Valid Georgia Promissory Note Template

The Georgia Promissory Note form serves as a vital financial instrument that outlines the terms of a loan agreement between a borrower and a lender. This legally binding document specifies the amount borrowed, the interest rate, and the repayment schedule, ensuring both parties understand their obligations. It typically includes essential details such as the names and addresses of the parties involved, the due date for repayment, and any penalties for late payments. Additionally, the form may address the consequences of default, including the lender's rights to pursue legal action. By clearly stating the terms, the Georgia Promissory Note helps to protect the interests of both the lender and borrower, fostering transparency and trust in financial transactions. Understanding this form is crucial for anyone looking to engage in lending or borrowing within the state of Georgia.

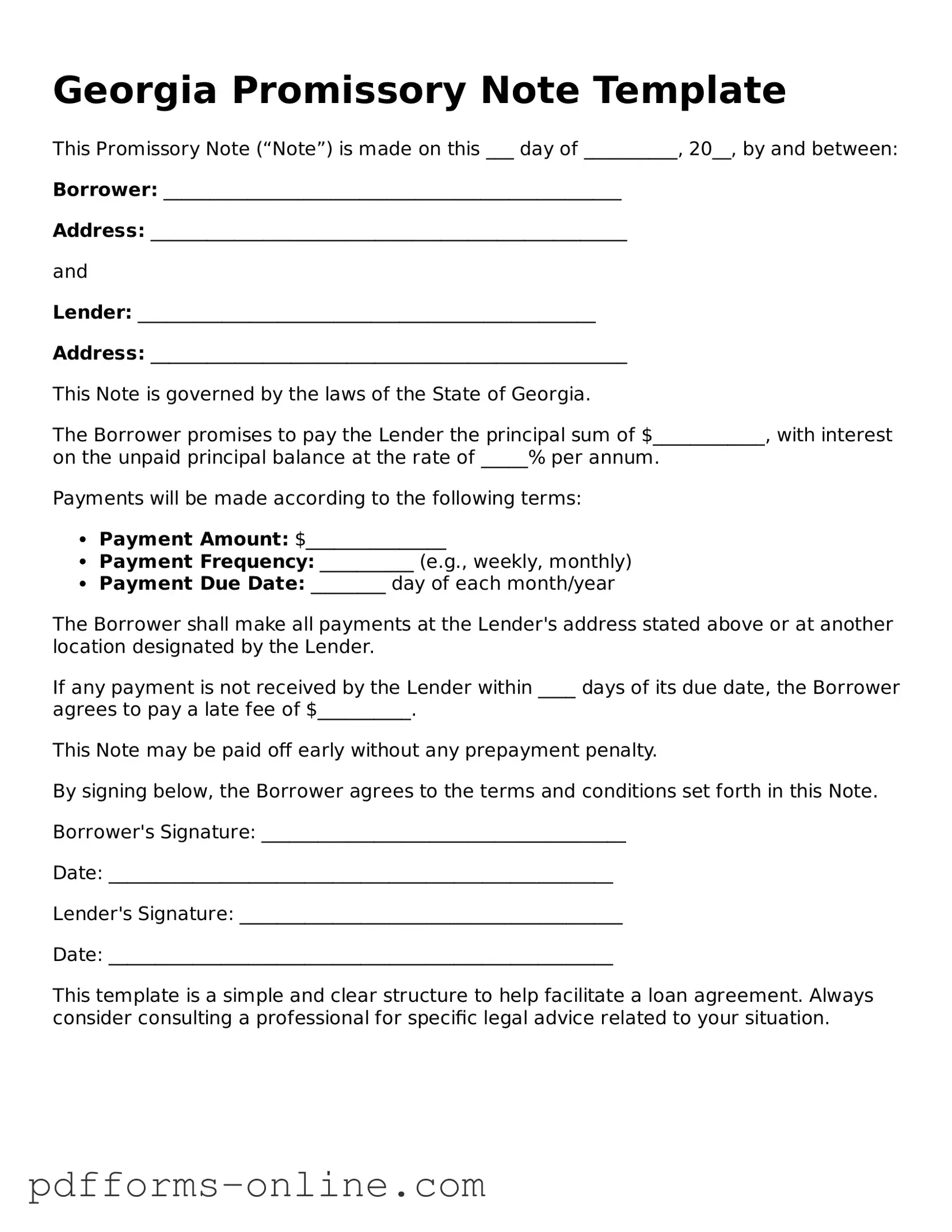

Document Example

Georgia Promissory Note Template

This Promissory Note (“Note”) is made on this ___ day of __________, 20__, by and between:

Borrower: _________________________________________________

Address: ___________________________________________________

and

Lender: _________________________________________________

Address: ___________________________________________________

This Note is governed by the laws of the State of Georgia.

The Borrower promises to pay the Lender the principal sum of $____________, with interest on the unpaid principal balance at the rate of _____% per annum.

Payments will be made according to the following terms:

- Payment Amount: $_______________

- Payment Frequency: __________ (e.g., weekly, monthly)

- Payment Due Date: ________ day of each month/year

The Borrower shall make all payments at the Lender's address stated above or at another location designated by the Lender.

If any payment is not received by the Lender within ____ days of its due date, the Borrower agrees to pay a late fee of $__________.

This Note may be paid off early without any prepayment penalty.

By signing below, the Borrower agrees to the terms and conditions set forth in this Note.

Borrower's Signature: _______________________________________

Date: ______________________________________________________

Lender's Signature: _________________________________________

Date: ______________________________________________________

This template is a simple and clear structure to help facilitate a loan agreement. Always consider consulting a professional for specific legal advice related to your situation.

Frequently Asked Questions

-

What is a Georgia Promissory Note?

A Georgia Promissory Note is a legal document in which one party (the borrower) promises to pay a specific amount of money to another party (the lender) at a defined future date or on demand. This note outlines the terms of the loan, including the interest rate, payment schedule, and any penalties for late payments.

-

What are the essential components of a Promissory Note?

Key components of a Georgia Promissory Note include:

- The names and addresses of the borrower and lender.

- The principal amount borrowed.

- The interest rate, if applicable.

- The payment schedule, including due dates.

- Any collateral securing the loan.

- Signatures of both parties.

-

Do I need a lawyer to create a Promissory Note in Georgia?

While it's not legally required to have a lawyer draft a Promissory Note, consulting with one can ensure that the document meets all legal requirements and adequately protects your interests. A lawyer can also help clarify any complex terms or conditions.

-

Can a Promissory Note be modified after it is signed?

Yes, a Promissory Note can be modified if both parties agree to the changes. It’s important to document any modifications in writing and have both parties sign the amended agreement to avoid disputes in the future.

-

What happens if the borrower defaults on the Promissory Note?

If the borrower fails to make payments as agreed, the lender has the right to take legal action to recover the owed amount. This may include filing a lawsuit or pursuing collection efforts. It’s crucial for both parties to understand the consequences of defaulting.

-

Is a Promissory Note enforceable in Georgia?

Yes, a properly executed Promissory Note is enforceable in Georgia. For the note to hold up in court, it must contain all essential elements and be signed by the borrower. Keeping a copy of the signed note is important for both parties.

Misconceptions

Below is a list of misconceptions regarding the Georgia Promissory Note form, along with explanations for each.

- Misconception 1: A promissory note must be notarized to be valid.

- Misconception 2: All promissory notes are the same regardless of state.

- Misconception 3: A verbal agreement can replace a written promissory note.

- Misconception 4: Interest rates on promissory notes are unlimited.

- Misconception 5: Promissory notes do not require a repayment schedule.

- Misconception 6: A promissory note is only for large loans.

- Misconception 7: Once signed, a promissory note cannot be modified.

In Georgia, a promissory note does not require notarization to be legally binding. However, notarization can provide additional proof of authenticity if disputes arise.

Promissory notes can vary by state. Georgia has specific requirements and provisions that may differ from those in other states.

While verbal agreements can be enforceable in some situations, a written promissory note is recommended for clarity and to provide evidence of the terms agreed upon.

Georgia law imposes limits on the maximum interest rates that can be charged on promissory notes. Exceeding these limits may render the note unenforceable.

A repayment schedule is typically included in a promissory note. Clearly outlining the payment terms helps avoid confusion and potential disputes.

Promissory notes can be used for loans of any size. They serve as a formal agreement for any amount of borrowed money.

Promissory notes can be amended if both parties agree to the changes. It is advisable to document any modifications in writing to ensure clarity.

Common mistakes

-

Incomplete Information: Many individuals fail to fill out all required fields. Omitting details such as the borrower's name, address, or loan amount can lead to complications down the line.

-

Incorrect Loan Amount: Entering the wrong amount can create confusion. It is crucial to double-check the figures to ensure accuracy.

-

Missing Signatures: Both parties must sign the document. Neglecting to include a signature can render the note unenforceable.

-

Failure to Date the Document: Not including the date of signing is a common oversight. A date provides clarity on when the agreement was made.

-

Ignoring Terms of Repayment: Clearly stating the repayment schedule is essential. Vague terms can lead to misunderstandings about when payments are due.

-

Not Specifying Interest Rates: If applicable, the interest rate should be clearly defined. Failing to do so can lead to disputes over the amount owed.

-

Neglecting to Include Collateral Information: If the loan is secured, it’s important to describe the collateral. This information protects the lender’s interests.

-

Using Ambiguous Language: Clarity is key in legal documents. Avoiding vague terms helps prevent misinterpretations of the agreement.

-

Not Seeking Legal Advice: Many individuals fill out the form without consulting a legal professional. Seeking advice can help ensure that the document meets legal standards and protects both parties.

Find Some Other Promissory Note Forms for Specific States

Online Promissory Note - Promissory notes can be used for personal loans, business loans, and real estate transactions.

When engaging in the sale or purchase of a mobile home, having the right documentation is paramount. The New York Mobile Home Bill of Sale form is essential, as it outlines the specifics of the transaction, protecting both parties involved. For those interested in acquiring this important form, it can be found at https://documentonline.org/blank-new-york-mobile-home-bill-of-sale/, which provides clear guidance on the ownership transfer process.

Promissory Note for Personal Loan - The date of repayment completion should be agreed upon and clearly stated in the note.

PDF Attributes

| Fact Name | Details |

|---|---|

| Definition | A promissory note in Georgia is a written promise to pay a specific sum of money to a designated person at a specified time. |

| Governing Law | The Georgia Promissory Note is governed by the Uniform Commercial Code (UCC) as adopted in Georgia. |

| Requirements | For validity, the note must include the date, the amount to be paid, the payee's name, and the signature of the maker. |

| Types | Promissory notes can be secured or unsecured, depending on whether collateral backs the obligation. |

| Enforcement | If the maker defaults, the payee has the right to enforce the note through legal means, including filing a lawsuit. |

Similar forms

A loan agreement is similar to a Georgia Promissory Note because both documents outline the terms of a loan. A loan agreement typically includes details about the loan amount, interest rate, repayment schedule, and any collateral involved. While a promissory note serves as a promise to repay, a loan agreement often provides a more comprehensive view of the relationship between the lender and borrower, detailing the rights and obligations of each party.

A mortgage is another document that shares similarities with a Georgia Promissory Note. While a promissory note represents the borrower's commitment to repay the loan, a mortgage secures that loan with real property. In essence, the mortgage serves as collateral for the loan outlined in the promissory note. If the borrower defaults, the lender can take possession of the property through foreclosure, making the mortgage a crucial component of real estate transactions.

An installment agreement also resembles a Georgia Promissory Note. Both documents outline a repayment plan, often broken down into smaller, manageable payments over time. However, an installment agreement may include additional terms regarding the consequences of late payments or defaults, whereas a promissory note primarily focuses on the borrower's promise to pay back the loan amount. Both documents aim to create clarity and structure around financial obligations.

A personal loan agreement can be compared to a Georgia Promissory Note in that both serve as formal records of a borrowing arrangement. Personal loan agreements often detail the specific terms, including the purpose of the loan, repayment terms, and interest rates. Although a promissory note is generally simpler and more straightforward, both documents establish the borrower's commitment and the lender's expectations regarding repayment.

Understanding the various forms of loan agreements is crucial, and for those seeking to protect sensitive financial information regarding such agreements, resources like OnlineLawDocs.com can provide valuable insights into drafting appropriate Non-disclosure Agreements.

A business loan agreement is similar to a Georgia Promissory Note in that it outlines the terms of borrowing for business purposes. This type of agreement may include specific details about how the funds will be used, repayment timelines, and any covenants the borrower must adhere to. While a promissory note is a straightforward promise to pay, a business loan agreement can be more complex, reflecting the unique aspects of business financing.

Finally, a secured promissory note is closely related to a Georgia Promissory Note, as both documents involve a borrower's promise to repay a loan. However, a secured promissory note includes collateral, which provides additional protection to the lender. If the borrower fails to repay, the lender can claim the collateral specified in the note. This added layer of security distinguishes it from an unsecured promissory note, emphasizing the importance of collateral in certain lending situations.