Blank Gift Letter Template

The Gift Letter form serves as an important document in various financial transactions, particularly in real estate and mortgage applications. This form is typically used when one individual provides a monetary gift to another, often to assist with a down payment on a home. It outlines the details of the gift, including the amount, the relationship between the giver and the recipient, and a declaration that the funds do not need to be repaid. Lenders often require this form to ensure that the gift is legitimate and not a loan disguised as a gift, as this can impact the borrower’s financial profile. Furthermore, the Gift Letter form helps clarify the source of funds, which is crucial in meeting regulatory requirements. By documenting the nature of the gift, both parties can avoid potential misunderstandings or complications in the future. Understanding the nuances of this form can provide significant benefits to those navigating the complexities of financial assistance in property transactions.

Document Example

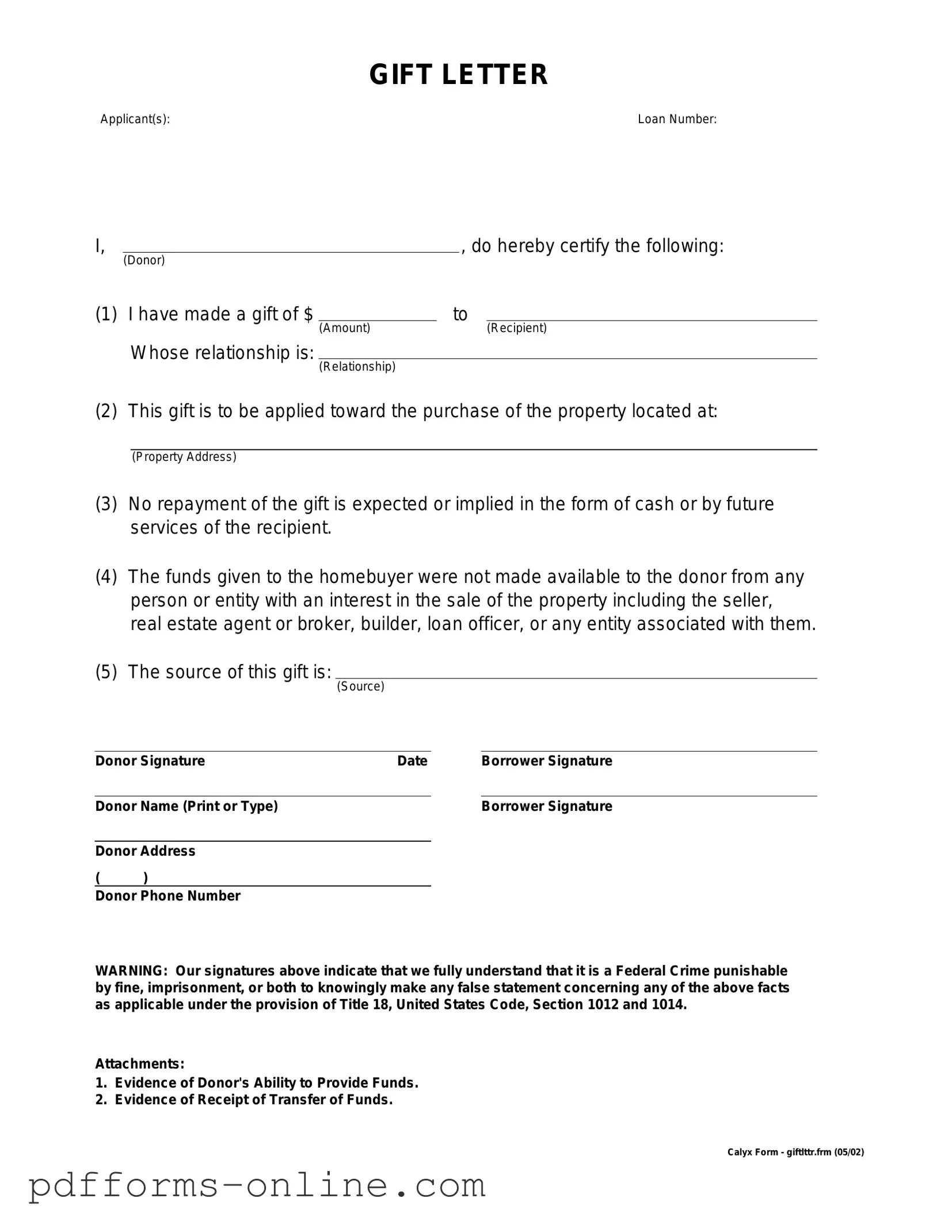

GIFT LETTER

Applicant(s): |

Loan Number: |

I, |

|

|

, do hereby certify the following: |

||

|

(Donor) |

|

|

|

|

(1) I have made a gift of $ |

|

to |

|

||

|

|

(Amount) |

|

|

(Recipient) |

|

Whose relationship is: |

|

|

|

|

|

|

(Relationship) |

|

|

|

(2) This gift is to be applied toward the purchase of the property located at:

(Property Address)

(3)No repayment of the gift is expected or implied in the form of cash or by future services of the recipient.

(4)The funds given to the homebuyer were not made available to the donor from any person or entity with an interest in the sale of the property including the seller, real estate agent or broker, builder, loan officer, or any entity associated with them.

(5)The source of this gift is:

(Source)

Donor Signature |

Date |

Borrower Signature |

||

|

|

|

|

|

Donor Name (Print or Type) |

|

|

Borrower Signature |

|

|

|

|

|

|

Donor Address |

|

|

|

|

( |

) |

|

|

|

Donor Phone Number

WARNING: Our signatures above indicate that we fully understand that it is a Federal Crime punishable by fine, imprisonment, or both to knowingly make any false statement concerning any of the above facts as applicable under the provision of Title 18, United States Code, Section 1012 and 1014.

Attachments:

1.Evidence of Donor's Ability to Provide Funds.

2.Evidence of Receipt of Transfer of Funds.

Calyx Form - giftlttr.frm (05/02)

Frequently Asked Questions

-

What is a Gift Letter?

A Gift Letter is a document used to confirm that a monetary gift has been given to an individual, often for the purpose of assisting with a home purchase. This letter typically outlines the amount of the gift, the relationship between the giver and the recipient, and affirms that the funds do not need to be repaid.

-

Why is a Gift Letter important in the mortgage process?

When applying for a mortgage, lenders want to ensure that the borrower has sufficient funds for a down payment. A Gift Letter serves as proof that the money is a gift and not a loan. This distinction is crucial because loans must be repaid, which could impact the borrower’s ability to meet mortgage payments.

-

What information should be included in a Gift Letter?

A well-structured Gift Letter should include the following details:

- The date of the gift.

- The amount of money being gifted.

- The names of both the giver and the recipient.

- The relationship between the two parties.

- A statement confirming that the funds are a gift and do not require repayment.

-

Do I need to provide any additional documentation with the Gift Letter?

In many cases, lenders may require additional documentation to verify the source of the funds. This could include bank statements from the giver showing the withdrawal of the gifted amount. It is advisable to check with the lender for specific requirements to ensure a smooth process.

Misconceptions

When it comes to the Gift Letter form, there are several misconceptions that can lead to confusion. Understanding these misunderstandings can help ensure that the process goes smoothly and that all parties involved are on the same page. Here are nine common misconceptions:

- Gift Letters are only for large sums of money. Many believe that gift letters are only necessary for substantial financial gifts. In reality, any monetary gift that affects a loan application may require documentation.

- Only family members can provide gifts. Some think that gifts can only come from relatives. However, friends and other acquaintances can also provide financial gifts, as long as the source is disclosed.

- A Gift Letter guarantees loan approval. Many assume that submitting a gift letter will automatically lead to loan approval. While it can strengthen an application, it does not guarantee approval, as lenders consider various factors.

- Gift Letters must be notarized. Some people believe that a gift letter needs to be notarized to be valid. In most cases, a simple signed letter is sufficient, but it’s always good to check with the lender for their specific requirements.

- Gift Letters are only needed for home purchases. There is a misconception that gift letters are only relevant in the context of buying a home. However, they can also be necessary for other types of loans where a gift is involved.

- Gift Letters can be verbal. Some individuals think that a verbal agreement suffices. A written gift letter is typically required to provide clear documentation of the gift.

- All lenders require the same gift letter format. People often assume that there is a universal format for gift letters. In truth, different lenders may have specific requirements, so it’s essential to follow their guidelines.

- Gifts do not need to be reported to the IRS. Many believe that gifts are tax-free and do not need to be reported. While there is a gift tax exclusion, larger gifts may require filing IRS forms.

- Once a gift letter is signed, it cannot be changed. Some think that a signed gift letter is set in stone. However, if circumstances change, it may be possible to amend the letter, provided all parties agree.

Understanding these misconceptions can help individuals navigate the complexities of financial gifts and ensure that all necessary documentation is in order. Always consult with a financial advisor or lender for specific guidance tailored to individual situations.

Common mistakes

-

Inaccurate Donor Information: One common mistake is providing incorrect or incomplete information about the donor. This includes the donor's name, address, and relationship to the recipient. Ensure all details are accurate, as discrepancies can lead to complications.

-

Missing Signatures: Both the donor and the recipient must sign the gift letter. Failing to obtain these signatures can render the document invalid. Always double-check for signatures before submission.

-

Not Specifying the Gift Amount: Clearly stating the amount of the gift is crucial. Some individuals forget to include this information, which can create confusion later on. Be explicit about the gift's value to avoid misunderstandings.

-

Omitting the Purpose of the Gift: A gift letter should include the purpose of the gift, such as whether it is for a home purchase or other financial assistance. This context can be important for tax purposes and for the lender's records.

-

Neglecting to Date the Letter: Failing to date the gift letter can lead to issues regarding the timing of the gift. It is essential to include the date to establish when the gift was made. This detail can be significant for both tax implications and loan processing.

Additional PDF Templates

Printable:5s6uydlipco= Living Will Template - Five Wishes has been translated into multiple languages, making it accessible for diverse populations.

Creating a well-structured Employee Handbook is essential for maintaining clarity and consistency in any organization. This guide not only articulates the policies and expectations of your company but also helps employees understand their roles within the workplace. For more detailed paperwork, you can refer to All Arizona Forms to complete the necessary documentation and ensure your business operations are smoothly aligned.

P45 Means - Filling the P45 out correctly helps prevent overdeductions in taxes for the new employer.

Document Data

| Fact Name | Description |

|---|---|

| Purpose | A gift letter is used to document a monetary gift, typically for a home purchase, ensuring that the funds are not a loan. |

| Donor and Recipient | The letter must clearly state the relationship between the donor (the person giving the gift) and the recipient (the person receiving the gift). |

| Amount of Gift | The specific amount of money being gifted should be included in the letter to avoid any confusion during the mortgage application process. |

| Signature Requirement | The donor must sign the gift letter, affirming that the funds are indeed a gift and not a loan that requires repayment. |

| State-Specific Forms | Some states may have specific requirements or forms related to gift letters, governed by local laws. For example, California follows the California Civil Code. |

| Documentation | It is advisable to provide additional documentation, such as bank statements, to support the gift letter and verify the source of funds. |

| Tax Implications | Gifts above a certain amount may have tax implications for the donor, who may need to file a gift tax return with the IRS. |

| Usage in Mortgage Applications | Lenders often require a gift letter as part of the mortgage application process to ensure compliance with underwriting guidelines. |

Similar forms

The Gift Letter form is similar to the Affidavit of Support. Both documents serve to verify financial support provided by one individual to another. In the case of the Affidavit of Support, it is often used in immigration contexts, where a sponsor must demonstrate their ability to support a visa applicant financially. Like the Gift Letter, it requires the sponsor to disclose their income and assets, ensuring that the recipient will not become a public charge. The primary difference lies in the context and purpose of the documents, but both emphasize the importance of financial backing.

For anyone involved in vehicle ownership transfers, understanding the importance of documentation such as the Ohio Motor Vehicle Bill of Sale is essential. This legal form not only records the essential details of the transaction but also acts as proof of ownership change. To obtain this document, you can explore resources online, including this link: https://documentonline.org/blank-ohio-motor-vehicle-bill-of-sale/, which provides a blank template suitable for your needs.

Another document akin to the Gift Letter is the Loan Agreement. While the Gift Letter indicates that funds are given without expectation of repayment, a Loan Agreement establishes terms for repayment. Both documents require clarity regarding the source and amount of funds, but the Loan Agreement also includes interest rates, repayment schedules, and conditions for default. Each document aims to protect the interests of the parties involved, but they do so through different frameworks of financial obligation.

Finally, the Bank Statement can be compared to the Gift Letter in that both documents provide proof of financial transactions. A Bank Statement reflects the actual movement of funds, showing deposits and withdrawals, while the Gift Letter serves as a declaration of intent regarding the transfer of funds as a gift. Both documents are often used in financial transactions, particularly in real estate purchases, to verify the legitimacy of funds. However, the Bank Statement focuses on historical financial activity, while the Gift Letter conveys a specific intent regarding the nature of the funds being transferred.