Valid Georgia Quitclaim Deed Template

The Georgia Quitclaim Deed form serves as a crucial tool in real estate transactions, particularly when transferring property ownership without guaranteeing clear title. This form allows an individual, known as the grantor, to convey their interest in a property to another party, referred to as the grantee. Unlike other types of deeds, a quitclaim deed does not provide warranties or assurances about the property’s title, making it essential for both parties to understand the implications of such a transfer. The document typically includes vital information such as the names of the grantor and grantee, a legal description of the property, and the date of the transaction. It is important to note that while a quitclaim deed can facilitate quick transfers, it is often used in specific situations, such as between family members or in divorce settlements, where trust exists between the parties involved. Understanding the nuances of this form can help individuals navigate property transfers more effectively and ensure that their interests are adequately protected.

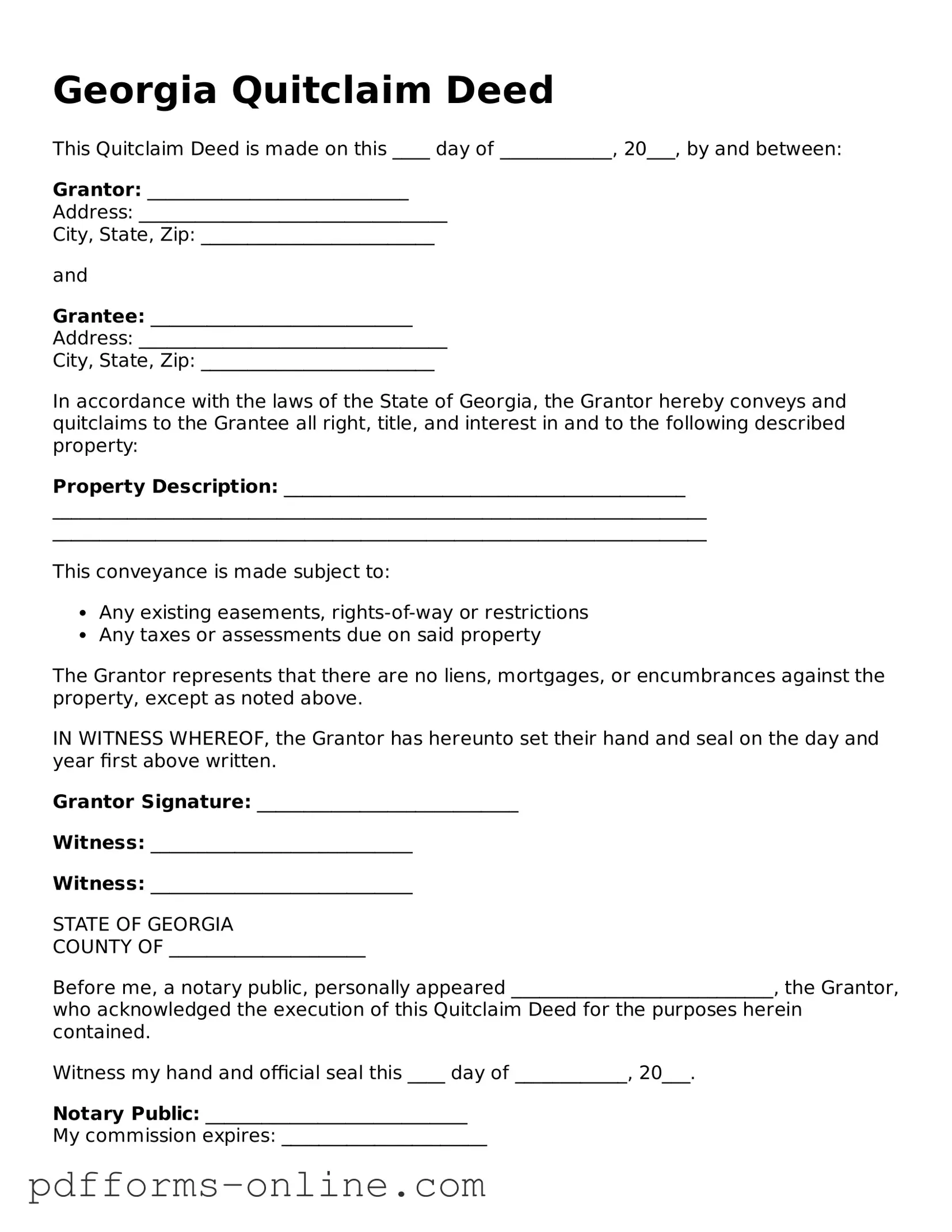

Document Example

Georgia Quitclaim Deed

This Quitclaim Deed is made on this ____ day of ____________, 20___, by and between:

Grantor: ____________________________

Address: _________________________________

City, State, Zip: _________________________

and

Grantee: ____________________________

Address: _________________________________

City, State, Zip: _________________________

In accordance with the laws of the State of Georgia, the Grantor hereby conveys and quitclaims to the Grantee all right, title, and interest in and to the following described property:

Property Description: ___________________________________________

______________________________________________________________________

______________________________________________________________________

This conveyance is made subject to:

- Any existing easements, rights-of-way or restrictions

- Any taxes or assessments due on said property

The Grantor represents that there are no liens, mortgages, or encumbrances against the property, except as noted above.

IN WITNESS WHEREOF, the Grantor has hereunto set their hand and seal on the day and year first above written.

Grantor Signature: ____________________________

Witness: ____________________________

Witness: ____________________________

STATE OF GEORGIA

COUNTY OF _____________________

Before me, a notary public, personally appeared ____________________________, the Grantor, who acknowledged the execution of this Quitclaim Deed for the purposes herein contained.

Witness my hand and official seal this ____ day of ____________, 20___.

Notary Public: ____________________________

My commission expires: ______________________

Frequently Asked Questions

-

What is a Quitclaim Deed in Georgia?

A Quitclaim Deed is a legal document used to transfer ownership of real property from one party to another. In Georgia, this type of deed allows the grantor to convey whatever interest they have in the property, without guaranteeing that the title is clear or free of claims. It is often used in situations where the parties know each other, such as family transfers or divorces.

-

When should I use a Quitclaim Deed?

Quitclaim Deeds are commonly used in various scenarios, including:

- Transferring property between family members

- Transferring property as part of a divorce settlement

- Clearing up title issues

- Transferring property into or out of a trust

-

How do I complete a Quitclaim Deed in Georgia?

To complete a Quitclaim Deed, follow these steps:

- Obtain a Quitclaim Deed form, which can be found online or at a local office supply store.

- Fill in the names of the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Provide a legal description of the property being transferred.

- Sign the deed in the presence of a notary public.

-

Do I need to have the Quitclaim Deed notarized?

Yes, in Georgia, a Quitclaim Deed must be notarized to be legally valid. This ensures that the signatures on the document are authentic and that the parties involved understand the transaction.

-

Is a Quitclaim Deed the same as a Warranty Deed?

No, a Quitclaim Deed is not the same as a Warranty Deed. A Warranty Deed provides a guarantee that the grantor holds clear title to the property and has the right to transfer it. In contrast, a Quitclaim Deed offers no such guarantees, making it a less secure option for the grantee.

-

Are there any tax implications when using a Quitclaim Deed?

While transferring property via a Quitclaim Deed does not typically trigger a transfer tax, it is important to consult with a tax professional. Certain situations, such as transferring property as a gift, may have tax consequences that need to be considered.

-

How do I record a Quitclaim Deed in Georgia?

To record a Quitclaim Deed in Georgia, you must take the completed and notarized deed to the county clerk's office where the property is located. There, you will submit the deed for recording. A small fee is usually required for this service.

-

Can a Quitclaim Deed be revoked?

Once a Quitclaim Deed has been executed and recorded, it generally cannot be revoked. However, the grantor can create a new deed to transfer the property back or to another party. Legal advice may be necessary in complex situations.

-

What should I do if I have more questions about Quitclaim Deeds?

If you have further questions or need assistance, consider consulting a real estate attorney or a qualified professional who can provide guidance specific to your situation. They can help clarify any uncertainties and ensure that the deed is executed properly.

Misconceptions

Understanding the Georgia Quitclaim Deed can help avoid confusion and ensure a smooth property transfer. Here are ten common misconceptions about this form:

- A Quitclaim Deed transfers ownership of property. Many believe that a Quitclaim Deed guarantees ownership. In reality, it transfers whatever interest the grantor has, which may be none at all.

- A Quitclaim Deed provides a warranty of title. Some think this deed offers a warranty or guarantee. However, it does not assure that the title is clear or free of liens.

- Only married couples can use a Quitclaim Deed. This is false. Anyone can use a Quitclaim Deed to transfer property, regardless of marital status.

- A Quitclaim Deed is only for family transfers. While often used among family members, it can be used in various situations, including sales and transfers between strangers.

- A Quitclaim Deed is the same as a Warranty Deed. These are different. A Warranty Deed provides assurances about the title, while a Quitclaim Deed does not.

- You cannot use a Quitclaim Deed for real estate transactions. This is incorrect. Quitclaim Deeds are valid for real estate transfers, though they are less common in sales.

- A Quitclaim Deed does not need to be recorded. While it's not legally required to record it, doing so protects the new owner's interest in the property.

- A Quitclaim Deed is only effective in Georgia. This form is recognized in many states, but the rules and implications can vary significantly.

- You must hire a lawyer to create a Quitclaim Deed. While legal advice can be helpful, individuals can create and file a Quitclaim Deed on their own.

- A Quitclaim Deed can solve all title issues. This is misleading. It may transfer interests, but it does not resolve existing title problems or disputes.

Being aware of these misconceptions can lead to better decision-making when handling property transfers in Georgia.

Common mistakes

-

Incorrect Property Description: One common mistake is failing to provide a complete and accurate description of the property. The legal description must include details such as the lot number, block number, and any relevant subdivision information. Without this, the deed may be deemed invalid.

-

Not Signing in Front of a Notary: A Quitclaim Deed must be signed in the presence of a notary public. Some individuals overlook this requirement, which can lead to issues in the future. Ensure that all parties sign the document in front of a notary to avoid complications.

-

Failing to Include Grantee Information: The grantee, or the person receiving the property, must be clearly identified. Omitting this information or providing incomplete details can result in legal challenges later on. Always double-check that the name and address of the grantee are correctly filled out.

-

Not Recording the Deed: After completing the Quitclaim Deed, it’s essential to record it with the county clerk's office. Many people neglect this step, which can lead to disputes over property ownership. Recording the deed protects the new owner's rights and ensures public notice of the transfer.

-

Overlooking Tax Implications: Some individuals do not consider the potential tax consequences of transferring property through a Quitclaim Deed. It is crucial to consult with a tax professional to understand how this transfer may affect property taxes or capital gains taxes in the future.

Find Some Other Quitclaim Deed Forms for Specific States

How to Gift Land to Family Member - This document allows for a no-fuss property transfer with minimal paperwork.

Quick Claim Deed Illinois - It is relatively easy to complete and file with little fuss.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | A Quitclaim Deed in Georgia transfers ownership of property without any guarantees about the title's status. |

| Governing Law | The Quitclaim Deed is governed by Georgia Code Title 44, Chapter 5. |

| Usage | This form is often used between family members or in situations where the buyer trusts the seller. |

| Requirements | The deed must be signed by the grantor and notarized to be legally effective. |

| Recording | It's important to record the Quitclaim Deed with the county clerk to protect your ownership rights. |

Similar forms

The Georgia Quitclaim Deed is similar to a Warranty Deed, which is another common type of property transfer document. Both documents facilitate the transfer of real estate from one party to another. However, a Warranty Deed offers more protection to the buyer. It guarantees that the seller holds clear title to the property and has the right to sell it. In contrast, a Quitclaim Deed transfers whatever interest the seller has in the property without making any promises about the title’s validity. This makes the Warranty Deed a safer option for buyers who want assurance regarding their ownership rights.

Another document akin to the Quitclaim Deed is the Bargain and Sale Deed. Like the Quitclaim Deed, this document transfers property rights from the seller to the buyer. However, the Bargain and Sale Deed typically implies that the seller has some interest in the property but does not guarantee a clear title. This means the buyer may assume some risk regarding existing liens or claims against the property. Both documents are often used in transactions where the seller may not be able to provide a full warranty on the title.

A third document that shares similarities with the Quitclaim Deed is the Special Warranty Deed. This deed also transfers property ownership but comes with limited warranties. Specifically, the seller guarantees that they have not done anything to harm the title during their ownership. Unlike a Quitclaim Deed, which offers no warranties, a Special Warranty Deed provides some assurance to the buyer that the seller has not created any new claims against the property. This makes it a middle ground between a Quitclaim Deed and a full Warranty Deed.

Lastly, the Affidavit of Title is another document that can be compared to the Quitclaim Deed. While not a deed itself, this affidavit is often used in conjunction with property transfers. It serves as a sworn statement by the seller affirming their ownership and the absence of any liens or claims against the property. This document can provide additional assurance to the buyer, similar to a Warranty Deed. However, unlike the Quitclaim Deed, the Affidavit of Title does not transfer property rights; it merely supports the transaction by clarifying the seller's ownership status.