Valid Florida Quitclaim Deed Template

The Florida Quitclaim Deed form is a vital tool for property owners looking to transfer their interest in real estate quickly and efficiently. Unlike other types of deeds, this form does not guarantee that the property title is free from liens or other claims, making it a straightforward option for transferring ownership without extensive legal scrutiny. Commonly used among family members, friends, or in situations involving divorce settlements, the Quitclaim Deed allows one party to relinquish their claim to a property while the other party accepts it. The form typically requires basic information such as the names of the parties involved, a description of the property, and the signature of the grantor. Importantly, while it is a simple and cost-effective way to transfer property, it is essential for the parties involved to understand the implications of using a Quitclaim Deed, particularly regarding potential risks and the absence of warranties. This makes it crucial for anyone considering this option to weigh their decisions carefully and seek guidance if necessary.

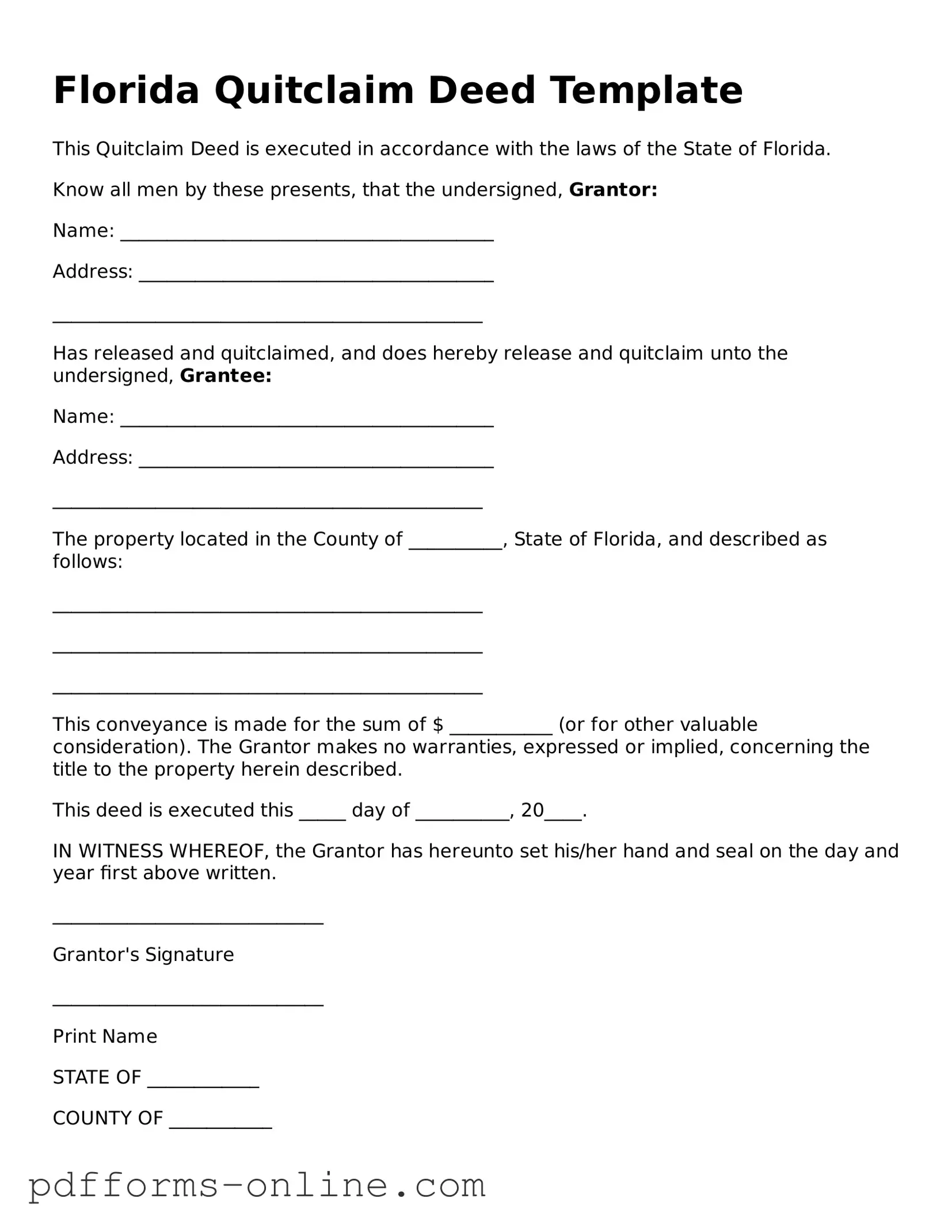

Document Example

Florida Quitclaim Deed Template

This Quitclaim Deed is executed in accordance with the laws of the State of Florida.

Know all men by these presents, that the undersigned, Grantor:

Name: ________________________________________

Address: ______________________________________

______________________________________________

Has released and quitclaimed, and does hereby release and quitclaim unto the undersigned, Grantee:

Name: ________________________________________

Address: ______________________________________

______________________________________________

The property located in the County of __________, State of Florida, and described as follows:

______________________________________________

______________________________________________

______________________________________________

This conveyance is made for the sum of $ ___________ (or for other valuable consideration). The Grantor makes no warranties, expressed or implied, concerning the title to the property herein described.

This deed is executed this _____ day of __________, 20____.

IN WITNESS WHEREOF, the Grantor has hereunto set his/her hand and seal on the day and year first above written.

_____________________________

Grantor's Signature

_____________________________

Print Name

STATE OF ____________

COUNTY OF ___________

Before me, a Notary Public in and for said State and County, personally appeared ________________ (Grantor's Name), who is known to me or who has produced ___________________ as identification, and who acknowledged that he/she executed the foregoing Quitclaim Deed for the purposes therein contained.

Given under my hand and official seal this _____ day of __________, 20____.

_____________________________

Notary Public

My Commission Expires: ________________

Frequently Asked Questions

-

What is a Quitclaim Deed?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one person to another. Unlike other types of deeds, a quitclaim deed does not guarantee that the person transferring the property has clear title to it. Instead, it simply conveys whatever interest the grantor has in the property, if any.

-

When should I use a Quitclaim Deed?

Quitclaim Deeds are often used in situations where the parties know each other well, such as family transfers, divorces, or when adding or removing someone from the title. They are also used to clear up title issues or to transfer property between business partners. However, they are not recommended for transactions involving unknown parties, as they offer no protection against claims or liens on the property.

-

How do I complete a Quitclaim Deed in Florida?

To complete a Quitclaim Deed in Florida, follow these steps:

- Obtain the Quitclaim Deed form, which can be found online or at local county offices.

- Fill in the names of the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Provide a legal description of the property, which can usually be found on the original deed or through county property records.

- Have the document signed by the grantor in the presence of a notary public.

- File the completed deed with the county clerk’s office where the property is located.

-

Is a Quitclaim Deed the same as a Warranty Deed?

No, a Quitclaim Deed is not the same as a Warranty Deed. A Warranty Deed provides a guarantee that the grantor holds clear title to the property and has the right to transfer it. In contrast, a Quitclaim Deed offers no such assurances. This means that if there are any issues with the title, the grantee cannot hold the grantor responsible.

-

Are there any risks associated with using a Quitclaim Deed?

Yes, there are risks involved with using a Quitclaim Deed. Since it transfers ownership without warranties, the grantee may inherit any existing liens, claims, or other encumbrances on the property. Additionally, if the grantor does not actually own the property, the grantee may end up with nothing. It’s crucial to conduct a title search or consult with a real estate attorney before proceeding with a Quitclaim Deed.

Misconceptions

When it comes to the Florida Quitclaim Deed form, there are several misconceptions that can lead to confusion. Here are seven common misunderstandings:

- A Quitclaim Deed transfers ownership of property. This is not entirely accurate. A Quitclaim Deed transfers whatever interest the grantor has in the property, but it does not guarantee that the grantor actually owns the property or has clear title.

- Quitclaim Deeds are only used between family members. While they are often used in family transactions, Quitclaim Deeds can be used in any situation where the parties agree to transfer interests in property.

- A Quitclaim Deed is the same as a Warranty Deed. This is a common misconception. A Warranty Deed provides a guarantee of clear title, while a Quitclaim Deed does not offer any warranties or guarantees.

- You do not need to record a Quitclaim Deed. Although it is not legally required to record it, failing to do so can lead to disputes about ownership. Recording the deed protects your interest in the property.

- A Quitclaim Deed can be used to remove a person's name from a mortgage. This is incorrect. A Quitclaim Deed only transfers the ownership interest, not the mortgage responsibility. The mortgage remains in the name of the original borrower unless refinanced.

- You can use a Quitclaim Deed to transfer property without any legal assistance. While it is possible to fill out a Quitclaim Deed on your own, seeking legal advice is recommended to ensure that the deed is completed correctly and meets all legal requirements.

- Once a Quitclaim Deed is signed, it cannot be undone. This is misleading. While a Quitclaim Deed is generally considered final, it may be possible to challenge it in court under certain circumstances, such as fraud or duress.

Understanding these misconceptions can help clarify the role of a Quitclaim Deed in property transactions in Florida.

Common mistakes

-

Incorrect Names: People often misspell their names or use nicknames instead of their legal names. This can lead to confusion and potential legal issues.

-

Missing Signatures: Failing to sign the deed is a common mistake. All parties involved must sign for the deed to be valid.

-

Improper Notarization: Not having the deed notarized or using an unlicensed notary can invalidate the document. Always ensure the notary is authorized to perform this service.

-

Incorrect Property Description: A vague or incorrect description of the property can cause problems. It's crucial to provide a clear and accurate description to avoid disputes.

-

Failure to Include Consideration: Some people forget to state the consideration, or payment, for the transfer. Even if it's a gift, it should be noted on the deed.

-

Not Checking Local Requirements: Each county may have specific requirements for filing a quitclaim deed. Not checking these can lead to delays or rejections.

-

Ignoring Tax Implications: People often overlook potential tax consequences of transferring property. It's wise to consult with a tax professional before completing the deed.

-

Not Keeping Copies: Failing to make copies of the completed deed can be a mistake. Always keep a copy for your records after filing.

Find Some Other Quitclaim Deed Forms for Specific States

Warranty Deed - A Quitclaim Deed can also be used in a simple home sale.

Quit Claim Deed Form Michigan Pdf - A Quitclaim may be used in zoning issues or boundary adjustments concerning property lines between adjacent owners.

How to Gift Land to Family Member - A Quitclaim Deed is often used in living trusts and estate planning.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | A Quitclaim Deed transfers ownership of property without guaranteeing that the title is clear. |

| Use | Commonly used to transfer property between family members or to clear up title issues. |

| Governing Law | Florida Statutes, Chapter 689.01 governs the use of Quitclaim Deeds in Florida. |

| Requirements | The form must be signed by the grantor and typically requires notarization. |

| Filing | Once completed, the deed should be filed with the county clerk's office where the property is located. |

| Limitations | This deed does not provide any warranties; the grantee takes the property "as is." |

Similar forms

A Warranty Deed is similar to a Quitclaim Deed in that both are used to transfer ownership of real property. However, the key difference lies in the guarantees provided. A Warranty Deed offers a guarantee that the grantor holds clear title to the property and has the right to sell it. This means that if any issues arise regarding ownership, the grantor is responsible for resolving them. In contrast, a Quitclaim Deed does not provide such assurances, making it a riskier option for the grantee.

A Special Warranty Deed shares similarities with a Quitclaim Deed but includes some protective language for the grantee. Like a Quitclaim Deed, it transfers property without any warranties regarding the title. However, a Special Warranty Deed only guarantees that the grantor has not caused any title issues during their ownership. This means the grantee is still at risk for any problems that may have existed before the grantor acquired the property.

A Bargain and Sale Deed is another document that resembles a Quitclaim Deed. It conveys property from one party to another but does not include warranties regarding the title. This type of deed implies that the grantor has the right to sell the property but does not guarantee that the title is free from defects. Like the Quitclaim Deed, it provides limited protection for the grantee, making it essential for buyers to perform due diligence before proceeding.

A Deed of Trust functions similarly to a Quitclaim Deed in that it involves the transfer of property rights. However, it is primarily used in real estate financing. In a Deed of Trust, the borrower conveys property to a trustee as security for a loan. If the borrower defaults, the trustee can sell the property to recover the loan amount. While both documents involve property transfer, a Deed of Trust serves a different purpose related to securing debt.

An Affidavit of Title is another document that can be compared to a Quitclaim Deed. While a Quitclaim Deed transfers ownership, an Affidavit of Title is a sworn statement made by the seller regarding the ownership of the property. It confirms that the seller has the right to sell and that there are no undisclosed liens or encumbrances. This document can be used in conjunction with a Quitclaim Deed to provide additional assurance to the buyer, even though it does not transfer ownership itself.