Valid Illinois Deed Template

The Illinois Deed form plays a crucial role in real estate transactions, serving as a legal document that facilitates the transfer of property ownership. This form is essential for both buyers and sellers, as it provides a clear record of the transaction and outlines the terms under which the property is being conveyed. Key components of the Illinois Deed include the names of the grantor and grantee, a legal description of the property, and the consideration, or payment, involved in the transfer. Additionally, the form often includes information regarding any encumbrances or liens on the property, ensuring that the new owner is fully informed about the status of their investment. Understanding the nuances of this form is vital for anyone involved in real estate in Illinois, as it helps to protect the rights of all parties and ensures compliance with state laws. Proper execution and recording of the deed are necessary steps that validate the transfer and provide public notice of the new ownership, making it an indispensable part of the property transaction process.

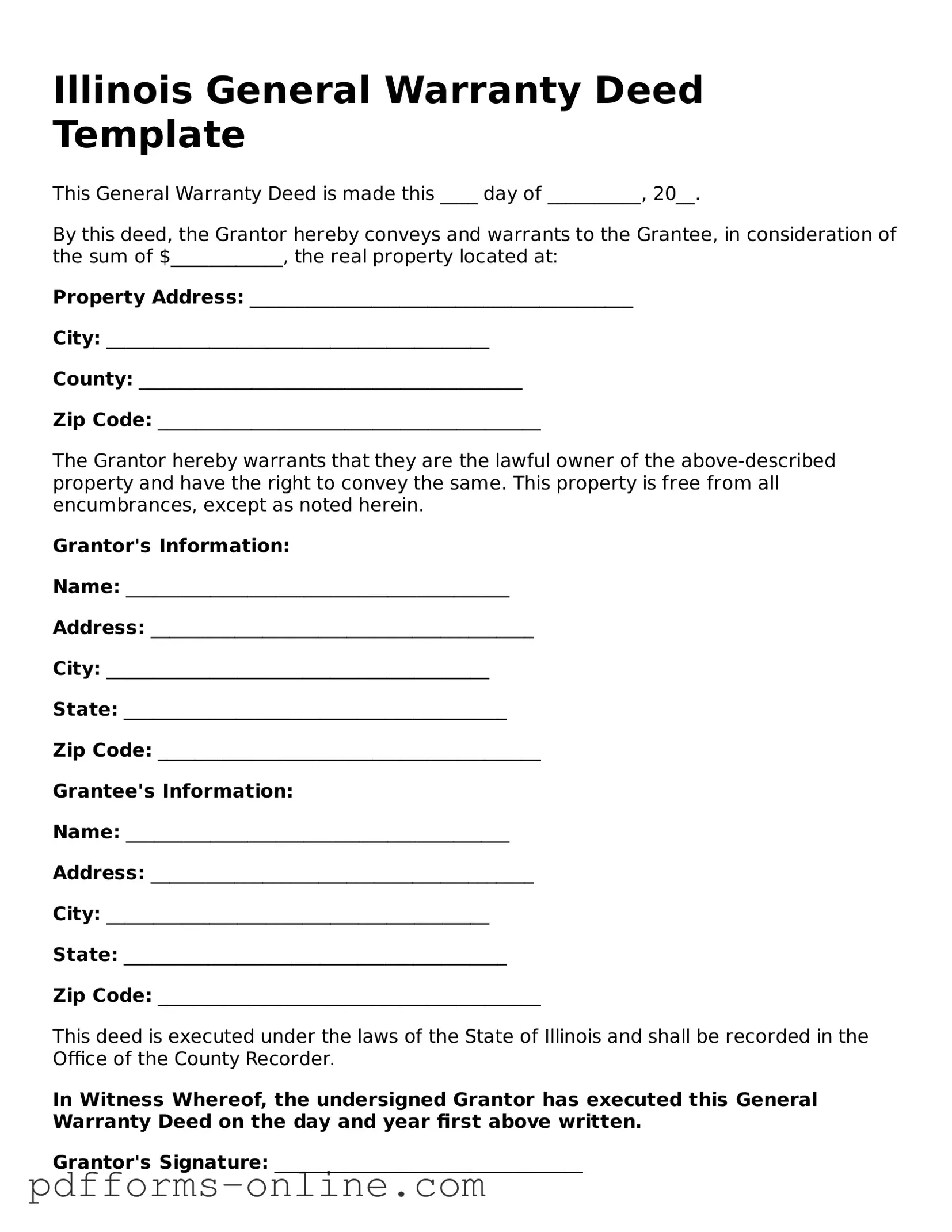

Document Example

Illinois General Warranty Deed Template

This General Warranty Deed is made this ____ day of __________, 20__.

By this deed, the Grantor hereby conveys and warrants to the Grantee, in consideration of the sum of $____________, the real property located at:

Property Address: _________________________________________

City: _________________________________________

County: _________________________________________

Zip Code: _________________________________________

The Grantor hereby warrants that they are the lawful owner of the above-described property and have the right to convey the same. This property is free from all encumbrances, except as noted herein.

Grantor's Information:

Name: _________________________________________

Address: _________________________________________

City: _________________________________________

State: _________________________________________

Zip Code: _________________________________________

Grantee's Information:

Name: _________________________________________

Address: _________________________________________

City: _________________________________________

State: _________________________________________

Zip Code: _________________________________________

This deed is executed under the laws of the State of Illinois and shall be recorded in the Office of the County Recorder.

In Witness Whereof, the undersigned Grantor has executed this General Warranty Deed on the day and year first above written.

Grantor's Signature: _________________________________

Witness Signature: _________________________________

Witness Name: ________________________________________

Notary Public:

State of Illinois

County of ____________________________________

Subscribed and sworn before me this ____ day of __________, 20__.

Notary Signature: _________________________________

My Commission Expires: ___________________________

Frequently Asked Questions

-

What is an Illinois Deed form?

An Illinois Deed form is a legal document used to transfer ownership of real property from one party to another within the state of Illinois. This form outlines the details of the transaction, including the names of the parties involved, the property description, and the type of deed being used.

-

What types of deeds are available in Illinois?

Illinois recognizes several types of deeds, including:

- Warranty Deed: Offers the highest level of protection to the buyer, ensuring that the seller has clear title to the property.

- Quitclaim Deed: Transfers any interest the seller has in the property without guaranteeing that the title is clear.

- Special Warranty Deed: Similar to a warranty deed, but the seller only guarantees the title for the time they owned the property.

-

Who can prepare an Illinois Deed form?

While anyone can technically fill out a deed form, it is advisable to have it prepared by a legal professional or a qualified document preparer. This ensures that the deed complies with state laws and accurately reflects the intentions of the parties involved.

-

What information is required on an Illinois Deed form?

The deed must include specific information such as:

- The full names and addresses of the grantor (seller) and grantee (buyer).

- A legal description of the property being transferred.

- The date of the transaction.

- The type of deed being executed.

-

Is notarization required for an Illinois Deed?

Yes, in Illinois, a deed must be signed in the presence of a notary public. The notary will verify the identities of the parties signing the deed and affix their seal to the document.

-

How is the deed recorded in Illinois?

After the deed is signed and notarized, it must be filed with the appropriate county recorder's office. This step is crucial as it provides public notice of the property transfer and protects the buyer's ownership rights.

-

Are there any fees associated with recording a deed?

Yes, there are typically fees for recording a deed in Illinois. These fees vary by county, so it is advisable to check with the local recorder’s office for specific amounts. Additionally, there may be transfer taxes applicable to the property transfer.

-

What happens if the deed is not recorded?

If a deed is not recorded, it may create complications for the buyer's ownership rights. Unrecorded deeds can lead to disputes over property ownership and may not provide the same level of legal protection as recorded deeds.

Misconceptions

When it comes to the Illinois Deed form, there are several misconceptions that can lead to confusion. Understanding these myths can help ensure a smoother property transfer process. Here are eight common misconceptions:

- All deeds are the same. Many people believe that all deed forms are interchangeable. In reality, different types of deeds serve different purposes, such as warranty deeds, quitclaim deeds, and special warranty deeds. Each has its own legal implications.

- You don’t need a deed for a property transfer. Some may think that a verbal agreement or a handshake is sufficient for transferring property. However, a deed is a legal document that provides proof of ownership and must be properly executed and recorded.

- Only a lawyer can prepare a deed. While legal assistance can be helpful, it is not mandatory. Individuals can prepare their own deeds as long as they follow the state’s requirements for validity.

- Once a deed is recorded, it cannot be changed. Many believe that recording a deed locks it in place permanently. However, deeds can be amended or revoked through a new deed if the property owner wishes to make changes.

- There are no fees associated with recording a deed. Some people assume that recording a deed is free. In Illinois, there are fees involved in the recording process, which can vary by county.

- Only the seller needs to sign the deed. It is a common misconception that only the seller’s signature is necessary. In fact, both the grantor (seller) and grantee (buyer) typically need to sign the deed for it to be valid.

- Deeds do not need to be notarized. Many individuals think notarization is optional. In Illinois, most deeds must be notarized to be legally binding and to ensure proper recording.

- Using a deed template is always sufficient. While templates can be helpful, relying solely on them without understanding the specific requirements for your situation can lead to errors. It’s important to ensure that the template meets Illinois laws and accurately reflects the transaction.

By dispelling these misconceptions, property owners can approach the process of transferring ownership with greater confidence and clarity. Always consider verifying information with reliable sources or professionals when in doubt.

Common mistakes

-

Incorrect Grantee Information: Failing to provide the full legal name of the grantee can lead to delays. Ensure that names are spelled correctly and match official identification.

-

Missing Signatures: All required parties must sign the deed. Omitting a signature can invalidate the document.

-

Inaccurate Property Description: A vague or incorrect property description can cause confusion. Use precise legal descriptions as found in previous deeds or property records.

-

Failure to Notarize: Many deeds require notarization. Without a notary's signature and seal, the document may not be accepted.

-

Improperly Completed Date: The date of execution must be clearly indicated. Leaving this blank or using an incorrect format can create issues.

-

Neglecting to Record the Deed: After filling out the form, it must be recorded with the county. Failing to do so can lead to disputes over property ownership.

Find Some Other Deed Forms for Specific States

What Does a House Deed Look Like in Pa - A deed is a foundational document in real estate transactions.

The importance of having a well-drafted Mobile Home Bill of Sale cannot be overstated, as it not only protects the interests of the buyer and seller but also ensures compliance with legal requirements. For more information on how to properly execute this form, you can visit documentonline.org/blank-new-york-mobile-home-bill-of-sale/, where resources are available to guide you through the process.

How Long Does It Take to Record a Deed in Florida - It is prudent to keep a copy of the filed Deed for personal records.

PDF Attributes

| Fact Name | Description |

|---|---|

| Type of Deed | In Illinois, the most common types of deeds are warranty deeds and quitclaim deeds, which serve different purposes in property transfer. |

| Governing Law | The Illinois Deed form is governed by the Illinois Compiled Statutes, specifically 765 ILCS 1005 and 765 ILCS 200/1. |

| Requirements | The deed must be signed by the grantor and acknowledged before a notary public to be legally effective. |

| Recording | To protect the interests of the new owner, the deed should be recorded with the county clerk’s office in the county where the property is located. |

Similar forms

The Illinois Deed form is similar to the Quitclaim Deed, which is used to transfer ownership without guaranteeing that the title is clear. Both documents serve the purpose of transferring property, but a Quitclaim Deed offers no warranties about the property’s title. This means the grantor simply conveys whatever interest they have, if any, without any assurances. This can be useful in situations where the parties know each other and trust each other’s claims to the property.

Another document similar to the Illinois Deed is the Warranty Deed. This type of deed provides a guarantee that the grantor holds clear title to the property and has the right to sell it. Unlike the Illinois Deed, which may not include such warranties, the Warranty Deed protects the buyer by ensuring that they receive full ownership without any hidden claims or liens. This added layer of security makes the Warranty Deed a preferred choice in many real estate transactions.

The Bargain and Sale Deed also bears resemblance to the Illinois Deed. This document implies that the grantor has the right to transfer the property but does not provide any warranties regarding the title. It is often used in foreclosure sales or tax lien sales, where the seller may not have full knowledge of the property’s condition or title. Like the Illinois Deed, it facilitates the transfer of ownership but with less assurance for the buyer.

A Special Purpose Deed is another document that shares similarities with the Illinois Deed. This type of deed is often used for specific transactions, such as transferring property into a trust or for estate planning purposes. While it serves a unique function, it still operates under the same basic principle of transferring property ownership. The focus remains on the transfer, much like the Illinois Deed, but with additional stipulations based on the purpose of the transaction.

The Trustee’s Deed is also comparable to the Illinois Deed. This document is used when a property is transferred by a trustee, typically in the context of a trust or bankruptcy. While the Illinois Deed is generally used for standard property transactions, the Trustee’s Deed emphasizes the role of the trustee in managing and transferring property. Both documents facilitate ownership transfer, but the context and authority behind the transfer differ significantly.

Understanding a Florida Loan Agreement document is essential for anyone looking to engage in lending or borrowing, as it lays down the terms and conditions that protect all parties involved in the transaction.

Lastly, the Personal Representative’s Deed is similar to the Illinois Deed in that it is used to transfer property from an estate to heirs or beneficiaries after a person passes away. This deed allows the personal representative, appointed by the court, to convey the property as part of the estate settlement process. Like the Illinois Deed, it serves to formalize the transfer of ownership, but it is specifically tied to the probate process and the responsibilities of the personal representative.