Valid Florida Tractor Bill of Sale Template

When purchasing or selling a tractor in Florida, having a properly executed bill of sale is essential for both parties involved in the transaction. This document serves as a legal record of the sale, detailing crucial information such as the buyer and seller's names and addresses, the tractor's make, model, year, and identification number, as well as the sale price. Additionally, the form often includes the date of the transaction and any warranties or conditions related to the sale. By providing a clear outline of the agreement, the bill of sale protects both the buyer and seller, ensuring that the terms are understood and agreed upon. Without this important document, disputes may arise, leading to complications that could have been easily avoided. Understanding the significance of the Florida Tractor Bill of Sale form is vital for anyone engaging in this type of transaction, as it not only facilitates a smooth exchange but also helps establish ownership and liability moving forward.

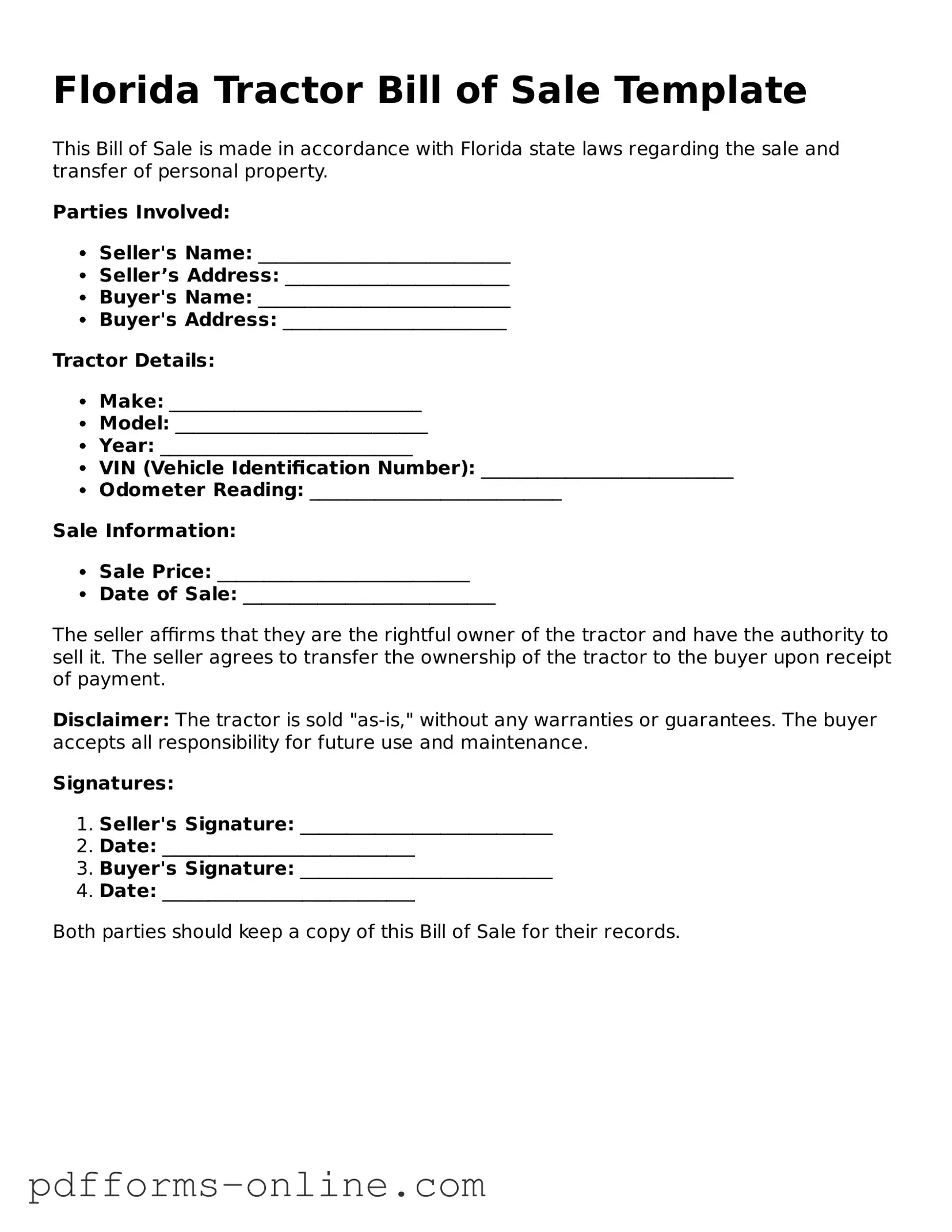

Document Example

Florida Tractor Bill of Sale Template

This Bill of Sale is made in accordance with Florida state laws regarding the sale and transfer of personal property.

Parties Involved:

- Seller's Name: ___________________________

- Seller’s Address: ________________________

- Buyer's Name: ___________________________

- Buyer's Address: ________________________

Tractor Details:

- Make: ___________________________

- Model: ___________________________

- Year: ___________________________

- VIN (Vehicle Identification Number): ___________________________

- Odometer Reading: ___________________________

Sale Information:

- Sale Price: ___________________________

- Date of Sale: ___________________________

The seller affirms that they are the rightful owner of the tractor and have the authority to sell it. The seller agrees to transfer the ownership of the tractor to the buyer upon receipt of payment.

Disclaimer: The tractor is sold "as-is," without any warranties or guarantees. The buyer accepts all responsibility for future use and maintenance.

Signatures:

- Seller's Signature: ___________________________

- Date: ___________________________

- Buyer's Signature: ___________________________

- Date: ___________________________

Both parties should keep a copy of this Bill of Sale for their records.

Frequently Asked Questions

-

What is a Florida Tractor Bill of Sale?

A Florida Tractor Bill of Sale is a legal document that records the transfer of ownership of a tractor from one party to another. This form includes important details such as the buyer's and seller's information, tractor specifications, and the sale price.

-

Why do I need a Bill of Sale for my tractor?

A Bill of Sale serves as proof of the transaction. It protects both the buyer and seller by documenting the sale details. This can be useful for registration, tax purposes, or if any disputes arise later.

-

What information should be included in the Bill of Sale?

The Bill of Sale should include:

- The names and addresses of both the buyer and seller

- The date of the sale

- A detailed description of the tractor (make, model, year, VIN)

- The sale price

- Any warranties or guarantees provided

-

Is the Bill of Sale required by law in Florida?

While not legally required for all sales, it is highly recommended. Having a Bill of Sale can simplify the registration process and provide legal protection for both parties involved.

-

How do I complete a Florida Tractor Bill of Sale?

To complete the form, fill in all required fields accurately. Ensure that both the buyer and seller sign and date the document. Each party should keep a copy for their records.

-

Can I create my own Bill of Sale?

Yes, you can create your own Bill of Sale. Just make sure to include all necessary information and follow the format typical for such documents. However, using a standard form can help ensure you don’t miss any important details.

-

What if the tractor has a loan or lien on it?

If there is a loan or lien, it’s essential to address it before the sale. The seller must pay off the loan or obtain permission from the lender to transfer ownership. Disclosing this information to the buyer is also crucial.

-

Where do I file the Bill of Sale after completing it?

You do not need to file the Bill of Sale with any government agency in Florida. However, you should keep it with your important documents. The buyer may need it when registering the tractor with the Florida Department of Highway Safety and Motor Vehicles.

Misconceptions

There are several misconceptions regarding the Florida Tractor Bill of Sale form. Understanding these can help clarify its purpose and importance.

- It is not necessary for private sales. Many believe that a bill of sale is only required for dealer transactions. However, it is advisable to have a bill of sale for any private sale to document the transfer of ownership.

- All states use the same form. Some people think that a bill of sale is universal across all states. Each state has its own requirements and forms, including Florida.

- A bill of sale is the same as a title. While both documents are important, they serve different purposes. A title proves ownership, while a bill of sale records the transaction details.

- It must be notarized. Not all transactions require notarization. In Florida, notarization is not mandatory for a bill of sale unless specified by the parties involved.

- Only the seller needs to sign. Both the seller and the buyer should sign the bill of sale to ensure that both parties agree to the terms of the sale.

- It is only for tractors. While the form is designed for tractors, it can also be used for other types of agricultural equipment. The specifics may vary based on the equipment being sold.

- The form is difficult to obtain. Many think that acquiring a bill of sale form is complicated. In reality, it can be easily found online or created using simple templates.

Common mistakes

-

Incomplete Information: Many individuals fail to provide all necessary details, such as the buyer's and seller's full names, addresses, and contact information. Omitting this information can lead to confusion and potential disputes in the future.

-

Incorrect Vehicle Identification Number (VIN): The VIN is crucial for identifying the tractor. Mistakes in entering this number can result in legal complications or difficulties in registering the tractor.

-

Failure to Include Purchase Price: Some sellers neglect to indicate the sale price. This omission can affect tax obligations and may lead to misunderstandings between the buyer and seller.

-

Not Signing the Document: A bill of sale is not valid unless both parties sign it. Some individuals mistakenly believe that a verbal agreement suffices, but a signature is essential for legal recognition.

-

Neglecting to Date the Form: Without a date, it becomes challenging to establish when the transaction took place. This can create issues, especially if disputes arise later regarding ownership or payment.

-

Ignoring State-Specific Requirements: Each state may have specific regulations regarding the sale of vehicles. Failing to comply with Florida's requirements can render the bill of sale ineffective.

-

Not Keeping Copies: After completing the form, some people forget to make copies for both the buyer and seller. Keeping a copy is vital for record-keeping and can serve as evidence in case of future disputes.

Find Some Other Tractor Bill of Sale Forms for Specific States

Is Bill of Sale Same as Title - Offers a simple way to document the sale of a used tractor.

Tractor Bill of Sale - It typically requires the seller's and buyer's names and signatures.

The Florida Medical Power of Attorney form serves as a critical tool for individuals seeking to ensure their healthcare choices are respected. By appointing someone they trust, individuals can guarantee that their medical preferences are followed even in incapacitation. For a better understanding of this process, consider reviewing the detailed guidelines on the Medical Power of Attorney form process.

Do Tractors Need to Be Registered - This form can be customized to include additional terms.

How to Transfer Ownership of a Tractor - Can help in establishing warranty or as-is conditions.

PDF Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Florida Tractor Bill of Sale form serves as a legal document to transfer ownership of a tractor from one party to another. |

| Governing Law | This form is governed by the Florida Statutes, specifically Chapter 319, which pertains to the transfer of motor vehicle ownership. |

| Required Information | Both the buyer and seller must provide their names, addresses, and signatures on the form. |

| Vehicle Details | The form must include specific details about the tractor, such as make, model, year, and Vehicle Identification Number (VIN). |

| Notarization | Although notarization is not mandatory, having the document notarized can provide additional legal protection for both parties. |

| Sales Tax | Sales tax may be applicable based on the purchase price of the tractor and should be calculated accordingly. |

| Record Keeping | It is advisable for both parties to retain a copy of the signed bill of sale for their records. |

| Additional Documentation | Buyers may need to provide additional documentation, such as proof of identity or financing, when registering the tractor. |

Similar forms

The Florida Vehicle Bill of Sale is quite similar to the Tractor Bill of Sale form. Both documents serve as proof of transfer of ownership for a vehicle or machinery. When someone sells a car or a tractor, the bill of sale provides essential details like the buyer’s and seller’s names, the sale price, and a description of the item. This document is important for registering the vehicle in the new owner’s name and can help protect both parties in case of disputes regarding the sale.

The IRS 2553 form is an essential part of the business documentation landscape, much like the Florida Boat Bill of Sale is for watercraft transactions. Understanding the tax implications of your business structure is crucial for owners, and for those looking to elect S corporation status, resources like https://onlinelawdocs.com/ can provide helpful guidance on the process, ensuring clarity and compliance with the IRS requirements.

The Florida Boat Bill of Sale is another document that shares similarities with the Tractor Bill of Sale. Just like the tractor, boats require a bill of sale to finalize the transfer of ownership. This document includes information about the boat, such as its make, model, and hull identification number. Both bills of sale serve as legal proof of the transaction and are often required for registration with state authorities, ensuring that the new owner has clear ownership rights.