Valid Florida Loan Agreement Template

In the realm of personal and business finance, the Florida Loan Agreement form serves as a crucial document that outlines the terms and conditions of a loan between a lender and a borrower. This form typically includes essential details such as the loan amount, interest rate, repayment schedule, and any collateral involved. Clarity is paramount, as both parties must understand their rights and obligations. The agreement may also address potential late fees, default terms, and the governing law, ensuring that both lender and borrower are on the same page regarding the legal framework that applies to their transaction. Additionally, the form often provides space for signatures, signifying mutual consent to the outlined terms. By establishing a clear understanding of the loan's parameters, the Florida Loan Agreement form not only protects the interests of both parties but also promotes transparency and accountability throughout the lending process.

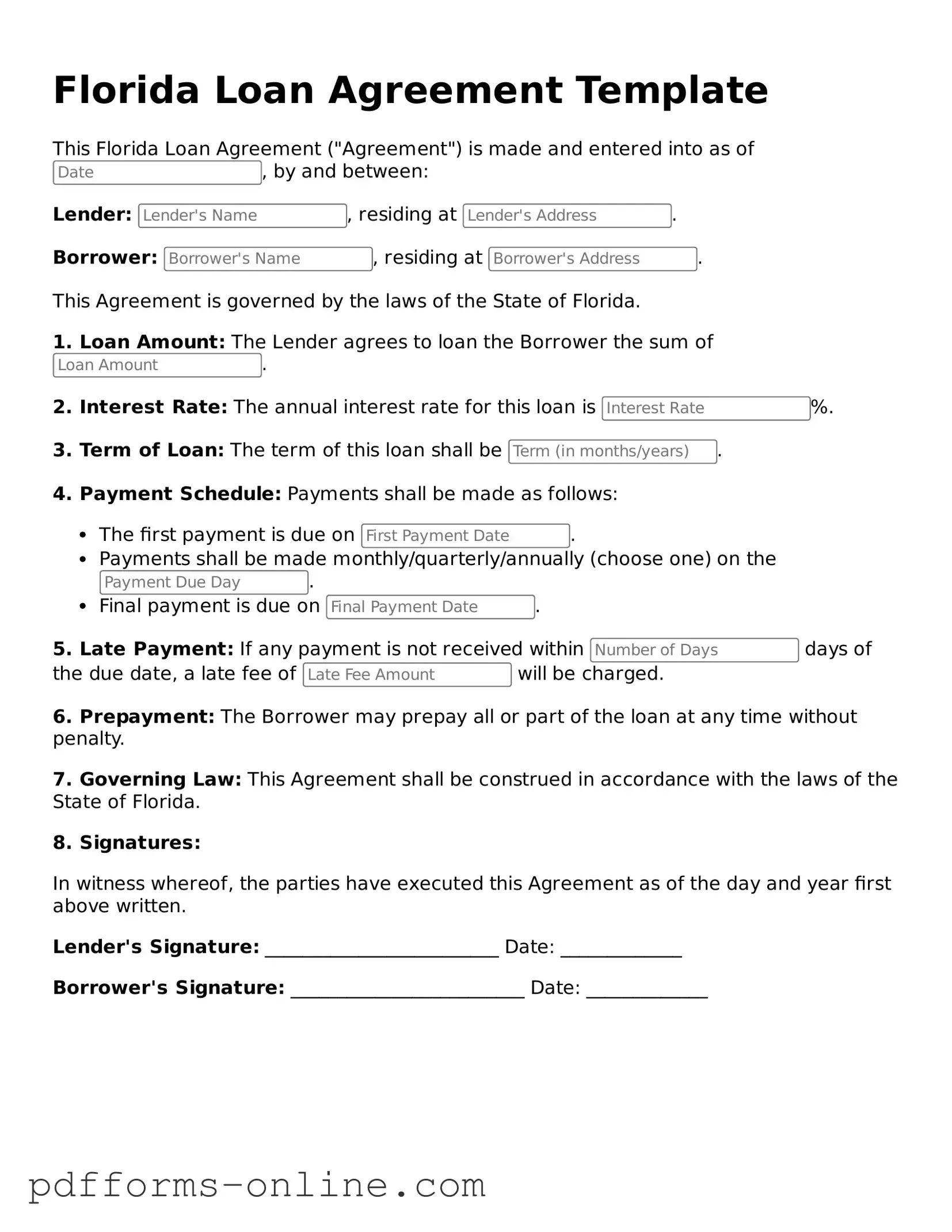

Document Example

Florida Loan Agreement Template

This Florida Loan Agreement ("Agreement") is made and entered into as of , by and between:

Lender: , residing at .

Borrower: , residing at .

This Agreement is governed by the laws of the State of Florida.

1. Loan Amount: The Lender agrees to loan the Borrower the sum of .

2. Interest Rate: The annual interest rate for this loan is %.

3. Term of Loan: The term of this loan shall be .

4. Payment Schedule: Payments shall be made as follows:

- The first payment is due on .

- Payments shall be made monthly/quarterly/annually (choose one) on the .

- Final payment is due on .

5. Late Payment: If any payment is not received within days of the due date, a late fee of will be charged.

6. Prepayment: The Borrower may prepay all or part of the loan at any time without penalty.

7. Governing Law: This Agreement shall be construed in accordance with the laws of the State of Florida.

8. Signatures:

In witness whereof, the parties have executed this Agreement as of the day and year first above written.

Lender's Signature: _________________________ Date: _____________

Borrower's Signature: _________________________ Date: _____________

Frequently Asked Questions

-

What is a Florida Loan Agreement form?

The Florida Loan Agreement form is a legal document that outlines the terms and conditions of a loan between a lender and a borrower in the state of Florida. This agreement specifies the amount borrowed, interest rates, repayment schedule, and any collateral involved. It serves to protect both parties by clearly defining their rights and obligations.

-

Who can use the Florida Loan Agreement form?

Any individual or business in Florida that wishes to lend or borrow money can use this form. This includes personal loans between friends or family, as well as business loans between companies. It’s important that both parties understand the terms before signing.

-

What information is typically included in the form?

A Florida Loan Agreement usually includes:

- The names and addresses of the lender and borrower.

- The loan amount.

- The interest rate.

- The repayment schedule.

- Any fees or penalties for late payments.

- Details about collateral, if applicable.

- Signatures of both parties.

-

Is the Florida Loan Agreement form legally binding?

Yes, once both parties sign the agreement, it becomes a legally binding contract. This means that both the lender and borrower must adhere to the terms outlined in the agreement. If either party fails to comply, the other party may have legal recourse.

-

Do I need a lawyer to create a Florida Loan Agreement?

While it's not legally required to have a lawyer draft the agreement, it is highly recommended. A lawyer can ensure that the document complies with Florida laws and protects your interests. If you choose to create the agreement yourself, be sure to include all necessary details and review it carefully.

-

Can the terms of the loan agreement be changed after it is signed?

Yes, but both parties must agree to any changes. Modifications should be documented in writing and signed by both the lender and borrower. This helps avoid misunderstandings and ensures that all parties are on the same page.

-

What happens if the borrower defaults on the loan?

If the borrower fails to make payments as agreed, the lender has several options. They may attempt to collect the debt through communication or negotiation. If that fails, the lender may pursue legal action to recover the owed amount, which could include seizing collateral if applicable.

-

Is there a standard form for the Florida Loan Agreement?

While there is no official state form, many templates are available online. These templates can serve as a good starting point. However, it’s essential to customize the agreement to fit the specific terms of your loan and ensure it complies with Florida law.

-

Where can I find a Florida Loan Agreement form?

You can find Florida Loan Agreement forms online through legal websites, law firms, or document preparation services. Be sure to select a reputable source to ensure that the form is valid and up-to-date with current laws.

Misconceptions

Understanding the Florida Loan Agreement form is essential for anyone involved in lending or borrowing. However, several misconceptions can lead to confusion. Here are eight common misconceptions explained:

-

All loan agreements are the same.

Each loan agreement is unique, tailored to the specific terms and conditions agreed upon by the lender and borrower. Variations can arise based on the type of loan, interest rates, and repayment terms.

-

Verbal agreements are sufficient.

While verbal agreements may seem binding, they are often difficult to enforce. A written loan agreement provides clarity and legal backing, reducing the risk of misunderstandings.

-

Only large loans require a formal agreement.

Even small loans should have a written agreement. This protects both parties and ensures that terms are clear, regardless of the loan amount.

-

Loan agreements are only for banks.

Individuals and private lenders can also create loan agreements. It’s not limited to financial institutions; anyone lending money should document the terms.

-

Once signed, the terms cannot be changed.

Loan agreements can be modified if both parties agree. Changes should be documented in writing to maintain clarity and legal standing.

-

Loan agreements are only necessary for personal loans.

Business loans, mortgages, and other types of financing also require formal agreements. Each serves to protect the interests of both the lender and borrower.

-

Signing a loan agreement means you understand all the terms.

Many borrowers may sign without fully understanding the terms. It’s crucial to read and comprehend the entire document before signing.

-

The loan agreement is the only document needed.

Additional documents, such as collateral agreements or personal guarantees, may be required depending on the nature of the loan. Always check for any supplementary paperwork.

Common mistakes

-

Incomplete Information: Many individuals fail to provide all necessary details. This can include missing personal information such as full names, addresses, or social security numbers. Incomplete forms may lead to delays or even denials of the loan application.

-

Incorrect Loan Amount: Applicants often miscalculate the amount they wish to borrow. Entering an incorrect figure can create confusion and result in the need for revisions, which can prolong the approval process.

-

Failure to Review Terms: Some people overlook the terms and conditions outlined in the agreement. Ignoring these details can lead to misunderstandings regarding repayment schedules, interest rates, and potential penalties for late payments.

-

Not Providing Supporting Documentation: Applicants sometimes neglect to include required documentation, such as proof of income or employment verification. Without this information, lenders may reject the application or request additional time to process it.

Find Some Other Loan Agreement Forms for Specific States

Texas Promissory Note Requirements - The terms of repayment can vary based on the relationship between lender and borrower.

Promissory Note Template Georgia - Clarifies how payment disputes will be resolved.

Promissory Note Template New York - It can be used in various situations, from informal loans to structured financial agreements.

In addition to outlining the distribution of assets, a Texas Last Will and Testament form can also include provisions for guardianship of minor children, making it an essential tool for parents. By utilizing this legal document, individuals not only ensure that their wishes are fulfilled but also provide guidance during difficult times. For those looking to create or update their will, resources like OnlineLawDocs.com can be incredibly helpful.

Free Promissory Note Template California - It typically includes information on how payments should be made and what happens in case of late payments.

PDF Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Florida Loan Agreement form is used to outline the terms of a loan between a lender and a borrower. |

| Governing Law | This agreement is governed by the laws of the State of Florida. |

| Parties Involved | The form includes sections for both the lender and the borrower to provide their information. |

| Loan Amount | The form specifies the total amount of money being loaned to the borrower. |

| Interest Rate | The agreement details the interest rate applicable to the loan, which can be fixed or variable. |

| Repayment Terms | It outlines the repayment schedule, including due dates and any late fees. |

Similar forms

The Florida Promissory Note is similar to the Loan Agreement form in that both documents outline the terms of a loan. A promissory note serves as a written promise from the borrower to repay the lender a specific amount of money, usually with interest, by a certain date. While the Loan Agreement may detail additional terms such as collateral and repayment schedules, the Promissory Note focuses primarily on the borrower's commitment to repay the loan amount. Both documents are legally binding and can be enforced in court if necessary.

The Florida Mortgage Agreement is another document closely related to the Loan Agreement. This form is used when a borrower secures a loan by placing a lien on real property. Like the Loan Agreement, the Mortgage Agreement includes terms regarding repayment and interest rates. However, it specifically outlines the rights of the lender to take possession of the property if the borrower defaults on the loan. This document provides additional security for the lender, making it a critical part of real estate transactions.

The Florida Security Agreement is akin to the Loan Agreement in that it establishes terms for securing a loan with collateral. This document specifies what assets the borrower is using as security for the loan, such as equipment or inventory. In a Loan Agreement, collateral may also be mentioned, but the Security Agreement focuses specifically on the details of the collateral and the lender's rights in case of default. Both documents aim to protect the lender's interests while providing the borrower access to funds.

The Florida Lease Agreement shares similarities with the Loan Agreement, particularly in terms of payment terms and obligations. A Lease Agreement outlines the rental terms for property, including the amount due and the schedule for payments. Both documents require the borrower or tenant to adhere to specific financial commitments. While a Loan Agreement typically involves a loan for cash, a Lease Agreement involves renting property, but both create legally binding obligations between parties.

The Florida Installment Sale Agreement is comparable to the Loan Agreement in that both involve a buyer and seller where payment is made over time. In an Installment Sale Agreement, the buyer agrees to pay for an item in installments, similar to how a borrower repays a loan. This document includes terms about the payment schedule, interest, and what happens if payments are missed. Both agreements facilitate the transfer of property while establishing clear payment terms.

The Florida Personal Guarantee is another document that relates to the Loan Agreement. This form is often used when a business loan is involved, where an individual agrees to personally repay the loan if the business defaults. Similar to a Loan Agreement, it outlines the obligations of the borrower. The Personal Guarantee adds an additional layer of security for the lender, ensuring that personal assets can be pursued if necessary, thus reinforcing the commitment to repay the loan.

Furthermore, it is essential for tenants and landlords to understand various legal documents when entering into rental agreements. One such important document is the New York Residential Lease Agreement, which not only defines the lease terms but also ensures that both parties are aware of their rights and obligations. For more information on this essential agreement, you can visit https://documentonline.org/blank-new-york-residential-lease-agreement.

The Florida Commercial Loan Agreement is similar to the Loan Agreement but is specifically tailored for business transactions. This document includes terms regarding the loan amount, interest rate, repayment schedule, and any fees associated with the loan. Both agreements serve the same purpose of formalizing a loan, but the Commercial Loan Agreement often contains additional clauses relevant to business operations, such as covenants that the borrower must follow.

Lastly, the Florida Line of Credit Agreement resembles the Loan Agreement in that it provides a borrower access to funds up to a specified limit. This agreement allows borrowers to withdraw money as needed, similar to a Loan Agreement where a lump sum is provided upfront. The terms of repayment, interest, and fees are also outlined in both documents. However, a Line of Credit Agreement typically offers more flexibility in borrowing and repayment compared to a traditional Loan Agreement.