Valid Georgia Loan Agreement Template

The Georgia Loan Agreement form is an essential document that outlines the terms and conditions under which a borrower receives funds from a lender. This form typically includes critical details such as the loan amount, interest rate, repayment schedule, and any collateral that may be required. Additionally, it specifies the rights and obligations of both parties, ensuring that there is a clear understanding of the expectations involved in the transaction. Important clauses may address late payment penalties, default conditions, and dispute resolution processes. By clearly delineating these aspects, the agreement serves to protect both the lender's investment and the borrower's interests. The form is designed to be straightforward, allowing individuals and businesses to engage in lending activities with confidence, knowing that their agreement is legally binding and enforceable under Georgia law.

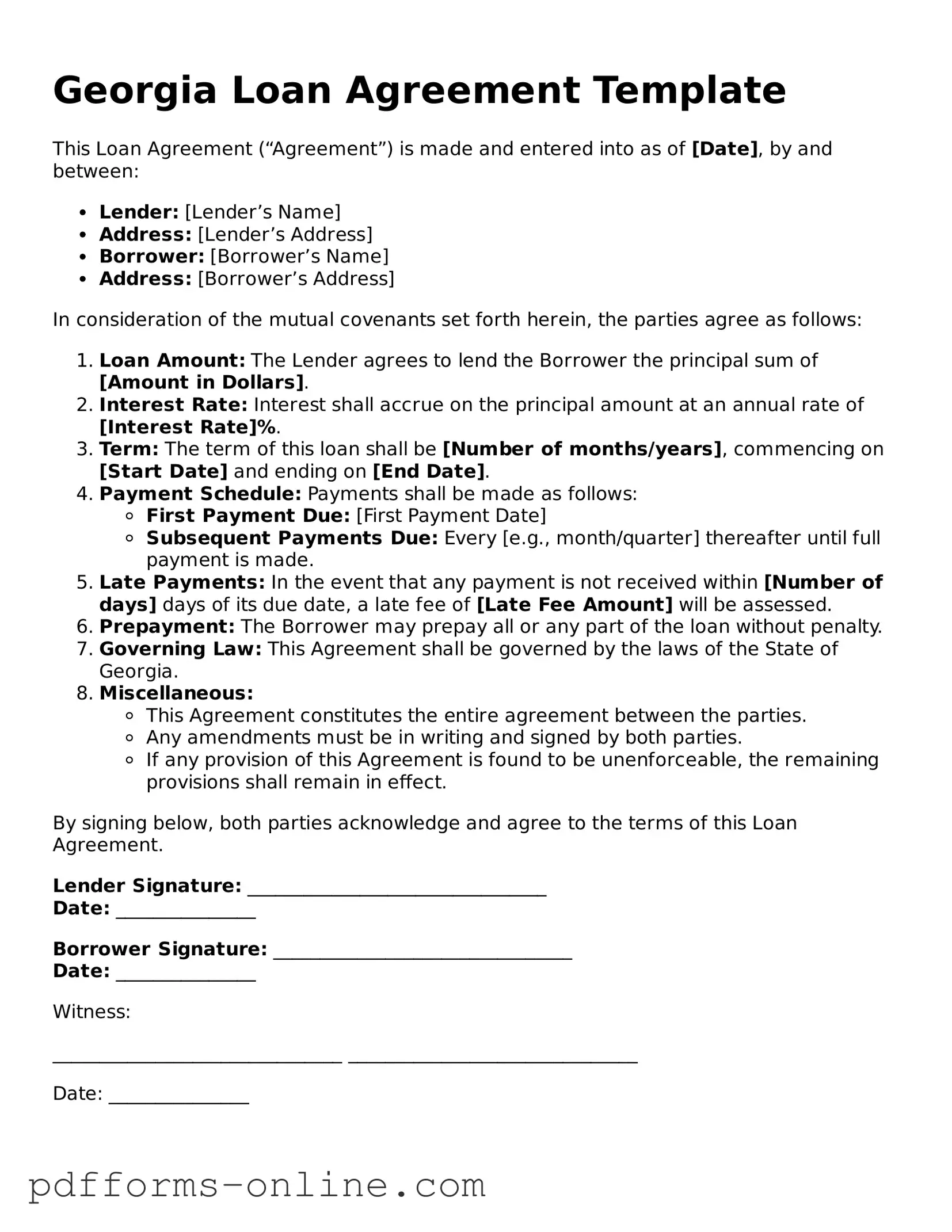

Document Example

Georgia Loan Agreement Template

This Loan Agreement (“Agreement”) is made and entered into as of [Date], by and between:

- Lender: [Lender’s Name]

- Address: [Lender’s Address]

- Borrower: [Borrower’s Name]

- Address: [Borrower’s Address]

In consideration of the mutual covenants set forth herein, the parties agree as follows:

- Loan Amount: The Lender agrees to lend the Borrower the principal sum of [Amount in Dollars].

- Interest Rate: Interest shall accrue on the principal amount at an annual rate of [Interest Rate]%.

- Term: The term of this loan shall be [Number of months/years], commencing on [Start Date] and ending on [End Date].

- Payment Schedule: Payments shall be made as follows:

- First Payment Due: [First Payment Date]

- Subsequent Payments Due: Every [e.g., month/quarter] thereafter until full payment is made.

- Late Payments: In the event that any payment is not received within [Number of days] days of its due date, a late fee of [Late Fee Amount] will be assessed.

- Prepayment: The Borrower may prepay all or any part of the loan without penalty.

- Governing Law: This Agreement shall be governed by the laws of the State of Georgia.

- Miscellaneous:

- This Agreement constitutes the entire agreement between the parties.

- Any amendments must be in writing and signed by both parties.

- If any provision of this Agreement is found to be unenforceable, the remaining provisions shall remain in effect.

By signing below, both parties acknowledge and agree to the terms of this Loan Agreement.

Lender Signature: ________________________________

Date: _______________

Borrower Signature: ________________________________

Date: _______________

Witness:

_______________________________ _______________________________

Date: _______________

Frequently Asked Questions

-

What is a Georgia Loan Agreement form?

A Georgia Loan Agreement form is a legal document that outlines the terms and conditions of a loan between a lender and a borrower in the state of Georgia. This agreement specifies the amount of the loan, interest rates, repayment schedule, and any collateral involved.

-

Who needs a Loan Agreement?

Anyone who is lending or borrowing money should consider using a Loan Agreement. This includes individuals, businesses, and organizations. Having a written agreement helps protect both parties by clearly defining their rights and responsibilities.

-

What are the key components of a Loan Agreement?

A typical Loan Agreement includes:

- The names and contact information of both parties

- The loan amount

- The interest rate

- The repayment schedule

- Any collateral securing the loan

- Consequences of default

-

Is a Loan Agreement required by law in Georgia?

No, a Loan Agreement is not legally required in Georgia. However, it is highly recommended. Without a written agreement, disputes may arise over the terms of the loan, which can lead to misunderstandings and potential legal issues.

-

Can I customize the Loan Agreement?

Yes, the Loan Agreement can be customized to meet the specific needs of both parties. You may include additional clauses or terms that reflect the unique circumstances of the loan. However, it is essential that both parties agree to these modifications.

-

What happens if the borrower defaults on the loan?

If the borrower defaults, the lender has the right to take legal action as outlined in the Loan Agreement. This may include pursuing repayment through court or seizing any collateral that was pledged. The specific consequences of default should be clearly stated in the agreement.

-

Do I need a lawyer to draft a Loan Agreement?

While it is possible to create a Loan Agreement without legal assistance, consulting a lawyer is advisable. A lawyer can ensure that the agreement complies with Georgia law and adequately protects your interests.

-

How can I ensure the Loan Agreement is enforceable?

To ensure the Loan Agreement is enforceable, both parties should sign the document in the presence of a witness or notary. Additionally, keeping a copy of the signed agreement is crucial for both parties. Clear terms and conditions will also help enforceability.

Misconceptions

Understanding the Georgia Loan Agreement form is essential for anyone involved in lending or borrowing. However, several misconceptions can lead to confusion. Here are eight common misconceptions about this form:

- All loan agreements are the same. Many people believe that all loan agreements follow a standard template. In reality, each loan agreement can vary significantly based on the terms negotiated between the lender and borrower.

- You don’t need a written agreement for small loans. Some individuals think that small loans do not require formal documentation. However, having a written agreement, regardless of the loan amount, can protect both parties in case of disputes.

- The loan agreement only protects the lender. While lenders often have more rights, a well-drafted loan agreement also safeguards the borrower’s interests, outlining their responsibilities and rights.

- Once signed, the terms cannot be changed. Many assume that the terms of a loan agreement are set in stone once signed. In fact, both parties can agree to modify the terms, but this should be documented in writing.

- Interest rates are negotiable. Some borrowers think that interest rates are fixed and cannot be negotiated. In Georgia, as in many states, borrowers can negotiate terms before signing the agreement.

- Loan agreements are only for large sums of money. People often believe that loan agreements are only necessary for significant loans. However, even small loans can benefit from a formal agreement to clarify expectations.

- Verbal agreements are sufficient. Many believe that a verbal agreement is enough to secure a loan. However, without written documentation, it can be challenging to enforce the terms of a verbal agreement.

- Only banks use loan agreements. It is a common misconception that only banks and financial institutions require loan agreements. Individuals and private lenders also benefit from using these agreements to ensure clarity and protection.

By addressing these misconceptions, individuals can better navigate the lending process and ensure that their rights and responsibilities are clear.

Common mistakes

-

Not reading the entire form before starting. This can lead to confusion and mistakes later on.

-

Forgetting to include personal information. Make sure to fill in your full name, address, and contact details.

-

Leaving out the loan amount. Be clear about how much money you are borrowing.

-

Not specifying the purpose of the loan. It's important to explain why you need the funds.

-

Overlooking the interest rate. Double-check that you understand what rate applies to your loan.

-

Failing to read the repayment terms. Know when payments are due and how much they will be.

-

Not signing the agreement. Without a signature, the document is not valid.

-

Neglecting to date the form. A date is crucial for tracking the timeline of the loan.

-

Using incorrect or outdated contact information for the lender. Ensure that all details are current.

-

Not keeping a copy of the completed form. Always save a copy for your records.

Find Some Other Loan Agreement Forms for Specific States

Free Promissory Note Template California - It may also include provisions for loan extension or modification under certain conditions.

To ensure a secure and mutually understood foundation for your marriage, consider utilizing a prenuptial agreement, which is a wise step that many couples take. This legal document not only defines asset ownership in the event of a divorce or death but also fosters open communication about financial matters. To navigate the specifics of this process, refer to All Arizona Forms that can assist in making informed decisions together.

Promissory Note Florida - Clarity in the loan purpose fosters responsible borrowing practices.

PDF Attributes

| Fact Name | Details |

|---|---|

| Document Type | Georgia Loan Agreement Form is a legal document used to outline the terms of a loan between a lender and a borrower. |

| Governing Law | The agreement is governed by the laws of the State of Georgia. |

| Parties Involved | The form requires identification of both the lender and the borrower, including their legal names and contact information. |

| Loan Amount | The specific loan amount must be clearly stated in the agreement. |

| Interest Rate | The form should specify the interest rate, whether fixed or variable, applicable to the loan. |

| Repayment Terms | Details regarding repayment schedule, including due dates and payment methods, must be included. |

Similar forms

The Georgia Loan Agreement form shares similarities with the Promissory Note. Both documents outline the terms of a loan, specifying the amount borrowed, interest rates, and repayment schedules. A Promissory Note is often a standalone document that emphasizes the borrower's promise to repay the loan, while the Loan Agreement typically includes more detailed provisions, such as collateral and default conditions. However, both serve the fundamental purpose of formalizing a lending arrangement between parties.

The Georgia Deed form is a crucial document used in real estate transactions within the state of Georgia. It legally transfers property ownership from the seller to the buyer. Understanding the details of this form is essential for anyone involved in buying or selling property in Georgia. For more information, you can visit onlinelawdocs.com/.

Another document that resembles the Georgia Loan Agreement is the Mortgage Agreement. This agreement is used when real property is involved as collateral for a loan. Like the Loan Agreement, it details the loan amount, interest rates, and repayment terms. However, the Mortgage Agreement specifically addresses the rights and obligations related to the property, including what happens in the event of default. Both documents protect the lender’s interests while providing clarity for the borrower.

The Security Agreement also parallels the Georgia Loan Agreement in its function of securing a loan with collateral. This document outlines the specific assets that the borrower pledges to the lender as security for the loan. While the Loan Agreement may reference collateral, the Security Agreement goes further by detailing the rights of the lender in the event of default. Both documents work together to ensure that the lender has a claim to the specified collateral if repayment obligations are not met.

The Installment Sale Agreement is another document that shares characteristics with the Georgia Loan Agreement. In an Installment Sale Agreement, the buyer makes payments over time to purchase an asset, similar to a loan arrangement. Both documents include payment terms, interest rates, and consequences for non-payment. However, the Installment Sale Agreement also transfers ownership of the asset to the buyer upon full payment, while the Loan Agreement does not transfer ownership until the loan is repaid.

The Lease Agreement can also be compared to the Georgia Loan Agreement, particularly in commercial contexts. Both documents outline the terms under which one party provides financial resources to another. A Lease Agreement typically involves the rental of property, while a Loan Agreement involves the provision of funds. However, both documents detail payment schedules and consequences for non-compliance, thus serving to protect the interests of the party providing the financial benefit.

The Credit Agreement is another document akin to the Georgia Loan Agreement. This document governs the terms under which a lender extends credit to a borrower. Similar to the Loan Agreement, it specifies the amount of credit, interest rates, and repayment terms. However, a Credit Agreement may also include revolving credit features, allowing borrowers to withdraw funds up to a certain limit, which is not typically found in standard loan agreements.

The Line of Credit Agreement is also similar to the Georgia Loan Agreement in that it provides a borrower access to funds up to a specified limit. Both documents outline repayment terms and interest rates. However, a Line of Credit Agreement allows for flexible borrowing, meaning the borrower can draw funds as needed, repay them, and then borrow again, whereas a traditional Loan Agreement typically involves a fixed sum that is disbursed all at once.

Lastly, the Loan Modification Agreement bears resemblance to the Georgia Loan Agreement, particularly when changes to the original loan terms are necessary. This document modifies the existing Loan Agreement to reflect new terms, such as interest rates or repayment schedules. Both agreements aim to ensure that the borrower and lender maintain a clear understanding of their obligations, especially in circumstances that may necessitate adjustments to the original terms.