Valid Florida Operating Agreement Template

In Florida, the Operating Agreement form serves as a crucial document for limited liability companies (LLCs), outlining the internal workings and governance of the business. This form typically includes essential details such as the management structure, member responsibilities, and procedures for making important decisions. It addresses financial matters, including profit distribution and capital contributions, ensuring clarity among members regarding their investments and returns. Additionally, the Operating Agreement may outline the process for adding or removing members, as well as the procedures for handling disputes. By establishing these guidelines, the form helps protect the rights of all members and fosters a cooperative business environment. While Florida law does not mandate an Operating Agreement for LLCs, having one in place is highly recommended to avoid potential conflicts and misunderstandings in the future.

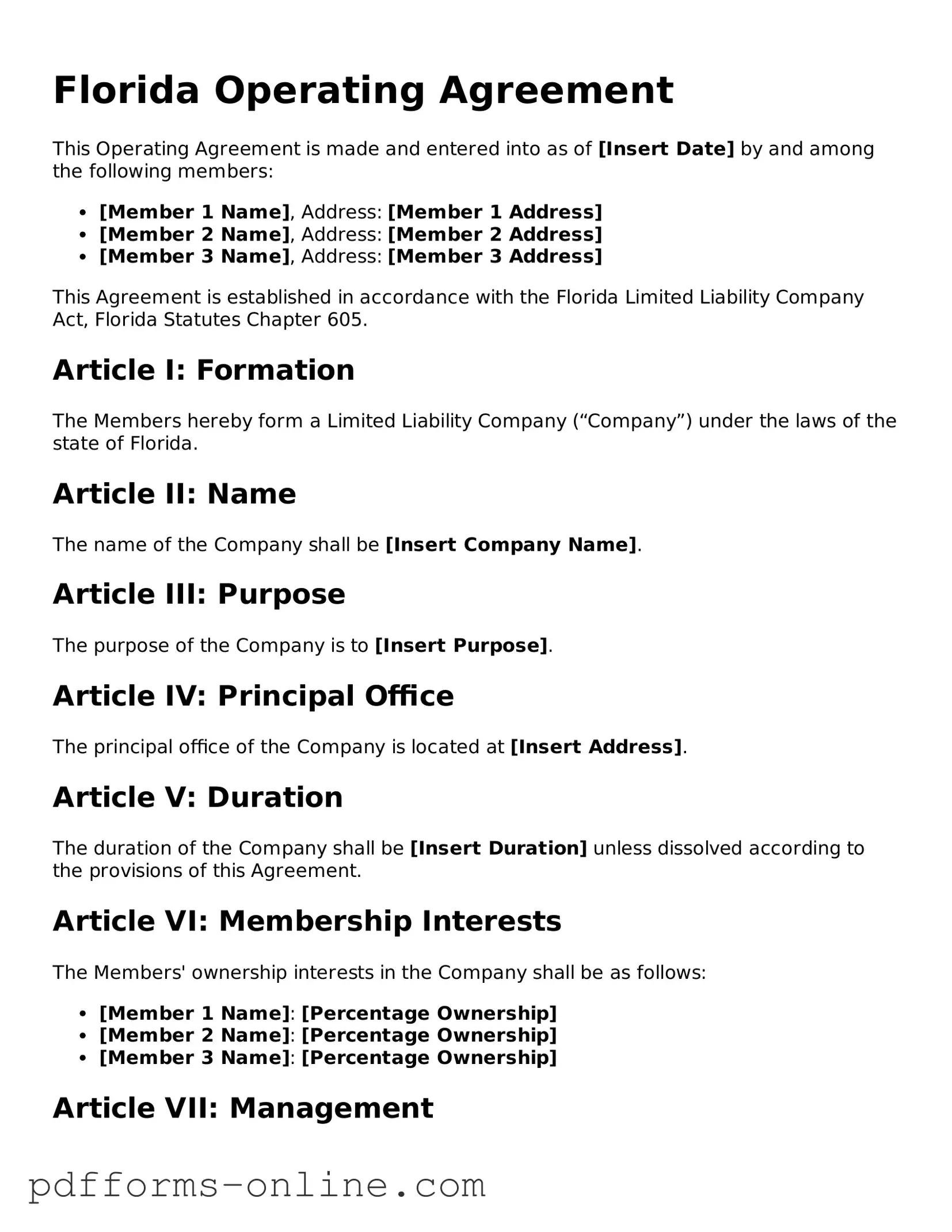

Document Example

Florida Operating Agreement

This Operating Agreement is made and entered into as of [Insert Date] by and among the following members:

- [Member 1 Name], Address: [Member 1 Address]

- [Member 2 Name], Address: [Member 2 Address]

- [Member 3 Name], Address: [Member 3 Address]

This Agreement is established in accordance with the Florida Limited Liability Company Act, Florida Statutes Chapter 605.

Article I: Formation

The Members hereby form a Limited Liability Company (“Company”) under the laws of the state of Florida.

Article II: Name

The name of the Company shall be [Insert Company Name].

Article III: Purpose

The purpose of the Company is to [Insert Purpose].

Article IV: Principal Office

The principal office of the Company is located at [Insert Address].

Article V: Duration

The duration of the Company shall be [Insert Duration] unless dissolved according to the provisions of this Agreement.

Article VI: Membership Interests

The Members' ownership interests in the Company shall be as follows:

- [Member 1 Name]: [Percentage Ownership]

- [Member 2 Name]: [Percentage Ownership]

- [Member 3 Name]: [Percentage Ownership]

Article VII: Management

The Company shall be managed by its Members. Decisions shall be made by a majority vote of the Members.

Article VIII: Contributions

The Members shall make initial capital contributions as follows:

- [Member 1 Name]: [Amount]

- [Member 2 Name]: [Amount]

- [Member 3 Name]: [Amount]

Article IX: Distributions

Distributions shall be made to the Members in proportion to their respective ownership interests at the time such distributions are made.

Article X: Amendments

This Agreement may be amended only by a written agreement signed by all Members.

Article XI: Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the state of Florida.

IN WITNESS WHEREOF, the undersigned Members have executed this Operating Agreement as of the date first above written.

______________________________

[Member 1 Signature]

______________________________

[Member 2 Signature]

______________________________

[Member 3 Signature]

Frequently Asked Questions

-

What is a Florida Operating Agreement?

A Florida Operating Agreement is a legal document that outlines the management structure and operating procedures of a limited liability company (LLC) in Florida. It serves as a foundational document that governs the rights and responsibilities of the members, as well as the operational guidelines for the business. This agreement is crucial for ensuring that all members are on the same page regarding the management and financial aspects of the LLC.

-

Is an Operating Agreement required in Florida?

While Florida law does not mandate that LLCs have an Operating Agreement, it is highly recommended. Having an Operating Agreement can help prevent misunderstandings among members and provide a clear framework for resolving disputes. Moreover, if the LLC faces legal challenges or if a member leaves, a well-drafted Operating Agreement can protect the interests of all parties involved.

-

What should be included in a Florida Operating Agreement?

A comprehensive Florida Operating Agreement typically includes several key components:

- The name and purpose of the LLC.

- The names and addresses of the members.

- The management structure (member-managed or manager-managed).

- Capital contributions and ownership percentages.

- Profit and loss distribution.

- Procedures for adding or removing members.

- Dispute resolution mechanisms.

- Amendment procedures for the agreement.

Including these elements can help ensure clarity and avoid potential conflicts in the future.

-

Can an Operating Agreement be amended?

Yes, an Operating Agreement can be amended. The process for amending the agreement should be clearly outlined within the document itself. Typically, amendments require the consent of a certain percentage of the members, which can vary based on the specific terms set forth in the original agreement. It is important to follow the outlined procedures to ensure that any changes are legally binding and recognized by all members.

-

How does an Operating Agreement affect the management of the LLC?

The Operating Agreement plays a critical role in determining how the LLC is managed. It specifies whether the LLC will be managed by its members or by appointed managers. This distinction can significantly impact decision-making processes, responsibilities, and the overall operation of the business. By clearly defining the management structure, the Operating Agreement helps to streamline operations and clarify roles among members.

-

What happens if there is no Operating Agreement?

If an LLC does not have an Operating Agreement, it will be governed by Florida's default LLC laws. These laws may not align with the specific wishes or needs of the members. Without an Operating Agreement, members may face challenges regarding profit distribution, decision-making authority, and dispute resolution. This lack of clarity can lead to misunderstandings and conflicts, making it difficult to manage the business effectively.

Misconceptions

Many people have misunderstandings about the Florida Operating Agreement form. Here are ten common misconceptions, clarified for your understanding.

- It’s only necessary for large businesses. Many believe that only large companies need an Operating Agreement. In reality, even small businesses and single-member LLCs benefit from having one.

- It’s a legally required document. While it’s highly recommended, Florida law does not require an Operating Agreement for LLCs. However, having one can prevent disputes and clarify operations.

- All Operating Agreements are the same. This is false. Each Operating Agreement can be customized to fit the specific needs of the business and its members.

- Once created, it can’t be changed. Operating Agreements can be amended. Members can update the agreement as the business evolves or as circumstances change.

- It only covers financial matters. While financial aspects are important, an Operating Agreement also outlines management structure, member roles, and procedures for decision-making.

- It’s only for multi-member LLCs. Single-member LLCs should also have an Operating Agreement. It helps establish credibility and provides a clear framework for the owner.

- Verbal agreements are sufficient. Relying on verbal agreements can lead to misunderstandings. Written agreements provide clarity and serve as a reference point.

- It’s a one-time document. An Operating Agreement should be reviewed regularly. Changes in business structure or membership may necessitate updates.

- It’s only for legal protection. While it does offer legal protection, it also serves to define roles, responsibilities, and expectations among members, fostering better communication.

- It’s too complicated to create. Many resources are available to help draft an Operating Agreement. Templates and legal advice can simplify the process.

Understanding these misconceptions can help you make informed decisions about your business structure and operations in Florida.

Common mistakes

-

Inaccurate Member Information: Many individuals mistakenly provide incorrect or incomplete information about the members of the LLC. This can include misspellings of names, wrong addresses, or failing to list all members. Ensuring accuracy is crucial, as this information is foundational to the agreement.

-

Omitting Key Provisions: Some people overlook essential provisions that should be included in the operating agreement. These might involve voting rights, profit distribution, and procedures for member withdrawal. Omitting these details can lead to misunderstandings and disputes in the future.

-

Not Customizing the Agreement: Using a generic template without tailoring it to the specific needs of the LLC is a common mistake. Each business has unique circumstances, and a one-size-fits-all approach can result in significant gaps or conflicts in the agreement.

-

Failing to Sign and Date: Finally, some individuals neglect to sign and date the operating agreement. Without proper signatures, the document may not be considered valid, which can cause issues when trying to enforce the terms of the agreement later on.

Find Some Other Operating Agreement Forms for Specific States

How to Make an Operating Agreement - It serves as a roadmap for decision-making processes within the company.

Nys Llc Operating Agreement Template - This agreement can govern monetary contributions from members.

Nc Operating Agreement Template - It offers clarity on management roles within the company.

An Arizona Operating Agreement form is a crucial document that defines the operations of a Limited Liability Company (LLC) within the state of Arizona, laying out the roles, responsibilities, and financial arrangements among its members. Despite the file content being currently unavailable, understanding the importance and structure of such an agreement is essential for any LLC operating in Arizona. For those looking to craft a comprehensive and legally sound operating agreement, click the button below to begin the process of filling out the form, or visit All Arizona Forms for more information.

How to Create an Operating Agreement - The Operating Agreement can specify how disputes will be managed.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | The Florida Operating Agreement outlines the management structure and operational guidelines for a limited liability company (LLC) in Florida. |

| Governing Law | The agreement is governed by Florida Statutes, specifically Chapter 605, which pertains to limited liability companies. |

| Member Rights | It establishes the rights and responsibilities of each member, ensuring clarity in decision-making and profit-sharing. |

| Flexibility | Florida allows significant flexibility in how an LLC can structure its Operating Agreement, accommodating various business needs. |

| Formal Requirements | While it is advisable to have a written agreement, Florida law does not require an Operating Agreement to be filed with the state. |

| Dispute Resolution | The agreement can include provisions for resolving disputes among members, such as mediation or arbitration processes. |

| Amendments | Members can amend the Operating Agreement as needed, provided they follow the procedures outlined within the document itself. |

| Tax Treatment | It can specify how the LLC will be taxed, including options for pass-through taxation or corporate taxation. |

| Duration | The agreement can specify the duration of the LLC, whether it is perpetual or for a defined period. |

| Importance | A well-drafted Operating Agreement is crucial for protecting members' interests and ensuring smooth operations. |

Similar forms

The Florida Operating Agreement is similar to a Partnership Agreement. Both documents outline the structure and rules governing a business relationship among partners. A Partnership Agreement details each partner's responsibilities, profit-sharing, and decision-making processes. Like the Operating Agreement, it serves to prevent misunderstandings by clearly defining the roles and expectations of each party involved. This clarity helps to foster a cooperative working environment and can mitigate potential disputes down the line.

Another document akin to the Florida Operating Agreement is the Shareholders' Agreement. This document is used by corporations and outlines the rights and obligations of shareholders. Similar to the Operating Agreement, it addresses issues such as voting rights, transfer of shares, and management of the company. Both agreements aim to ensure that all parties are on the same page regarding governance and can help in resolving conflicts when they arise.

The Limited Liability Company (LLC) Articles of Organization also share similarities with the Florida Operating Agreement. While the Articles of Organization serve as the formal paperwork to establish the LLC, the Operating Agreement provides the internal rules and guidelines for its operation. Both documents are essential for defining the structure of the business, but the Operating Agreement goes further by detailing the operational procedures and member responsibilities.

A Joint Venture Agreement is another document that resembles the Florida Operating Agreement. This type of agreement is used when two or more parties collaborate on a specific project while retaining their separate legal identities. Like the Operating Agreement, it outlines each party's contributions, responsibilities, and profit-sharing arrangements. Both documents aim to clarify expectations and foster a successful partnership, minimizing the risk of disputes.

The Franchise Agreement is also similar in purpose to the Florida Operating Agreement. This document governs the relationship between a franchisor and a franchisee. It outlines the rights and obligations of both parties, including fees, operational procedures, and marketing strategies. Much like the Operating Agreement, it seeks to provide a clear framework for the business relationship, ensuring that both parties understand their roles and responsibilities.

When entering into a rental agreement, it's crucial to understand the terms and conditions that govern the relationship between landlord and tenant. For those in Ohio, utilizing a reliable source for the Ohio Residential Lease Agreement form can help clarify these terms and prevent any ambiguities. To access this document, you can visit https://documentonline.org/blank-ohio-residential-lease-agreement/ for further details and guidance.

Lastly, the Bylaws of a corporation bear resemblance to the Florida Operating Agreement. Bylaws set forth the internal rules for managing a corporation, including the roles of directors and officers, meeting protocols, and voting procedures. While the Operating Agreement applies to LLCs, both documents serve a similar purpose in defining governance and operational procedures, ensuring that all members or shareholders know how the organization will function.