Valid Florida Power of Attorney Template

The Florida Power of Attorney form is a crucial legal document that allows individuals to designate someone they trust to make decisions on their behalf, particularly in financial and healthcare matters. This form is particularly important for those who may become incapacitated or unable to manage their affairs due to illness or injury. By completing this document, the principal, or the person granting the authority, can specify the extent of the powers being granted, whether it’s for a specific transaction or ongoing management of financial affairs. Additionally, the form can include specific instructions and limitations, ensuring that the agent acts in accordance with the principal's wishes. In Florida, the Power of Attorney can be durable, meaning it remains effective even if the principal becomes incapacitated, or it can be non-durable, which is effective only while the principal is competent. It is also essential to consider that the form must be signed in the presence of a notary public or witnessed by two individuals to ensure its validity. Understanding the nuances of this document can empower individuals to take control of their future, ensuring that their preferences are respected even when they are unable to voice them directly.

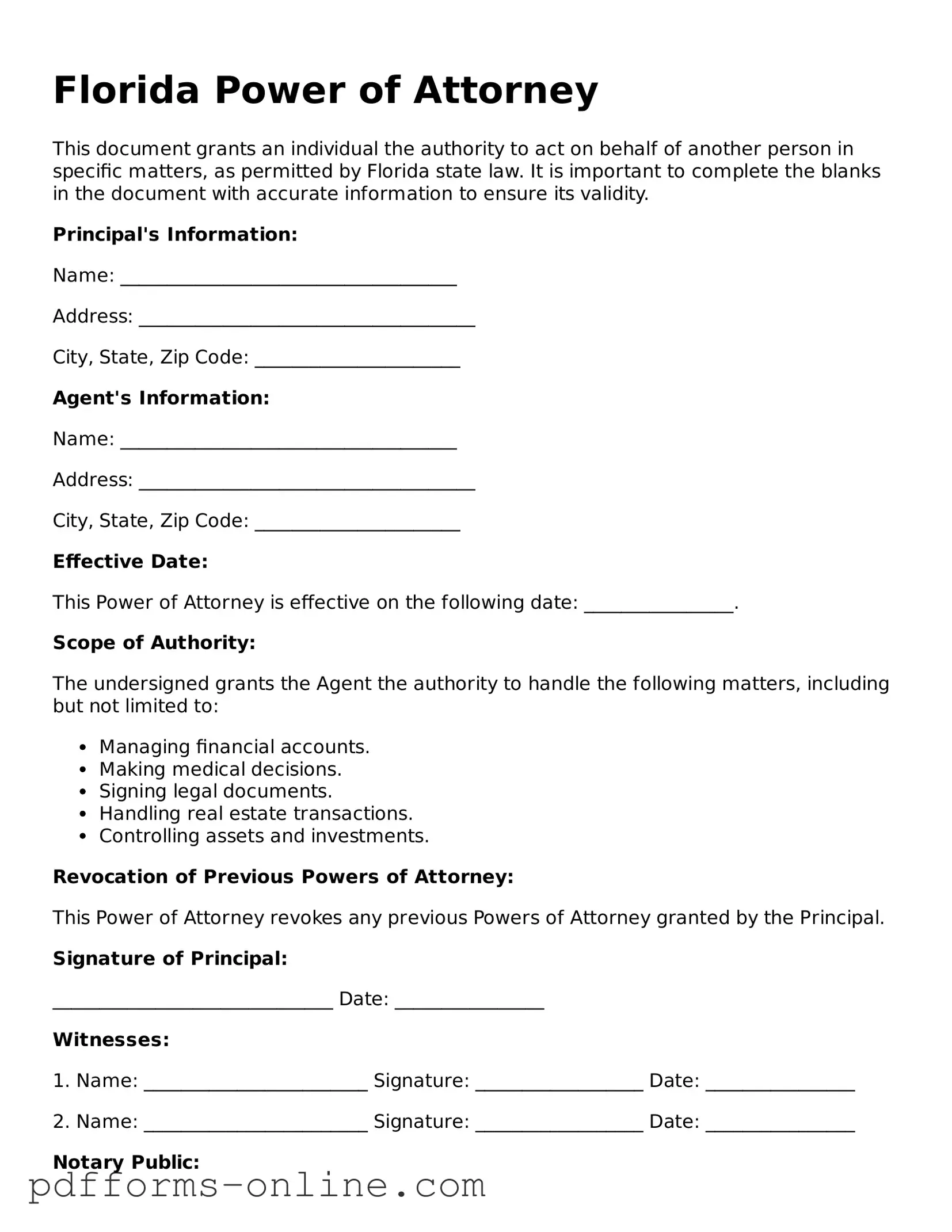

Document Example

Florida Power of Attorney

This document grants an individual the authority to act on behalf of another person in specific matters, as permitted by Florida state law. It is important to complete the blanks in the document with accurate information to ensure its validity.

Principal's Information:

Name: ____________________________________

Address: ____________________________________

City, State, Zip Code: ______________________

Agent's Information:

Name: ____________________________________

Address: ____________________________________

City, State, Zip Code: ______________________

Effective Date:

This Power of Attorney is effective on the following date: ________________.

Scope of Authority:

The undersigned grants the Agent the authority to handle the following matters, including but not limited to:

- Managing financial accounts.

- Making medical decisions.

- Signing legal documents.

- Handling real estate transactions.

- Controlling assets and investments.

Revocation of Previous Powers of Attorney:

This Power of Attorney revokes any previous Powers of Attorney granted by the Principal.

Signature of Principal:

______________________________ Date: ________________

Witnesses:

1. Name: ________________________ Signature: __________________ Date: ________________

2. Name: ________________________ Signature: __________________ Date: ________________

Notary Public:

State of Florida

County of ____________________

On this ___ day of __________, 20___, before me, a Notary Public, personally appeared the above-named Principal, who is known to me to be the person described in and who executed this Power of Attorney.

______________________________ Notary Public Signature

My Commission Expires: _____________

Frequently Asked Questions

-

What is a Power of Attorney (POA) in Florida?

A Power of Attorney is a legal document that allows one person (the principal) to authorize another person (the agent or attorney-in-fact) to act on their behalf. In Florida, this document can grant the agent broad or limited powers, depending on the principal's needs. It can cover financial decisions, healthcare choices, or both. It’s essential to choose someone you trust, as they will have significant authority over your affairs.

-

How do I create a Power of Attorney in Florida?

To create a Power of Attorney in Florida, you must be at least 18 years old and mentally competent. The document should be in writing and signed by you (the principal) in the presence of two witnesses and a notary public. It's important to ensure that the form complies with Florida law. You can find templates online or consult with an attorney to help you draft a document that meets your specific needs.

-

Can I revoke a Power of Attorney in Florida?

Yes, you can revoke a Power of Attorney in Florida at any time, as long as you are mentally competent. To do this, you should create a written revocation document and notify your agent and any institutions or individuals who were relying on the original POA. It’s a good practice to destroy any copies of the original document to prevent confusion.

-

What happens if I become incapacitated and do not have a Power of Attorney?

If you become incapacitated without a Power of Attorney in place, your loved ones may need to go through a court process to obtain guardianship. This can be time-consuming and costly. Having a POA allows you to choose someone you trust to make decisions on your behalf, providing peace of mind for you and your family.

Misconceptions

Understanding the Florida Power of Attorney form is essential for anyone considering its use. Here are ten common misconceptions about this important legal document:

- It is only for elderly individuals. Many people believe that a Power of Attorney is only necessary for seniors. In reality, anyone can benefit from having one, regardless of age.

- It grants unlimited power to the agent. A Power of Attorney does not automatically give the agent unlimited authority. The principal can specify which powers are granted, allowing for tailored control.

- It becomes invalid upon the principal’s incapacity. This is not true. A durable Power of Attorney remains effective even if the principal becomes incapacitated, as long as it is drafted to be durable.

- It must be notarized to be valid. While notarization is recommended for legal clarity, it is not strictly required. Witness signatures may suffice in some cases.

- It can be used for any purpose. A Power of Attorney is limited to the powers specified in the document. It cannot be used for purposes outside those granted by the principal.

- All agents are required to act in the principal’s best interest. While agents are expected to act responsibly, the document may not explicitly require them to prioritize the principal's interests over their own.

- It is a permanent document. A Power of Attorney can be revoked at any time by the principal, as long as they are mentally competent to do so.

- It is the same as a living will. A Power of Attorney and a living will serve different purposes. The former allows someone to manage financial or legal affairs, while the latter addresses medical decisions.

- Only lawyers can create a Power of Attorney. While legal assistance is beneficial, individuals can create their own Power of Attorney using templates, as long as they comply with state laws.

- It is only needed for financial matters. A Power of Attorney can cover a wide range of areas, including healthcare decisions, property management, and legal matters.

Clearing up these misconceptions can help individuals make informed decisions regarding their Power of Attorney needs.

Common mistakes

-

Not specifying the powers granted: One common mistake is failing to clearly outline the specific powers you want to grant. Without this clarity, your agent may not have the authority to act as you intended.

-

Choosing the wrong agent: Selecting someone who may not act in your best interest can lead to issues. It’s essential to choose a trustworthy person who understands your wishes.

-

Not signing in front of a witness: In Florida, a Power of Attorney must be signed in the presence of a notary public or two witnesses. Skipping this step can invalidate the document.

-

Failing to date the document: Forgetting to include the date can create confusion about when the Power of Attorney takes effect. Always remember to date your document.

-

Using outdated forms: Laws change, and using an old version of the Power of Attorney form may lead to complications. Always use the most current form available.

-

Not reviewing the form thoroughly: Rushing through the form can lead to mistakes. Take your time to ensure every detail is accurate and complete.

-

Overlooking revocation clauses: If you have an existing Power of Attorney, failing to revoke it properly can create conflicts. Be sure to address any previous documents.

-

Not discussing your wishes with your agent: It’s crucial to have a conversation with your chosen agent about your wishes and expectations. This ensures they understand your intentions.

-

Neglecting to keep copies: After completing the form, it’s important to keep copies for yourself and provide one to your agent. This helps avoid confusion later on.

-

Ignoring state-specific requirements: Each state has its own rules regarding Power of Attorney forms. Be sure to follow Florida’s specific requirements to ensure validity.

Find Some Other Power of Attorney Forms for Specific States

Pa Power of Attorney Form - Your Power of Attorney can be designed to be effective immediately or upon a triggering event.

How to Get Power of Attorney in North Carolina - A Power of Attorney is important for organizing your personal affairs.

Ga Power of Attorney Form - Empower someone you trust to act on your behalf when needed.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | A Florida Power of Attorney form allows an individual to designate another person to act on their behalf in legal and financial matters. |

| Governing Law | The Florida Power of Attorney is governed by Chapter 709 of the Florida Statutes. |

| Durability | This form can be made durable, meaning it remains effective even if the principal becomes incapacitated. |

| Types of Powers | The form can grant broad or limited powers, depending on the principal's wishes. |

| Signature Requirements | The principal must sign the document in the presence of a notary public and two witnesses. |

| Revocation | The principal can revoke the Power of Attorney at any time, as long as they are competent. |

| Agent's Duties | The agent must act in the best interest of the principal and follow their instructions. |

| Healthcare Decisions | A separate document, the Florida Advance Directive, is needed for healthcare decisions. |

| Filing Requirements | There is no requirement to file the Power of Attorney with the state, but it should be kept in a safe place. |

Similar forms

The Florida Power of Attorney form is similar to a Living Will. A Living Will outlines an individual's preferences regarding medical treatment in situations where they are unable to communicate their wishes. Both documents serve to protect an individual's rights and ensure their wishes are honored, but they focus on different aspects of personal decision-making. While the Power of Attorney can grant authority to another person to make financial or legal decisions, the Living Will specifically addresses healthcare decisions and end-of-life care.

Another document that shares similarities with the Florida Power of Attorney is the Healthcare Proxy. This document designates a specific individual to make healthcare decisions on behalf of another person if they become incapacitated. Like the Power of Attorney, a Healthcare Proxy allows for the delegation of decision-making authority, but it is limited strictly to medical decisions. Both documents are crucial for ensuring that an individual's preferences are respected in times of crisis.

The Durable Power of Attorney is closely related to the Florida Power of Attorney. The key distinction is that the Durable Power of Attorney remains effective even if the principal becomes incapacitated. This ensures that the appointed agent can continue to manage financial and legal matters without interruption. Both documents empower individuals to designate an agent, but the Durable Power of Attorney provides additional security in the event of incapacity.

A Financial Power of Attorney is another document akin to the Florida Power of Attorney. This form specifically grants authority to an agent to handle financial matters, such as banking, investments, and property transactions. While the Florida Power of Attorney can encompass both financial and legal decisions, the Financial Power of Attorney focuses solely on financial affairs, making it a more specialized option for those who wish to address financial management exclusively.

The Advance Directive is also similar to the Florida Power of Attorney, as it combines elements of both a Living Will and a Healthcare Proxy. It allows individuals to express their medical treatment preferences while also appointing someone to make healthcare decisions on their behalf. This dual function ensures that both the individual's wishes and decision-making authority are clearly outlined, similar to how the Florida Power of Attorney encompasses various powers.

The Guardianship document is another related legal instrument. A Guardianship is established through the court system when an individual is deemed unable to make decisions for themselves. While the Florida Power of Attorney allows individuals to choose their agents voluntarily, Guardianship involves a legal process to appoint a guardian, often leading to more oversight. Both serve to protect individuals, but they operate under different frameworks and levels of formality.

The Trust document also bears resemblance to the Florida Power of Attorney. A Trust allows individuals to manage their assets during their lifetime and dictate how those assets will be distributed after death. While a Power of Attorney grants authority to act on behalf of another, a Trust can provide a structured way to manage and protect assets. Both documents are integral to estate planning, but they serve distinct purposes in asset management and distribution.

Lastly, the Will is similar to the Florida Power of Attorney in that both are essential components of estate planning. A Will outlines how an individual's assets will be distributed after their death, while the Power of Attorney designates someone to make decisions on behalf of an individual during their lifetime. Both documents ensure that an individual's wishes are honored, but they apply to different stages of life and decision-making processes.