Valid Florida Deed Template

When it comes to transferring property in Florida, understanding the Florida Deed form is essential for both buyers and sellers. This legal document serves as the official record of the transfer of ownership from one party to another. It outlines key details, including the names of the parties involved, a description of the property, and the type of deed being used, such as a warranty deed or a quitclaim deed. Each type of deed carries different implications for the rights and responsibilities of the parties. Additionally, the form must be signed and notarized to be legally binding, ensuring that the transaction is recognized by the state. Properly completing and filing this deed is crucial for protecting ownership rights and avoiding potential disputes in the future. Understanding these components can make the process smoother and help individuals navigate the complexities of real estate transactions in Florida.

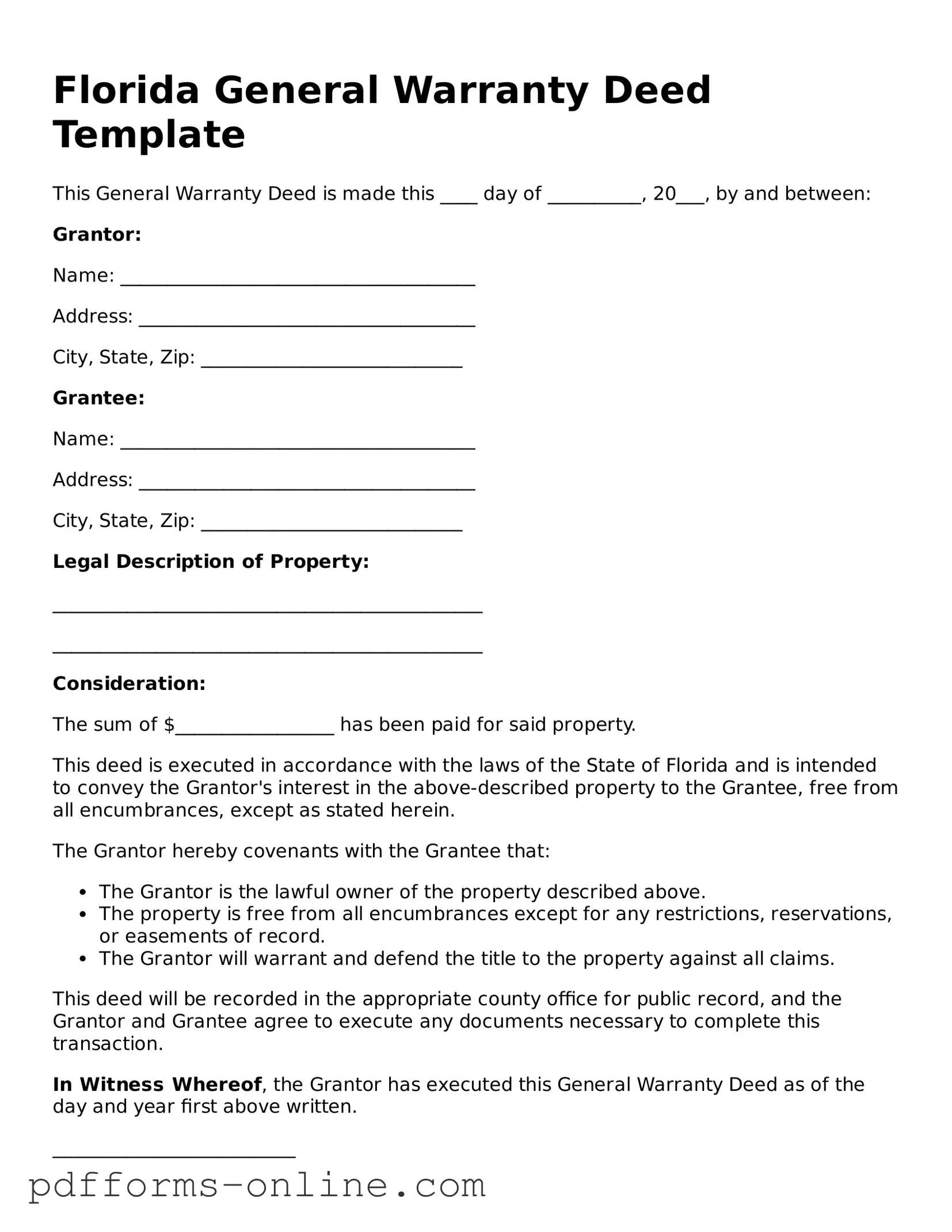

Document Example

Florida General Warranty Deed Template

This General Warranty Deed is made this ____ day of __________, 20___, by and between:

Grantor:

Name: ______________________________________

Address: ____________________________________

City, State, Zip: ____________________________

Grantee:

Name: ______________________________________

Address: ____________________________________

City, State, Zip: ____________________________

Legal Description of Property:

______________________________________________

______________________________________________

Consideration:

The sum of $_________________ has been paid for said property.

This deed is executed in accordance with the laws of the State of Florida and is intended to convey the Grantor's interest in the above-described property to the Grantee, free from all encumbrances, except as stated herein.

The Grantor hereby covenants with the Grantee that:

- The Grantor is the lawful owner of the property described above.

- The property is free from all encumbrances except for any restrictions, reservations, or easements of record.

- The Grantor will warrant and defend the title to the property against all claims.

This deed will be recorded in the appropriate county office for public record, and the Grantor and Grantee agree to execute any documents necessary to complete this transaction.

In Witness Whereof, the Grantor has executed this General Warranty Deed as of the day and year first above written.

__________________________

Grantor's Signature

__________________________

Grantee's Signature

Witnesses:

__________________________

Signature of Witness 1

Name: _____________________________________

__________________________

Signature of Witness 2

Name: _____________________________________

Frequently Asked Questions

-

What is a Florida Deed form?

A Florida Deed form is a legal document used to transfer ownership of real property in the state of Florida. This document outlines the details of the transfer, including the names of the parties involved, a description of the property, and any conditions or restrictions related to the transfer. Different types of deeds exist, such as warranty deeds and quitclaim deeds, each serving different purposes in property transactions.

-

What information is required to complete a Florida Deed form?

To complete a Florida Deed form, several key pieces of information are necessary:

- The full names of the grantor (seller) and grantee (buyer).

- A legal description of the property being transferred, which can often be found in the property's existing deed or tax records.

- The date of the transfer.

- Consideration amount, which is the price or value exchanged for the property.

In addition, both parties may need to sign the document in front of a notary public to ensure its validity.

-

How do I record a Florida Deed form?

To officially record a Florida Deed form, you must submit the completed document to the Clerk of the Circuit Court in the county where the property is located. This process typically involves:

- Ensuring the deed is properly signed and notarized.

- Paying any applicable recording fees, which can vary by county.

- Providing any additional documents that may be required, such as a cover letter or a property tax identification number.

Once recorded, the deed becomes part of the public record, providing legal proof of ownership.

-

What is the difference between a warranty deed and a quitclaim deed?

A warranty deed offers the highest level of protection for the grantee. It guarantees that the grantor holds clear title to the property and has the right to transfer it. If any issues arise regarding the title, the grantor is responsible for resolving them.

In contrast, a quitclaim deed transfers whatever interest the grantor has in the property without any guarantees. This means the grantee receives no assurances regarding the title. Quitclaim deeds are often used in situations like transferring property between family members or in divorce settlements.

-

Can I create my own Florida Deed form?

Yes, you can create your own Florida Deed form, but it is essential to ensure that it meets all legal requirements. The form must include specific language and details to be valid. While templates are available online, it is advisable to consult with a real estate attorney or a qualified professional to ensure that the deed complies with Florida laws and accurately reflects your intentions.

-

What happens if I do not record the Florida Deed form?

If you do not record the Florida Deed form, the transfer of ownership may not be legally recognized. This can lead to complications, especially if the property is sold again or if disputes arise regarding ownership. Recording the deed protects your rights as the new owner and provides public notice of your ownership, which is crucial for future transactions.

Misconceptions

Understanding the Florida Deed form is essential for anyone involved in real estate transactions in the state. However, several misconceptions can lead to confusion and mistakes. Here are nine common misunderstandings about the Florida Deed form:

- All deeds are the same. Many people believe that all deeds serve the same purpose, but this is not true. Different types of deeds, such as warranty deeds and quitclaim deeds, offer varying levels of protection and rights.

- A deed must be notarized to be valid. While notarization is often required for a deed to be recorded, it is not strictly necessary for the deed to be legally valid. The essential requirement is that the deed is signed by the grantor.

- Verbal agreements are sufficient. Some individuals think that a verbal agreement is enough to transfer property. However, Florida law requires a written deed for any transfer of real estate to be enforceable.

- Once a deed is recorded, it cannot be changed. While recording a deed provides public notice of the transaction, it does not mean the deed cannot be amended or revoked under certain circumstances, such as mutual agreement between parties.

- All property transfers require a lawyer. Although having legal assistance can be beneficial, it is not mandatory to hire a lawyer for every property transfer in Florida. Individuals can prepare and file deeds on their own if they choose.

- Only the seller needs to sign the deed. This is a common misconception. Both the seller (grantor) and the buyer (grantee) should be aware of the deed's contents, but only the grantor is required to sign for the deed to be valid.

- A deed is the same as a title. Many people confuse a deed with a title. The deed is the legal document that transfers ownership, while the title refers to the legal right to own and use the property.

- Tax implications are not related to the deed. Some assume that the deed itself does not affect taxes. In reality, transferring property can have tax consequences, including potential capital gains tax and documentary stamp taxes in Florida.

- All deeds need to be recorded. While recording a deed is advisable for establishing public notice and protecting ownership rights, it is not a legal requirement for the deed to be valid. However, unrecorded deeds may be harder to enforce against third parties.

By clarifying these misconceptions, individuals can better navigate the complexities of real estate transactions in Florida and ensure that their property transfers are handled correctly.

Common mistakes

-

Incorrect Names: Ensure that all names are spelled correctly. Mistakes in spelling can lead to legal complications.

-

Wrong Property Description: The property must be accurately described. Include the correct parcel number and legal description to avoid confusion.

-

Missing Signatures: All required parties must sign the deed. A missing signature can invalidate the document.

-

Improper Notarization: The deed must be notarized correctly. Ensure that the notary public is authorized and that the notarization is completed properly.

-

Incorrect Date: The date of signing should be accurate. An incorrect date can raise questions about the validity of the deed.

-

Failure to Include Consideration: Clearly state the amount of consideration (payment) involved in the transfer. Omitting this can create issues later.

-

Not Following State Requirements: Florida has specific requirements for deeds. Familiarize yourself with these to ensure compliance.

-

Neglecting to Record the Deed: After completing the deed, it must be recorded with the county clerk. Failing to do so can lead to disputes over ownership.

Find Some Other Deed Forms for Specific States

Michigan Property Transfer Affidavit - Deciding on which type of deed to use can impact future property rights.

Who Has the Deed to My House - A Deed may also indicate the type of ownership being transferred.

In addition to filling out the Living Will form, it's essential to familiarize yourself with all available legal documents that can assist in making informed decisions about your healthcare. For comprehensive resources, you can refer to All Arizona Forms, which provide valuable information and guidance on the different forms necessary for ensuring your medical preferences are honored.

What Does a Deed Look Like in Illinois - Utilized by real estate agents and brokers frequently.

Deed Form Texas - In some cases, a deed can be modified or amended if necessary.

PDF Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Florida Deed form is used to transfer ownership of real property from one party to another. |

| Types of Deeds | Common types include Warranty Deed, Quit Claim Deed, and Special Warranty Deed. |

| Governing Law | Florida Statutes, Chapter 689 governs the requirements for real property conveyances. |

| Signature Requirement | The deed must be signed by the grantor (seller) in the presence of two witnesses. |

| Notarization | A notary public must acknowledge the grantor's signature for the deed to be valid. |

| Recording | To protect the new owner's rights, the deed should be recorded in the county where the property is located. |

| Tax Implications | Transfer taxes may apply when the deed is recorded, depending on the property's value. |

Similar forms

The Florida Deed form shares similarities with the Quitclaim Deed. Both documents are used to transfer ownership of real property. However, the Quitclaim Deed is often utilized when the transfer is made without any guarantees regarding the property’s title. This means that the person transferring the property (the grantor) does not assure the recipient (the grantee) that the title is clear of liens or other claims. It is commonly used between family members or in situations where the parties know each other well and trust each other’s intentions.

Another document similar to the Florida Deed form is the Warranty Deed. Like the Florida Deed, a Warranty Deed transfers ownership of real property, but it provides additional protection to the buyer. The seller guarantees that they hold clear title to the property and have the right to sell it. This means that if any issues arise regarding the title after the sale, the seller is responsible for resolving them. This added layer of security makes the Warranty Deed a popular choice in real estate transactions.

The Bargain and Sale Deed is also comparable to the Florida Deed form. This type of deed conveys property from one party to another but does not include any warranties about the title. It implies that the seller has ownership of the property and the right to sell it, but it does not protect the buyer against any potential claims or liens. This deed is often used in situations involving foreclosures or tax sales, where the seller may not have complete control over the property’s title.

Understanding the nuances between various deeds is essential for anyone involved in real estate transactions. For instance, the Quitclaim Deed, often utilized in familial transfers or for resolving title issues, stands out from documents like the Warranty Deed or Bargain and Sale Deed. If you're looking for detailed guidance on these forms, including the Quitclaim Deed, consider visiting onlinelawdocs.com for comprehensive resources to help navigate your options.

Additionally, the Special Purpose Deed is another document that resembles the Florida Deed form. This type of deed is used for specific transactions, such as transferring property held in a trust or by an estate. While it serves the purpose of transferring ownership, it often comes with unique stipulations or conditions based on the specific situation. This makes it a versatile tool for various legal contexts, ensuring that property can be transferred while adhering to specific legal requirements.

Lastly, the Grant Deed is similar to the Florida Deed form in that it is used to transfer property ownership. It typically includes assurances that the property has not been sold to anyone else and that there are no undisclosed encumbrances. This deed provides a level of protection for the buyer, as it ensures that the seller has not made any prior claims on the property. While it may not offer as many guarantees as a Warranty Deed, it still provides a degree of security in the transaction.