Valid Illinois Bill of Sale Template

The Illinois Bill of Sale form serves as a crucial document in various transactions, particularly when buying or selling personal property. This form provides a clear record of the exchange, detailing essential information such as the names and addresses of both the buyer and the seller, a description of the item being sold, and the sale price. By documenting these key elements, the Bill of Sale helps protect both parties involved in the transaction. It can be used for a wide range of items, from vehicles to furniture, ensuring that ownership is properly transferred. Additionally, it may include terms regarding warranties or conditions of the sale, which further clarify the agreement between the buyer and seller. Understanding the importance of this form is vital for anyone engaging in a sale in Illinois, as it not only legitimizes the transaction but also provides peace of mind to both parties.

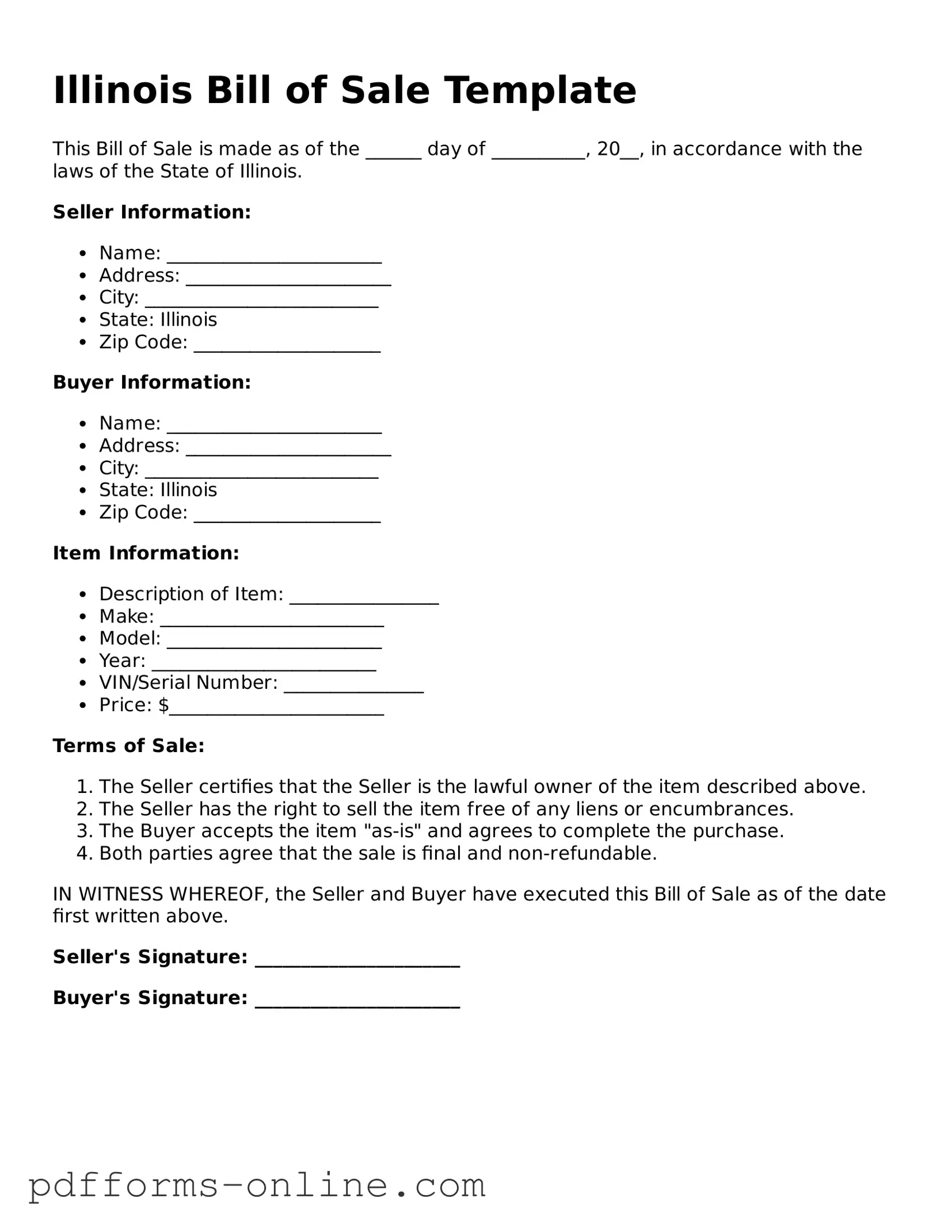

Document Example

Illinois Bill of Sale Template

This Bill of Sale is made as of the ______ day of __________, 20__, in accordance with the laws of the State of Illinois.

Seller Information:

- Name: _______________________

- Address: ______________________

- City: _________________________

- State: Illinois

- Zip Code: ____________________

Buyer Information:

- Name: _______________________

- Address: ______________________

- City: _________________________

- State: Illinois

- Zip Code: ____________________

Item Information:

- Description of Item: ________________

- Make: ________________________

- Model: _______________________

- Year: ________________________

- VIN/Serial Number: _______________

- Price: $_______________________

Terms of Sale:

- The Seller certifies that the Seller is the lawful owner of the item described above.

- The Seller has the right to sell the item free of any liens or encumbrances.

- The Buyer accepts the item "as-is" and agrees to complete the purchase.

- Both parties agree that the sale is final and non-refundable.

IN WITNESS WHEREOF, the Seller and Buyer have executed this Bill of Sale as of the date first written above.

Seller's Signature: ______________________

Buyer's Signature: ______________________

Frequently Asked Questions

-

What is an Illinois Bill of Sale?

An Illinois Bill of Sale is a legal document that serves as proof of the transfer of ownership of personal property from one individual to another. This document is particularly important for transactions involving vehicles, boats, and other high-value items. It includes details such as the names of the buyer and seller, a description of the item being sold, the sale price, and the date of the transaction.

-

When do I need a Bill of Sale in Illinois?

A Bill of Sale is typically required when you are buying or selling items that require registration, such as cars or boats. While it is not mandatory for all personal property sales, having a Bill of Sale can help protect both the buyer and the seller by providing a written record of the transaction. It can also be useful for tax purposes or in case of disputes.

-

What information should be included in an Illinois Bill of Sale?

To ensure the Bill of Sale is valid, include the following information:

- Full names and addresses of both the buyer and seller

- Description of the item being sold, including make, model, year, and VIN (for vehicles)

- Sale price

- Date of the transaction

- Signatures of both parties

Including all this information helps to create a clear and comprehensive record of the sale.

-

Do I need to have the Bill of Sale notarized?

In Illinois, notarization of a Bill of Sale is not required by law. However, having the document notarized can add an extra layer of security and authenticity to the transaction. It can be particularly beneficial if there are any disputes in the future, as a notarized document is generally viewed as more credible.

Misconceptions

Understanding the Illinois Bill of Sale form is essential for anyone involved in buying or selling personal property. However, several misconceptions can lead to confusion. Here are ten common misconceptions about this important document:

- A Bill of Sale is only necessary for vehicles. Many people believe that a Bill of Sale is only required for the sale of cars or motorcycles. In reality, it can be used for any personal property transaction, including boats, electronics, and furniture.

- All Bill of Sale forms are the same. While there are standard elements that most Bill of Sale forms include, specific requirements may vary by state. It’s important to use the correct form for Illinois to ensure compliance with local laws.

- A Bill of Sale does not need to be notarized. In Illinois, notarization is not typically required for a Bill of Sale. However, having it notarized can provide additional legal protection and verification for both parties.

- Only the seller needs to sign the Bill of Sale. Both the buyer and seller should sign the Bill of Sale to make it valid. This protects the interests of both parties involved in the transaction.

- A Bill of Sale is not legally binding. A properly completed Bill of Sale is a legally binding document. It serves as proof of the transaction and can be used in court if disputes arise.

- Once signed, a Bill of Sale cannot be changed. While it’s best to ensure all information is correct before signing, a Bill of Sale can be amended if both parties agree to the changes. It’s advisable to document any amendments in writing.

- A Bill of Sale is only for private sales. Many believe that Bill of Sale forms are only necessary for private transactions. However, they can also be useful in sales between businesses or in auctions.

- You don’t need a Bill of Sale if you have a receipt. While a receipt can serve as proof of purchase, a Bill of Sale provides more detailed information about the transaction, including descriptions of the property and any warranties.

- A Bill of Sale is not required for gifts. Even if you are giving an item as a gift, a Bill of Sale can be helpful. It can clarify ownership and prevent future disputes over the property.

- The Illinois Bill of Sale form is difficult to obtain. In fact, many resources are available online to access a Bill of Sale form. Templates can be easily found and customized to fit specific needs.

By addressing these misconceptions, individuals can better understand the importance of the Illinois Bill of Sale form and its role in property transactions.

Common mistakes

-

Incomplete Information: Many individuals forget to fill out all required fields. This can include the names of both the buyer and seller, the date of the transaction, and a detailed description of the item being sold. Omitting any of this information can lead to confusion or disputes later on.

-

Incorrect Item Description: Providing a vague or inaccurate description of the item can create problems. It’s essential to include specific details such as the make, model, year, and condition. A clear description helps ensure both parties understand exactly what is being sold.

-

Failure to Sign: One common oversight is neglecting to sign the document. Both the buyer and seller should sign the Bill of Sale to validate the transaction. Without signatures, the document may not be considered legally binding.

-

Not Keeping Copies: After completing the Bill of Sale, some people forget to make copies for their records. It’s wise to keep a copy for both the buyer and seller. This can serve as proof of the transaction and can be helpful in case any issues arise in the future.

Find Some Other Bill of Sale Forms for Specific States

Mv New York - A Bill of Sale can help establish a timeline of ownership for certain items over time.

Bill of Sale Dmv - It's recommended to keep a copy of the Bill of Sale for personal records.

Free Bill of Sale Georgia - Buyers should review the Bill of Sale to ensure all terms are satisfactory before signing.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | An Illinois Bill of Sale is a legal document that records the transfer of ownership of personal property from one party to another. |

| Governing Law | The Bill of Sale is governed by the Illinois Uniform Commercial Code (UCC), specifically Article 2. |

| Types of Property | This form can be used for various types of personal property, including vehicles, boats, and equipment. |

| Notarization | Notarization is not required for all Bill of Sale forms in Illinois, but it is recommended for vehicles to ensure authenticity. |

| Seller's Information | The form must include the seller's full name, address, and signature to validate the transfer. |

| Buyer's Information | Buyer's full name and address must also be provided to complete the transaction record. |

| Date of Sale | The date of the transaction should be clearly stated on the Bill of Sale. |

| Consideration | The form should specify the purchase price or consideration exchanged for the property. |

| As-Is Clause | It is common to include an "as-is" clause, indicating the buyer accepts the property in its current condition. |

| Record Keeping | Both parties should keep a copy of the Bill of Sale for their records and future reference. |

Similar forms

The Illinois Bill of Sale form shares similarities with the Purchase Agreement. A Purchase Agreement is a comprehensive document that outlines the terms and conditions of a sale between a buyer and a seller. Like the Bill of Sale, it serves as proof of the transaction. Both documents detail the item being sold, the purchase price, and the identities of the parties involved. However, the Purchase Agreement often contains more extensive provisions, such as warranties and contingencies, while the Bill of Sale is generally more straightforward and focused solely on the transfer of ownership.

Another document that bears resemblance to the Illinois Bill of Sale is the Vehicle Title Transfer. This document is crucial in the sale of a motor vehicle, as it officially transfers ownership from the seller to the buyer. Similar to the Bill of Sale, the Vehicle Title Transfer includes essential information such as the vehicle identification number (VIN), the names of both parties, and the sale date. However, the Vehicle Title Transfer is specifically tailored for vehicles and is often required by state law to complete the registration process.

The Lease Agreement also shares common elements with the Illinois Bill of Sale. While a Lease Agreement pertains to the rental of property rather than a sale, both documents establish a legal relationship between parties. They outline the rights and responsibilities of each party, including payment terms and duration. The Lease Agreement serves to protect both the landlord and tenant, much like the Bill of Sale protects the interests of the buyer and seller in a transaction. However, the Lease Agreement typically includes more detailed provisions regarding the use of the property and conditions for termination.

Another similar document is the Receipt for Payment. A Receipt for Payment is often issued after a transaction occurs, confirming that payment has been made for goods or services. Like the Bill of Sale, it provides evidence of the transaction and includes information about the item sold and the amount paid. However, a Receipt for Payment may not include the same level of detail regarding the terms of the sale or the identities of the parties involved, focusing instead on confirming the financial exchange.

Finally, the Affidavit of Ownership can be compared to the Illinois Bill of Sale. An Affidavit of Ownership is a sworn statement that attests to the ownership of an item, often used when a Bill of Sale is not available. Both documents serve to establish proof of ownership, but the Affidavit of Ownership may be necessary in situations where the original documentation is lost or unavailable. While the Bill of Sale is a straightforward record of a transaction, the Affidavit of Ownership involves a legal declaration that can be used in various contexts, including disputes over ownership.