Valid Illinois Durable Power of Attorney Template

The Illinois Durable Power of Attorney form is a vital legal document that allows individuals to designate a trusted person to make decisions on their behalf in the event they become unable to do so themselves. This form is particularly important for ensuring that financial and healthcare decisions can be managed according to the individual’s wishes, even if they are incapacitated. It encompasses various powers, including the authority to handle financial matters, manage real estate, and make medical decisions. The form can be tailored to fit specific needs, allowing the principal to grant broad or limited powers to the agent. Importantly, the durable aspect of this power of attorney means that it remains effective even if the principal becomes mentally incompetent. To execute the form, certain requirements must be met, such as the principal's signature and witnessing by two individuals or notarization. Understanding the implications and processes associated with this form is crucial for anyone looking to ensure their preferences are honored in times of need.

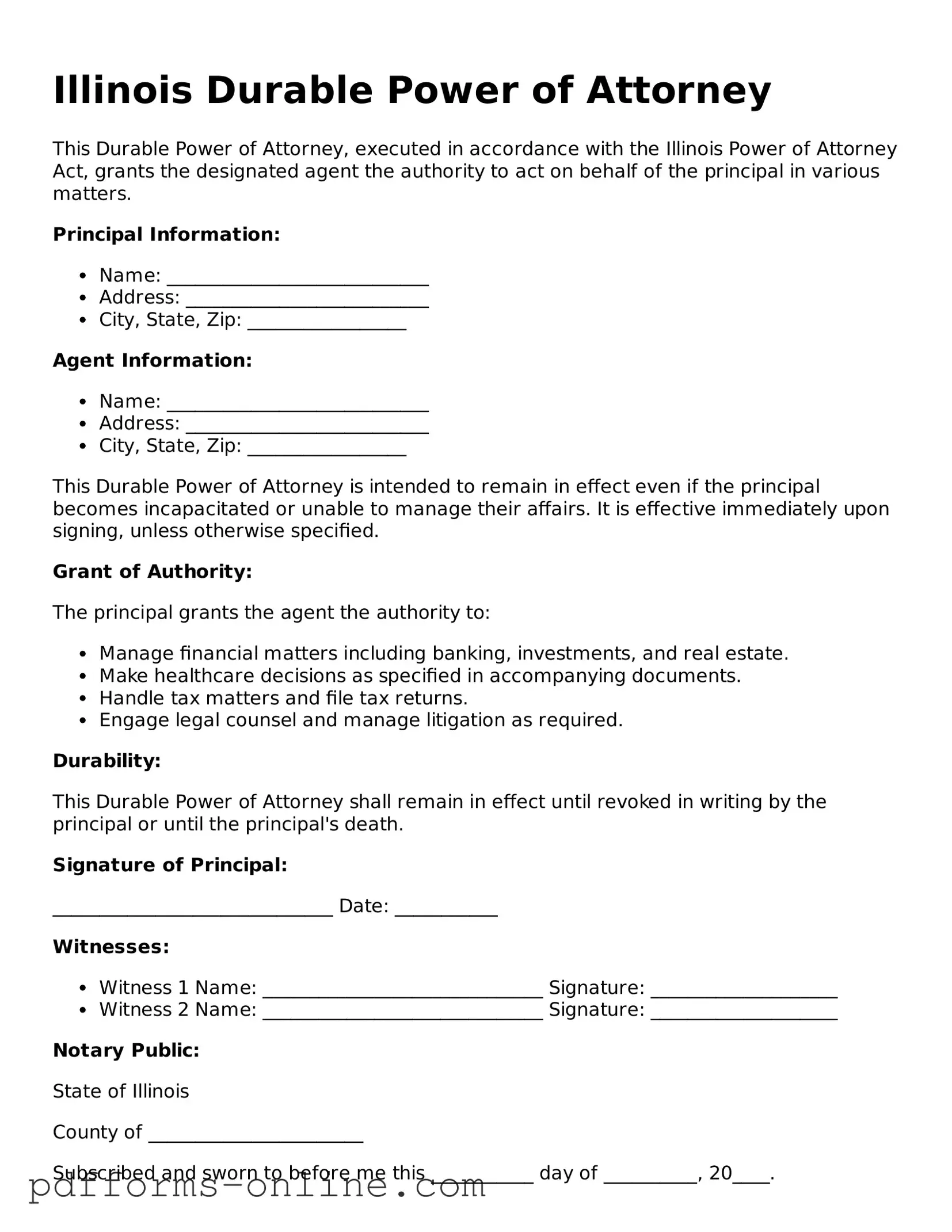

Document Example

Illinois Durable Power of Attorney

This Durable Power of Attorney, executed in accordance with the Illinois Power of Attorney Act, grants the designated agent the authority to act on behalf of the principal in various matters.

Principal Information:

- Name: ____________________________

- Address: __________________________

- City, State, Zip: _________________

Agent Information:

- Name: ____________________________

- Address: __________________________

- City, State, Zip: _________________

This Durable Power of Attorney is intended to remain in effect even if the principal becomes incapacitated or unable to manage their affairs. It is effective immediately upon signing, unless otherwise specified.

Grant of Authority:

The principal grants the agent the authority to:

- Manage financial matters including banking, investments, and real estate.

- Make healthcare decisions as specified in accompanying documents.

- Handle tax matters and file tax returns.

- Engage legal counsel and manage litigation as required.

Durability:

This Durable Power of Attorney shall remain in effect until revoked in writing by the principal or until the principal's death.

Signature of Principal:

______________________________ Date: ___________

Witnesses:

- Witness 1 Name: ______________________________ Signature: ____________________

- Witness 2 Name: ______________________________ Signature: ____________________

Notary Public:

State of Illinois

County of _______________________

Subscribed and sworn to before me this ___________ day of __________, 20____.

______________________________

Notary Public Signature: ____________________

Frequently Asked Questions

-

What is a Durable Power of Attorney in Illinois?

A Durable Power of Attorney (DPOA) in Illinois is a legal document that allows you to appoint someone to make decisions on your behalf if you become unable to do so. This document remains effective even if you become incapacitated. The person you appoint is known as your agent or attorney-in-fact.

-

What decisions can my agent make under a Durable Power of Attorney?

Your agent can make a wide range of decisions, including financial and healthcare choices. For financial matters, this may involve managing your bank accounts, paying bills, or selling property. For healthcare decisions, your agent can make choices about medical treatment and access your medical records. You can specify the powers you want to grant in the document.

-

How do I create a Durable Power of Attorney in Illinois?

To create a DPOA, you need to fill out the appropriate form, which can be obtained online or from legal offices. You must sign the document in the presence of a notary public or two witnesses. It’s important to ensure that the form meets Illinois state requirements to be valid.

-

Can I revoke or change my Durable Power of Attorney?

Yes, you can revoke or change your DPOA at any time as long as you are mentally competent. To revoke it, you should create a written notice stating your intention to revoke the DPOA and notify your agent. If you create a new DPOA, it will automatically revoke any previous versions.

-

What happens if I do not have a Durable Power of Attorney?

If you do not have a DPOA and become incapacitated, the court may appoint a guardian to make decisions on your behalf. This process can be lengthy and costly. Having a DPOA in place allows you to choose someone you trust to manage your affairs without court intervention.

Misconceptions

Understanding the Illinois Durable Power of Attorney (DPOA) form is crucial for anyone considering this important legal document. However, several misconceptions can cloud people's understanding. Let’s clarify some of the most common myths surrounding the DPOA.

- Myth 1: A Durable Power of Attorney is only for the elderly.

- Myth 2: A DPOA can only be used for financial matters.

- Myth 3: Once a DPOA is signed, the principal loses all control.

- Myth 4: A DPOA is the same as a will.

- Myth 5: You need a lawyer to create a DPOA.

- Myth 6: A DPOA is only valid in Illinois.

- Myth 7: A DPOA can make decisions against the principal’s wishes.

This is not true. Anyone, regardless of age, can benefit from a DPOA. Life is unpredictable, and having a plan in place is wise for all adults.

While many people associate DPOAs with financial decisions, they can also cover health care decisions. You can specify what medical treatments you want or don’t want in case you are unable to communicate your wishes.

This misconception is misleading. A DPOA remains in effect as long as the principal is competent. You can revoke or change it at any time, as long as you are still capable of making decisions.

A DPOA and a will serve different purposes. A will takes effect after your death, while a DPOA is active during your lifetime, allowing someone to act on your behalf if you become incapacitated.

While consulting a lawyer can be beneficial, it’s not strictly necessary. Illinois provides a statutory form that you can fill out on your own, but having legal advice can ensure that your document meets all your needs.

While the Illinois DPOA is designed to comply with state laws, it may also be recognized in other states. However, it’s essential to check the specific requirements of the state where you are residing or traveling.

This is a significant misunderstanding. The agent appointed through a DPOA is legally obligated to act in the best interest of the principal and to follow their wishes as outlined in the document.

By debunking these misconceptions, you can better understand the value and function of a Durable Power of Attorney in Illinois. Taking proactive steps to prepare for the future is always a wise decision.

Common mistakes

-

Not specifying the powers granted: One common mistake is failing to clearly outline the specific powers you wish to grant your agent. This can lead to confusion and limit your agent's ability to act on your behalf.

-

Using outdated forms: Some people mistakenly use older versions of the Durable Power of Attorney form. Always ensure that you are using the most current version to avoid potential legal issues.

-

Not signing the document: It may seem obvious, but forgetting to sign the form is a frequent oversight. Without your signature, the document holds no legal weight.

-

Neglecting to date the form: Failing to include the date when you sign the form can create ambiguity about when the powers take effect. Always add the date to ensure clarity.

-

Overlooking witness and notarization requirements: Some individuals forget that Illinois law requires certain forms to be witnessed or notarized. Not adhering to these requirements can invalidate the document.

-

Choosing the wrong agent: Selecting an agent who may not act in your best interests can be a significant mistake. It's crucial to choose someone trustworthy and capable of handling the responsibilities.

Find Some Other Durable Power of Attorney Forms for Specific States

How to Get Power of Attorney in Nc - It can help secure your assets and ensure they are managed per your wishes.

How to Get a Power of Attorney in Florida - Assign authority for managing your assets and paying bills if you cannot do so yourself.

Nys Durable Power of Attorney Form 2023 - You can revoke or modify this document as long as you are still mentally competent.

Power of Attorney Michigan - It can serve specific purposes, such as medical or financial powers.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | An Illinois Durable Power of Attorney allows an individual to appoint someone else to make decisions on their behalf, even if they become incapacitated. |

| Governing Law | This form is governed by the Illinois Power of Attorney Act (755 ILCS 45/2-1 et seq.). |

| Durability | The "durable" aspect means the authority remains effective even if the principal is no longer able to make decisions. |

| Scope of Authority | The appointed agent can manage a wide range of affairs, including financial, legal, and healthcare decisions, depending on the powers granted. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are mentally competent to do so. |

Similar forms

The Illinois Durable Power of Attorney (DPOA) form is similar to a General Power of Attorney (GPOA). Both documents allow an individual, known as the principal, to designate another person, called the agent, to make decisions on their behalf. However, the key difference lies in the durability of the authority granted. A GPOA typically becomes void if the principal becomes incapacitated, while a DPOA remains effective even if the principal loses the ability to make decisions. This makes the DPOA particularly useful for long-term planning, especially for those concerned about future health issues.

Another document that shares similarities with the DPOA is a Healthcare Power of Attorney (HPOA). This specific form allows the principal to appoint someone to make medical decisions for them if they become unable to do so. Like the DPOA, the HPOA is designed to remain in effect during periods of incapacity. While the DPOA can cover a broad range of financial and legal matters, the HPOA is focused solely on healthcare choices. This distinction is crucial for individuals looking to ensure their medical preferences are honored when they cannot communicate them directly.

The Living Will is another document that aligns with the intentions of a DPOA. While the DPOA grants authority to an agent to act on behalf of the principal, a Living Will specifically outlines the principal's wishes regarding medical treatment and end-of-life care. It serves as a guide for healthcare providers and family members when the principal is unable to express their desires. Although it does not appoint an agent, it complements the DPOA by providing clear instructions about medical care preferences, ensuring that the principal's wishes are respected.

Lastly, the Revocable Trust shares some characteristics with the Durable Power of Attorney. A Revocable Trust allows individuals to manage their assets during their lifetime and designate how those assets should be distributed after their death. Like the DPOA, a Revocable Trust can be altered or revoked at any time while the individual is still competent. Both documents are tools for estate planning, but they serve different purposes. The DPOA focuses on decision-making authority during the principal's lifetime, while the Revocable Trust primarily addresses the management and distribution of assets upon death.