Valid Florida Promissory Note Template

In Florida, a Promissory Note serves as a crucial financial document that outlines the terms of a loan between a borrower and a lender. This form details the amount borrowed, the interest rate, and the repayment schedule, ensuring both parties have a clear understanding of their obligations. It also specifies the consequences of default, which can include late fees or legal action, providing a safety net for the lender. The Promissory Note can be tailored to meet the specific needs of the transaction, allowing for flexibility in terms and conditions. Additionally, it may include provisions for prepayment, enabling borrowers to pay off their debt earlier without penalties. Understanding the essential components of this form is vital for anyone involved in lending or borrowing money in Florida, as it lays the foundation for a transparent and enforceable agreement.

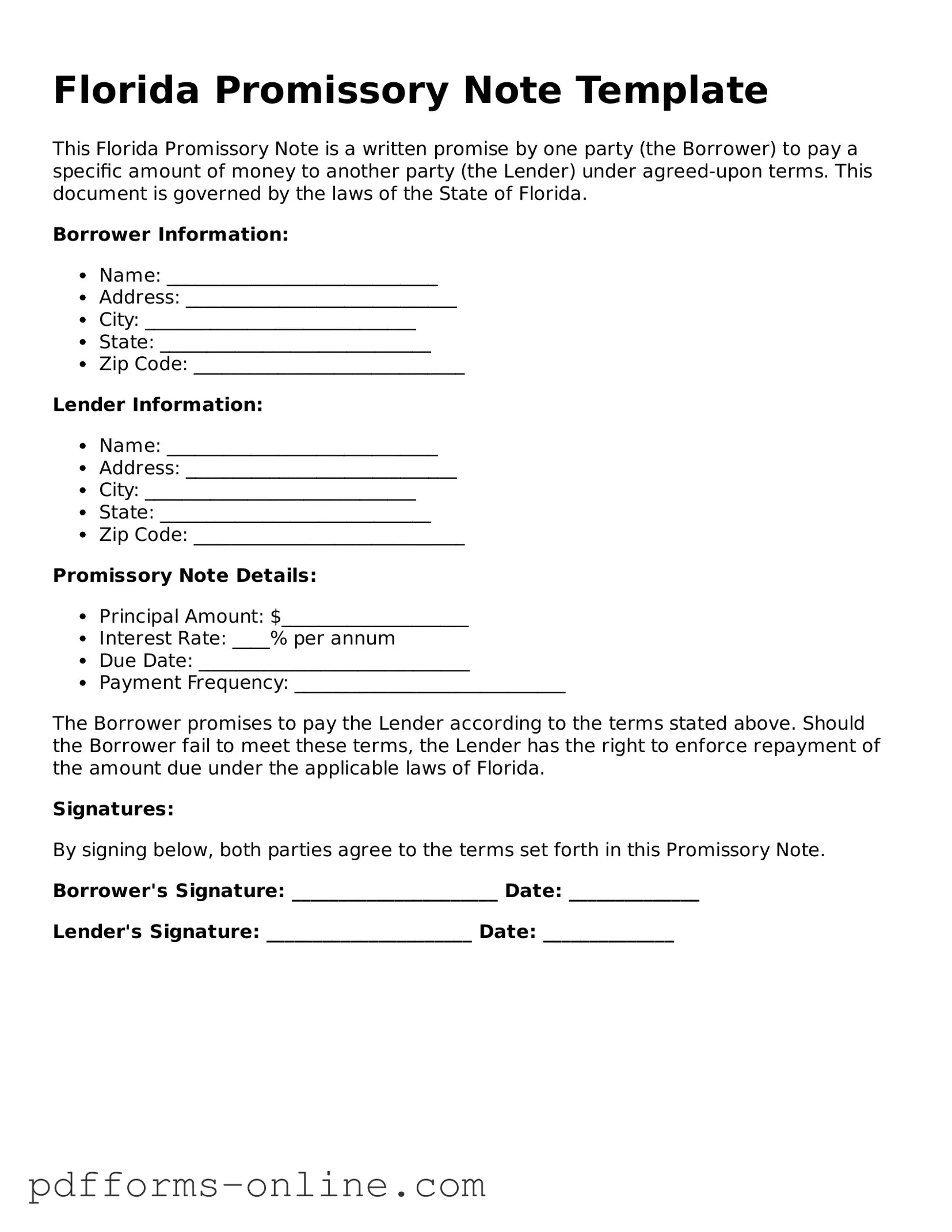

Document Example

Florida Promissory Note Template

This Florida Promissory Note is a written promise by one party (the Borrower) to pay a specific amount of money to another party (the Lender) under agreed-upon terms. This document is governed by the laws of the State of Florida.

Borrower Information:

- Name: _____________________________

- Address: _____________________________

- City: _____________________________

- State: _____________________________

- Zip Code: _____________________________

Lender Information:

- Name: _____________________________

- Address: _____________________________

- City: _____________________________

- State: _____________________________

- Zip Code: _____________________________

Promissory Note Details:

- Principal Amount: $____________________

- Interest Rate: ____% per annum

- Due Date: _____________________________

- Payment Frequency: _____________________________

The Borrower promises to pay the Lender according to the terms stated above. Should the Borrower fail to meet these terms, the Lender has the right to enforce repayment of the amount due under the applicable laws of Florida.

Signatures:

By signing below, both parties agree to the terms set forth in this Promissory Note.

Borrower's Signature: ______________________ Date: ______________

Lender's Signature: ______________________ Date: ______________

Frequently Asked Questions

-

What is a Florida Promissory Note?

A Florida Promissory Note is a written agreement between a borrower and a lender. It outlines the terms under which the borrower agrees to repay a loan. This document specifies the amount borrowed, the interest rate, repayment schedule, and any other relevant conditions. It serves as a legal record of the debt and the obligations of both parties.

-

What are the key components of a Florida Promissory Note?

Several essential elements must be included in a Florida Promissory Note:

- Principal Amount: This is the total amount of money being borrowed.

- Interest Rate: The rate at which interest will accrue on the borrowed amount.

- Repayment Terms: This section outlines how and when the borrower will repay the loan, including any installment amounts.

- Maturity Date: The date by which the loan must be fully repaid.

- Signatures: Both the borrower and lender must sign the document to make it legally binding.

-

Do I need to have the Promissory Note notarized?

While notarization is not strictly required for a Florida Promissory Note to be valid, it is highly recommended. Having the document notarized adds an extra layer of authenticity and can help prevent disputes later on. It provides proof that both parties willingly signed the document.

-

Can I modify the terms of a Promissory Note after it has been signed?

Yes, the terms of a Promissory Note can be modified after it has been signed, but both parties must agree to the changes. It is advisable to create a written amendment that clearly outlines the new terms. This amendment should also be signed by both parties to ensure that it is legally enforceable.

-

What happens if the borrower defaults on the Promissory Note?

If the borrower fails to make payments as agreed, they are considered to be in default. The lender has several options, which may include:

- Demanding immediate repayment of the full amount owed.

- Charging late fees as outlined in the note.

- Pursuing legal action to recover the owed amount.

It is important for both parties to understand their rights and responsibilities in the event of a default.

Misconceptions

Understanding the Florida Promissory Note form is important for anyone involved in lending or borrowing money. However, several misconceptions can lead to confusion. Here are four common misconceptions explained.

- Misconception 1: A promissory note must be notarized to be valid.

- Misconception 2: A promissory note is the same as a loan agreement.

- Misconception 3: Interest rates in promissory notes are always fixed.

- Misconception 4: Once signed, a promissory note cannot be changed.

This is not true. While notarization can add an extra layer of authenticity, it is not a requirement for a promissory note to be legally binding in Florida. As long as the note includes essential elements like the amount, terms, and signatures, it is valid.

A promissory note is not the same as a loan agreement. The note is a simple document that outlines the borrower's promise to repay the loan. A loan agreement, on the other hand, is more comprehensive and includes additional terms, such as collateral and default consequences.

This is incorrect. Promissory notes can have either fixed or variable interest rates. The terms should be clearly stated in the note, allowing both parties to understand how interest will be calculated over time.

This is a misunderstanding. While a signed promissory note is a binding agreement, it can be modified if both parties agree to the changes. It's important to document any modifications in writing to avoid disputes later.

Common mistakes

-

Incomplete Information: Failing to provide all required details, such as the names of the borrower and lender, can lead to issues. Each party's full legal name should be clearly stated.

-

Incorrect Loan Amount: Entering an incorrect loan amount can create disputes later. Double-check the figure to ensure it matches the agreed-upon amount.

-

Missing Interest Rate: Not specifying the interest rate, or leaving it blank, can lead to confusion. Clearly state whether the loan is interest-free or includes a specific rate.

-

Omitting Payment Terms: Failing to outline the repayment schedule, including due dates and payment amounts, can result in misunderstandings. Clearly define how and when payments should be made.

-

Not Including Default Terms: Not specifying what happens in the event of default can leave both parties unprotected. Include terms that outline the consequences of non-payment.

-

Neglecting Signatures: Both parties must sign the document for it to be valid. Omitting signatures can invalidate the agreement.

-

Failing to Date the Note: Not including the date on which the note is signed can create confusion regarding the start of the loan period. Always date the document.

Find Some Other Promissory Note Forms for Specific States

Michigan Promissory Note Example - It is advisable to consult a financial advisor before entering into a Promissory Note.

In many situations, individuals and businesses in New York may find it essential to utilize a Hold Harmless Agreement to streamline their operations and mitigate potential legal risks. This important document, which specifies that one party agrees not to hold the other liable for any injuries, damages, or losses, is invaluable for ensuring smoother engagements. For those seeking to understand and implement this agreement effectively, resources like onlinelawdocs.com can provide critical insights and guidelines.

How to Write a Promissory Note Example - This document can serve as a foundation for formalizing more complex agreements if additional terms are necessary.

Promissory Note Template Illinois - It is essential for both lenders and borrowers to understand the terms before signing.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | A Florida Promissory Note is a legal document that outlines a borrower's promise to repay a loan under specified terms. |

| Governing Law | The Florida Promissory Note is governed by Florida Statutes, specifically Chapter 673, which pertains to negotiable instruments. |

| Essential Elements | The note must include the amount borrowed, the interest rate, repayment schedule, and signatures of both parties. |

| Enforceability | If properly executed, a promissory note is enforceable in court, allowing the lender to seek legal remedies in case of default. |

Similar forms

A Florida Promissory Note is similar to a Loan Agreement. Both documents outline the terms under which one party borrows money from another. They specify the loan amount, interest rate, repayment schedule, and any penalties for late payments. While a Promissory Note is often simpler and more straightforward, a Loan Agreement can be more detailed, including additional clauses that protect both the lender and the borrower.

Another document that shares similarities with the Florida Promissory Note is a Mortgage. A Mortgage is a specific type of loan secured by real property. Like a Promissory Note, it includes terms about repayment and interest rates. However, the key difference is that a Mortgage gives the lender a legal claim to the property if the borrower fails to repay the loan, whereas a Promissory Note does not involve collateral.

A Credit Agreement is also comparable to a Promissory Note. This document outlines the terms of a line of credit extended by a lender to a borrower. Similar to a Promissory Note, it includes details about interest rates and repayment terms. However, a Credit Agreement may allow for ongoing borrowing and repayment, whereas a Promissory Note usually involves a single loan amount.

The Secured Note is another document that resembles a Florida Promissory Note. A Secured Note is backed by collateral, which provides security to the lender. Like a Promissory Note, it details the loan amount and repayment terms. However, the presence of collateral in a Secured Note adds a layer of protection for the lender that a standard Promissory Note does not provide.

When forming a corporation in Arizona, it is essential to complete the necessary documentation, including understanding the All Arizona Forms that guide you through the process. These forms are not only vital for legal recognition but also provide a framework for your business's operational structure, ensuring compliance with state requirements.

A Demand Note is similar to a Promissory Note in that it represents a promise to pay a specific amount of money. However, the key difference lies in the repayment terms. A Demand Note requires the borrower to repay the loan upon the lender's request, while a Promissory Note typically has a set repayment schedule.

An IOU is another document that shares characteristics with a Promissory Note. An IOU acknowledges a debt but is generally less formal and may not include detailed repayment terms or interest rates. While both documents signify that one party owes money to another, an IOU lacks the legal enforceability that a Promissory Note typically has.

A Personal Loan Agreement is also akin to a Florida Promissory Note. This document outlines the terms of a personal loan between individuals. Like a Promissory Note, it specifies the loan amount, interest rate, and repayment schedule. However, a Personal Loan Agreement may include additional terms that reflect the personal relationship between the borrower and lender.

Finally, a Business Loan Agreement is similar to a Promissory Note but is tailored for business purposes. It includes the same essential elements, such as loan amount and repayment terms. However, it often incorporates additional clauses related to the business's financial health and operational terms, which are not typically found in a standard Promissory Note.