Valid Florida Transfer-on-Death Deed Template

The Florida Transfer-on-Death Deed form is a valuable estate planning tool that allows property owners to transfer their real estate to designated beneficiaries upon their passing, without the need for probate. This simple yet effective form provides a way to ensure that your loved ones receive your property directly, streamlining the process and minimizing potential complications. By filling out this deed, property owners can retain full control over their property during their lifetime, as the transfer only takes effect after death. Importantly, this deed must be executed with specific legal requirements to be valid, including proper signatures and notarization. Understanding how to complete and file this form correctly can make a significant difference in how your estate is managed after you’re gone, offering peace of mind that your wishes will be honored and your beneficiaries will be protected. Whether you are planning for the future or managing an existing estate, the Transfer-on-Death Deed is a practical option worth considering.

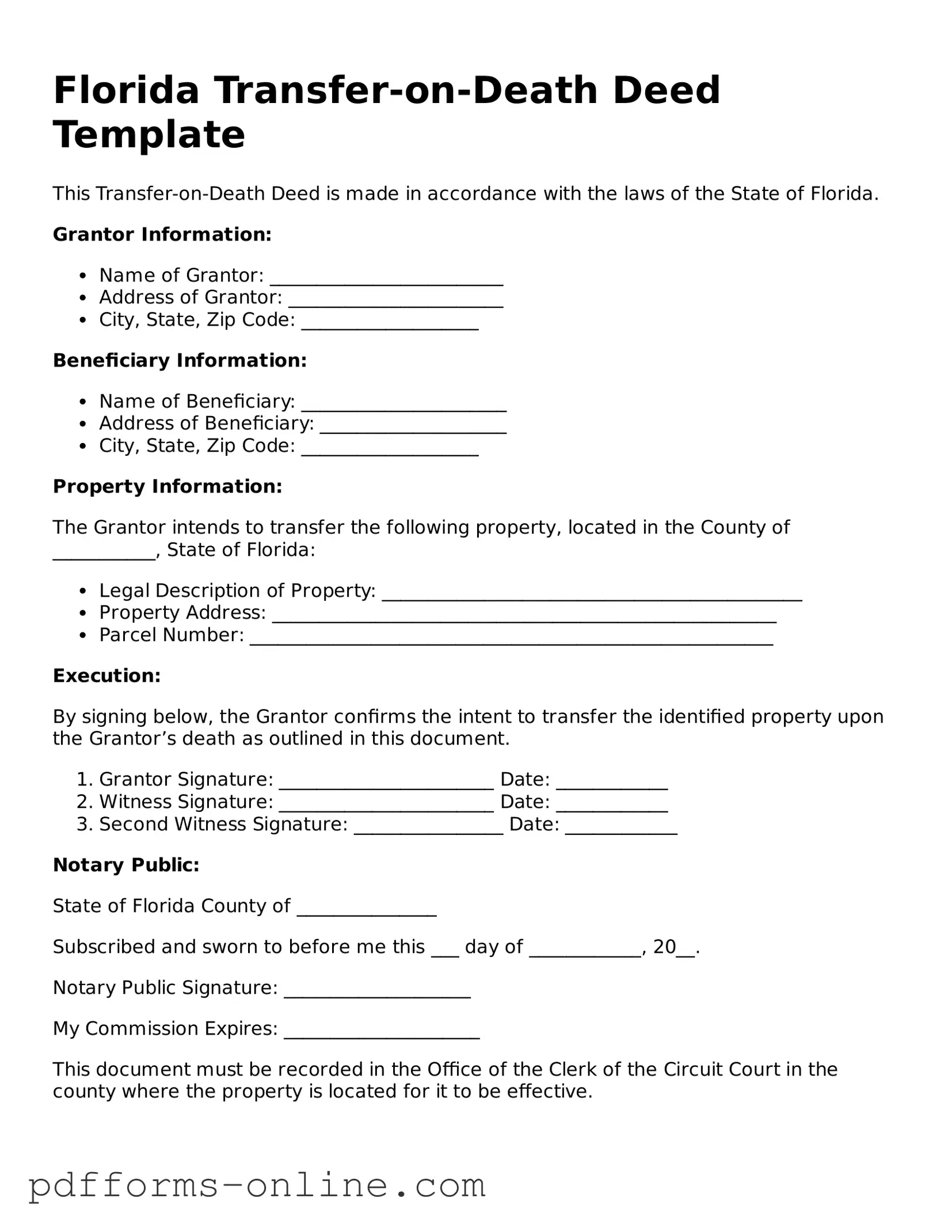

Document Example

Florida Transfer-on-Death Deed Template

This Transfer-on-Death Deed is made in accordance with the laws of the State of Florida.

Grantor Information:

- Name of Grantor: _________________________

- Address of Grantor: _______________________

- City, State, Zip Code: ___________________

Beneficiary Information:

- Name of Beneficiary: ______________________

- Address of Beneficiary: ____________________

- City, State, Zip Code: ___________________

Property Information:

The Grantor intends to transfer the following property, located in the County of ___________, State of Florida:

- Legal Description of Property: _____________________________________________

- Property Address: ______________________________________________________

- Parcel Number: ________________________________________________________

Execution:

By signing below, the Grantor confirms the intent to transfer the identified property upon the Grantor’s death as outlined in this document.

- Grantor Signature: _______________________ Date: ____________

- Witness Signature: _______________________ Date: ____________

- Second Witness Signature: ________________ Date: ____________

Notary Public:

State of Florida County of _______________

Subscribed and sworn to before me this ___ day of ____________, 20__.

Notary Public Signature: ____________________

My Commission Expires: _____________________

This document must be recorded in the Office of the Clerk of the Circuit Court in the county where the property is located for it to be effective.

Frequently Asked Questions

-

What is a Transfer-on-Death Deed in Florida?

A Transfer-on-Death Deed (TOD) is a legal document that allows property owners in Florida to designate a beneficiary who will automatically receive the property upon the owner's death. This deed does not transfer ownership during the owner’s lifetime, allowing the owner to retain full control over the property until their passing.

-

How does a Transfer-on-Death Deed work?

When the property owner passes away, the designated beneficiary can claim the property without going through the probate process. This means the transfer can occur more quickly and with less expense. The beneficiary must file the TOD deed with the local property records office after the owner's death to formalize the transfer.

-

Are there any restrictions on who can be named as a beneficiary?

Yes, beneficiaries can be individuals, such as family members or friends, or entities like trusts or charities. However, the property cannot be transferred to multiple beneficiaries without specifying how the property will be divided. It’s crucial to ensure that the beneficiary is legally capable of inheriting the property.

-

Can I change or revoke a Transfer-on-Death Deed?

Absolutely. The property owner has the right to change or revoke the TOD deed at any time during their lifetime. This can be done by executing a new TOD deed or by filing a formal revocation document with the local property records office. It’s important to ensure that any changes are properly documented to avoid confusion later.

-

What happens if the beneficiary predeceases the property owner?

If the designated beneficiary dies before the property owner, the TOD deed will typically become void unless alternative beneficiaries are specified. The property owner should consider naming contingent beneficiaries to ensure that the property still has a designated recipient in such an event.

-

Is there a cost associated with filing a Transfer-on-Death Deed?

Yes, there may be filing fees associated with submitting the TOD deed to the local property records office. The fees can vary by county. Additionally, while there are no ongoing costs associated with the deed itself, it’s advisable to consult with a legal professional to ensure that all aspects of the transfer are handled correctly.

Misconceptions

Understanding the Florida Transfer-on-Death Deed form can be challenging, and several misconceptions may lead to confusion. Here are four common misunderstandings about this important legal document.

-

Misconception 1: The Transfer-on-Death Deed automatically transfers property upon death.

This is not accurate. The deed does not transfer ownership until the death of the property owner, but it must be properly executed and recorded while the owner is still alive. Until that time, the owner retains full control over the property.

-

Misconception 2: A Transfer-on-Death Deed avoids probate entirely.

While this deed can help simplify the transfer process and may avoid probate for the designated beneficiaries, it does not eliminate the need for probate in all situations. Certain circumstances, such as outstanding debts or disputes, may still necessitate probate proceedings.

-

Misconception 3: The Transfer-on-Death Deed is only for single individuals.

This is a common belief, but the deed can be utilized by married couples as well. Both spouses can designate beneficiaries, ensuring that property transfers according to their wishes, regardless of marital status.

-

Misconception 4: Once a Transfer-on-Death Deed is executed, it cannot be changed.

This is misleading. The property owner has the right to revoke or modify the deed at any time before their death. Changes can be made to beneficiaries or other details, allowing for flexibility as circumstances change.

Being informed about these misconceptions can help individuals make better decisions regarding their estate planning and ensure that their wishes are honored. Always consider consulting with a legal professional for personalized advice.

Common mistakes

-

Not Naming Beneficiaries Clearly: It's crucial to specify the beneficiaries with full names. Vague terms like "my children" can lead to confusion.

-

Failing to Include a Legal Description: A complete legal description of the property must be included. This ensures that the property can be accurately identified.

-

Not Signing the Deed Properly: The deed must be signed in the presence of a notary. Neglecting this step can invalidate the deed.

-

Forgetting to Record the Deed: After filling out the form, it's essential to record it with the county clerk. Failing to do so means the deed may not be recognized.

-

Ignoring State-Specific Requirements: Each state has its own rules regarding Transfer-on-Death Deeds. Make sure to check Florida's specific requirements to avoid issues.

Find Some Other Transfer-on-Death Deed Forms for Specific States

Transfer on Death Deed Nc - This approach to property transfer emphasizes the owner’s intent, minimizing daily management issues.

The Dirt Bike Bill of Sale form is essential for anyone engaging in the buying or selling of a dirt bike in New York, ensuring that both parties have a documented record of the transaction. This form not only provides proof of ownership but also details the specifics of the sale, making it vital for a legitimate transfer of ownership. For further guidance on filling out the form, you can visit documentonline.org/blank-new-york-dirt-bike-bill-of-sale/.

Does a Beneficiary Deed Avoid Probate - Property owners are encouraged to consider this deed as a vital part of responsible estate planning.

PDF Attributes

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The Florida Transfer-on-Death Deed is governed by Florida Statutes, specifically Chapter 732.4015. |

| Eligibility | Any individual who owns real estate in Florida can create a Transfer-on-Death Deed. |

| Beneficiaries | Property owners can designate one or more beneficiaries to receive the property after their death. |

| Revocation | A Transfer-on-Death Deed can be revoked at any time by the property owner, as long as they are alive. |

| Filing Requirements | The deed must be signed and notarized, and it should be recorded with the county clerk's office to be effective. |

| Tax Implications | Transferring property via a Transfer-on-Death Deed does not trigger gift taxes during the owner's lifetime. |

| Limitations | Transfer-on-Death Deeds cannot be used for all types of property, such as property held in a trust or jointly owned property. |

Similar forms

The Florida Transfer-on-Death Deed (TODD) allows property owners to transfer their real estate to beneficiaries without going through probate. This document is similar to a Last Will and Testament. Both documents express a person's wishes regarding the distribution of their assets after death. However, a will typically requires probate, which can be a lengthy and costly process, while a TODD allows for a direct transfer of property to the designated beneficiaries upon the owner's death, simplifying the transfer process significantly.

Understanding the different documents that facilitate smooth asset transfers can be complex, especially when comparing options like the Florida Transfer-on-Death Deed and the Non-disclosure Agreement. For those in legal or business contexts, ensuring confidentiality through a Non-disclosure Agreement (NDA) form is crucial. A Non-disclosure Agreement (NDA) form in New York is a legally binding contract designed to protect sensitive information from being disclosed. It is commonly used by individuals and businesses to safeguard trade secrets and other confidential data. The form lays out the terms under which proprietary information is shared, ensuring that the parties involved understand their obligations to maintain secrecy. For more information on NDAs, you can visit OnlineLawDocs.com.