Valid Illinois Articles of Incorporation Template

Incorporating a business in Illinois is a significant step that offers various legal protections and benefits. The Illinois Articles of Incorporation form serves as a foundational document that officially establishes a corporation within the state. This form requires essential information, including the corporation's name, purpose, and the address of its registered office. Additionally, it mandates the listing of the initial board of directors, which is crucial for governance. The form also addresses the type of stock the corporation is authorized to issue, providing clarity on ownership and investment opportunities. Understanding these elements is vital for anyone looking to navigate the incorporation process smoothly and effectively. By accurately completing the Articles of Incorporation, entrepreneurs can ensure compliance with state regulations while laying the groundwork for their business's future growth and success.

Document Example

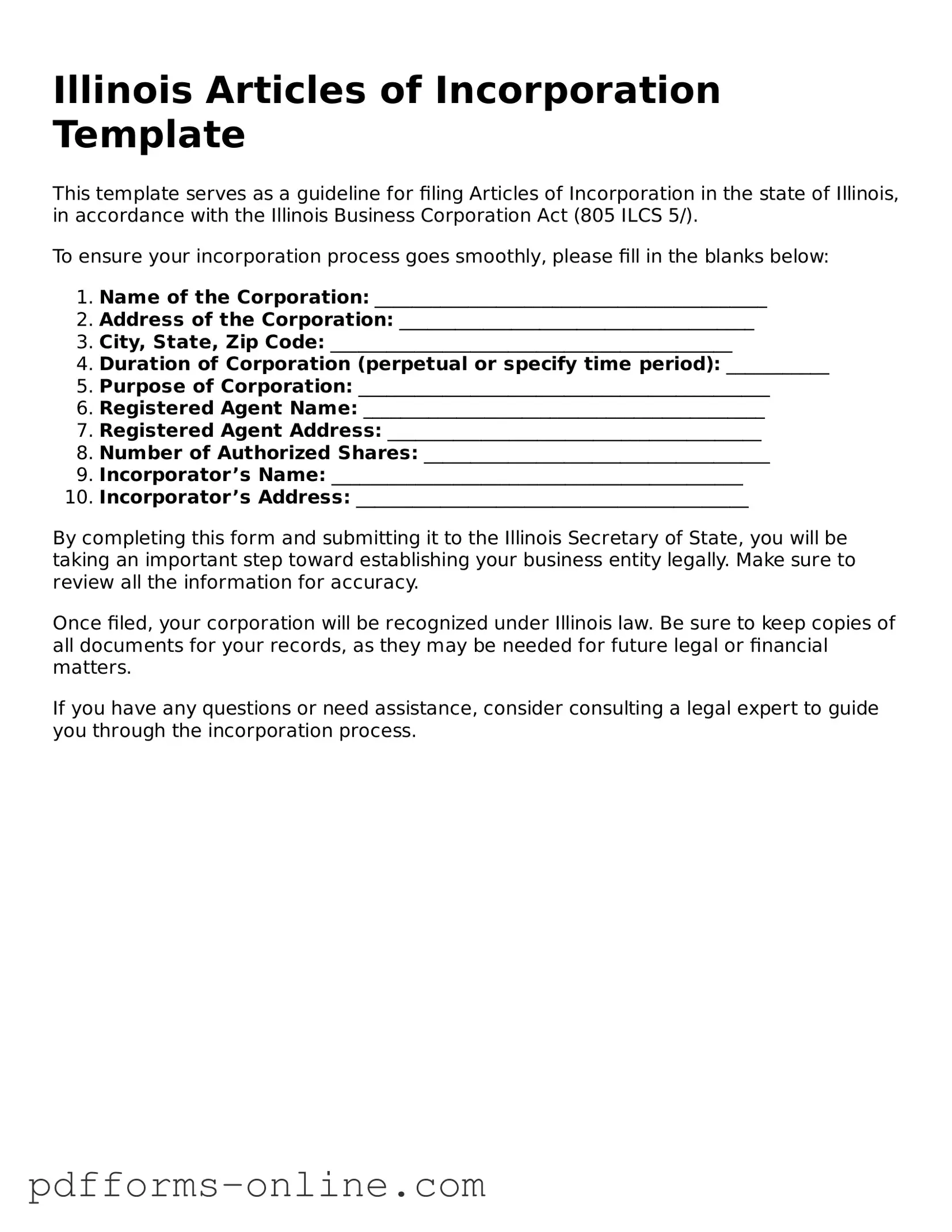

Illinois Articles of Incorporation Template

This template serves as a guideline for filing Articles of Incorporation in the state of Illinois, in accordance with the Illinois Business Corporation Act (805 ILCS 5/).

To ensure your incorporation process goes smoothly, please fill in the blanks below:

- Name of the Corporation: __________________________________________

- Address of the Corporation: ______________________________________

- City, State, Zip Code: ___________________________________________

- Duration of Corporation (perpetual or specify time period): ___________

- Purpose of Corporation: ____________________________________________

- Registered Agent Name: ___________________________________________

- Registered Agent Address: ________________________________________

- Number of Authorized Shares: _____________________________________

- Incorporator’s Name: ____________________________________________

- Incorporator’s Address: __________________________________________

By completing this form and submitting it to the Illinois Secretary of State, you will be taking an important step toward establishing your business entity legally. Make sure to review all the information for accuracy.

Once filed, your corporation will be recognized under Illinois law. Be sure to keep copies of all documents for your records, as they may be needed for future legal or financial matters.

If you have any questions or need assistance, consider consulting a legal expert to guide you through the incorporation process.

Frequently Asked Questions

-

What are the Articles of Incorporation?

The Articles of Incorporation are a set of formal documents filed with the state to legally create a corporation. This document outlines the basic details about the corporation, including its name, purpose, and structure.

-

Why do I need to file Articles of Incorporation?

Filing Articles of Incorporation is essential for establishing your corporation as a separate legal entity. This protects your personal assets from business liabilities and provides credibility to your business in the eyes of customers and investors.

-

What information is required in the Articles of Incorporation?

The form typically requires the following information:

- The name of the corporation

- The purpose of the corporation

- The registered agent's name and address

- The number of shares the corporation is authorized to issue

- The names and addresses of the incorporators

-

How do I file the Articles of Incorporation in Illinois?

To file the Articles of Incorporation in Illinois, you can submit the form online through the Secretary of State's website or send a paper application via mail. Be sure to include the required filing fee, which can vary based on the type of corporation you are forming.

-

What is the filing fee for the Articles of Incorporation?

The filing fee for the Articles of Incorporation in Illinois varies depending on the type of corporation. Generally, it ranges from $50 to $150. Check the Illinois Secretary of State's website for the most current fee schedule.

-

How long does it take to process the Articles of Incorporation?

Processing times can vary. Typically, it takes about 10 to 15 business days for the state to process your Articles of Incorporation. If you need faster service, expedited processing options may be available for an additional fee.

-

Can I amend the Articles of Incorporation after filing?

Yes, you can amend the Articles of Incorporation after they have been filed. To do this, you will need to submit an amendment form along with any required fees. This is important if you need to change the corporation's name, purpose, or other critical details.

-

Do I need a lawyer to file the Articles of Incorporation?

While it is not legally required to hire a lawyer to file the Articles of Incorporation, it can be beneficial. A lawyer can help ensure that your documents are filled out correctly and that you comply with all state requirements.

-

What happens after I file the Articles of Incorporation?

Once your Articles of Incorporation are approved, you will receive a certificate of incorporation. This document serves as proof that your corporation is officially recognized by the state. You can then proceed with other important steps, such as obtaining an Employer Identification Number (EIN) and setting up your corporate bylaws.

Misconceptions

Many people have misunderstandings about the Illinois Articles of Incorporation form. Here are eight common misconceptions, along with explanations to clarify them.

- Misconception 1: You need to hire a lawyer to file the Articles of Incorporation.

- Misconception 2: The Articles of Incorporation must be filed in person.

- Misconception 3: Only large businesses need to file Articles of Incorporation.

- Misconception 4: The Articles of Incorporation are the same as a business license.

- Misconception 5: You can change the name of your corporation after filing the Articles without any issue.

- Misconception 6: Filing Articles of Incorporation guarantees business success.

- Misconception 7: All states have the same Articles of Incorporation requirements.

- Misconception 8: Once filed, the Articles of Incorporation cannot be changed.

This is not true. While legal advice can be helpful, individuals can prepare and file the form themselves without needing an attorney.

Filing can be done online or by mail. Illinois offers multiple methods for submission, making it convenient for business owners.

Any business entity, regardless of size, that wants to operate as a corporation must file these articles.

These are different documents. The Articles establish the corporation's existence, while a business license allows operation within a specific jurisdiction.

Changing the name requires filing an amendment. It is not as simple as just updating your marketing materials.

While filing is a necessary step to establish a corporation, it does not ensure profitability or success. Business planning and management are also crucial.

Each state has its own rules and forms. It is important to follow Illinois-specific guidelines when filing.

Amendments can be made to the Articles after they are filed. This allows for flexibility as the business evolves.

Common mistakes

-

Incomplete Information: One of the most common mistakes is failing to provide all necessary details. Each section of the Articles of Incorporation must be filled out completely. Omitting information, such as the name of the corporation or the address of the registered agent, can lead to delays or rejections.

-

Incorrect Entity Name: The name chosen for the corporation must comply with Illinois naming rules. It should be unique and not too similar to existing entities. Additionally, it must include an appropriate designation, such as "Corporation" or "Inc." Many applicants overlook this requirement, risking rejection of their application.

-

Failure to Designate a Registered Agent: Every corporation in Illinois is required to have a registered agent. This person or entity must be located in Illinois and is responsible for receiving legal documents. Neglecting to provide this information can cause significant issues down the line.

-

Not Including the Purpose of the Corporation: The Articles of Incorporation must state the purpose of the corporation. While many opt for broad language, being too vague can lead to complications. A clear and specific purpose helps define the corporation’s activities and can prevent misunderstandings in the future.

Find Some Other Articles of Incorporation Forms for Specific States

California Articles of Incorporation - Requests verification of the corporation's formation.

Pa Division of Corporations - Guidance for completion is often provided by state business offices.

PDF Attributes

| Fact Name | Details |

|---|---|

| Governing Law | The Illinois Articles of Incorporation are governed by the Illinois Business Corporation Act of 1983. |

| Purpose | The form is used to officially create a corporation in the state of Illinois. |

| Filing Requirement | Filing the Articles of Incorporation with the Illinois Secretary of State is mandatory to establish a corporation. |

| Information Required | Key information includes the corporation's name, purpose, registered agent, and address. |

| Filing Fee | A filing fee is required, which varies depending on the type of corporation being formed. |

| Effective Date | The corporation can specify an effective date for the Articles of Incorporation, which may be the filing date or a future date. |

| Amendments | Changes to the Articles of Incorporation can be made through a formal amendment process. |

| Public Record | Once filed, the Articles of Incorporation become part of the public record and can be accessed by the public. |

Similar forms

The Illinois Articles of Incorporation form is similar to the Certificate of Incorporation, which is used in many states across the U.S. This document serves a similar purpose by officially establishing a corporation and providing essential details such as the company name, business purpose, and registered agent. Both documents are filed with the state government and are crucial for legal recognition. The Certificate of Incorporation often includes provisions regarding the structure of the corporation, just as the Articles of Incorporation do, ensuring that both documents lay the groundwork for corporate governance.

Another document comparable to the Articles of Incorporation is the Bylaws. While the Articles of Incorporation outline the basic structure and purpose of the corporation, Bylaws delve into the internal rules and procedures for governance. They define how meetings are conducted, how officers are appointed, and how decisions are made. Together, these documents create a comprehensive framework for the corporation, with the Articles providing external recognition and the Bylaws detailing internal operations.

The Operating Agreement is akin to the Articles of Incorporation, particularly for Limited Liability Companies (LLCs). This document outlines the management structure and operational procedures of the LLC, similar to how the Articles describe the corporation's foundational aspects. Both documents are essential for legal compliance and help clarify the roles and responsibilities of members or shareholders, ensuring smooth operation and governance of the business entity.

Partnership Agreements also share similarities with the Articles of Incorporation. While the Articles are specific to corporations, a Partnership Agreement establishes the terms and conditions under which partners will operate their business. This document details the roles, profit-sharing, and decision-making processes among partners. Both documents serve to formalize business relationships and provide a clear framework for operations, whether in a corporate or partnership setting.

Finally, the Statement of Information is another document that relates closely to the Articles of Incorporation. This document is often required by states to provide updated information about the corporation, such as its address, officers, and registered agent. While the Articles of Incorporation establish the corporation's existence, the Statement of Information ensures that the state has current and accurate details about the corporation's operations. Both documents are vital for maintaining good standing with state authorities and ensuring transparency in business activities.