Valid Florida Deed in Lieu of Foreclosure Template

In the challenging landscape of real estate, homeowners facing financial difficulties often seek solutions to alleviate their burdens. One such option available in Florida is the Deed in Lieu of Foreclosure. This legal instrument allows a homeowner to voluntarily transfer ownership of their property back to the lender, effectively bypassing the lengthy and often stressful foreclosure process. By executing this deed, homeowners can potentially avoid the negative consequences associated with foreclosure, such as a tarnished credit score and the emotional toll of losing a home through litigation. The Deed in Lieu of Foreclosure form outlines essential details, including the property description, the parties involved, and any existing liens or encumbrances. It serves not only as a formal agreement but also as a means to facilitate communication between the homeowner and the lender, paving the way for a smoother transition. Understanding the nuances of this form can empower homeowners to make informed decisions about their financial futures while providing lenders with a more efficient method of reclaiming their assets.

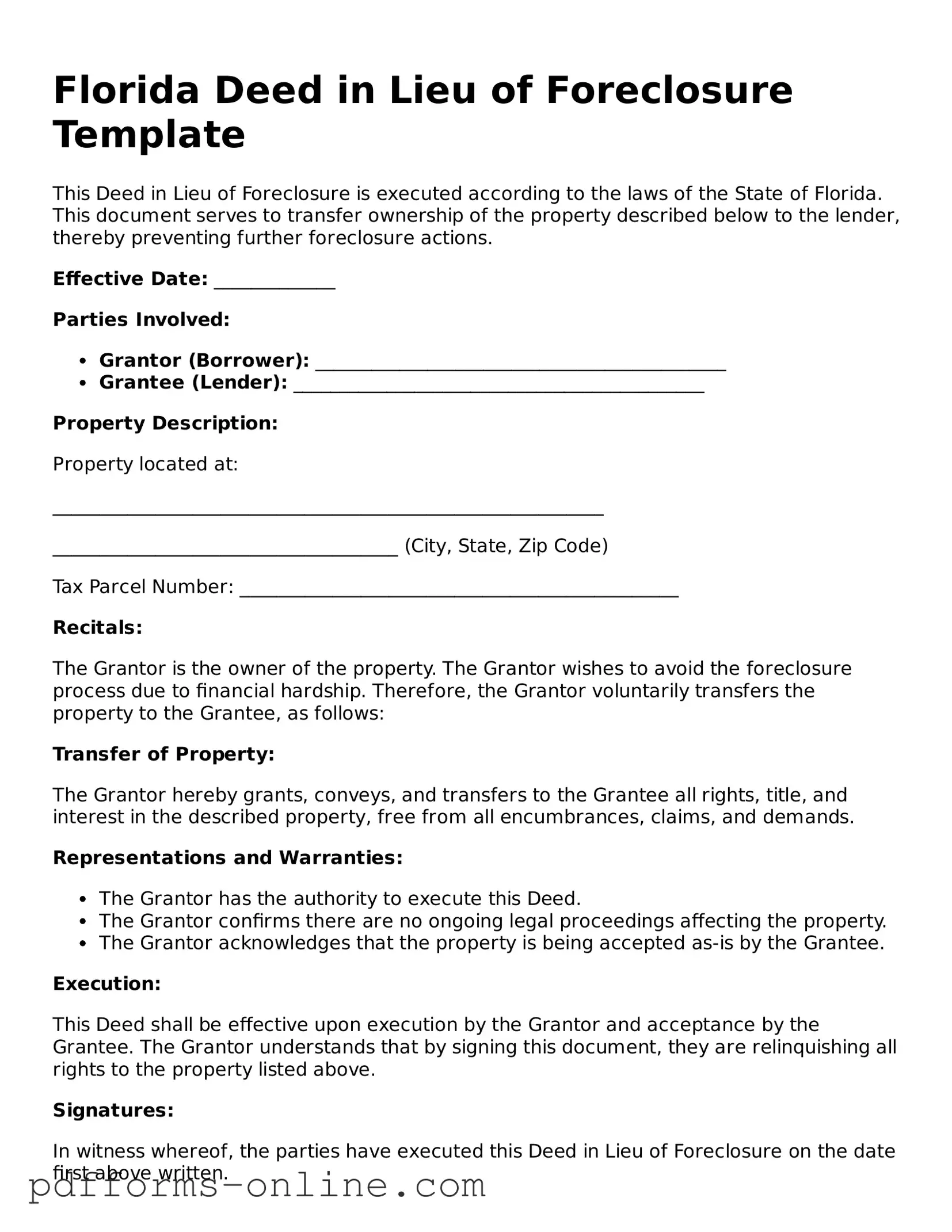

Document Example

Florida Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is executed according to the laws of the State of Florida. This document serves to transfer ownership of the property described below to the lender, thereby preventing further foreclosure actions.

Effective Date: _____________

Parties Involved:

- Grantor (Borrower): ____________________________________________

- Grantee (Lender): ____________________________________________

Property Description:

Property located at:

___________________________________________________________

_____________________________________ (City, State, Zip Code)

Tax Parcel Number: _______________________________________________

Recitals:

The Grantor is the owner of the property. The Grantor wishes to avoid the foreclosure process due to financial hardship. Therefore, the Grantor voluntarily transfers the property to the Grantee, as follows:

Transfer of Property:

The Grantor hereby grants, conveys, and transfers to the Grantee all rights, title, and interest in the described property, free from all encumbrances, claims, and demands.

Representations and Warranties:

- The Grantor has the authority to execute this Deed.

- The Grantor confirms there are no ongoing legal proceedings affecting the property.

- The Grantor acknowledges that the property is being accepted as-is by the Grantee.

Execution:

This Deed shall be effective upon execution by the Grantor and acceptance by the Grantee. The Grantor understands that by signing this document, they are relinquishing all rights to the property listed above.

Signatures:

In witness whereof, the parties have executed this Deed in Lieu of Foreclosure on the date first above written.

Grantor: _____________________________________

Date: ____________

Grantee: _____________________________________

Date: ____________

Witness: _____________________________________

Date: ____________

Notary Public:

_______________________________________________

My Commission Expires: ______________________

This document must be recorded in the appropriate county office to be effective against third parties.

Frequently Asked Questions

-

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal process where a homeowner voluntarily transfers the title of their property to the lender to avoid foreclosure. This option allows the homeowner to relinquish their property, and in return, the lender may agree to cancel the mortgage debt.

-

Who is eligible for a Deed in Lieu of Foreclosure?

Eligibility typically depends on the lender's policies. Generally, homeowners who are struggling to make mortgage payments and facing foreclosure may qualify. However, the lender will assess the homeowner's financial situation and the property's condition before approving the deed.

-

What are the benefits of choosing a Deed in Lieu of Foreclosure?

There are several advantages to this option:

- It can help avoid the lengthy foreclosure process.

- The homeowner may avoid a deficiency judgment, which is when the lender seeks to recover the remaining balance after a foreclosure sale.

- It can have a less negative impact on the homeowner's credit score compared to a foreclosure.

- The process may allow for a smoother transition to renting or purchasing a new home in the future.

-

Are there any drawbacks to a Deed in Lieu of Foreclosure?

Yes, there are some potential downsides. Homeowners may still face tax implications on any forgiven debt. Additionally, not all lenders accept a deed in lieu, and the homeowner may need to negotiate terms. Lastly, the homeowner will lose their property and any equity they may have built up.

-

How do I initiate a Deed in Lieu of Foreclosure?

The process begins by contacting your lender to express your interest in this option. The lender will likely require documentation of your financial situation and may ask for a hardship letter explaining why you are unable to continue making payments. Once approved, you will need to complete the necessary paperwork to transfer the deed.

-

Will I still owe money after a Deed in Lieu of Foreclosure?

This depends on the agreement made with the lender. In many cases, lenders will agree to forgive any remaining mortgage balance. However, it is crucial to get this in writing. If the lender does not forgive the debt, they may pursue a deficiency judgment.

-

Can I change my mind after signing a Deed in Lieu of Foreclosure?

Once the deed is signed and recorded, the transfer of ownership is typically final. It is essential to fully understand the implications before proceeding. If you are uncertain, consider seeking legal advice before making any decisions.

Misconceptions

When it comes to understanding the Florida Deed in Lieu of Foreclosure, several misconceptions can cloud the issue. It's important to clarify these misunderstandings to help homeowners make informed decisions.

- Misconception 1: A Deed in Lieu of Foreclosure is the same as a short sale.

- Misconception 2: Homeowners can simply walk away from their mortgage by signing a Deed in Lieu of Foreclosure.

- Misconception 3: A Deed in Lieu of Foreclosure will not affect the homeowner's credit score.

- Misconception 4: The process is quick and easy.

This is not true. While both options allow homeowners to avoid foreclosure, a short sale involves selling the property for less than the amount owed on the mortgage, with the lender's approval. In contrast, a Deed in Lieu of Foreclosure transfers ownership of the property back to the lender, usually without any sale taking place.

This is misleading. While the deed transfers ownership to the lender, it does not absolve the homeowner from all financial responsibility. If there is a remaining balance on the mortgage after the deed is executed, the lender may still pursue the homeowner for that amount, depending on the terms agreed upon.

This is a common belief, but it is incorrect. Like a foreclosure, a Deed in Lieu of Foreclosure can have a significant negative impact on a homeowner's credit score. The extent of the damage can vary, but it typically remains on the credit report for several years.

While a Deed in Lieu of Foreclosure can be faster than going through a full foreclosure process, it still requires careful consideration and negotiation with the lender. Homeowners must provide documentation, and the lender must agree to the terms. Therefore, it is not an instant solution.

Common mistakes

-

Failing to provide accurate property information. It is essential to ensure that the property description is complete and correct. Inaccuracies can lead to delays or complications in the process.

-

Not including all necessary parties. All individuals or entities listed on the mortgage must sign the deed. Omitting a party can invalidate the document.

-

Using incorrect legal names. It is important to use the full legal names of all parties involved. Nicknames or abbreviations may cause confusion and legal issues.

-

Neglecting to obtain necessary signatures. Every required party must sign the deed. Missing signatures can result in the deed being rejected.

-

Overlooking the notarization requirement. Most deeds need to be notarized to be legally binding. Failing to have the document notarized can render it ineffective.

-

Not understanding the implications of the deed. A deed in lieu of foreclosure can have significant consequences for credit and future homeownership. It is vital to fully understand these implications before proceeding.

-

Ignoring local laws and regulations. Each jurisdiction may have specific requirements for deeds in lieu of foreclosure. Familiarity with local laws is crucial to avoid errors.

-

Submitting the form without a review. It is advisable to have the completed form reviewed by a professional. A second set of eyes can catch mistakes that may have been overlooked.

Find Some Other Deed in Lieu of Foreclosure Forms for Specific States

What Does an Arizona Homeowner Lose When Choosing to Use Deed in Lieu of Foreclosure? - Lenders must confirm the property’s condition before accepting the deed.

In addition to the prenuptial agreement form, it is essential to understand the various legal documents that may be required during this process to protect your interests. For comprehensive guidance and resources, refer to All Arizona Forms, which provides valuable information to ensure that your rights are secured in the event of a marital dissolution.

Foreclosure Vs Deed in Lieu - Each lender may have specific requirements for accepting a deed in lieu of foreclosure.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal document where a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure proceedings. |

| Governing Law | The process is governed by Florida Statutes, particularly Chapter 697, which outlines the rights and responsibilities of both borrowers and lenders in these transactions. |

| Eligibility | Typically, homeowners facing financial hardship may qualify for a deed in lieu of foreclosure, provided they have no other liens on the property. |

| Process | The borrower must submit a request to the lender, who will evaluate the situation and may require a financial hardship statement and other documentation. |

| Benefits | This option can help borrowers avoid the lengthy and damaging foreclosure process, potentially preserving their credit score to some extent. |

| Risks | Borrowers may still face tax implications, as the IRS may consider forgiven debt as taxable income, depending on individual circumstances. |

| Legal Assistance | It is often advisable for borrowers to seek legal counsel before proceeding with a deed in lieu of foreclosure to fully understand their rights and obligations. |

Similar forms

A mortgage release is a document that signifies the termination of a mortgage agreement. It is issued by the lender once the borrower has fulfilled their obligations, typically by paying off the loan in full. Similar to a deed in lieu of foreclosure, a mortgage release allows the borrower to regain clear title to their property. Both documents serve to eliminate the lender's claim to the property, ensuring that the borrower is no longer responsible for the mortgage debt. This process can provide a sense of relief for homeowners who have successfully navigated their financial obligations.

A short sale agreement involves the sale of a property for less than the amount owed on the mortgage. In this scenario, the lender agrees to accept a reduced payoff to avoid the costs and time associated with foreclosure. Like a deed in lieu of foreclosure, a short sale can provide a way for homeowners to avoid the negative consequences of foreclosure. Both options allow borrowers to relinquish their property without the lengthy legal process, but a short sale requires finding a buyer, which can take time and effort.

A loan modification agreement is a restructuring of the terms of an existing mortgage. It may involve lowering the interest rate, extending the loan term, or changing the type of loan. This document aims to make the mortgage more manageable for the borrower, thus preventing foreclosure. While a deed in lieu of foreclosure results in the transfer of property ownership, a loan modification keeps the homeowner in their home by adjusting the financial terms. Both options are intended to provide relief to borrowers facing financial hardship.

A foreclosure notice is a legal document that informs a borrower that the lender is initiating foreclosure proceedings due to missed payments. This document serves as a warning and outlines the steps the borrower can take to avoid losing their home. While a deed in lieu of foreclosure is a proactive measure taken by the borrower to avoid foreclosure, a foreclosure notice is often a last resort. Both documents highlight the seriousness of the situation, but they represent different stages in the process of dealing with mortgage default.

An assumption agreement allows a buyer to take over the existing mortgage of a seller. This document can be beneficial for both parties, as it enables the seller to transfer their financial obligations while allowing the buyer to take advantage of potentially favorable mortgage terms. Similar to a deed in lieu of foreclosure, an assumption agreement can relieve the seller of their mortgage burden. However, it requires a willing buyer and lender approval, making it a more complex option than simply relinquishing the property through a deed in lieu.

A forbearance agreement is a temporary arrangement between a lender and borrower that allows the borrower to pause or reduce their mortgage payments for a specified period. This document is often used in situations where the borrower is experiencing financial difficulties but expects to recover soon. Like a deed in lieu of foreclosure, a forbearance agreement aims to prevent foreclosure by providing relief to the borrower. However, unlike a deed in lieu, this option does not involve transferring ownership of the property.

A quitclaim deed is a legal document that allows a property owner to transfer their interest in a property to another party without making any guarantees about the title. This document is often used in situations such as divorce or gifting property. While a quitclaim deed does not directly relate to foreclosure, it can be used in conjunction with a deed in lieu of foreclosure when a borrower wishes to transfer their property to the lender. Both documents facilitate the transfer of ownership, but a quitclaim deed does not address the underlying mortgage debt.

An eviction notice is a formal document issued by a landlord to a tenant, informing them that they must vacate the property. This document is typically used in rental situations, whereas a deed in lieu of foreclosure pertains to homeowners. Both documents signify a loss of property rights, but they operate in different contexts. An eviction notice is often a result of lease violations, while a deed in lieu of foreclosure is a voluntary agreement to transfer ownership to avoid the foreclosure process.

In addition to the aforementioned documents, understanding the legal implications of agreements like the Georgia Hold Harmless Agreement is crucial for both borrowers and lenders. This form is instrumental in clearly defining responsibilities and liabilities, ensuring that parties are protected in various situations. For further information on this essential document, visit onlinelawdocs.com/.

A bankruptcy filing can serve as a protective measure for individuals facing overwhelming debt, including mortgage obligations. When a borrower files for bankruptcy, it can halt foreclosure proceedings temporarily. Although bankruptcy does not directly relate to a deed in lieu of foreclosure, both options are utilized by individuals seeking to manage their financial difficulties. While a deed in lieu involves voluntarily giving up property, bankruptcy may allow the borrower to keep their home while reorganizing their debts.