Valid Illinois Last Will and Testament Template

In the state of Illinois, the Last Will and Testament form serves as a crucial legal document that outlines an individual's wishes regarding the distribution of their assets upon death. This form allows a testator, or the person making the will, to designate beneficiaries who will inherit their property, ensuring that their intentions are respected after they pass away. Additionally, the document may include provisions for the appointment of an executor, who is responsible for managing the estate and ensuring that the terms of the will are executed properly. Illinois law requires that the will be signed by the testator and witnessed by at least two individuals, providing a layer of authenticity and reducing the potential for disputes among heirs. The form also allows for specific bequests, which can include personal property, real estate, or financial assets, thereby giving the testator the ability to express their preferences clearly. Furthermore, the inclusion of guardianship provisions for minor children can be addressed within the will, ensuring that the testator’s wishes regarding their care are legally documented. Overall, the Illinois Last Will and Testament form is an essential tool for individuals seeking to exert control over their estate and provide clarity for their loved ones during a challenging time.

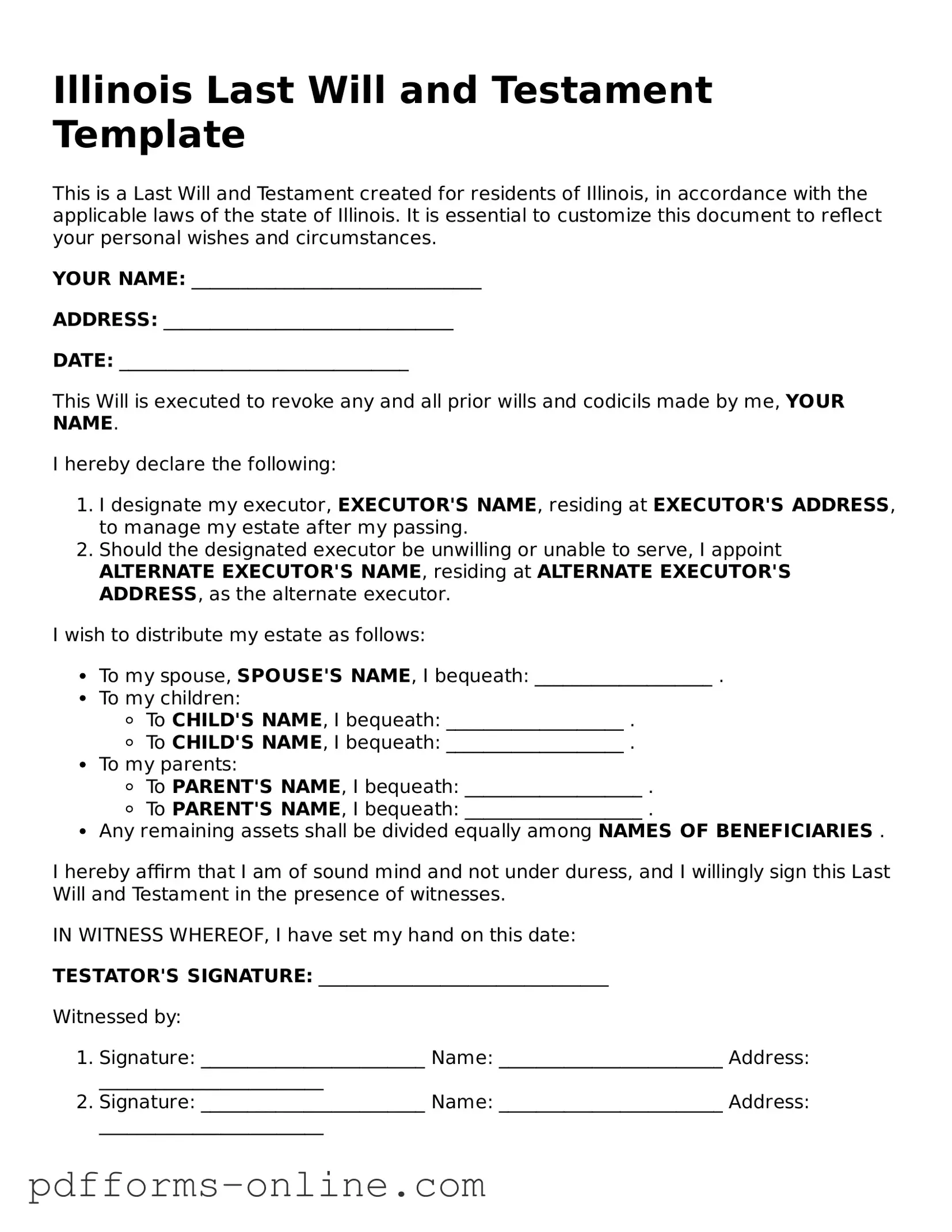

Document Example

Illinois Last Will and Testament Template

This is a Last Will and Testament created for residents of Illinois, in accordance with the applicable laws of the state of Illinois. It is essential to customize this document to reflect your personal wishes and circumstances.

YOUR NAME: _______________________________

ADDRESS: _______________________________

DATE: _______________________________

This Will is executed to revoke any and all prior wills and codicils made by me, YOUR NAME.

I hereby declare the following:

- I designate my executor, EXECUTOR'S NAME, residing at EXECUTOR'S ADDRESS, to manage my estate after my passing.

- Should the designated executor be unwilling or unable to serve, I appoint ALTERNATE EXECUTOR'S NAME, residing at ALTERNATE EXECUTOR'S ADDRESS, as the alternate executor.

I wish to distribute my estate as follows:

- To my spouse, SPOUSE'S NAME, I bequeath: ___________________ .

- To my children:

- To CHILD'S NAME, I bequeath: ___________________ .

- To CHILD'S NAME, I bequeath: ___________________ .

- To my parents:

- To PARENT'S NAME, I bequeath: ___________________ .

- To PARENT'S NAME, I bequeath: ___________________ .

- Any remaining assets shall be divided equally among NAMES OF BENEFICIARIES .

I hereby affirm that I am of sound mind and not under duress, and I willingly sign this Last Will and Testament in the presence of witnesses.

IN WITNESS WHEREOF, I have set my hand on this date:

TESTATOR'S SIGNATURE: _______________________________

Witnessed by:

- Signature: ________________________ Name: ________________________ Address: ________________________

- Signature: ________________________ Name: ________________________ Address: ________________________

This template should be used as a guide. It is important to consult with a qualified attorney to ensure that your Will complies with all relevant state laws and accurately reflects your wishes.

Frequently Asked Questions

-

What is a Last Will and Testament?

A Last Will and Testament is a legal document that outlines how a person's assets and property should be distributed after their death. It can also specify guardianship for minor children and other important wishes.

-

Why do I need a Last Will and Testament?

Having a Last Will ensures that your wishes are followed regarding the distribution of your assets. Without a will, the state decides how to distribute your belongings, which may not align with your wishes.

-

Who can create a Last Will and Testament in Illinois?

In Illinois, any person who is at least 18 years old and of sound mind can create a Last Will and Testament. This includes residents and non-residents who own property in Illinois.

-

What are the requirements for a valid will in Illinois?

To be valid, a will in Illinois must be in writing and signed by the testator (the person making the will). It must also be witnessed by at least two individuals who are present at the same time. These witnesses cannot be beneficiaries of the will.

-

Can I change my Last Will and Testament?

Yes, you can change your will at any time while you are still alive. This can be done by creating a new will or by making a codicil, which is an amendment to your existing will.

-

What happens if I die without a will in Illinois?

If you die without a will, your assets will be distributed according to Illinois intestacy laws. This means the state will determine who inherits your property, which may not reflect your wishes.

-

Can I revoke my Last Will and Testament?

Yes, you can revoke your will at any time. This can be done by physically destroying the document, creating a new will, or stating your intention to revoke in writing.

-

Do I need a lawyer to create a Last Will and Testament?

While it is not required to have a lawyer, consulting one can help ensure that your will meets all legal requirements and accurately reflects your wishes. Many people choose to use online services or legal document preparers for assistance.

-

How should I store my Last Will and Testament?

Your will should be stored in a safe place where it can be easily accessed after your death. Consider keeping it in a safe deposit box, with your attorney, or in a fireproof safe at home. Make sure your loved ones know where to find it.

Misconceptions

Understanding the Illinois Last Will and Testament form is crucial for anyone looking to create a valid will. However, several misconceptions can lead to confusion. Here are ten common misconceptions:

- Only wealthy individuals need a will. Many people believe that wills are only for the rich. In reality, anyone with assets or dependents should consider having a will to ensure their wishes are honored.

- A will is only necessary for older adults. Some think that wills are only for seniors. However, accidents can happen at any age, making it wise for adults of all ages to have a will.

- Handwritten wills are not valid in Illinois. While it's true that formal requirements exist, Illinois does recognize handwritten wills, known as holographic wills, as long as they meet specific criteria.

- Verbal wills are legally binding. In Illinois, verbal wills are generally not recognized. A will must be in writing to be considered valid.

- Once a will is created, it cannot be changed. This is false. Individuals can revise their wills as their circumstances change, and it is often advisable to do so regularly.

- All assets automatically go to the spouse. Many people assume that a spouse will inherit everything. In Illinois, the distribution of assets can depend on various factors, including whether children are involved.

- Having a will avoids probate entirely. While a will is essential, it does not prevent probate. Instead, it helps guide the probate process.

- Witnesses can be anyone. In Illinois, witnesses must be disinterested parties, meaning they should not stand to gain from the will's provisions.

- Wills are public documents immediately. Although wills become public after probate begins, they are not public until that process starts.

- Creating a will is too complicated. Many people believe that drafting a will requires a lawyer. While legal assistance can be beneficial, there are resources and templates available that make it easier for individuals to create their own wills.

Common mistakes

-

Not Clearly Identifying the Testator: Failing to clearly state your full name and address can lead to confusion. Ensure that your identity is unmistakably established at the beginning of the document.

-

Omitting Witness Signatures: In Illinois, at least two witnesses must sign the will. Forgetting to include their signatures can render the will invalid.

-

Not Dated Properly: A will should always include the date it was signed. Without a date, it may be difficult to determine its validity compared to any previous wills.

-

Failing to Specify Assets Clearly: Be specific about the assets you wish to distribute. Vague descriptions can lead to disputes among heirs.

-

Ignoring State Requirements: Each state has specific laws regarding wills. Ignoring Illinois' requirements can jeopardize the enforceability of your will.

-

Not Revoking Previous Wills: If you have created previous wills, it is crucial to revoke them. This can be done by stating in the new will that all prior wills are revoked.

-

Neglecting to Update the Will: Life changes such as marriage, divorce, or the birth of a child necessitate updates to your will. Failing to make these updates can lead to unintended distributions.

Find Some Other Last Will and Testament Forms for Specific States

Free Michigan Will Template - A Last Will can define how your business interests should be handled after your death.

For anyone considering entering a rental agreement in Ohio, it is vital to review the Ohio Residential Lease Agreement form thoroughly. This essential document clearly defines the roles and obligations of both the landlord and tenant, thereby minimizing any potential disputes. To access a template that can assist in creating a comprehensive lease, you can visit documentonline.org/blank-ohio-residential-lease-agreement, which provides valuable resources for a smooth rental experience.

Who Can Prepare a Will - A mechanism to avoid potential disputes among heirs after your death.

Last Will and Testament Template Texas - Encourages ongoing discussions about estate planning among family members.

Georgia Will Template - Can reduce potential taxes on your estate for beneficiaries.

PDF Attributes

| Fact Name | Description |

|---|---|

| Legal Requirement | In Illinois, a Last Will and Testament must be in writing and signed by the testator, the person making the will. |

| Witnesses | The will must be witnessed by at least two individuals who are present at the same time. These witnesses cannot be beneficiaries of the will. |

| Governing Law | The Illinois Probate Act governs the creation and execution of wills in the state, specifically under 755 ILCS 5/. |

| Revocation | A will can be revoked by the testator at any time before their death, either by creating a new will or by destroying the existing one. |

| Age Requirement | To create a valid will in Illinois, the testator must be at least 18 years old and of sound mind. |

Similar forms

The Illinois Last Will and Testament form shares similarities with a Living Will. While a Last Will outlines how a person wishes their assets to be distributed after death, a Living Will focuses on healthcare decisions during a person’s lifetime. Both documents serve to express an individual's preferences, but they do so in different contexts. A Living Will provides guidance on medical treatments and interventions a person desires or wishes to avoid if they become incapacitated. In this way, both documents ensure that a person’s wishes are honored, whether in matters of property or health.

Another document akin to the Illinois Last Will and Testament is the Revocable Living Trust. Like a Last Will, a Revocable Living Trust allows individuals to dictate how their assets will be managed and distributed. However, a key difference lies in the timing of these directives. A Revocable Living Trust takes effect during a person's lifetime, allowing for the management of assets while they are still alive. This can help avoid probate, a lengthy legal process that a Last Will typically must go through after death. Both documents provide a framework for asset distribution, but they operate at different stages of life.

For those engaged in the regulatory landscape of employee management, understanding the nuances of workplace documentation is vital. To ensure seamless operations and compliance, one should familiarize themselves with various essential forms like the Employee Handbook. This handbook not only outlines the expectations for employees but also serves to clarify the responsibilities within the organization. To access comprehensive resources, you can refer to All Arizona Forms for detailed guidance and templates.

The Illinois Last Will and Testament is also similar to a Power of Attorney for Finances. This document grants another person the authority to make financial decisions on behalf of someone else, typically when they are unable to do so themselves. While a Last Will comes into play after death, a Power of Attorney is active during a person’s life. Both documents are crucial for ensuring that an individual's wishes regarding financial matters are respected, whether in life or after passing. They empower individuals to designate trusted people to act on their behalf, thereby providing peace of mind.

Lastly, a Health Care Power of Attorney is another document that bears resemblance to the Illinois Last Will and Testament. This form designates someone to make medical decisions for an individual if they are unable to do so. Like the Last Will, it reflects personal choices and preferences, but it specifically addresses health-related matters rather than the distribution of property. Both documents are essential for ensuring that an individual’s desires are respected, whether regarding their estate or their medical care. They empower individuals to take control of their future, ensuring that their wishes are followed in critical situations.