Valid Georgia Operating Agreement Template

When forming a business in Georgia, particularly a limited liability company (LLC), one of the most critical documents you'll encounter is the Operating Agreement. This essential form serves as the backbone of your LLC, outlining the internal workings and management structure of your business. It details the roles and responsibilities of members, the distribution of profits and losses, and the procedures for making important decisions. Additionally, the Operating Agreement addresses how new members can be added and what happens in the event of a member's departure or death. By clearly establishing these guidelines, the agreement not only helps prevent conflicts among members but also provides a level of protection against personal liability. Understanding the nuances of this form is crucial for any entrepreneur looking to navigate the complexities of business ownership in Georgia. As you prepare to draft or review your Operating Agreement, consider the specific needs of your business and how this document can support your goals.

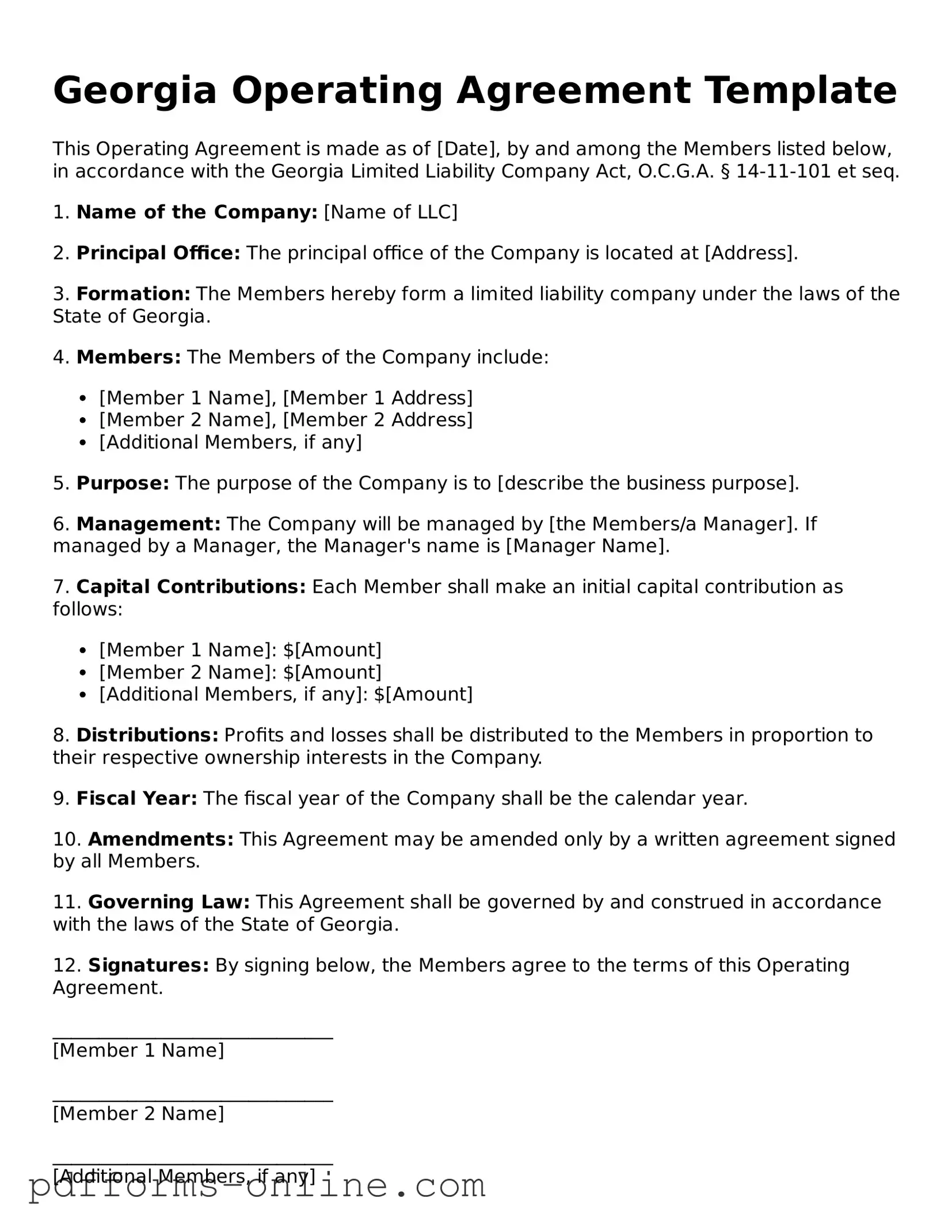

Document Example

Georgia Operating Agreement Template

This Operating Agreement is made as of [Date], by and among the Members listed below, in accordance with the Georgia Limited Liability Company Act, O.C.G.A. § 14-11-101 et seq.

1. Name of the Company: [Name of LLC]

2. Principal Office: The principal office of the Company is located at [Address].

3. Formation: The Members hereby form a limited liability company under the laws of the State of Georgia.

4. Members: The Members of the Company include:

- [Member 1 Name], [Member 1 Address]

- [Member 2 Name], [Member 2 Address]

- [Additional Members, if any]

5. Purpose: The purpose of the Company is to [describe the business purpose].

6. Management: The Company will be managed by [the Members/a Manager]. If managed by a Manager, the Manager's name is [Manager Name].

7. Capital Contributions: Each Member shall make an initial capital contribution as follows:

- [Member 1 Name]: $[Amount]

- [Member 2 Name]: $[Amount]

- [Additional Members, if any]: $[Amount]

8. Distributions: Profits and losses shall be distributed to the Members in proportion to their respective ownership interests in the Company.

9. Fiscal Year: The fiscal year of the Company shall be the calendar year.

10. Amendments: This Agreement may be amended only by a written agreement signed by all Members.

11. Governing Law: This Agreement shall be governed by and construed in accordance with the laws of the State of Georgia.

12. Signatures: By signing below, the Members agree to the terms of this Operating Agreement.

______________________________

[Member 1 Name]

______________________________

[Member 2 Name]

______________________________

[Additional Members, if any]

Frequently Asked Questions

-

What is a Georgia Operating Agreement?

A Georgia Operating Agreement is a legal document that outlines the management structure and operating procedures of a Limited Liability Company (LLC) in Georgia. It serves as an internal guideline for members, detailing their rights, responsibilities, and the distribution of profits and losses. While not required by law, having an Operating Agreement is highly recommended to prevent misunderstandings among members.

-

Why should I create an Operating Agreement for my LLC?

Creating an Operating Agreement helps establish clear rules for your business. It can help prevent disputes among members by clearly defining roles, responsibilities, and processes. Additionally, having an Operating Agreement can strengthen your LLC's credibility and protect your personal assets by reinforcing the separation between personal and business liabilities.

-

What should be included in a Georgia Operating Agreement?

Key elements to include in an Operating Agreement are:

- Names and addresses of the members

- Management structure (member-managed or manager-managed)

- Capital contributions from each member

- Profit and loss distribution methods

- Voting rights and decision-making processes

- Procedures for adding or removing members

- Dispute resolution methods

Including these details can help ensure smooth operations and reduce the likelihood of conflicts.

-

Is the Operating Agreement filed with the state?

No, the Operating Agreement is not filed with the state of Georgia. It is an internal document that should be kept on file with your business records. However, it is advisable to have it accessible to all members and to update it as needed, especially when there are changes in membership or business structure.

-

Can I change the Operating Agreement later?

Yes, you can change your Operating Agreement at any time. It is important to follow the amendment process outlined in the original document. Typically, this involves obtaining consent from the members, either through a vote or written agreement. Keeping the Operating Agreement up to date ensures that it reflects the current operations and agreements among members.

-

What happens if I don’t have an Operating Agreement?

If you do not have an Operating Agreement, your LLC will be governed by Georgia’s default LLC laws. This may not align with your business's specific needs or the expectations of the members. Without a clear agreement, disputes may arise, and it could lead to complications in decision-making and profit distribution.

Misconceptions

Understanding the Georgia Operating Agreement form is crucial for those involved in limited liability companies (LLCs). However, several misconceptions can lead to confusion. Below is a list of common misunderstandings regarding this important document.

- All LLCs are required to have an Operating Agreement. While it is highly recommended for LLCs to have one, Georgia does not legally require all LLCs to create an Operating Agreement. However, having one can help clarify the management structure and operating procedures.

- The Operating Agreement must be filed with the state. This is not true. The Operating Agreement is an internal document and does not need to be submitted to the Georgia Secretary of State. It should be kept on file for reference.

- Only multi-member LLCs need an Operating Agreement. This is a misconception. Single-member LLCs also benefit from having an Operating Agreement to establish the owner's rights and responsibilities.

- The Operating Agreement is a static document. In reality, the Operating Agreement can and should be updated as the business evolves. Changes in membership, management, or business structure may necessitate revisions.

- All provisions in the Operating Agreement are enforceable. While many provisions are enforceable, some may conflict with state laws and thus be considered void. It is essential to ensure that the agreement complies with Georgia law.

- Verbal agreements are sufficient. Relying solely on verbal agreements can lead to misunderstandings and disputes. A written Operating Agreement provides clarity and serves as a legal reference.

- The Operating Agreement is only for financial matters. This is misleading. The document covers various aspects, including management structure, decision-making processes, and member responsibilities, beyond just financial considerations.

- Operating Agreements are only for new LLCs. Existing LLCs can also benefit from creating or updating an Operating Agreement, especially if there have been changes in ownership or management.

- Once created, the Operating Agreement is no longer relevant. This is incorrect. The Operating Agreement remains relevant throughout the life of the LLC and should be consulted regularly to ensure compliance with its terms.

By addressing these misconceptions, individuals can better understand the significance of the Georgia Operating Agreement form and ensure their LLC operates smoothly and effectively.

Common mistakes

-

Neglecting to Include All Members: One common mistake is failing to list all members of the LLC. It is essential to include everyone who has a stake in the business to ensure clarity and legal protection.

-

Inaccurate or Incomplete Information: Providing incorrect details, such as names, addresses, or roles, can lead to confusion and potential legal issues. Double-checking this information before submission is crucial.

-

Not Specifying Ownership Percentages: Some individuals forget to outline the ownership percentages for each member. Clearly stating these percentages helps prevent disputes and clarifies profit-sharing arrangements.

-

Ignoring Voting Rights: Another mistake is overlooking the voting rights of each member. It’s important to define how decisions will be made and what voting power each member holds to avoid future conflicts.

-

Failing to Address Dissolution Procedures: Many people do not include provisions for what happens if the LLC needs to be dissolved. Including these procedures can save time and reduce stress should the need arise.

Find Some Other Operating Agreement Forms for Specific States

How to Make an Operating Agreement - It can specify how often and where member meetings will occur.

Before entering into a rental agreement, it is essential for both landlords and tenants to familiarize themselves with the Ohio Lease Agreement, which can be found at https://documentonline.org/blank-ohio-lease-agreement. This document provides a clear framework for managing rental relationships effectively and ensures that both parties understand their rights and obligations.

How to Make an Operating Agreement - This document can guide how the company handles its debts and liabilities.

Is an Operating Agreement Required for an Llc in California - It can include stipulations for profit reinvestment in the business.

Llc in Texas Cost - This document is crucial for ensuring each member's contribution is valued and recognized.

PDF Attributes

| Fact Name | Details |

|---|---|

| Purpose | The Georgia Operating Agreement outlines the management structure and operating procedures of a limited liability company (LLC) in Georgia. |

| Governing Law | This agreement is governed by the Georgia Limited Liability Company Act, found in Title 14, Chapter 11 of the Official Code of Georgia Annotated (O.C.G.A.). |

| Customization | Members can customize the agreement to fit their specific needs, covering aspects such as profit distribution, member roles, and decision-making processes. |

| Legal Requirement | While not legally required, having an Operating Agreement is highly recommended to prevent disputes and clarify member responsibilities. |

Similar forms

The Georgia Operating Agreement is similar to the Limited Liability Company (LLC) Agreement, which serves as the foundational document for LLCs in many states. Both documents outline the management structure and operational procedures of the company. They define the roles and responsibilities of members and managers, helping to prevent misunderstandings and disputes among stakeholders. Like the Georgia Operating Agreement, an LLC Agreement can specify profit distribution, voting rights, and procedures for adding or removing members.

Another comparable document is the Partnership Agreement. This agreement outlines the terms of a partnership between two or more individuals or entities. Similar to the Georgia Operating Agreement, it details each partner's contributions, responsibilities, and profit-sharing arrangements. Both documents aim to provide clarity and structure, ensuring that all parties are aware of their rights and obligations within the business relationship.

The Bylaws of a corporation also share similarities with the Georgia Operating Agreement. Bylaws govern the internal management of a corporation, much like an operating agreement does for an LLC. Both documents establish rules for meetings, voting procedures, and the roles of officers or managers. They serve as essential guides for maintaining order and compliance within the respective business entities.

For those seeking to formalize their business transactions, it's important to understand the various documents involved, such as the Trailer Bill of Sale form which plays a crucial role in recording the sale and transfer of assets. Accessible information about creating this essential document can be found at OnlineLawDocs.com, ensuring that both buyers and sellers have clarity in their dealings.

The Shareholders Agreement is another document that parallels the Georgia Operating Agreement. This agreement is specifically designed for corporations and outlines the rights and obligations of shareholders. It addresses issues such as share transfers, voting rights, and management decisions. Like the Operating Agreement, it aims to protect the interests of all parties involved and provide a clear framework for decision-making.

The Joint Venture Agreement is also akin to the Georgia Operating Agreement. This document outlines the terms of a business arrangement between two or more parties who agree to collaborate on a specific project. It details each party's contributions, responsibilities, and profit-sharing arrangements, similar to how an operating agreement delineates the roles of LLC members. Both documents emphasize cooperation and mutual benefit in business ventures.

The Employment Agreement can be compared to the Georgia Operating Agreement in terms of defining roles and expectations. While the Operating Agreement focuses on the relationship between members of an LLC, the Employment Agreement outlines the terms of employment between an employer and an employee. Both documents aim to clarify responsibilities, compensation, and other key aspects of the working relationship, contributing to a well-structured environment.

The Non-Disclosure Agreement (NDA) is another document that shares some similarities with the Georgia Operating Agreement. While NDAs primarily focus on protecting confidential information, they often include terms that govern the relationship between the parties involved. Both documents are designed to establish clear expectations and protect the interests of the parties, though they serve different purposes within the business context.

Lastly, the Business Plan can be seen as a document that complements the Georgia Operating Agreement. While the Operating Agreement outlines the governance and operational aspects of an LLC, the Business Plan details the company's goals, strategies, and financial projections. Both documents are essential for guiding the business and ensuring that all members are aligned with the company's vision and objectives.