Valid Georgia Durable Power of Attorney Template

In the realm of estate planning and personal finance management, the Georgia Durable Power of Attorney form stands as a vital tool for individuals seeking to ensure their financial and healthcare decisions are handled according to their wishes, even in the event of incapacitation. This legal document grants a trusted person, known as an agent or attorney-in-fact, the authority to make decisions on behalf of the principal, the person creating the document. Unlike a standard power of attorney, the durable version remains effective even if the principal becomes mentally or physically unable to manage their affairs. This characteristic is particularly crucial in situations involving serious illness or cognitive decline. The form encompasses various powers, which can include managing bank accounts, making investment decisions, and handling real estate transactions. It can also extend to healthcare decisions, depending on how it is drafted. Importantly, the principal retains the ability to specify the extent of the powers granted, ensuring that their preferences are respected. Understanding the nuances of this form is essential for anyone looking to secure their future and protect their interests in an unpredictable world.

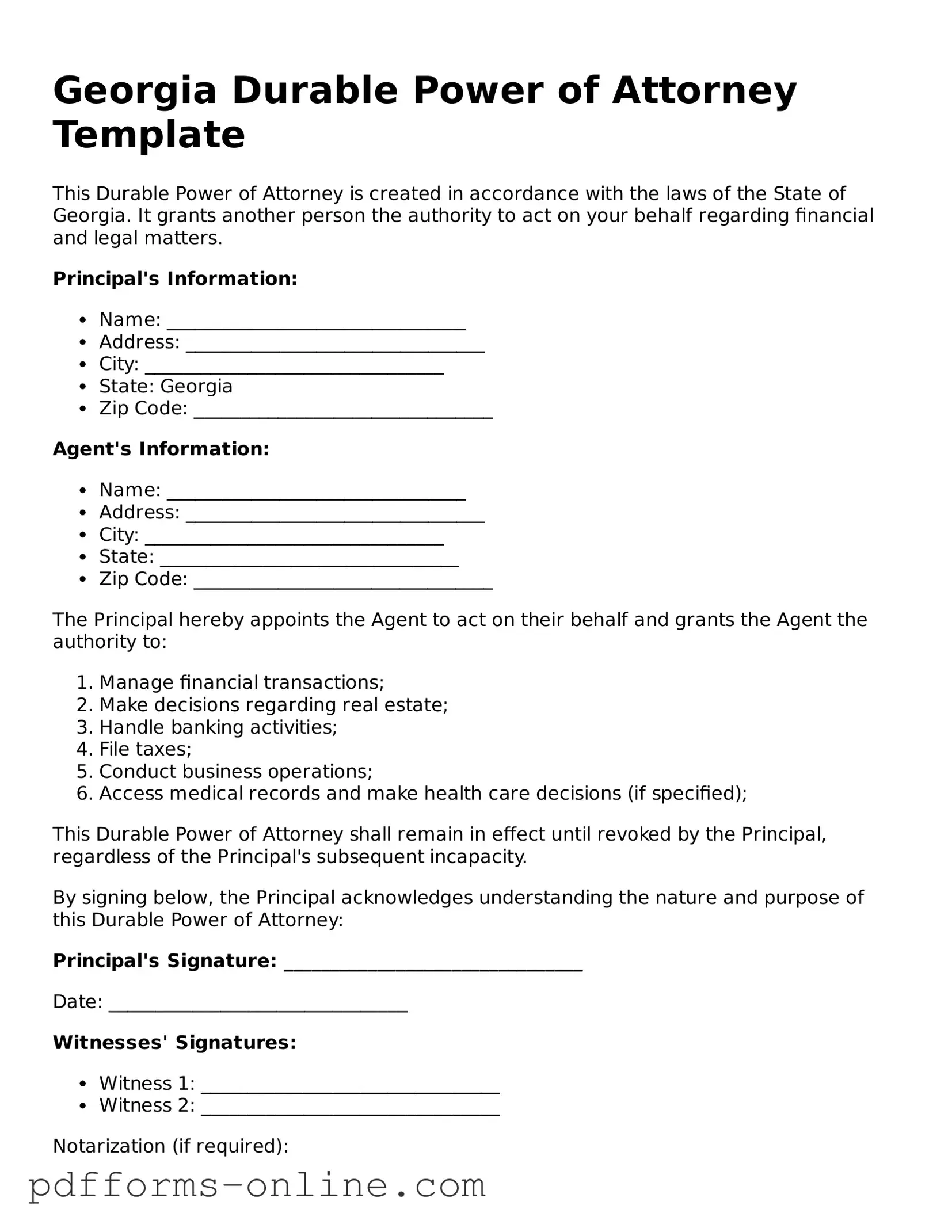

Document Example

Georgia Durable Power of Attorney Template

This Durable Power of Attorney is created in accordance with the laws of the State of Georgia. It grants another person the authority to act on your behalf regarding financial and legal matters.

Principal's Information:

- Name: ________________________________

- Address: ________________________________

- City: ________________________________

- State: Georgia

- Zip Code: ________________________________

Agent's Information:

- Name: ________________________________

- Address: ________________________________

- City: ________________________________

- State: ________________________________

- Zip Code: ________________________________

The Principal hereby appoints the Agent to act on their behalf and grants the Agent the authority to:

- Manage financial transactions;

- Make decisions regarding real estate;

- Handle banking activities;

- File taxes;

- Conduct business operations;

- Access medical records and make health care decisions (if specified);

This Durable Power of Attorney shall remain in effect until revoked by the Principal, regardless of the Principal's subsequent incapacity.

By signing below, the Principal acknowledges understanding the nature and purpose of this Durable Power of Attorney:

Principal's Signature: ________________________________

Date: ________________________________

Witnesses' Signatures:

- Witness 1: ________________________________

- Witness 2: ________________________________

Notarization (if required):

Subscribed and sworn before me this ____ day of ___________, 20____.

Notary Public Signature: ________________________________

My Commission Expires: ________________________________

Frequently Asked Questions

-

What is a Durable Power of Attorney in Georgia?

A Durable Power of Attorney (DPOA) in Georgia is a legal document that allows an individual, known as the principal, to appoint another person, called the agent or attorney-in-fact, to make decisions on their behalf. This document remains effective even if the principal becomes incapacitated, ensuring that their financial and legal matters can be managed without interruption.

-

What are the key components of a Georgia Durable Power of Attorney?

A Georgia DPOA typically includes the following components:

- The name and contact information of the principal.

- The name and contact information of the agent.

- A statement indicating that the power of attorney is durable.

- A list of specific powers granted to the agent, which may include managing finances, real estate transactions, and making healthcare decisions.

- The principal's signature, dated and witnessed, or notarized, to validate the document.

-

How does one create a Durable Power of Attorney in Georgia?

To create a Durable Power of Attorney in Georgia, the principal must follow these steps:

- Choose a trusted individual to act as the agent.

- Draft the DPOA document, ensuring it includes all necessary components.

- Sign the document in the presence of a notary public or have it witnessed by two individuals who are not named in the document.

- Provide copies of the signed DPOA to the agent and any relevant financial institutions or healthcare providers.

-

Can a Durable Power of Attorney be revoked?

Yes, a Durable Power of Attorney can be revoked at any time by the principal, as long as they are mentally competent. To revoke the DPOA, the principal should create a written revocation document, sign it, and notify the agent and any institutions that have a copy of the original DPOA. This ensures that the agent no longer has authority to act on the principal's behalf.

Misconceptions

- Misconception 1: A Durable Power of Attorney is only for financial matters.

- Misconception 2: The agent must be a lawyer or a financial expert.

- Misconception 3: A Durable Power of Attorney is only valid while you are alive.

- Misconception 4: You can’t change or revoke a Durable Power of Attorney once it’s signed.

- Misconception 5: A Durable Power of Attorney is the same as a living will.

This is not true. While many people associate a Durable Power of Attorney with financial decisions, it can also cover health care decisions. You can specify what actions your agent can take regarding your medical care.

In reality, anyone you trust can serve as your agent. This could be a family member, friend, or anyone who understands your wishes and can act in your best interest.

While it is true that this document is effective during your lifetime, it remains valid even if you become incapacitated. This is what makes it "durable." It ensures your wishes are honored when you cannot express them yourself.

This is false. You have the right to revoke or change your Durable Power of Attorney at any time, as long as you are mentally competent. It’s important to keep your documents updated to reflect your current wishes.

This is a common misunderstanding. A Durable Power of Attorney allows someone to make decisions on your behalf, while a living will specifically outlines your wishes regarding medical treatment in the event you cannot communicate them yourself.

Common mistakes

-

Not Specifying Powers Clearly: One common mistake is failing to clearly outline the specific powers granted to the agent. It is essential to list the exact authorities you want to give. This could include financial decisions, healthcare choices, or property management.

-

Forgetting to Sign and Date: Some people overlook the importance of signing and dating the form. Without your signature, the document may not be valid. Always double-check that you have signed in the appropriate places.

-

Neglecting to Choose Alternate Agents: Many individuals only name one agent. If that person is unavailable or unwilling to act, there may be no one to step in. Consider naming an alternate agent to avoid this issue.

-

Not Having Witnesses or Notarization: In Georgia, the Durable Power of Attorney must be signed in front of a notary public. Some people forget this step, which can lead to complications. Ensure you follow the requirements for witnessing or notarization.

Find Some Other Durable Power of Attorney Forms for Specific States

General Power of Attorney Form Pennsylvania - Choosing a reliable agent is critical, as they will have significant authority over your affairs.

When dealing with transactions involving recreational vehicles, it is important to have the appropriate documentation in place. A useful resource is the complete RV Bill of Sale document, which ensures that all necessary details are captured to facilitate a smooth transfer of ownership while safeguarding the interests of both parties involved.

Statutory Durable Power of Attorney Texas - Your agent must act in your best interest at all times.

How to Get a Power of Attorney in Florida - Be proactive in protecting your future by appointing a Durable Power of Attorney.

Nys Durable Power of Attorney Form 2023 - A Durable Power of Attorney can be a critical part of a comprehensive estate plan.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | A Georgia Durable Power of Attorney allows an individual (the principal) to designate another person (the agent) to make decisions on their behalf, even if the principal becomes incapacitated. |

| Governing Law | The Durable Power of Attorney in Georgia is governed by the Georgia Uniform Power of Attorney Act, found in O.C.G.A. § 10-6B-1 et seq. |

| Durability | This type of power of attorney remains effective even if the principal becomes mentally or physically incapacitated, ensuring continuous decision-making authority for the agent. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are competent to do so. This can be done through a written notice to the agent. |

| Agent's Authority | The agent's authority can be broad or limited, depending on the principal's preferences. Specific powers can be outlined in the document. |

| Witness and Notary Requirements | In Georgia, the Durable Power of Attorney must be signed by the principal in the presence of two witnesses and a notary public to be valid. |

Similar forms

The Georgia Durable Power of Attorney form is similar to the General Power of Attorney. Both documents allow an individual to appoint someone else to manage their financial and legal affairs. However, the General Power of Attorney typically becomes invalid if the person who created it becomes incapacitated. In contrast, the Durable Power of Attorney remains effective even if the principal loses the ability to make decisions, making it a more reliable option for long-term planning.

Another document that shares similarities is the Medical Power of Attorney. This form allows a person to designate someone to make medical decisions on their behalf if they are unable to do so. Like the Durable Power of Attorney, the Medical Power of Attorney ensures that the appointed individual can act in the principal's best interest, but it specifically focuses on health care decisions rather than financial matters.

The Living Will is also comparable to the Durable Power of Attorney. While a Living Will outlines a person's wishes regarding end-of-life medical treatment, it does not appoint someone to make decisions. However, both documents serve to express the principal's preferences and can work together to ensure that their wishes are honored in critical situations.

The Revocable Trust shares some similarities with the Durable Power of Attorney in terms of asset management. A Revocable Trust allows a person to place their assets in a trust, which can be managed by a trustee. Like a Durable Power of Attorney, it can help avoid the probate process. However, a trust typically requires more formalities to establish and fund than a power of attorney.

The Advance Directive is another document akin to the Durable Power of Attorney. An Advance Directive combines a Living Will and a Medical Power of Attorney. It allows individuals to specify their healthcare preferences and appoint a representative to make decisions. Both documents ensure that a person's wishes are respected, particularly in medical situations, but the Advance Directive is more comprehensive regarding healthcare choices.

The Financial Power of Attorney is similar as well. This document specifically grants authority to someone to handle financial matters on behalf of the principal. While the Durable Power of Attorney can encompass a broader range of powers, the Financial Power of Attorney is focused solely on financial decisions, making it a specialized version of the broader durable power.

A Health Care Proxy is another related document. It allows individuals to appoint someone to make health care decisions for them if they cannot do so. Similar to the Medical Power of Attorney, a Health Care Proxy emphasizes health care choices but may not cover financial decisions. Both documents ensure that the appointed person can act on behalf of the principal in medical contexts.

Understanding the nuances of a General Power of Attorney document is vital for ensuring that your interests are well-managed by a trusted agent. This form enables the designated agent to act on your behalf, making important decisions about your financial and legal matters when you are unable to do so.

The Guardianship document has similarities as well. In situations where an individual becomes incapacitated and has not designated a Durable Power of Attorney, a court may appoint a guardian to manage their affairs. While the Durable Power of Attorney allows individuals to choose their representative, guardianship is typically established through court proceedings, making it a less flexible option.

The Will also shares some common ground with the Durable Power of Attorney. A Will outlines how a person's assets should be distributed after their death. While the Durable Power of Attorney is effective during the principal's lifetime, both documents play crucial roles in estate planning. They work together to ensure that a person's wishes are fulfilled both during life and after death.

Lastly, the Business Power of Attorney is similar in that it allows a person to manage business affairs on behalf of another individual or entity. This document grants authority to handle specific business-related tasks, much like the Durable Power of Attorney does for personal matters. However, the Business Power of Attorney is tailored specifically for business transactions and decisions, making it a focused tool for those managing corporate affairs.