Blank Gift Deed Form

A Gift Deed is an important legal document that facilitates the transfer of property or assets from one individual to another without any exchange of money. This form serves as a formal declaration of the donor's intention to give a gift, ensuring that the recipient, known as the donee, receives full ownership rights. Typically, a Gift Deed includes essential details such as the names and addresses of both parties, a clear description of the property being gifted, and any specific conditions or limitations associated with the gift. Additionally, the document often requires the signatures of witnesses to validate the transfer and may need to be notarized, depending on state laws. Understanding the nuances of a Gift Deed is crucial, as it not only outlines the legal aspects of the transaction but also protects the interests of both the donor and the recipient. Whether it involves real estate, personal belongings, or financial assets, a well-drafted Gift Deed can prevent future disputes and ensure that the donor's wishes are honored.

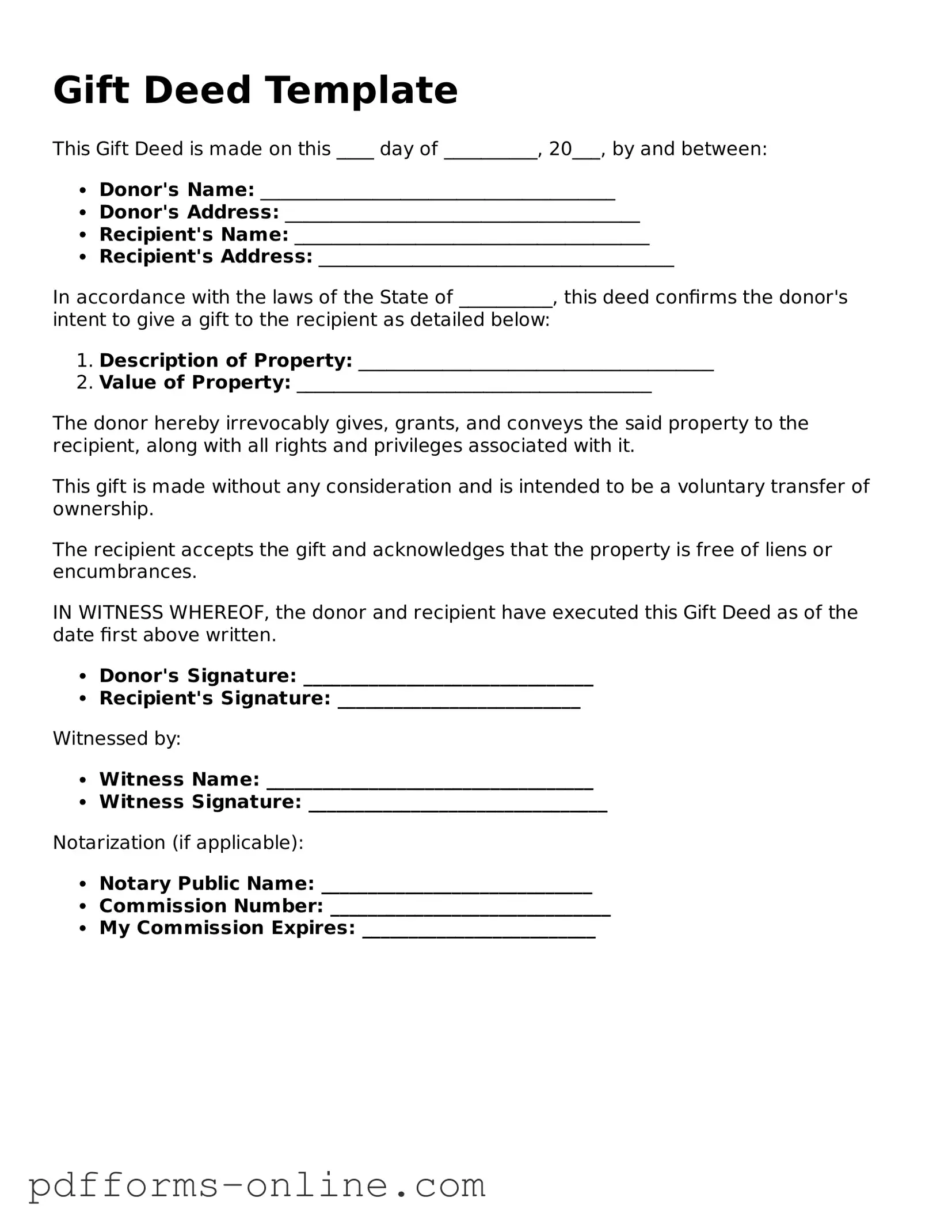

Document Example

Gift Deed Template

This Gift Deed is made on this ____ day of __________, 20___, by and between:

- Donor's Name: ______________________________________

- Donor's Address: ______________________________________

- Recipient's Name: ______________________________________

- Recipient's Address: ______________________________________

In accordance with the laws of the State of __________, this deed confirms the donor's intent to give a gift to the recipient as detailed below:

- Description of Property: ______________________________________

- Value of Property: ______________________________________

The donor hereby irrevocably gives, grants, and conveys the said property to the recipient, along with all rights and privileges associated with it.

This gift is made without any consideration and is intended to be a voluntary transfer of ownership.

The recipient accepts the gift and acknowledges that the property is free of liens or encumbrances.

IN WITNESS WHEREOF, the donor and recipient have executed this Gift Deed as of the date first above written.

- Donor's Signature: _______________________________

- Recipient's Signature: __________________________

Witnessed by:

- Witness Name: ___________________________________

- Witness Signature: ________________________________

Notarization (if applicable):

- Notary Public Name: _____________________________

- Commission Number: ______________________________

- My Commission Expires: _________________________

State-specific Guides for Gift Deed Documents

Frequently Asked Questions

-

What is a Gift Deed?

A Gift Deed is a legal document that formalizes the transfer of ownership of property from one person to another without any exchange of money. This document serves to ensure that the gift is legally recognized and can be enforced in a court of law.

-

Who can create a Gift Deed?

Any individual who is the legal owner of a property can create a Gift Deed. The person giving the gift is known as the donor, while the recipient is referred to as the donee. Both parties must be competent to enter into a contract.

-

What types of property can be transferred using a Gift Deed?

A Gift Deed can be used to transfer various types of property, including real estate, personal property, and financial assets. However, certain restrictions may apply based on local laws and the nature of the property.

-

Is a Gift Deed revocable?

Generally, a Gift Deed is irrevocable once executed, meaning the donor cannot take back the gift after the deed is signed. However, there may be specific circumstances under which a gift can be revoked, depending on state laws.

-

What are the requirements for a valid Gift Deed?

For a Gift Deed to be valid, it must include the following elements: the identification of the donor and donee, a clear description of the property being gifted, the intent to make a gift, and the signature of the donor. Some states may also require witnesses or notarization.

-

Do I need to pay taxes on a Gift Deed?

Gift tax laws vary by state and the value of the gift. In the United States, the IRS allows individuals to give gifts up to a certain amount each year without incurring a gift tax. It is advisable to consult a tax professional for specific guidance.

-

How is a Gift Deed executed?

To execute a Gift Deed, the donor must sign the document in the presence of witnesses or a notary public, depending on state requirements. The deed should then be recorded with the appropriate government office to ensure public notice of the transfer.

-

Can a Gift Deed be contested?

Yes, a Gift Deed can be contested in court. Common grounds for contesting a gift include claims of undue influence, lack of capacity, or improper execution. If contested, it will be up to the court to determine the validity of the deed.

-

What is the difference between a Gift Deed and a Will?

A Gift Deed transfers ownership of property during the donor's lifetime, while a Will specifies how a person's assets will be distributed after their death. A Gift Deed is immediate, whereas a Will takes effect only upon the testator's passing.

-

Where can I obtain a Gift Deed form?

Gift Deed forms can be obtained from various sources, including legal stationery stores, online legal document services, or through an attorney. It is important to ensure that the form complies with state laws and requirements.

Misconceptions

Understanding the Gift Deed form is essential for anyone considering making a gift of property. However, several misconceptions can lead to confusion. Here are nine common misconceptions about Gift Deeds:

-

Gift Deeds are only for real estate.

This is not true. Gift Deeds can be used for various types of property, including personal belongings, vehicles, and financial assets.

-

A Gift Deed is the same as a Will.

These are different legal documents. A Gift Deed transfers ownership immediately, while a Will distributes assets after death.

-

You don’t need witnesses for a Gift Deed.

Most states require at least one or two witnesses to sign the Gift Deed for it to be valid.

-

Gift Deeds are not legally binding.

When properly executed, a Gift Deed is legally binding and enforceable in court.

-

There are no tax implications with a Gift Deed.

Gift taxes may apply, depending on the value of the gift and the relationship between the giver and receiver.

-

You can revoke a Gift Deed anytime.

Once a Gift Deed is executed and accepted, it generally cannot be revoked without the consent of the recipient.

-

Gift Deeds are only for family members.

Anyone can give a gift to anyone else using a Gift Deed, not just family members.

-

A verbal agreement is enough for a Gift Deed.

A verbal agreement is not sufficient. A Gift Deed must be in writing to be valid.

-

All states have the same rules for Gift Deeds.

Gift Deed laws can vary significantly from state to state, so it’s important to understand local regulations.

Common mistakes

-

Incomplete Information: Many individuals fail to provide all necessary details on the Gift Deed form. This can include missing the names of the donor and recipient or neglecting to include the property description.

-

Incorrect Property Description: Accurately describing the property is crucial. Errors in the legal description can lead to complications or disputes in the future.

-

Failure to Sign: One common mistake is not signing the document. Both the donor and the recipient must sign the form for it to be valid.

-

Not Having Witnesses: Some states require the Gift Deed to be witnessed. Failing to have the appropriate number of witnesses can invalidate the deed.

-

Not Notarizing the Document: In certain jurisdictions, notarization is necessary. Skipping this step can result in legal challenges down the line.

-

Ignoring State Laws: Each state has its own regulations regarding Gift Deeds. Not adhering to these laws can lead to the deed being deemed invalid.

-

Failing to Record the Deed: After completing the Gift Deed, it’s important to record it with the appropriate local authority. Neglecting this step may leave the gift unrecognized legally.

-

Not Considering Tax Implications: Some individuals overlook potential tax consequences associated with gifting property. Understanding these implications is essential to avoid unexpected liabilities.

Fill out Common Types of Gift Deed Forms

Quick Title Deed - The form can vary slightly in format depending on state-specific requirements.

The New York Mobile Home Bill of Sale form serves as a crucial document that facilitates the transfer of ownership for a mobile home. This form ensures both the buyer and seller have a clear record of the transaction, detailing essential information about the mobile home and its sale. For those seeking a template, the documentonline.org/blank-new-york-mobile-home-bill-of-sale offers a reliable resource to aid in this important process.

Correction Deed California - Using a Corrective Deed can facilitate smoother transactions in future property dealings.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | A Gift Deed is a legal document that transfers ownership of property from one person to another without any exchange of money. |

| Intent | The donor must have a clear intent to give the gift, demonstrating that it is a voluntary transfer of ownership. |

| Consideration | Unlike other property transfers, a Gift Deed does not require consideration, meaning no payment is necessary. |

| Governing Law | In the United States, the laws governing Gift Deeds can vary by state. For example, in California, the governing law is found in the California Civil Code. |

| Written Requirement | A Gift Deed must be in writing to be legally enforceable. Oral gifts typically do not hold up in court. |

| Execution | The deed must be signed by the donor, and in many states, it should be notarized to ensure authenticity. |

| Tax Implications | Gifts may have tax implications. The IRS allows a certain amount to be gifted each year without incurring gift tax. |

| Revocability | Once executed, a Gift Deed is typically irrevocable, meaning the donor cannot take back the gift unless specific conditions are met. |

Similar forms

A Gift Deed is similar to a Will in that both documents involve the transfer of property. However, while a Gift Deed is an immediate transfer of ownership during the grantor's lifetime, a Will takes effect only after the individual's death. Both documents require careful consideration of the grantor's intentions and the beneficiaries involved. Furthermore, both may be subject to state laws regarding property transfer, which can affect their validity and enforceability.

An Affidavit of Gift also shares similarities with a Gift Deed. This document serves as a sworn statement confirming that a gift has been made. While a Gift Deed formally transfers ownership, an Affidavit of Gift can be used as supplementary evidence to support the transfer. Both documents aim to establish the intent to give, but the Affidavit does not itself transfer title; it merely verifies that a gift occurred.

Understanding the financial implications of property transactions can be enhanced by analyzing associated documents like the Profit And Loss form, often referred to as an income statement, which provides a snapshot of a company's financial performance. For detailed insights, you can explore resources such as OnlineLawDocs.com, where stakeholders can gain a deeper understanding of financial management within property dealings.

Finally, a Trust Agreement can be compared to a Gift Deed, as both involve the transfer of assets for the benefit of another party. A Trust Agreement establishes a fiduciary relationship, allowing a trustee to manage assets on behalf of beneficiaries. In contrast, a Gift Deed involves a straightforward transfer of ownership without ongoing management. Both documents can serve to protect the interests of the beneficiaries, but they operate in distinct ways regarding ownership and control of the assets involved.