Valid Georgia Deed in Lieu of Foreclosure Template

The Georgia Deed in Lieu of Foreclosure form serves as a crucial instrument for homeowners facing financial difficulties and potential foreclosure. This legal document allows property owners to voluntarily transfer the title of their property back to the lender, effectively settling the mortgage debt without the need for a lengthy foreclosure process. By utilizing this form, individuals can avoid the negative consequences associated with foreclosure, such as a damaged credit score and the stress of court proceedings. The process typically involves negotiations between the homeowner and the lender, ensuring that both parties agree on the terms and conditions of the transfer. It is essential for homeowners to understand their rights and obligations under this arrangement, as well as the potential impact on their future financial standing. In Georgia, specific requirements must be met for the deed to be valid, including the completion of necessary documentation and adherence to state regulations. Overall, this form provides a viable alternative for those looking to navigate the challenges of mortgage default while minimizing the repercussions of foreclosure.

Document Example

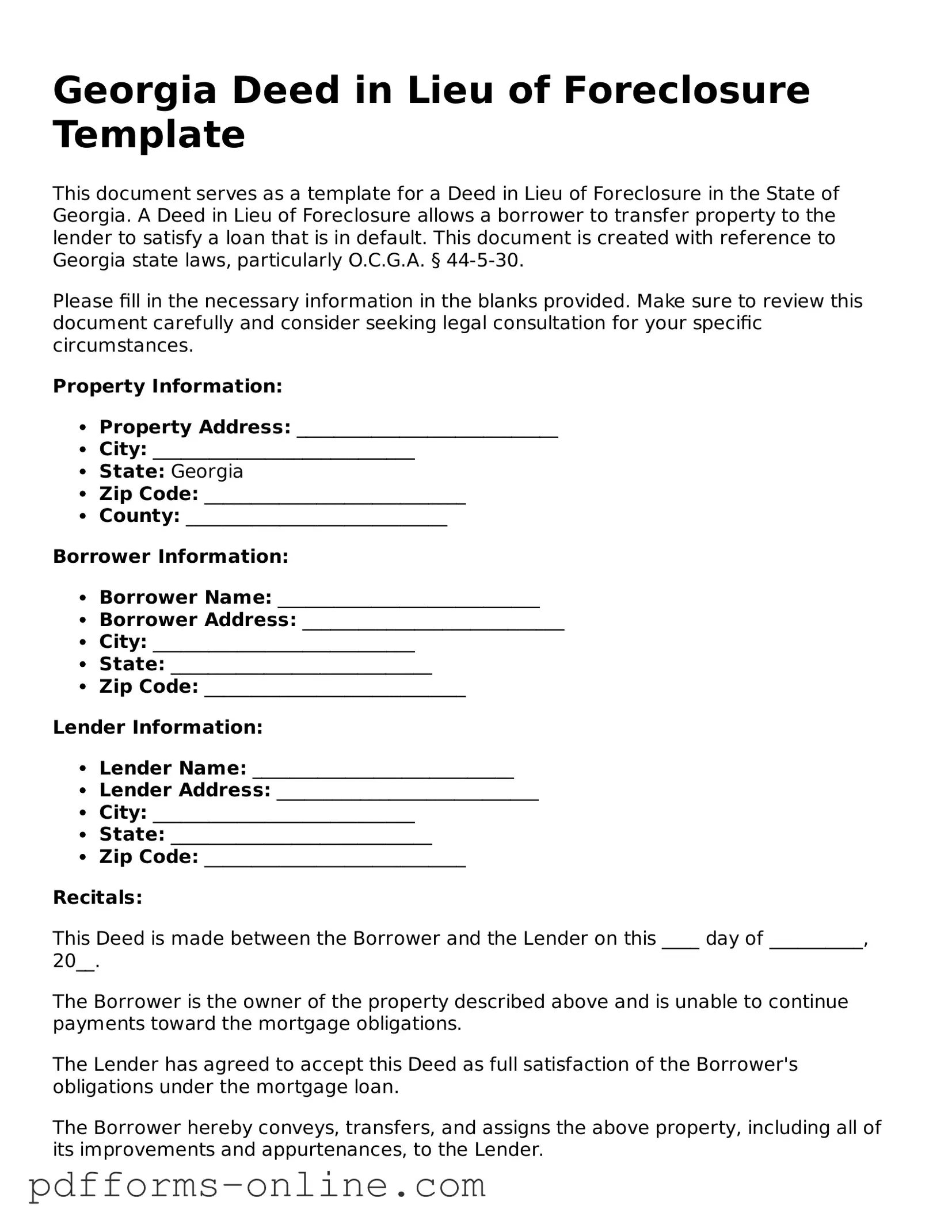

Georgia Deed in Lieu of Foreclosure Template

This document serves as a template for a Deed in Lieu of Foreclosure in the State of Georgia. A Deed in Lieu of Foreclosure allows a borrower to transfer property to the lender to satisfy a loan that is in default. This document is created with reference to Georgia state laws, particularly O.C.G.A. § 44-5-30.

Please fill in the necessary information in the blanks provided. Make sure to review this document carefully and consider seeking legal consultation for your specific circumstances.

Property Information:

- Property Address: ____________________________

- City: ____________________________

- State: Georgia

- Zip Code: ____________________________

- County: ____________________________

Borrower Information:

- Borrower Name: ____________________________

- Borrower Address: ____________________________

- City: ____________________________

- State: ____________________________

- Zip Code: ____________________________

Lender Information:

- Lender Name: ____________________________

- Lender Address: ____________________________

- City: ____________________________

- State: ____________________________

- Zip Code: ____________________________

Recitals:

This Deed is made between the Borrower and the Lender on this ____ day of __________, 20__.

The Borrower is the owner of the property described above and is unable to continue payments toward the mortgage obligations.

The Lender has agreed to accept this Deed as full satisfaction of the Borrower's obligations under the mortgage loan.

The Borrower hereby conveys, transfers, and assigns the above property, including all of its improvements and appurtenances, to the Lender.

Signatures:

IN WITNESS WHEREOF, the parties have executed this Deed as of the day and year first above written.

Borrower's Signature: ____________________________

Printed Name: ____________________________

Lender's Signature: ____________________________

Printed Name: ____________________________

This document must be notarized:

Notary Public's Signature: ____________________________

Printed Name: ____________________________

My commission expires: ____________________________

Frequently Asked Questions

-

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to voluntarily transfer the title of their property back to the lender. This typically occurs when the homeowner is unable to continue making mortgage payments and wants to avoid the lengthy foreclosure process.

-

How does a Deed in Lieu of Foreclosure work?

In this arrangement, the homeowner signs over the property to the lender. In return, the lender usually agrees to forgive the remaining mortgage debt. This process can help both parties: the homeowner avoids foreclosure, and the lender can quickly take possession of the property.

-

What are the benefits of a Deed in Lieu of Foreclosure?

- It can be less damaging to the homeowner's credit score compared to a foreclosure.

- The process is often quicker and less costly than foreclosure.

- Homeowners may have the opportunity to negotiate terms with the lender, such as the possibility of staying in the home for a short period after the transfer.

-

Are there any drawbacks to a Deed in Lieu of Foreclosure?

Yes, there can be drawbacks. Homeowners may still face tax implications, as forgiven debt could be considered taxable income. Additionally, not all lenders accept Deeds in Lieu of Foreclosure, and some may require the homeowner to demonstrate financial hardship.

-

What are the eligibility requirements for a Deed in Lieu of Foreclosure in Georgia?

Eligibility can vary by lender, but generally, homeowners must be facing financial hardship and unable to make mortgage payments. They should also have little to no equity in the home. It’s important to communicate openly with the lender to understand specific requirements.

-

What steps should a homeowner take to initiate a Deed in Lieu of Foreclosure?

First, homeowners should contact their lender to discuss their situation. Next, they should gather necessary documentation, such as financial statements and proof of hardship. Finally, they can formally request a Deed in Lieu of Foreclosure and begin negotiations with the lender.

-

What happens to the homeowner's credit score after a Deed in Lieu of Foreclosure?

While a Deed in Lieu of Foreclosure is less damaging than a foreclosure, it can still impact the homeowner's credit score. Typically, the score may drop, but the extent varies based on individual credit history. It's advisable to check with credit reporting agencies for more specific information.

-

Can a homeowner still be responsible for the mortgage debt after a Deed in Lieu of Foreclosure?

In many cases, if the lender agrees to the Deed in Lieu of Foreclosure, they will forgive the remaining mortgage debt. However, this is not guaranteed. Homeowners should clarify this point with their lender before proceeding.

-

What should a homeowner do if their lender denies the Deed in Lieu of Foreclosure?

If a lender denies the request, homeowners can explore other options, such as loan modification or short sale. Consulting with a housing counselor or attorney may also provide additional strategies to address their financial situation.

-

Is it necessary to hire a lawyer for a Deed in Lieu of Foreclosure?

While it's not legally required, hiring a lawyer can be beneficial. They can help navigate the complexities of the process, ensure that the homeowner's rights are protected, and assist with any negotiations with the lender.

Misconceptions

Understanding the Georgia Deed in Lieu of Foreclosure can be challenging. Here are six common misconceptions about this legal process:

- It eliminates all debt immediately. Many believe that signing a deed in lieu means they are free from all debts. However, this is not always the case. While it may relieve some mortgage obligations, other debts related to the property may still exist.

- It is a quick fix for financial problems. Some think that a deed in lieu is a fast solution to avoid foreclosure. In reality, the process can take time and requires careful consideration of the implications involved.

- It affects only the homeowner. Many assume that only the person who owns the property is impacted. However, co-borrowers or guarantors may also face consequences, including credit score impacts.

- It is the same as a short sale. Some confuse a deed in lieu with a short sale. While both involve transferring property to avoid foreclosure, a short sale typically requires selling the home for less than the mortgage balance, whereas a deed in lieu involves giving the property back to the lender.

- It guarantees a clean title transfer. People often believe that signing a deed in lieu guarantees a clear title. However, if there are liens or other encumbrances on the property, those may still need to be resolved.

- It is always approved by lenders. Many homeowners think that lenders will automatically accept a deed in lieu request. In reality, lenders evaluate each case individually and may deny the request based on specific criteria.

Being informed about these misconceptions can help individuals make better decisions regarding their financial futures.

Common mistakes

-

Inaccurate Property Description: One common mistake is failing to provide a precise and accurate description of the property. This includes not including the correct address, legal description, or parcel number. An incomplete or incorrect description can lead to complications in the transfer process and may delay the deed's acceptance.

-

Not Notarizing the Document: Another frequent error is neglecting to have the deed notarized. A deed in lieu of foreclosure must be signed in front of a notary public to be legally binding. Without this step, the document may not be recognized as valid, which could create further issues down the line.

-

Ignoring Lender Requirements: Some individuals overlook the specific requirements set by their lender. Each lender may have different forms, documents, or procedures that must be followed. Failing to comply with these requirements can result in the lender rejecting the deed in lieu of foreclosure.

-

Missing Signatures: Lastly, a common mistake is not obtaining all necessary signatures. If there are multiple owners or parties involved in the property, each must sign the deed. Missing even one signature can invalidate the document and complicate the foreclosure process.

Find Some Other Deed in Lieu of Foreclosure Forms for Specific States

Deed in Lieu of Foreclosure New York - Homeowners should prepare for the possibility of relocation after signing the deed.

A prenuptial agreement form in Arizona is a legal document that prospective spouses use to determine the ownership of their respective assets should the marriage end in divorce or death. It's designed to protect individuals' rights and to outline responsibilities in the event of a separation. Ensure you're prepared for the future by filling out the Arizona Prenuptial Agreement form—click the button below to get started. For more information, refer to All Arizona Forms.

California Property Transfer Deed - The form can help prevent further legal and financial complications for borrowers.

What Does an Arizona Homeowner Lose When Choosing to Use Deed in Lieu of Foreclosure? - A Deed in Lieu might not erase all financial obligations related to the property.

Deed in Lieu of Foreclosure Vs Foreclosure - A successful Deed in Lieu process can lead to a more amicable relationship between the homeowner and lender.

PDF Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Georgia Deed in Lieu of Foreclosure form allows a borrower to voluntarily transfer property ownership to the lender to avoid foreclosure. |

| Governing Law | This form is governed by the laws of the State of Georgia, specifically under Georgia Code Title 44, Chapter 14. |

| Benefits | Using this form can help borrowers minimize damage to their credit score compared to a foreclosure. |

| Eligibility | Borrowers must be in default on their mortgage payments and must obtain lender approval to use this option. |

| Process | After the form is completed and signed, it must be recorded with the local county clerk's office to finalize the transfer. |

Similar forms

A short sale agreement is a document that allows a homeowner to sell their property for less than the amount owed on the mortgage. Similar to a Deed in Lieu of Foreclosure, a short sale can help the homeowner avoid foreclosure. In both cases, the lender agrees to accept less than the full amount owed, which can relieve the financial burden on the homeowner. However, in a short sale, the property is sold to a third party, whereas a Deed in Lieu transfers ownership directly to the lender. Both options can be beneficial for those facing financial difficulties, offering a way to move forward without the lengthy process of foreclosure.

A loan modification agreement is another document that shares similarities with a Deed in Lieu of Foreclosure. This agreement involves changing the terms of an existing loan to make it more manageable for the borrower. Just like a Deed in Lieu, a loan modification aims to prevent foreclosure by allowing the homeowner to keep their property while adjusting payment terms. In both situations, the lender plays a crucial role in determining the outcome. While a Deed in Lieu results in the transfer of property ownership, a loan modification keeps the homeowner in their home, making it a more favorable option for those who can still afford their modified payments.

A foreclosure mediation agreement is designed to facilitate communication between a homeowner and their lender. This document is similar to a Deed in Lieu of Foreclosure in that it seeks to find an alternative to foreclosure. Mediation can lead to various solutions, including loan modifications or repayment plans. While a Deed in Lieu results in the homeowner relinquishing their property, mediation aims to keep them in their home, providing a more collaborative approach. Both options reflect the desire to resolve financial issues without the negative consequences of foreclosure.

In the context of property and financial agreements, it's also important to consider the implications of a Hold Harmless Agreement, particularly in New York, which is designed to protect parties from liability during various interactions or events. Such agreements, much like the Mortgage Satisfaction and Assignment of Mortgage, establish clear terms that help manage risks and obligations. For more information on this essential legal document, explore resources at OnlineLawDocs.com.

A bankruptcy filing can also be compared to a Deed in Lieu of Foreclosure. When a homeowner files for bankruptcy, it can halt foreclosure proceedings and provide a chance to reorganize debts. Like a Deed in Lieu, bankruptcy offers a way to address overwhelming financial challenges. However, while a Deed in Lieu involves voluntarily transferring property to the lender, bankruptcy is a legal process that can affect a homeowner's credit for years. Both options serve as potential solutions for individuals facing financial hardship, but they come with different implications and outcomes.