Valid Florida Durable Power of Attorney Template

In Florida, the Durable Power of Attorney form serves as a vital legal document that empowers individuals to designate someone they trust to make financial and legal decisions on their behalf. This authority remains effective even if the principal becomes incapacitated, ensuring that important matters can be managed without interruption. The form outlines the specific powers granted to the agent, which can include handling bank transactions, managing real estate, and making investment decisions. It is crucial for individuals to understand the implications of granting such powers, as the agent will have significant control over the principal's financial affairs. The Durable Power of Attorney can be tailored to fit individual needs, allowing for broad or limited authority as desired. Additionally, it is important to note that the form must be executed in accordance with Florida law, requiring the principal's signature and the presence of witnesses. This document not only provides peace of mind but also ensures that one’s financial interests are protected in times of need.

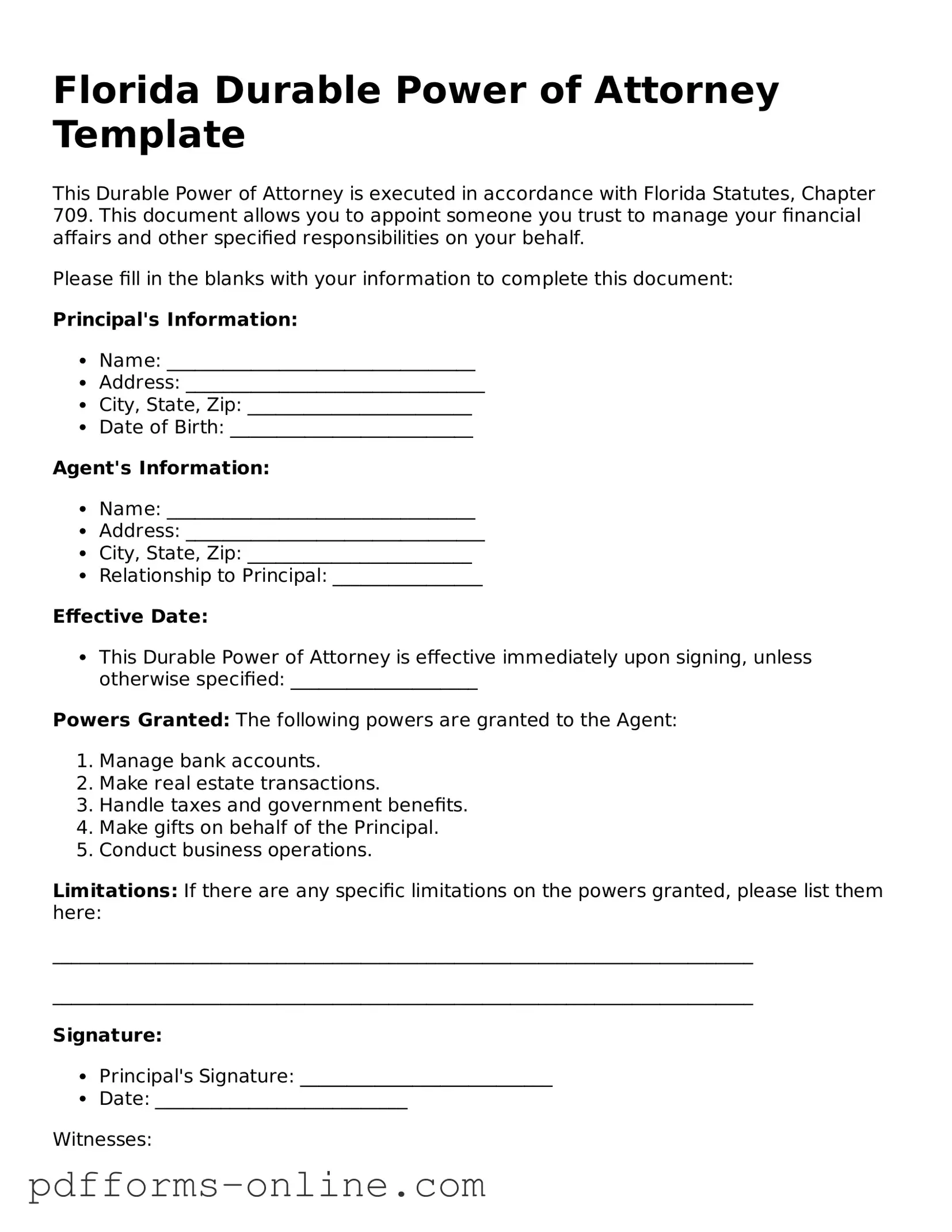

Document Example

Florida Durable Power of Attorney Template

This Durable Power of Attorney is executed in accordance with Florida Statutes, Chapter 709. This document allows you to appoint someone you trust to manage your financial affairs and other specified responsibilities on your behalf.

Please fill in the blanks with your information to complete this document:

Principal's Information:

- Name: _________________________________

- Address: ________________________________

- City, State, Zip: ________________________

- Date of Birth: __________________________

Agent's Information:

- Name: _________________________________

- Address: ________________________________

- City, State, Zip: ________________________

- Relationship to Principal: ________________

Effective Date:

- This Durable Power of Attorney is effective immediately upon signing, unless otherwise specified: ____________________

Powers Granted: The following powers are granted to the Agent:

- Manage bank accounts.

- Make real estate transactions.

- Handle taxes and government benefits.

- Make gifts on behalf of the Principal.

- Conduct business operations.

Limitations: If there are any specific limitations on the powers granted, please list them here:

___________________________________________________________________________

___________________________________________________________________________

Signature:

- Principal's Signature: ___________________________

- Date: ___________________________

Witnesses:

- Witness #1 Name: ________________________________

- Witness #1 Signature: ___________________________

- Date: ___________________________

- Witness #2 Name: ________________________________

- Witness #2 Signature: ___________________________

- Date: ___________________________

This document should be notarized for additional legal assurance.

Frequently Asked Questions

-

What is a Durable Power of Attorney in Florida?

A Durable Power of Attorney (DPOA) is a legal document that allows an individual (the principal) to appoint another person (the agent) to manage their financial and legal affairs. The term "durable" indicates that the authority granted remains effective even if the principal becomes incapacitated.

-

Why should someone create a Durable Power of Attorney?

A Durable Power of Attorney is essential for ensuring that someone you trust can make decisions on your behalf if you are unable to do so. This can include handling financial transactions, managing real estate, or making healthcare decisions. Without a DPOA, your loved ones may face legal challenges in managing your affairs.

-

Who can be appointed as an agent under a Durable Power of Attorney?

In Florida, any competent adult can be appointed as an agent. This can include family members, friends, or professionals such as attorneys or financial advisors. It is crucial to choose someone who is trustworthy and understands your wishes.

-

How does one create a Durable Power of Attorney in Florida?

To create a DPOA in Florida, the principal must complete a specific form that complies with state laws. The document must be signed by the principal in the presence of a notary public and two witnesses. It is advisable to consult with a legal professional to ensure that the document meets all legal requirements.

-

Can a Durable Power of Attorney be revoked?

Yes, a Durable Power of Attorney can be revoked at any time as long as the principal is competent. To revoke the DPOA, the principal must create a written revocation and notify the agent and any relevant institutions or parties that relied on the original document.

-

What happens if I do not have a Durable Power of Attorney?

If you do not have a Durable Power of Attorney and become incapacitated, your family may need to go through a court process to obtain guardianship. This process can be time-consuming, expensive, and may not reflect your wishes.

-

Is a Durable Power of Attorney the same as a Healthcare Proxy?

No, a Durable Power of Attorney primarily deals with financial and legal matters, while a Healthcare Proxy (or Advance Directive) specifically addresses medical decisions. However, it is possible to include healthcare decisions within a DPOA if the document is structured to allow for that authority.

-

Are there any limitations to the powers granted in a Durable Power of Attorney?

Yes, the principal can specify limitations within the DPOA. For example, they may restrict the agent from selling certain assets or making specific financial decisions. It is important to clearly outline these limitations to avoid confusion and ensure that the agent acts within the principal's wishes.

Misconceptions

When it comes to the Florida Durable Power of Attorney form, there are several misconceptions that can lead to confusion. Understanding the realities behind these misunderstandings is essential for anyone considering this important legal document.

- Misconception 1: A Durable Power of Attorney is only for financial matters.

- Misconception 2: A Durable Power of Attorney is effective only when the principal is incapacitated.

- Misconception 3: A Durable Power of Attorney cannot be revoked.

- Misconception 4: All Durable Power of Attorney forms are the same.

Many people believe that a Durable Power of Attorney (DPOA) can only be used for financial decisions. However, this form can also grant authority for health care decisions, making it a versatile tool for managing various aspects of a person's life if they become incapacitated.

Some individuals think that a DPOA only takes effect when the person who created it (the principal) is unable to make decisions. In reality, a DPOA can be effective immediately upon signing, depending on the language used in the document. This allows the designated agent to act on the principal's behalf right away, if needed.

Another common belief is that once a DPOA is established, it cannot be changed or revoked. This is not true. The principal retains the right to revoke or amend the DPOA at any time, as long as they are mentally competent. It’s important to communicate any changes to the agent and relevant institutions.

Many assume that all DPOA forms are identical. However, this is not the case. Each form can be tailored to fit specific needs and situations. It’s crucial to ensure that the form used complies with Florida laws and accurately reflects the principal's wishes.

Common mistakes

-

Not Specifying Powers Clearly: Individuals often fail to clearly outline the specific powers granted to the agent. This can lead to confusion and potential disputes about what the agent can or cannot do on behalf of the principal.

-

Neglecting to Date the Document: A common oversight is not dating the Durable Power of Attorney form. Without a date, it may be challenging to determine when the powers were granted, which can complicate matters if the principal's capacity is questioned later.

-

Forgetting to Sign in Front of a Witness: Some individuals overlook the requirement for a witness signature. In Florida, having a witness is essential for the document to be legally valid, and failing to include one can render the form ineffective.

-

Not Revoking Previous Powers of Attorney: When creating a new Durable Power of Attorney, it is crucial to revoke any prior versions. Failing to do so can create conflicts and confusion regarding which document is currently valid.

-

Ignoring the Agent's Understanding: Many people do not discuss the responsibilities with the chosen agent before filling out the form. It is vital that the agent understands their role and the powers they will be granted to ensure they can act effectively when needed.

Find Some Other Durable Power of Attorney Forms for Specific States

Power of Attorney Michigan - It can empower an agent to handle financial matters and make legal decisions.

Illinois Durable Power of Attorney for Finances Form - It ensures continuity in decision-making during challenging times.

How to Notarize a Power of Attorney in Ohio - A Durable Power of Attorney can serve as a safety net, ensuring your affairs are managed when you cannot do so yourself.

PDF Attributes

| Fact Name | Details |

|---|---|

| Definition | A Durable Power of Attorney allows one person to make decisions on behalf of another, even if the principal becomes incapacitated. |

| Governing Law | The Florida Durable Power of Attorney is governed by Florida Statutes, Chapter 709. |

| Durability | This type of power of attorney remains effective even if the principal becomes mentally incompetent. |

| Principal | The individual granting authority is known as the principal. |

| Agent | The person designated to act on behalf of the principal is called the agent or attorney-in-fact. |

| Notarization | In Florida, the Durable Power of Attorney must be signed in the presence of a notary public and two witnesses. |

| Scope of Authority | The agent can be granted broad or limited powers, depending on the principal's wishes. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are competent. |

| Agent's Duties | The agent must act in the best interests of the principal and adhere to the terms set forth in the document. |

| Common Uses | This form is often used for financial matters, healthcare decisions, and other important life choices when the principal cannot act for themselves. |

Similar forms

The Florida Durable Power of Attorney form shares similarities with a General Power of Attorney. Both documents allow an individual, known as the principal, to appoint another person, referred to as the agent, to act on their behalf. However, the key distinction lies in durability. While a General Power of Attorney becomes invalid if the principal becomes incapacitated, a Durable Power of Attorney remains effective even in such circumstances, ensuring continuous representation and decision-making authority.

Another document that resembles the Florida Durable Power of Attorney is the Medical Power of Attorney. This form specifically grants authority to an agent to make healthcare decisions for the principal if they are unable to do so. Like the Durable Power of Attorney, it empowers the agent to act in the best interest of the principal, but it is focused solely on medical matters, emphasizing the importance of health care preferences and end-of-life decisions.

The Advance Healthcare Directive is also comparable. This document combines elements of a Medical Power of Attorney and a living will. It allows individuals to express their healthcare wishes while designating an agent to make decisions on their behalf. Similar to the Durable Power of Attorney, it ensures that an individual's preferences are honored even when they cannot communicate them directly.

A Living Will is another related document. It outlines an individual’s wishes regarding medical treatment and end-of-life care, serving as a guide for healthcare providers and family members. While it does not appoint an agent like the Durable Power of Attorney, it complements it by providing clarity on the principal’s desires, ensuring that decisions align with their values and beliefs.

The Revocable Trust shares some features with the Durable Power of Attorney, particularly in asset management. A Revocable Trust allows individuals to place their assets into a trust while retaining control during their lifetime. If the individual becomes incapacitated, a successor trustee can manage the assets, similar to how an agent operates under a Durable Power of Attorney. Both documents aim to facilitate financial management and protect the principal’s interests.

The Special Power of Attorney is another document that functions similarly. It allows the principal to grant limited authority to an agent for specific tasks or transactions. While a Durable Power of Attorney provides broad powers, the Special Power of Attorney is tailored for particular situations. This specificity can be useful when the principal only needs assistance in certain areas, such as real estate transactions or financial matters.

The Financial Power of Attorney is closely related, focusing exclusively on financial matters. It enables the agent to manage the principal’s finances, including paying bills, managing investments, and filing taxes. Like the Durable Power of Attorney, it remains effective during the principal’s incapacity, ensuring that financial obligations are met without interruption.

The Healthcare Proxy is another document that mirrors the Durable Power of Attorney in its purpose to designate an agent. Specifically, it allows an individual to appoint someone to make healthcare decisions on their behalf. While the Medical Power of Attorney typically encompasses this role, the Healthcare Proxy often emphasizes the agent's authority to communicate with medical professionals, ensuring that the principal's health care choices are respected.

The Guardianship document relates to the Durable Power of Attorney in that both address the care and management of individuals who cannot make decisions for themselves. A Guardianship is often established through a court process, appointing someone to make decisions for an incapacitated person. In contrast, a Durable Power of Attorney allows individuals to designate their own agents proactively, potentially avoiding the need for court intervention.

Finally, the Durable Power of Attorney for Finances is another document that aligns closely with the Florida Durable Power of Attorney. It specifically focuses on financial matters, granting authority to the agent to manage the principal’s financial affairs. This document, like the Durable Power of Attorney, remains effective during the principal's incapacity, ensuring that financial responsibilities are handled appropriately without delay.