Valid Florida Lady Bird Deed Template

The Florida Lady Bird Deed is a unique estate planning tool that allows property owners to transfer real estate to their beneficiaries while retaining certain rights during their lifetime. This form, officially known as an enhanced life estate deed, is particularly beneficial for individuals seeking to avoid probate, as it facilitates a smoother transition of property upon the owner’s death. By executing this deed, property owners can maintain control over their property, including the right to sell, lease, or mortgage it without the consent of the beneficiaries. Additionally, the Lady Bird Deed can provide significant tax advantages and protect the property from creditors, making it a compelling option for many Florida residents. The form is straightforward but requires careful consideration of the specific language and provisions included, as well as an understanding of how it interacts with existing estate plans. Ultimately, the Lady Bird Deed serves as a strategic instrument for managing property ownership and ensuring that one’s wishes are honored after death.

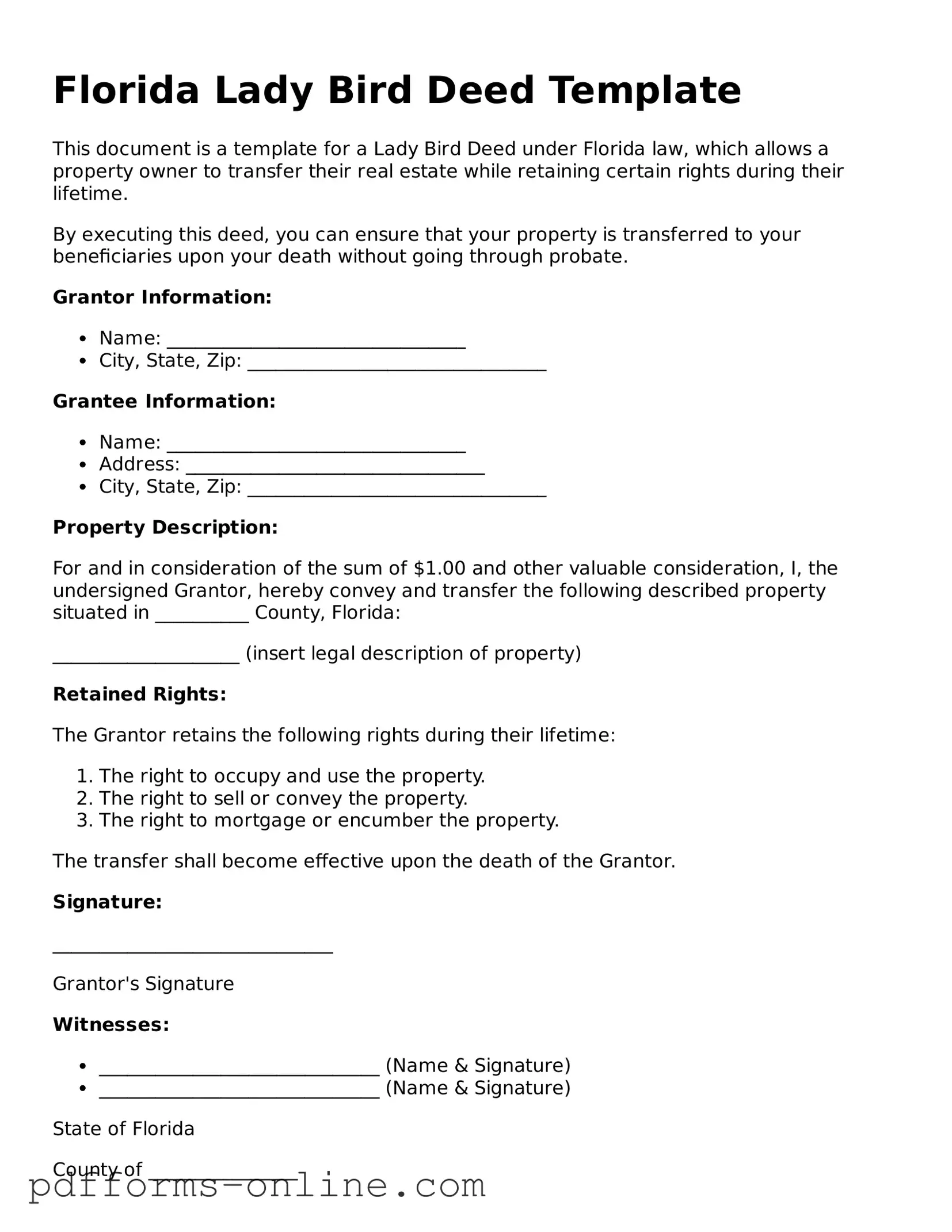

Document Example

Florida Lady Bird Deed Template

This document is a template for a Lady Bird Deed under Florida law, which allows a property owner to transfer their real estate while retaining certain rights during their lifetime.

By executing this deed, you can ensure that your property is transferred to your beneficiaries upon your death without going through probate.

Grantor Information:

- Name: ________________________________

- City, State, Zip: ________________________________

Grantee Information:

- Name: ________________________________

- Address: ________________________________

- City, State, Zip: ________________________________

Property Description:

For and in consideration of the sum of $1.00 and other valuable consideration, I, the undersigned Grantor, hereby convey and transfer the following described property situated in __________ County, Florida:

____________________ (insert legal description of property)

Retained Rights:

The Grantor retains the following rights during their lifetime:

- The right to occupy and use the property.

- The right to sell or convey the property.

- The right to mortgage or encumber the property.

The transfer shall become effective upon the death of the Grantor.

Signature:

______________________________

Grantor's Signature

Witnesses:

- ______________________________ (Name & Signature)

- ______________________________ (Name & Signature)

State of Florida

County of ________________

Signed and acknowledged before me this _____ day of __________, 20___.

______________________________

Notary Public

My Commission Expires: ______________

Frequently Asked Questions

-

What is a Florida Lady Bird Deed?

A Florida Lady Bird Deed, also known as an enhanced life estate deed, allows a property owner to transfer their property to beneficiaries while retaining the right to live in and control the property during their lifetime. Upon the owner's death, the property automatically transfers to the named beneficiaries without going through probate.

-

What are the benefits of using a Lady Bird Deed?

There are several advantages to using a Lady Bird Deed. First, it helps avoid probate, which can be a lengthy and costly process. Second, the property owner retains full control over the property during their lifetime, including the ability to sell or mortgage it. Additionally, the deed may provide tax benefits, as the property may receive a stepped-up basis for tax purposes upon the owner's death.

-

Who can create a Lady Bird Deed?

Any property owner in Florida can create a Lady Bird Deed. This includes individuals who own residential property, commercial property, or land. It is important that the property owner understands their rights and the implications of transferring the property to beneficiaries.

-

How is a Lady Bird Deed executed?

To execute a Lady Bird Deed, the property owner must complete the deed form, ensuring that it includes all necessary information, such as the legal description of the property and the names of the beneficiaries. The deed must then be signed by the property owner in the presence of a notary public. After signing, the deed should be recorded with the county clerk’s office where the property is located to make it legally effective.

-

Can a Lady Bird Deed be revoked?

Yes, a Lady Bird Deed can be revoked at any time during the property owner's lifetime. The owner can execute a new deed or a revocation document to remove the beneficiaries or change the terms of the existing deed. It is advisable to consult with a legal professional to ensure that the revocation is done correctly and in accordance with Florida law.

Misconceptions

The Florida Lady Bird Deed is a powerful tool for estate planning, but several misconceptions surround it. Understanding these misconceptions can help individuals make informed decisions about their property and estate. Here are six common misconceptions:

- 1. A Lady Bird Deed is only for married couples. Many believe this deed is exclusively for married couples, but it can be used by anyone who wants to transfer property to a beneficiary while retaining control during their lifetime.

- 2. The grantor loses all rights to the property. This is not true. With a Lady Bird Deed, the grantor retains the right to live in, sell, or change the property without the beneficiary's consent.

- 3. A Lady Bird Deed avoids probate entirely. While it does help avoid probate for the property transferred, it does not eliminate the need for probate for other assets in the estate.

- 4. The deed is only effective upon death. This misconception overlooks that the grantor maintains control over the property during their lifetime. The deed only transfers ownership automatically upon the grantor's death.

- 5. A Lady Bird Deed can be revoked only by a court. In reality, the grantor can revoke or change the deed at any time while they are alive, without needing court approval.

- 6. All properties are eligible for a Lady Bird Deed. Not every type of property qualifies. For example, properties with certain liens or those held in a trust may not be eligible for this type of deed.

By clearing up these misconceptions, individuals can better understand the benefits and limitations of a Florida Lady Bird Deed. This knowledge empowers them to make the best choices for their estate planning needs.

Common mistakes

-

Incorrect Property Description: One common mistake is failing to provide a complete and accurate description of the property. The legal description must be precise, including details like the lot number, block number, and any relevant subdivision information. Omitting this information can lead to confusion or disputes in the future.

-

Not Naming Beneficiaries Properly: Another frequent error occurs when individuals do not correctly name the beneficiaries. It’s essential to use full legal names and specify relationships clearly. Using nicknames or abbreviations can create ambiguity, potentially complicating the transfer of property upon the owner’s passing.

-

Failing to Sign and Date: Many people overlook the importance of signing and dating the form. Without a signature, the deed is not legally binding. Additionally, the date is crucial for establishing when the transfer takes effect, which can impact tax implications and other legal considerations.

-

Neglecting Notarization: A common oversight is forgetting to have the deed notarized. In Florida, a Lady Bird Deed must be notarized to be valid. Skipping this step can render the deed ineffective, leaving the property in limbo and potentially leading to legal challenges.

Find Some Other Lady Bird Deed Forms for Specific States

Life Estate Deed Sample - A Lady Bird Deed can be beneficial for couples wanting to ensure property passes to each other.

To ensure that these sensitive details remain protected, it's essential to consult resources like onlinelawdocs.com, which provide guidance on drafting and implementing a Non-disclosure Agreement effectively.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | A Lady Bird Deed is a type of property deed that allows a property owner to transfer their property to a beneficiary while retaining the right to use and control the property during their lifetime. |

| Governing Law | Lady Bird Deeds are governed by Florida Statutes, specifically under Chapter 689. |

| Benefits | This deed helps avoid probate, allowing the property to pass directly to the beneficiary upon the owner's death. |

| Retained Rights | The property owner retains the right to sell, mortgage, or change the beneficiaries at any time. |

| Tax Implications | There are no immediate tax implications for the property owner when executing a Lady Bird Deed. |

| Medicaid Protection | This type of deed can protect the property from being counted as an asset for Medicaid eligibility purposes. |

| Form Requirements | The deed must be in writing, signed by the property owner, and notarized to be valid. |

| Transfer Process | Upon the owner's death, the property automatically transfers to the designated beneficiary without the need for probate. |

Similar forms

The Florida Lady Bird Deed is similar to a traditional life estate deed. Both documents allow a property owner to retain certain rights during their lifetime. With a life estate deed, the owner can live in the property and use it as they wish, but they cannot sell or transfer the property without the consent of the remainderman, the person who will inherit the property after the owner's death. In contrast, the Lady Bird Deed allows the owner to sell, mortgage, or change the property without needing consent from anyone, providing greater flexibility and control over the property while still ensuring it passes to the intended beneficiaries upon death.

In addition to these estate planning tools, it's essential to have accurate documentation during vehicle transfers, which is where the Ohio Motor Vehicle Bill of Sale comes into play. This crucial legal form not only records the transfer of ownership but also ensures that all details regarding the transaction are clear and legitimate. For those looking to streamline this process, more information can be found at https://documentonline.org/blank-ohio-motor-vehicle-bill-of-sale/.