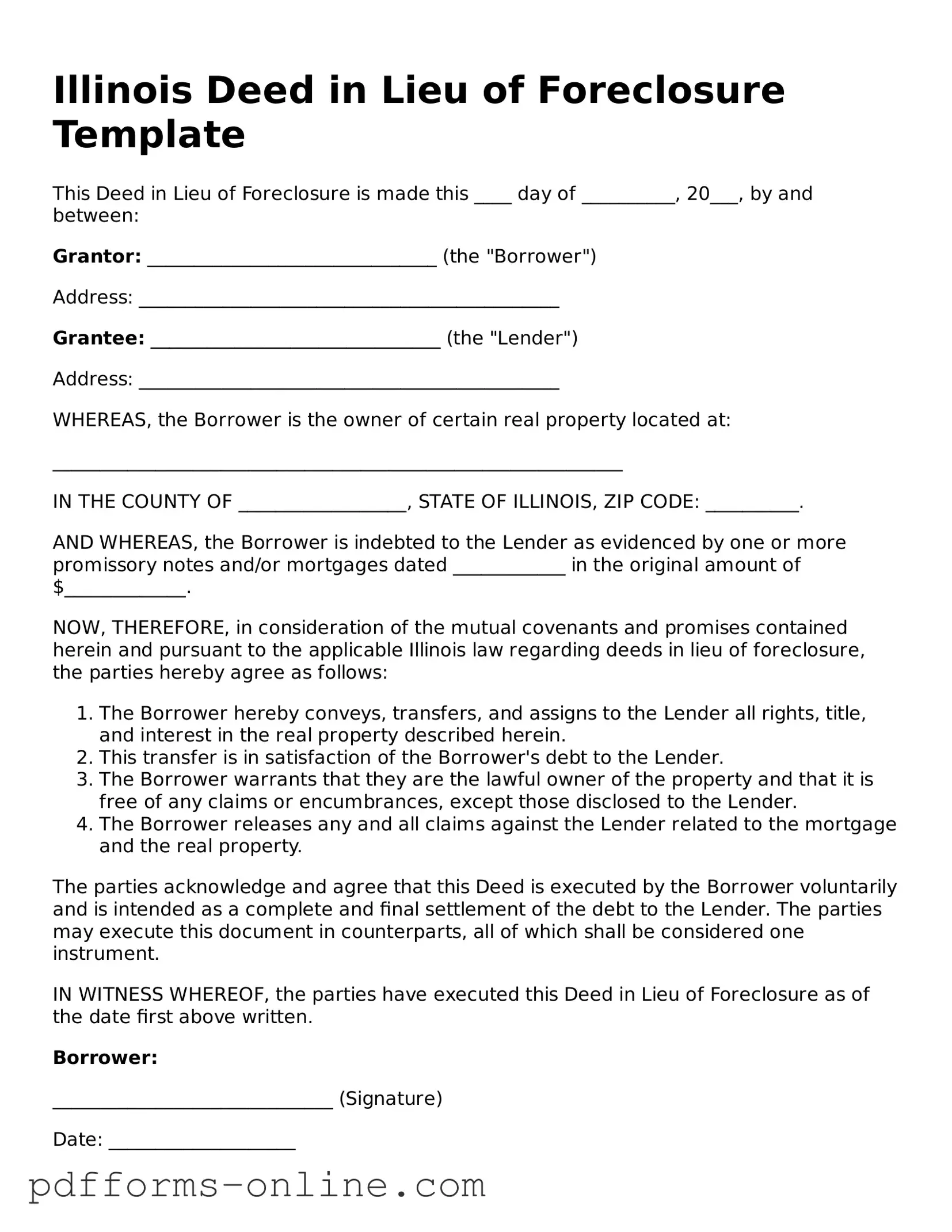

Valid Illinois Deed in Lieu of Foreclosure Template

In the state of Illinois, homeowners facing financial difficulties and the prospect of foreclosure may find a viable alternative in the Deed in Lieu of Foreclosure form. This legal instrument allows a borrower to voluntarily transfer ownership of their property back to the lender, thereby avoiding the often lengthy and costly foreclosure process. By executing this deed, the homeowner relinquishes their rights to the property in exchange for the lender's agreement to forgive the remaining mortgage debt. This arrangement can provide a sense of relief for homeowners, as it may mitigate the negative impact on their credit scores and allow them to move forward without the burden of an unpaid mortgage. The form itself encompasses several key components, including the identification of the parties involved, a clear description of the property, and any specific terms or conditions that may govern the transaction. Additionally, the form may outline the responsibilities of both the borrower and the lender, ensuring that all parties understand their rights and obligations. Ultimately, the Illinois Deed in Lieu of Foreclosure serves as a practical solution for those in distress, offering a pathway to financial recovery while preserving the dignity of the homeowner.

Frequently Asked Questions

-

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal process where a homeowner voluntarily transfers ownership of their property to the lender to avoid foreclosure. This arrangement allows the borrower to relinquish their property in exchange for the cancellation of their mortgage debt.

-

How does a Deed in Lieu of Foreclosure work?

In a Deed in Lieu of Foreclosure, the homeowner approaches the lender to propose the transfer of the property. If the lender agrees, both parties sign the deed, and the property ownership is transferred to the lender. This process can help the homeowner avoid the lengthy and costly foreclosure process.

-

What are the benefits of a Deed in Lieu of Foreclosure?

There are several benefits to consider:

- It can be less damaging to your credit score compared to a foreclosure.

- The process is often quicker and less expensive than going through foreclosure.

- Homeowners may be able to negotiate for a release from any remaining mortgage debt.

- It allows homeowners to avoid the stress and uncertainty associated with foreclosure proceedings.

-

Are there any drawbacks to a Deed in Lieu of Foreclosure?

Yes, there are some potential drawbacks:

- Not all lenders accept Deeds in Lieu of Foreclosure, so it may not be an option for everyone.

- Homeowners may still face tax implications if the lender forgives any remaining debt.

- It may not be suitable for those who wish to retain their home and are seeking alternatives to foreclosure.

-

What are the eligibility requirements for a Deed in Lieu of Foreclosure?

Eligibility can vary by lender, but generally, homeowners should:

- Be facing financial hardship.

- Be unable to keep up with mortgage payments.

- Have a property that is not subject to any other liens or encumbrances.

-

How do I initiate the process for a Deed in Lieu of Foreclosure?

To start, contact your lender to discuss your situation. Be honest about your financial difficulties and express your interest in a Deed in Lieu of Foreclosure. The lender may require you to provide financial documentation and may also conduct an evaluation of the property.

-

Can I negotiate terms with my lender?

Yes, negotiation is often possible. Homeowners may discuss various terms, including the potential for debt forgiveness or any relocation assistance. Each lender will have different policies, so it’s essential to communicate openly about your needs and concerns.

-

What should I do after signing a Deed in Lieu of Foreclosure?

Once the deed is signed, it’s important to ensure that the lender processes the transfer correctly. Keep copies of all documents for your records. Additionally, consider consulting a tax professional to understand any potential tax consequences related to the forgiven debt.

Misconceptions

Many homeowners facing foreclosure in Illinois may consider a Deed in Lieu of Foreclosure as a solution. However, several misconceptions can cloud understanding of this option. Here are five common misconceptions:

-

It eliminates all debt immediately.

A Deed in Lieu of Foreclosure does not automatically erase all debts. While it can relieve you of the mortgage obligation, any remaining debts or liens may still exist unless specifically addressed.

-

It is a simple process with no consequences.

While a Deed in Lieu may seem straightforward, it can have significant consequences. For example, it may impact your credit score and future borrowing ability.

-

It is always approved by lenders.

Not all lenders will accept a Deed in Lieu of Foreclosure. Each lender has specific criteria, and approval is not guaranteed.

-

It is the same as a short sale.

A Deed in Lieu of Foreclosure is different from a short sale. In a short sale, the property is sold for less than the mortgage balance with lender approval. A Deed in Lieu transfers ownership back to the lender without a sale.

-

It can only be used as a last resort.

While often viewed as a last resort, a Deed in Lieu can be a proactive choice for homeowners wanting to avoid the lengthy foreclosure process.

Common mistakes

-

Incomplete Information: One common mistake is failing to provide all required information. This includes not listing the correct legal description of the property or omitting the names of all parties involved. Each detail is crucial for the validity of the deed.

-

Not Notarizing the Document: A deed in lieu of foreclosure must be notarized to be legally binding. People often forget this step, which can lead to complications later on. Without a notarization, the document may not hold up in court.

-

Ignoring Lender Requirements: Lenders may have specific requirements for accepting a deed in lieu of foreclosure. Failing to check these requirements can result in rejection of the deed. Always communicate with the lender to ensure compliance.

-

Not Consulting Legal Advice: Many individuals attempt to fill out the form without seeking legal advice. This can lead to misunderstandings about rights and obligations. Consulting a legal professional can provide clarity and help avoid costly errors.

-

Failing to Understand Tax Implications: Some people overlook the potential tax consequences associated with a deed in lieu of foreclosure. It’s important to understand how this decision might affect your tax situation, as it could result in taxable income.

-

Not Keeping Copies: After completing the deed, individuals often neglect to keep copies of the signed document. This can be problematic if disputes arise later. Always retain copies for your records to ensure you have proof of the transaction.

Find Some Other Deed in Lieu of Foreclosure Forms for Specific States

What Does an Arizona Homeowner Lose When Choosing to Use Deed in Lieu of Foreclosure? - Documentation of the homeowner's financial hardship may be required as part of the process.

The importance of the New York Mobile Home Bill of Sale cannot be overstated, as it not only simplifies the transfer of ownership but also serves as a legal record that can help avoid disputes. For those looking to facilitate this essential transaction, resources like documentonline.org/blank-new-york-mobile-home-bill-of-sale/ offer templates that can make the process easier and more efficient for both buyers and sellers.

California Property Transfer Deed - The lender may waive certain fees in exchange for a Deed in Lieu.

PDF Attributes

| Fact Name | Details |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal document where a borrower voluntarily transfers property ownership to the lender to avoid foreclosure. |

| Governing Law | The process is governed by Illinois law, specifically the Illinois Compiled Statutes, Chapter 735, Section 5/15-1401. |

| Eligibility | Homeowners facing financial difficulties may qualify for this option if they are unable to continue making mortgage payments. |

| Advantages | This option can help borrowers avoid the lengthy foreclosure process and minimize damage to their credit score. |

| Disadvantages | Borrowers may still face tax implications, as the forgiven debt could be considered taxable income. |

| Process | The borrower must contact the lender, provide necessary documentation, and agree on the terms of the deed transfer. |

| Impact on Credit | A deed in lieu of foreclosure can negatively affect credit scores, but typically less severely than a full foreclosure. |

| Legal Representation | It is advisable for borrowers to seek legal advice before proceeding with a deed in lieu of foreclosure. |

| Alternatives | Other options include loan modification, short sale, or filing for bankruptcy, which may be more suitable for some homeowners. |

Similar forms

The Illinois Deed in Lieu of Foreclosure is similar to a Short Sale Agreement. In both situations, the homeowner is facing financial difficulties and seeks to avoid foreclosure. A short sale allows the homeowner to sell the property for less than the mortgage owed, with the lender's approval. This process can help the homeowner mitigate credit damage and provide the lender with a more favorable outcome than a foreclosure. Both options require cooperation between the homeowner and the lender, emphasizing negotiation and mutual agreement.

Additionally, it is essential for borrowers to understand the financial implications when exploring options such as a Deed in Lieu of Foreclosure. Tools like the Profit And Loss form can aid in assessing one's financial situation by summarizing revenues and expenses, offering clarity on cash flow and profitability. For further insights into managing financial documents and understanding your obligations, you can visit OnlineLawDocs.com.

Another document that shares similarities is the Mortgage Release or Satisfaction of Mortgage. This document signifies that a mortgage has been paid off or otherwise settled. In the case of a Deed in Lieu of Foreclosure, the lender accepts the property in exchange for releasing the homeowner from the mortgage obligation. Both documents serve to clear the homeowner’s debt, although the circumstances leading to their execution differ significantly.

A Foreclosure Notice is also comparable to the Deed in Lieu of Foreclosure. This notice is a formal communication from the lender indicating the initiation of foreclosure proceedings. While a Deed in Lieu of Foreclosure aims to prevent the lengthy process of foreclosure, both documents highlight the financial distress of the homeowner. The Deed in Lieu offers a way out, while the Foreclosure Notice marks the beginning of a more adversarial process.

The Loan Modification Agreement is another relevant document. This agreement involves changing the terms of an existing mortgage to make it more manageable for the borrower. Like the Deed in Lieu of Foreclosure, a loan modification seeks to prevent foreclosure. However, while the Deed in Lieu transfers ownership of the property, a loan modification allows the homeowner to retain ownership by adjusting their payment obligations.

The Bankruptcy Filing is also similar in that it can provide relief from foreclosure. When a homeowner files for bankruptcy, it can halt foreclosure proceedings temporarily. Both the Deed in Lieu of Foreclosure and bankruptcy aim to protect the homeowner's interests, although they do so through different legal mechanisms. In bankruptcy, the court intervenes, whereas a Deed in Lieu involves a direct agreement with the lender.

A Quitclaim Deed shares some similarities as well. This document allows a property owner to transfer their interest in the property to another party without guaranteeing that the title is clear. In a Deed in Lieu of Foreclosure, the homeowner is essentially relinquishing their interest in the property to the lender. Both documents involve the transfer of property rights, although the Quitclaim Deed does not necessarily involve a debt resolution.

The Property Settlement Agreement is another document that can be likened to the Deed in Lieu of Foreclosure. Often used in divorce cases, this agreement outlines how property will be divided between parties. In a similar vein, the Deed in Lieu of Foreclosure determines how the property is handled when financial obligations cannot be met. Both documents aim to settle ownership issues, albeit in different contexts.

Lastly, the Real Estate Purchase Agreement can be compared to the Deed in Lieu of Foreclosure. This agreement outlines the terms under which a property will be sold. In the case of a Deed in Lieu, the property is effectively sold back to the lender, eliminating the need for a traditional sale process. Both documents involve the transfer of property, but the motivations and processes differ significantly.