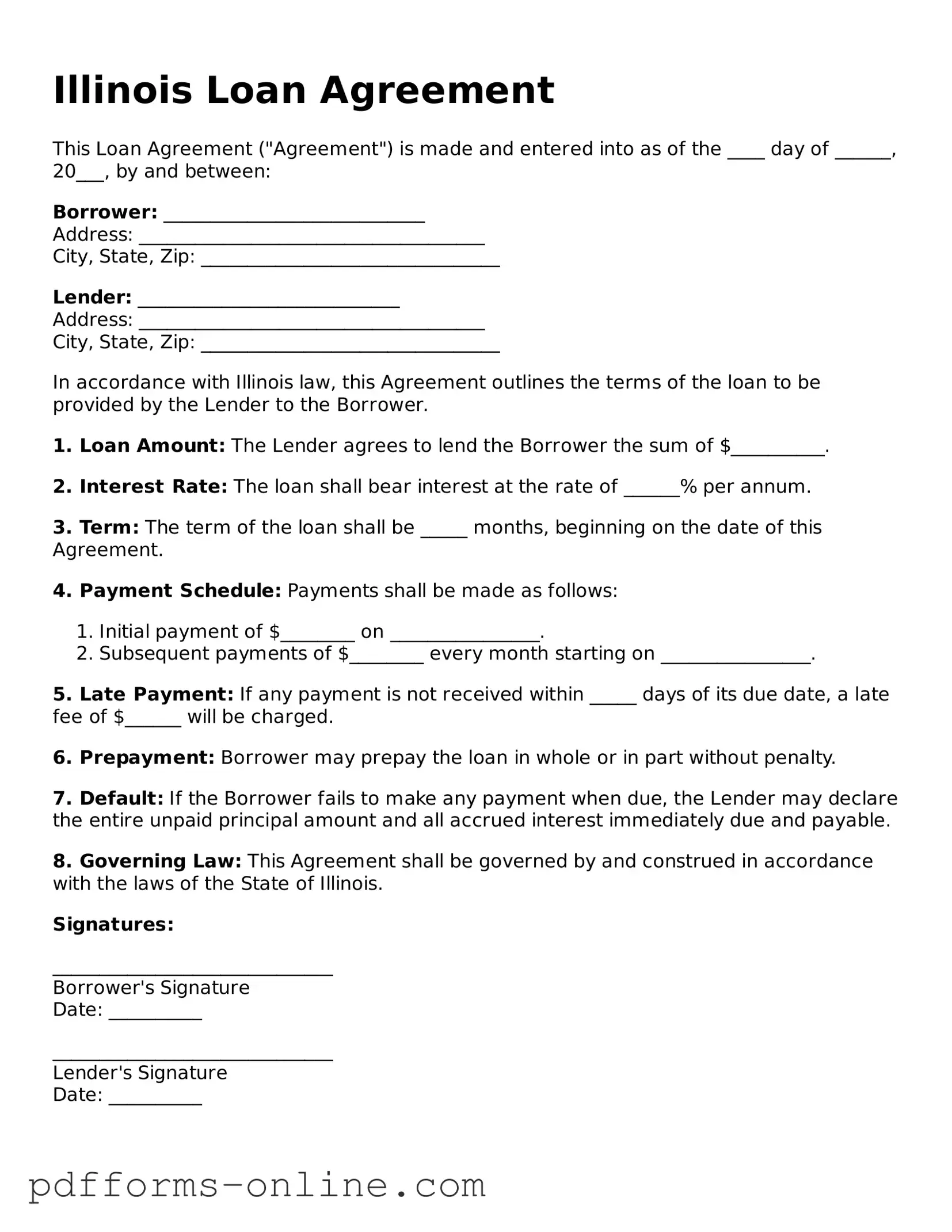

Document Example

Illinois Loan Agreement

This Loan Agreement ("Agreement") is made and entered into as of the ____ day of ______, 20___, by and between:

Borrower: ____________________________

Address: _____________________________________

City, State, Zip: ________________________________

Lender: ____________________________

Address: _____________________________________

City, State, Zip: ________________________________

In accordance with Illinois law, this Agreement outlines the terms of the loan to be provided by the Lender to the Borrower.

1. Loan Amount: The Lender agrees to lend the Borrower the sum of $__________.

2. Interest Rate: The loan shall bear interest at the rate of ______% per annum.

3. Term: The term of the loan shall be _____ months, beginning on the date of this Agreement.

4. Payment Schedule: Payments shall be made as follows:

- Initial payment of $________ on ________________.

- Subsequent payments of $________ every month starting on ________________.

5. Late Payment: If any payment is not received within _____ days of its due date, a late fee of $______ will be charged.

6. Prepayment: Borrower may prepay the loan in whole or in part without penalty.

7. Default: If the Borrower fails to make any payment when due, the Lender may declare the entire unpaid principal amount and all accrued interest immediately due and payable.

8. Governing Law: This Agreement shall be governed by and construed in accordance with the laws of the State of Illinois.

Signatures:

______________________________

Borrower's Signature

Date: __________

______________________________

Lender's Signature

Date: __________

Frequently Asked Questions

-

What is the Illinois Loan Agreement form?

The Illinois Loan Agreement form is a legal document used to outline the terms and conditions of a loan between a lender and a borrower in the state of Illinois. This form details the amount borrowed, interest rates, repayment schedule, and any collateral involved.

-

Who should use the Illinois Loan Agreement form?

This form is suitable for individuals or businesses that are lending or borrowing money. It is essential for both parties to have a clear understanding of their obligations and rights throughout the loan process.

-

What information is required to complete the form?

To complete the Illinois Loan Agreement form, you will need to provide:

- The names and addresses of both the lender and borrower.

- The loan amount.

- The interest rate and any applicable fees.

- The repayment schedule, including due dates.

- Any collateral securing the loan.

-

Is the Illinois Loan Agreement form legally binding?

Yes, once both parties sign the Illinois Loan Agreement form, it becomes a legally binding contract. This means that both the lender and borrower are obligated to adhere to the terms outlined in the document.

-

What happens if the borrower defaults on the loan?

If the borrower defaults, the lender has the right to take legal action to recover the owed amount. This may include pursuing collection efforts or seizing collateral if applicable. It is crucial for both parties to understand the implications of defaulting.

-

Can the terms of the loan agreement be modified?

Yes, the terms can be modified if both parties agree to the changes. It is advisable to document any modifications in writing and have both parties sign the amended agreement to avoid disputes later.

-

Is it necessary to have a lawyer review the Illinois Loan Agreement form?

While it is not mandatory, having a lawyer review the agreement can provide peace of mind. A legal professional can ensure that the terms are fair and comply with state laws, reducing the risk of future disputes.

-

Where can I obtain the Illinois Loan Agreement form?

The Illinois Loan Agreement form can be obtained from various sources, including online legal document providers, local legal offices, or financial institutions. Ensure that you are using a current and valid version of the form.

-

Are there any fees associated with using the Illinois Loan Agreement form?

Typically, there are no fees directly associated with the form itself. However, if you choose to have a lawyer draft or review the agreement, there may be legal fees involved. Additionally, lenders may charge interest or fees as part of the loan terms.

Misconceptions

When dealing with the Illinois Loan Agreement form, it’s easy to encounter misconceptions that can lead to confusion. Here are eight common misunderstandings about this important document:

-

All loan agreements are the same.

Many people believe that loan agreements are interchangeable. In reality, each loan agreement can vary significantly based on the terms negotiated between the lender and borrower.

-

The form is only for large loans.

Some think that the Illinois Loan Agreement form is only necessary for substantial amounts. However, it is beneficial for any loan, regardless of size, to ensure clarity and protection for both parties.

-

Verbal agreements are sufficient.

There is a misconception that a verbal agreement is enough to secure a loan. In Illinois, having a written agreement is essential to enforce the terms and conditions of the loan.

-

Once signed, the agreement cannot be changed.

Many believe that once a loan agreement is signed, it is set in stone. In fact, parties can modify the agreement if both agree to the changes and document them properly.

-

Loan agreements are only for personal loans.

Some individuals think that these forms are only applicable to personal loans. In reality, they are used for a variety of loans, including business loans and mortgages.

-

The lender always has the upper hand.

It’s often assumed that lenders dictate all terms. Borrowers have rights and can negotiate terms that work for them, making it a collaborative process.

-

Legal advice is unnecessary.

Many people overlook the importance of legal counsel when drafting or signing a loan agreement. Consulting a legal expert can help clarify terms and protect interests.

-

Loan agreements are only for individuals.

Some mistakenly believe that only individuals need loan agreements. In fact, businesses and organizations also require these agreements to formalize lending arrangements.

Understanding these misconceptions can help borrowers and lenders navigate the loan process more effectively, ensuring that both parties are protected and informed.

Common mistakes

-

Incomplete Information: Many individuals fail to fill out all required fields. Leaving sections blank can delay the processing of the loan.

-

Incorrect Personal Details: Providing inaccurate names, addresses, or social security numbers can lead to complications. Ensure that all personal information matches official documents.

-

Failure to Read Terms: Skimming through the terms and conditions can result in misunderstandings. It’s important to understand all obligations before signing.

-

Not Providing Proof of Income: Some applicants forget to include necessary documentation, such as pay stubs or tax returns. This documentation is often essential for loan approval.

-

Missing Signatures: A common oversight is neglecting to sign the agreement. All parties involved must provide their signatures for the agreement to be valid.

-

Ignoring Loan Amount Limits: Applicants sometimes request amounts exceeding what is permissible. Familiarizing oneself with the limits can prevent unnecessary rejections.

-

Not Disclosing Other Debts: Failing to mention existing debts can affect the loan approval process. Transparency is crucial when applying for a loan.

-

Inconsistent Information: Providing conflicting information in different sections can raise red flags. Consistency is key for a smooth application process.

-

Neglecting to Review Before Submission: Skipping the review process can lead to overlooked mistakes. Taking a moment to double-check the application can save time.

-

Not Keeping Copies: Failing to retain a copy of the completed form can lead to difficulties later. Always keep a record of submitted documents for personal reference.

Find Some Other Loan Agreement Forms for Specific States

Free Promissory Note Template California - Legal consequences can occur if the terms of the Loan Agreement are violated.

Promissory Note Florida - A Loan Agreement may include conditions for ensuring proper use of funds.

A New York Lease Agreement form is a legal document that outlines the terms and conditions between a landlord and a tenant for renting a residential or commercial property. This form serves as a binding contract, detailing essential elements such as rental price, lease duration, and the responsibilities of both parties. For more information about this agreement, you can visit https://documentonline.org/blank-new-york-lease-agreement/. Understanding this document is crucial for protecting rights and ensuring a smooth rental experience.

Texas Promissory Note Requirements - The Loan Agreement helps ensure both parties understand their rights and responsibilities.

Promissory Note Template Georgia - Lists any applicable state restrictions on interest charges.

PDF Attributes

| Fact Name | Description |

|---|---|

| Governing Law | The Illinois Loan Agreement is governed by the laws of the State of Illinois. |

| Parties Involved | The agreement typically involves a lender and a borrower. |

| Loan Amount | The specific amount of money being loaned must be clearly stated. |

| Interest Rate | The agreement should specify the interest rate applicable to the loan. |

| Repayment Terms | Details about repayment schedules and methods must be included. |

| Default Conditions | Conditions under which a borrower may default on the loan should be outlined. |

| Governing Jurisdiction | Any disputes will be resolved under Illinois jurisdiction. |

| Amendment Process | How the agreement can be amended must be clearly defined. |

| Signatures | The agreement requires signatures from both parties to be valid. |

Similar forms

The Illinois Promissory Note is a document that outlines the borrower's promise to repay a loan. Like the Loan Agreement, it specifies the loan amount, interest rate, and repayment terms. However, the Promissory Note is typically a simpler document that focuses primarily on the borrower's obligation rather than the broader terms of the loan agreement, which may include additional clauses regarding default, collateral, and other conditions.

The Illinois Security Agreement is similar in that it establishes a security interest in collateral to secure a loan. Both documents are used to protect the lender's interests. While the Loan Agreement details the terms of the loan, the Security Agreement specifically identifies the collateral and the rights of the lender in the event of default. This document is crucial when the loan is backed by tangible assets.

The Illinois Loan Application is a document used by lenders to assess the creditworthiness of a borrower. This form collects personal and financial information, including income, debts, and credit history. While the Loan Agreement outlines the terms of the loan after approval, the Loan Application is the initial step in the lending process, determining whether the borrower qualifies for the loan.

When considering the various financial agreements, it's essential to recognize the importance of each document in clarifying obligations and protecting interests. One such critical document is the Non-disclosure Agreement (NDA), particularly in contexts where sensitive information is involved. In New York, a Non-disclosure Agreement ensures that parties share confidential information under strict terms, as described by resources like OnlineLawDocs.com. This legal framework not only helps mitigate risk but also fosters trust among the engaging parties.

The Illinois Mortgage Agreement is closely related as it secures a loan with real property. Like the Loan Agreement, it includes terms such as the loan amount and interest rate. However, the Mortgage Agreement specifically involves real estate as collateral and includes provisions for foreclosure in case of default. This makes it a critical document for home loans and real estate transactions.

The Illinois Guaranty Agreement is another related document that involves a third party agreeing to repay the loan if the borrower defaults. This document is often used in conjunction with a Loan Agreement to provide additional security for the lender. Both agreements establish the terms of the loan, but the Guaranty Agreement introduces a guarantor who assumes responsibility for the debt if the primary borrower fails to pay.

The Illinois Loan Modification Agreement is used when existing loan terms need to be changed. This document is similar to the Loan Agreement in that it outlines the terms of the loan, but it specifically addresses modifications such as changes in interest rates, repayment schedules, or loan amounts. This agreement is essential for borrowers who are struggling to meet original loan terms and need to negotiate new conditions.

The Illinois Debt Settlement Agreement is a document that outlines the terms under which a borrower agrees to settle a debt for less than the full amount owed. Similar to the Loan Agreement, it details the obligations of both parties, but it is typically used when the borrower is unable to repay the full loan amount. This agreement often includes terms for how the reduced payment will be made and any potential tax implications for the borrower.