Valid Florida Last Will and Testament Template

Creating a Last Will and Testament is an essential step in ensuring that your wishes are honored after your passing. In Florida, this legal document serves several important purposes, such as outlining how your assets will be distributed, naming guardians for minor children, and appointing an executor to manage your estate. The Florida Last Will and Testament form is designed to be straightforward, allowing individuals to express their desires clearly. Key components of the form include the identification of beneficiaries, detailed instructions on asset distribution, and provisions for debts and taxes. Additionally, the form must be signed in the presence of witnesses to be legally valid, ensuring that your intentions are respected. Understanding these elements can provide peace of mind, knowing that your loved ones will be taken care of according to your wishes.

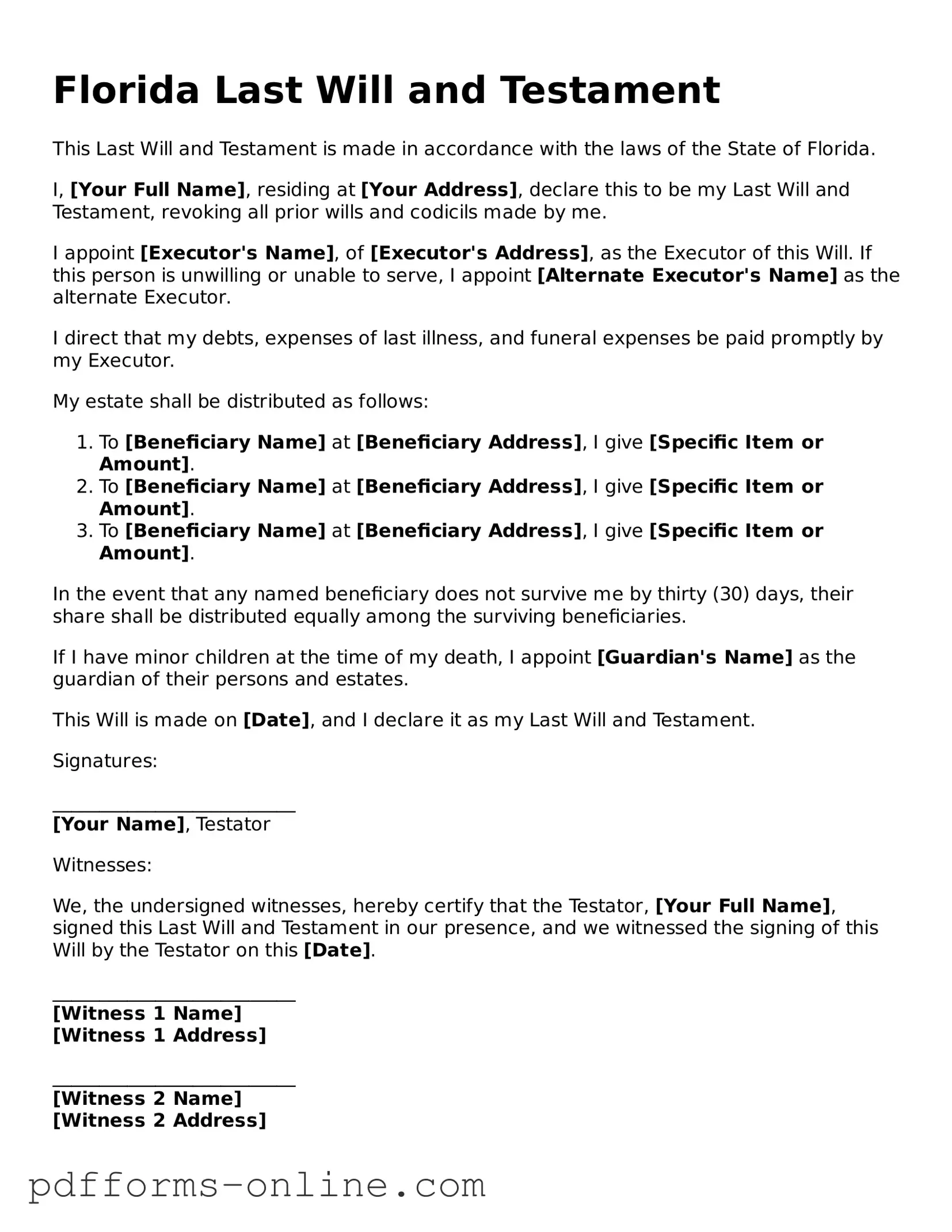

Document Example

Florida Last Will and Testament

This Last Will and Testament is made in accordance with the laws of the State of Florida.

I, [Your Full Name], residing at [Your Address], declare this to be my Last Will and Testament, revoking all prior wills and codicils made by me.

I appoint [Executor's Name], of [Executor's Address], as the Executor of this Will. If this person is unwilling or unable to serve, I appoint [Alternate Executor's Name] as the alternate Executor.

I direct that my debts, expenses of last illness, and funeral expenses be paid promptly by my Executor.

My estate shall be distributed as follows:

- To [Beneficiary Name] at [Beneficiary Address], I give [Specific Item or Amount].

- To [Beneficiary Name] at [Beneficiary Address], I give [Specific Item or Amount].

- To [Beneficiary Name] at [Beneficiary Address], I give [Specific Item or Amount].

In the event that any named beneficiary does not survive me by thirty (30) days, their share shall be distributed equally among the surviving beneficiaries.

If I have minor children at the time of my death, I appoint [Guardian's Name] as the guardian of their persons and estates.

This Will is made on [Date], and I declare it as my Last Will and Testament.

Signatures:

__________________________

[Your Name], Testator

Witnesses:

We, the undersigned witnesses, hereby certify that the Testator, [Your Full Name], signed this Last Will and Testament in our presence, and we witnessed the signing of this Will by the Testator on this [Date].

__________________________

[Witness 1 Name]

[Witness 1 Address]

__________________________

[Witness 2 Name]

[Witness 2 Address]

Frequently Asked Questions

-

What is a Last Will and Testament in Florida?

A Last Will and Testament is a legal document that outlines how a person wants their assets distributed after their death. In Florida, this document can also name guardians for minor children and appoint an executor to manage the estate. It ensures that your wishes are followed and can help avoid disputes among family members.

-

Who can create a Last Will and Testament in Florida?

Any person who is at least 18 years old and of sound mind can create a Last Will and Testament in Florida. This means that the individual must understand the nature of the document and the consequences of their decisions. There are no residency requirements, so even non-residents can create a will that is valid in Florida.

-

What are the requirements for a valid will in Florida?

For a will to be valid in Florida, it must be in writing and signed by the person creating the will (the testator). Additionally, it should be witnessed by at least two people who are present at the same time. These witnesses must also sign the will. It's important that the witnesses are not beneficiaries of the will to avoid potential conflicts.

-

Can I change or revoke my will in Florida?

Yes, you can change or revoke your will at any time while you are still alive. To change a will, you can create a new will that explicitly states it revokes all previous wills. Alternatively, you can create a codicil, which is an amendment to the existing will. If you want to revoke it entirely, you can destroy the document or clearly state your intention to revoke it in writing.

-

What happens if I die without a will in Florida?

If you die without a will, your estate will be distributed according to Florida's intestacy laws. This means the state will determine how your assets are divided, which may not align with your wishes. Typically, your assets will go to your closest relatives, such as your spouse, children, or parents. Having a will allows you to control this process and ensure your preferences are honored.

-

How can I ensure my will is executed properly?

To ensure your will is executed properly, consider working with an attorney who specializes in estate planning. They can guide you through the process and help you meet all legal requirements. Additionally, keep your will in a safe place and inform your executor and family members where to find it. Regularly review and update your will as your circumstances change, such as marriage, divorce, or the birth of children.

Misconceptions

Here are some common misconceptions about the Florida Last Will and Testament form:

- All wills must be notarized to be valid. In Florida, a will does not need to be notarized if it is signed by two witnesses. However, having a notary can make the process smoother.

- Only wealthy individuals need a will. Everyone can benefit from having a will, regardless of their financial situation. A will helps ensure that your wishes are followed after your passing.

- Verbal wills are acceptable in Florida. Florida does not recognize oral wills. A will must be in writing to be valid.

- Once a will is created, it cannot be changed. You can modify or revoke your will at any time as long as you are of sound mind. Just be sure to follow the legal requirements for making changes.

- A will can cover all aspects of estate planning. A will primarily addresses the distribution of assets. Other documents, like trusts and powers of attorney, may be needed for comprehensive planning.

- Having a will avoids probate. A will does not prevent probate. However, it does help to streamline the process and clarify your wishes for the court.

Common mistakes

-

Not signing the will properly: In Florida, the will must be signed by the testator in the presence of at least two witnesses. If the signature is missing or the witnesses do not sign, the will may be deemed invalid.

-

Failing to update the will: Life changes, such as marriage, divorce, or the birth of children, can affect the distribution of assets. Not revising the will to reflect these changes can lead to unintended consequences.

-

Overlooking specific bequests: When individuals want to leave particular items or amounts to specific people, they must clearly outline these wishes. Vague language can create confusion and disputes among heirs.

-

Not considering a self-proving affidavit: A self-proving affidavit can simplify the probate process. Without it, witnesses may need to testify about the will's validity, which can delay proceedings.

Find Some Other Last Will and Testament Forms for Specific States

Illinois Will Template - Validates the testator's intentions and provides clarity for heirs.

For anyone navigating property transactions, understanding the importance of a well-crafted Tractor Bill of Sale is vital. This document not only facilitates the transfer of ownership but also ensures all parties are protected during the exchange. For more information, refer to this essential guide about the Florida Tractor Bill of Sale.

Georgia Will Template - Helps prevent disputes among family members after you pass.

Last Will and Testament Template New York Pdf - A Last Will and Testament outlines how a person's assets will be distributed after their death.

PDF Attributes

| Fact Name | Description |

|---|---|

| Legal Requirement | In Florida, a Last Will and Testament must be in writing and signed by the testator (the person making the will) in the presence of two witnesses. |

| Governing Law | The Florida Probate Code governs the creation and execution of wills, specifically outlined in Chapter 732 of the Florida Statutes. |

| Witness Requirements | Witnesses must be at least 18 years old and must not be beneficiaries of the will to ensure impartiality. |

| Revocation | A Last Will and Testament can be revoked by the testator at any time through a subsequent will or by physically destroying the original document. |

Similar forms

The Florida Last Will and Testament is similar to a Living Will. A Living Will outlines your wishes regarding medical treatment in case you become incapacitated. While a Last Will deals with the distribution of your assets after death, a Living Will focuses on your healthcare preferences while you are still alive but unable to communicate. Both documents are essential for ensuring your wishes are respected, but they serve different purposes in your estate planning.

Another document akin to the Last Will is a Trust. A Trust allows you to manage your assets during your lifetime and specify how they should be distributed after your death. Unlike a Last Will, which goes through probate, a Trust can help your beneficiaries avoid this process, providing a quicker and potentially less costly transfer of assets. Both documents are vital for effective estate planning, but they operate in different ways.

A Durable Power of Attorney is also similar to the Last Will. This document grants someone the authority to make financial decisions on your behalf if you become incapacitated. While a Last Will takes effect after your death, a Durable Power of Attorney is active during your lifetime. Both are important for ensuring your wishes are followed, but they apply to different situations.

The Florida Health Care Surrogate Designation is another document that complements a Last Will. This form allows you to appoint someone to make healthcare decisions for you if you are unable to do so. Like a Living Will, it addresses medical preferences, while a Last Will focuses on asset distribution. Both documents are crucial for protecting your interests in different aspects of your life.

When considering legal documents essential for personal planning, one should not overlook the significance of an operating agreement, particularly for those forming a Limited Liability Company (LLC) in Arizona. This document delineates the operational structure and member roles, ensuring clarity and compliance with state regulations. For more information on related legal forms, All Arizona Forms can serve as a valuable resource in navigating these important requirements.

A Codicil is similar to a Last Will in that it serves to amend or add to an existing will. If you need to make changes to your Last Will, a Codicil can be a straightforward way to do so without creating an entirely new document. Both documents must be executed with the same legal formalities to ensure they are valid, highlighting the importance of proper estate planning.

The Declaration of Guardian is another document related to the Last Will. This form allows you to name a guardian for your minor children in the event of your death. While a Last Will distributes your assets, the Declaration of Guardian ensures that your children are cared for by someone you trust. Both documents work together to secure your family's future.

A Prenuptial Agreement can also be compared to a Last Will. This document outlines how assets will be divided in the event of divorce or death. While a Last Will specifies asset distribution after death, a Prenuptial Agreement addresses potential future scenarios while you are still alive. Both documents are important for protecting your interests and ensuring your wishes are honored.

The Living Trust is another document that shares similarities with a Last Will. A Living Trust allows you to manage your assets during your lifetime and specifies how they should be distributed upon your death. Unlike a Last Will, a Living Trust can help avoid probate, making the transfer of assets quicker and more private. Both documents are essential for comprehensive estate planning.

Finally, a Bill of Sale is somewhat similar in that it can be used to transfer ownership of specific assets. While a Last Will deals with the distribution of all your assets after death, a Bill of Sale is used for the sale or transfer of specific items during your lifetime. Both documents serve to clarify ownership and ensure that your wishes are followed, albeit in different contexts.