Valid Georgia Transfer-on-Death Deed Template

In the realm of estate planning, the Georgia Transfer-on-Death Deed form serves as a valuable tool for individuals seeking to simplify the transfer of real property upon their passing. This form allows property owners to designate beneficiaries who will inherit their real estate without the need for probate, thus streamlining the process and potentially reducing costs associated with estate administration. By executing this deed, the property owner retains full control over the property during their lifetime, ensuring that they can sell, lease, or modify the property as they see fit. Additionally, the form requires specific information, such as the legal description of the property and the names of the beneficiaries, to ensure clarity and prevent disputes after the owner's death. Importantly, the deed must be properly recorded with the county clerk to be effective, and it can be revoked or amended at any time before the owner's death. Understanding the nuances of the Transfer-on-Death Deed is essential for anyone looking to make informed decisions about their estate and ensure a smooth transition for their loved ones.

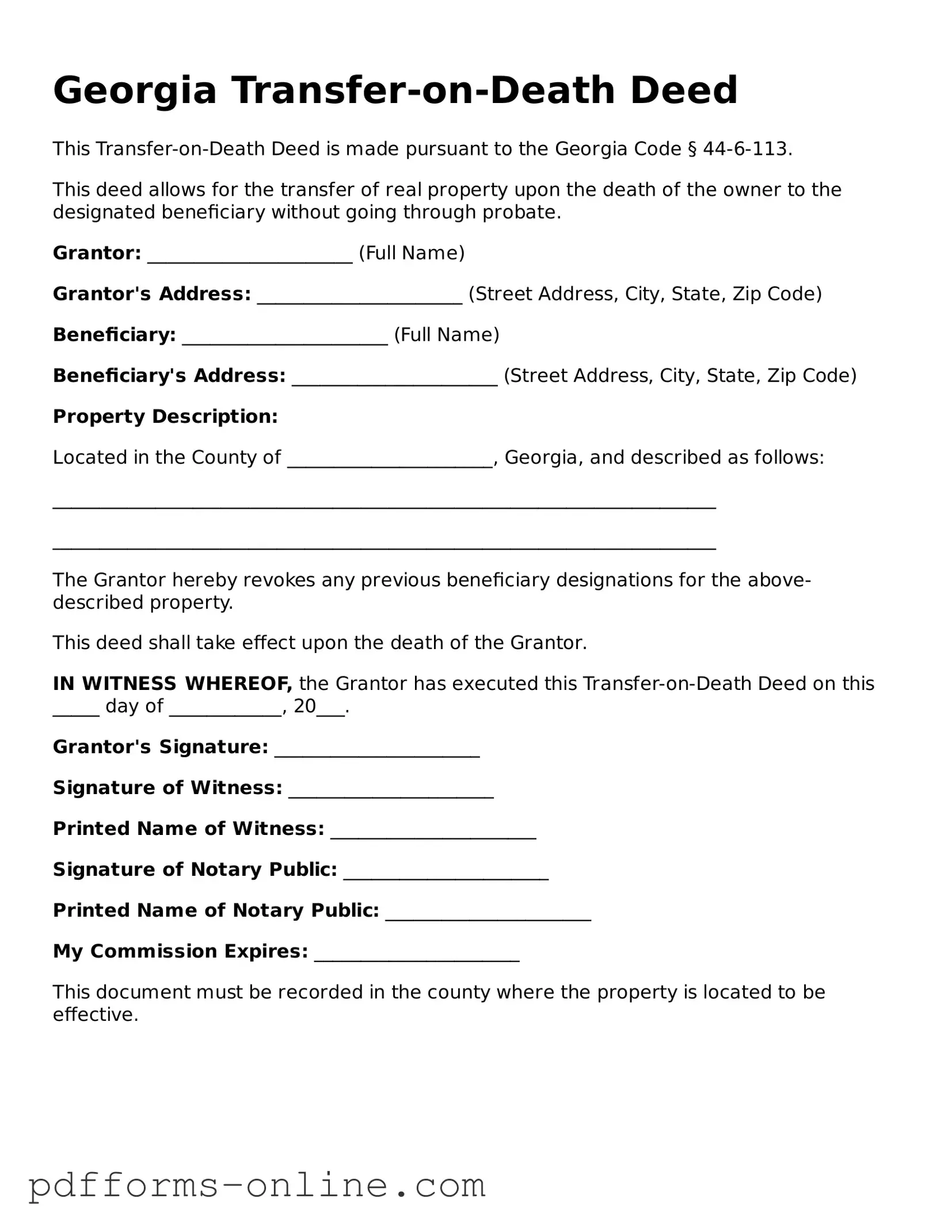

Document Example

Georgia Transfer-on-Death Deed

This Transfer-on-Death Deed is made pursuant to the Georgia Code § 44-6-113.

This deed allows for the transfer of real property upon the death of the owner to the designated beneficiary without going through probate.

Grantor: ______________________ (Full Name)

Grantor's Address: ______________________ (Street Address, City, State, Zip Code)

Beneficiary: ______________________ (Full Name)

Beneficiary's Address: ______________________ (Street Address, City, State, Zip Code)

Property Description:

Located in the County of ______________________, Georgia, and described as follows:

_______________________________________________________________________

_______________________________________________________________________

The Grantor hereby revokes any previous beneficiary designations for the above-described property.

This deed shall take effect upon the death of the Grantor.

IN WITNESS WHEREOF, the Grantor has executed this Transfer-on-Death Deed on this _____ day of ____________, 20___.

Grantor's Signature: ______________________

Signature of Witness: ______________________

Printed Name of Witness: ______________________

Signature of Notary Public: ______________________

Printed Name of Notary Public: ______________________

My Commission Expires: ______________________

This document must be recorded in the county where the property is located to be effective.

Frequently Asked Questions

-

What is a Transfer-on-Death Deed in Georgia?

A Transfer-on-Death Deed (TOD) is a legal document that allows property owners in Georgia to designate beneficiaries who will receive their real estate upon their death. This deed bypasses the probate process, making the transfer of property straightforward and efficient. By using a TOD deed, property owners can maintain control over their property during their lifetime while ensuring that it passes directly to their chosen beneficiaries upon their death.

-

How do I create a Transfer-on-Death Deed?

To create a Transfer-on-Death Deed in Georgia, you must complete the deed form, ensuring that it includes specific information such as the legal description of the property and the names of the beneficiaries. Once completed, the deed must be signed in the presence of a notary public. After notarization, it should be filed with the county clerk’s office where the property is located. It is important to follow these steps carefully to ensure the deed is valid and enforceable.

-

Can I revoke or change a Transfer-on-Death Deed?

Yes, you can revoke or change a Transfer-on-Death Deed at any time during your lifetime. To do this, you must create a new deed that explicitly revokes the previous one or file a formal revocation document with the county clerk’s office. It is crucial to ensure that any changes are properly documented to avoid confusion or disputes among beneficiaries later on.

-

What are the benefits of using a Transfer-on-Death Deed?

The benefits of using a Transfer-on-Death Deed include avoiding probate, maintaining control over the property during your lifetime, and simplifying the transfer process for your beneficiaries. Additionally, a TOD deed allows you to designate multiple beneficiaries and specify how the property should be divided among them. This flexibility can help ensure that your wishes are honored and can reduce potential conflicts among heirs.

Misconceptions

Understanding the Georgia Transfer-on-Death Deed can be complicated. Here are seven common misconceptions that people often have about this legal document:

- It is the same as a will. Many believe that a Transfer-on-Death Deed functions like a will. However, it is a separate legal document that allows for the direct transfer of property upon death, bypassing probate.

- It can only be used for residential property. Some think that this deed is limited to homes. In reality, it can be used for various types of real estate, including commercial properties and vacant land.

- It is irrevocable once signed. Many assume that once the deed is executed, it cannot be changed. In fact, the owner can revoke or modify the deed at any time before their death.

- All heirs must agree to the transfer. Some individuals believe that all heirs must consent to the Transfer-on-Death Deed. However, the property will transfer directly to the named beneficiary without needing consent from other heirs.

- It avoids all taxes. A common misconception is that using a Transfer-on-Death Deed eliminates all taxes. While it may help avoid probate taxes, other taxes, such as capital gains taxes, may still apply.

- It is only useful for wealthy individuals. Many think that this deed is only beneficial for those with significant assets. However, it can be a valuable tool for anyone looking to simplify the transfer of property to loved ones.

- It does not require legal assistance. Some believe they can complete the deed without help. While it is possible to do it independently, consulting a legal professional can ensure that the document is completed correctly and meets all legal requirements.

By clarifying these misconceptions, individuals can make more informed decisions regarding the use of a Transfer-on-Death Deed in Georgia.

Common mistakes

-

Not including all required information. Failing to provide complete details, such as the names of the property owners and the beneficiaries, can invalidate the deed.

-

Improperly signing the deed. All property owners must sign the deed. If one owner neglects to sign, the deed may not be recognized.

-

Not having the deed notarized. In Georgia, a Transfer-on-Death Deed must be notarized to be legally binding. Skipping this step can lead to complications.

-

Failing to record the deed. After completing the deed, it must be recorded with the appropriate county office. Without this step, the deed is not effective.

-

Using incorrect legal descriptions. The property description must be accurate. Errors in this section can cause confusion and legal disputes later.

-

Not understanding the implications. Some individuals may not fully grasp how a Transfer-on-Death Deed affects their estate planning and property rights.

-

Ignoring state-specific requirements. Each state has its own rules regarding Transfer-on-Death Deeds. Failing to adhere to Georgia's specific regulations can lead to issues.

-

Overlooking tax consequences. Individuals often forget to consider how transferring property through a Transfer-on-Death Deed might impact taxes for beneficiaries.

Find Some Other Transfer-on-Death Deed Forms for Specific States

Where Can I Get a Tod Form - This deed is often easy to fill out and file with local authorities.

Ladybird Deed Texas Form - It promotes clarity in the distribution of assets, potentially reducing family conflict.

The Texas Hold Harmless Agreement form is a legal document that protects one party from legal and financial responsibilities arising from specific incidents. This agreement is commonly used in situations involving potential risks or damages. For those interested in drafting or understanding this important document, resources like OnlineLawDocs.com provide valuable insights and templates, ensuring that individuals or entities can conduct business or engage in activities within Texas without worrying about unforeseen liabilities.

How to Avoid Probate in Pa - The completion of this form allows for peace of mind regarding future property inheritance.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death (TOD) deed allows property owners in Georgia to transfer real estate to beneficiaries upon their death, avoiding probate. |

| Governing Law | The Georgia Transfer-on-Death Deed is governed by O.C.G.A. § 44-6-70 through § 44-6-77. |

| Eligibility | Any individual who owns real estate in Georgia can create a TOD deed to transfer their property. |

| Revocation | The property owner can revoke the TOD deed at any time before their death, ensuring flexibility in estate planning. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries in the TOD deed, allowing for tailored estate distribution. |

| Execution Requirements | The TOD deed must be signed by the property owner and notarized to be valid in Georgia. |

| Filing | To take effect, the TOD deed must be recorded with the county clerk's office where the property is located. |

| Tax Implications | Transferring property via a TOD deed generally does not trigger gift taxes or capital gains taxes until the beneficiary sells the property. |

Similar forms

The Georgia Transfer-on-Death Deed (TOD) form is similar to a will in that both documents allow individuals to dictate the distribution of their assets upon death. A will is a legal document that outlines how a person's property and affairs should be handled after their death. Like a TOD deed, a will can specify beneficiaries and can be contested or modified during the grantor's lifetime. However, a will requires probate, while a TOD deed does not, making the transfer process more straightforward and often less time-consuming for the beneficiaries.

Another document comparable to the TOD deed is a living trust. A living trust allows individuals to place their assets into a trust during their lifetime. Upon death, the assets in the trust can be distributed to beneficiaries without going through probate. Both the TOD deed and living trust serve to facilitate the transfer of property outside of probate, but a living trust typically requires more management and oversight during the grantor's lifetime.

The TOD deed also shares similarities with a beneficiary designation form, often used for accounts like life insurance policies or retirement accounts. Both documents allow individuals to name specific beneficiaries who will receive assets upon the individual's death. While a beneficiary designation form is limited to certain types of accounts, the TOD deed specifically applies to real estate, providing a method for transferring property directly to the designated beneficiary.

A quitclaim deed is another document that has some parallels with the TOD deed. A quitclaim deed transfers ownership of property without guaranteeing that the title is clear. While a TOD deed ensures that the property will pass to the designated beneficiary upon death, a quitclaim deed can be used to transfer property during a person's lifetime. Both documents can affect ownership rights, but the quitclaim deed does not provide the same posthumous transfer benefits as a TOD deed.

A power of attorney (POA) can be compared to the TOD deed in that both documents involve the management and transfer of assets. A POA grants someone the authority to act on another person's behalf, particularly in financial matters. While a TOD deed specifies how property will be transferred after death, a POA is effective during the grantor's lifetime and can provide immediate management of assets, which can include real estate.

The New York Operating Agreement form is essential for individuals looking to properly manage their limited liability company (LLC) in New York. This document not only clarifies the roles and responsibilities of members but also establishes operational procedures that protect all parties involved. For a detailed example of how to create this vital document, you can visit documentonline.org/blank-new-york-operating-agreement/, which provides a helpful template and guidance for business owners navigating their LLC's management.

Another related document is a life estate deed. This deed allows an individual to retain the right to live in a property for their lifetime while designating a remainder beneficiary who will inherit the property upon their death. Like the TOD deed, a life estate deed provides a way to transfer property outside of probate, but it also involves the complexities of life tenancy and the rights of the life tenant versus the remainder beneficiary.

Finally, a joint tenancy deed can be likened to the TOD deed. In a joint tenancy, two or more individuals hold property together with rights of survivorship. Upon the death of one joint tenant, the property automatically passes to the surviving tenant(s). Both the joint tenancy deed and the TOD deed facilitate the transfer of property without probate; however, joint tenancy involves shared ownership during the grantor's lifetime, whereas the TOD deed allows for a single owner to designate a beneficiary for future transfer.