Valid Florida Articles of Incorporation Template

When starting a business in Florida, one of the first steps is to file the Articles of Incorporation, a crucial document that lays the foundation for your corporation. This form serves several important purposes, including establishing your business as a legal entity and defining its structure. Key components of the Articles of Incorporation include the name of the corporation, which must be unique and comply with state naming requirements, and the purpose of the business, which outlines its intended activities. Additionally, the form requires information about the registered agent, who will serve as the official point of contact for legal documents. The Articles also call for details regarding the number of shares the corporation is authorized to issue, as well as the names and addresses of the initial directors. By carefully completing this form, you not only comply with state regulations but also set your business on a path toward growth and success.

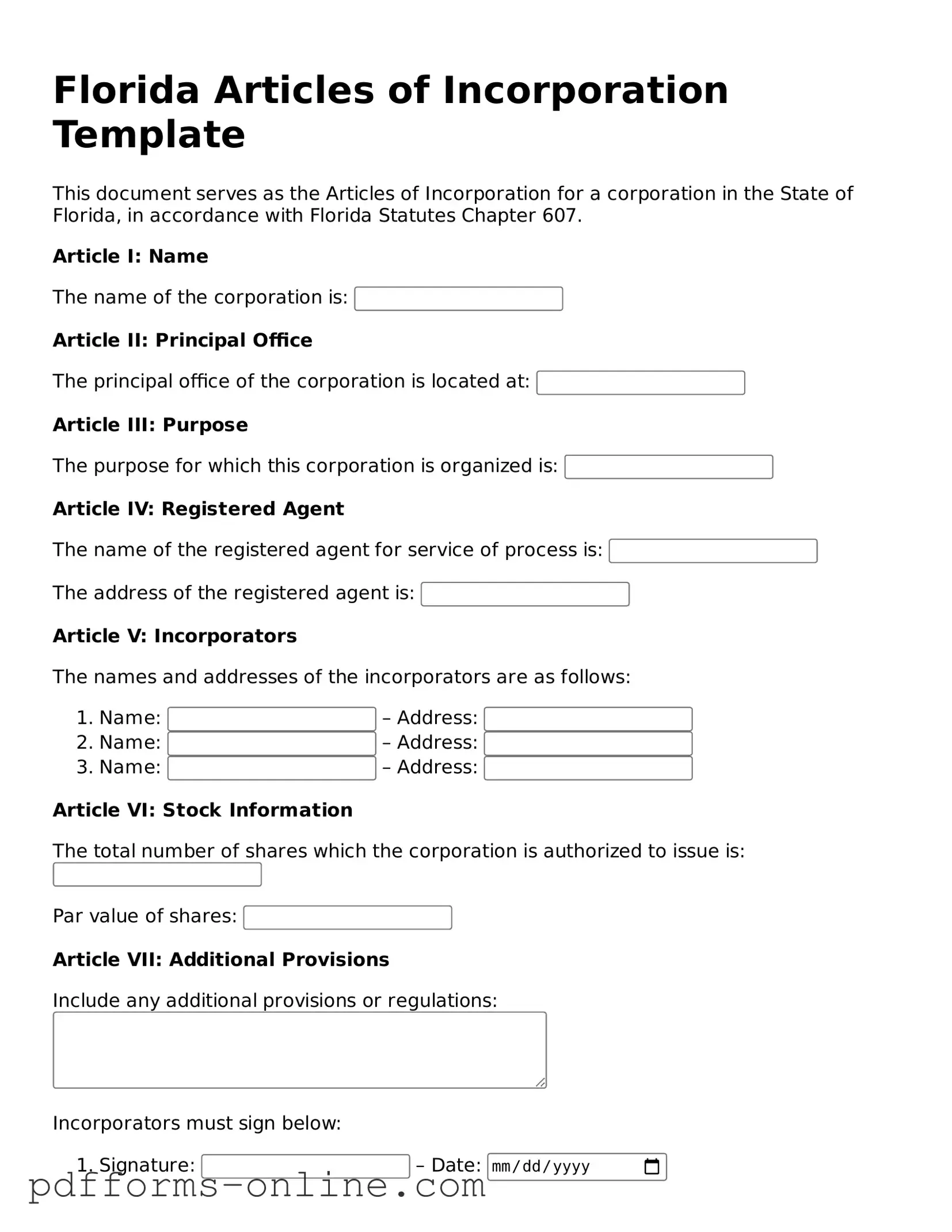

Document Example

Florida Articles of Incorporation Template

This document serves as the Articles of Incorporation for a corporation in the State of Florida, in accordance with Florida Statutes Chapter 607.

Article I: Name

The name of the corporation is:

Article II: Principal Office

The principal office of the corporation is located at:

Article III: Purpose

The purpose for which this corporation is organized is:

Article IV: Registered Agent

The name of the registered agent for service of process is:

The address of the registered agent is:

Article V: Incorporators

The names and addresses of the incorporators are as follows:

- Name: – Address:

- Name: – Address:

- Name: – Address:

Article VI: Stock Information

The total number of shares which the corporation is authorized to issue is:

Par value of shares:

Article VII: Additional Provisions

Include any additional provisions or regulations:

Incorporators must sign below:

- Signature: – Date:

- Signature: – Date:

- Signature: – Date:

This template must be filed with the Florida Department of State to create a corporation legally.

Frequently Asked Questions

-

What is the purpose of the Articles of Incorporation?

The Articles of Incorporation serve as a formal document that establishes a corporation in the state of Florida. This document outlines essential details about the corporation, such as its name, purpose, and the number of shares it is authorized to issue. By filing this document, you are legally creating a corporation that can conduct business in Florida.

-

Who needs to file the Articles of Incorporation?

Any individual or group looking to form a corporation in Florida must file the Articles of Incorporation. This includes businesses ranging from small startups to larger enterprises. If you plan to operate as a corporation rather than a sole proprietorship or partnership, this step is essential.

-

What information is required in the Articles of Incorporation?

The Articles of Incorporation must include several key pieces of information:

- The name of the corporation

- The principal office address

- The purpose of the corporation

- The number of shares the corporation is authorized to issue

- The names and addresses of the initial directors

- The registered agent's name and address

Providing accurate and complete information is crucial to avoid delays in processing.

-

How do I file the Articles of Incorporation?

You can file the Articles of Incorporation online through the Florida Division of Corporations' website or by mailing a paper form. If you choose to file online, ensure you have all required information ready to enter. For paper filings, download the form, complete it, and send it to the appropriate address along with the filing fee.

-

What is the filing fee for the Articles of Incorporation?

The standard filing fee for the Articles of Incorporation in Florida is typically around $70. However, additional fees may apply if you request expedited processing or if you include additional services, such as a certified copy of the document. Always check the Florida Division of Corporations' website for the most current fee schedule.

-

How long does it take to process the Articles of Incorporation?

Processing times can vary. Generally, online filings are processed more quickly, often within 1 to 2 business days. Paper filings may take longer, sometimes up to several weeks. If you need your filing to be expedited, you can request this option for an additional fee.

-

Can I amend the Articles of Incorporation after filing?

Yes, you can amend the Articles of Incorporation after they have been filed. If there are changes to the corporation’s name, purpose, or other significant details, you will need to file an amendment with the Florida Division of Corporations. This process also requires a filing fee.

-

What happens if I don’t file the Articles of Incorporation?

If you fail to file the Articles of Incorporation, your business cannot legally operate as a corporation in Florida. This means you would miss out on the benefits of limited liability protection and may face personal liability for business debts and obligations. It is crucial to complete this step to ensure your business is recognized legally.

-

Do I need a lawyer to file the Articles of Incorporation?

While it is not legally required to hire a lawyer to file the Articles of Incorporation, it can be beneficial. A legal professional can help ensure that all necessary information is included and that the filing complies with state laws. If you are unfamiliar with the process, seeking legal advice may save you time and potential issues down the line.

-

What is a registered agent, and why do I need one?

A registered agent is an individual or business entity designated to receive legal documents on behalf of your corporation. In Florida, every corporation must have a registered agent with a physical address in the state. This ensures that important legal documents, such as lawsuits or official government correspondence, are properly received and handled.

Misconceptions

When it comes to the Florida Articles of Incorporation, there are several misconceptions that can lead to confusion. Here’s a list of seven common misunderstandings:

- All businesses must file Articles of Incorporation. Many people think that every type of business needs to file this document. However, only corporations, not sole proprietorships or partnerships, are required to file Articles of Incorporation.

- Filing Articles of Incorporation guarantees business success. Some believe that simply filing this document will lead to a successful business. In reality, success depends on a variety of factors, including planning, management, and market conditions.

- You can’t change your Articles of Incorporation. This is not true. While you can’t change the Articles once they are filed without following a formal process, amendments can be made to update or modify them as needed.

- There’s no need to include a registered agent. Some people think they can skip this step. However, every corporation in Florida must designate a registered agent who can receive legal documents on behalf of the company.

- Articles of Incorporation are the same as a business license. This is a common mix-up. Articles of Incorporation establish your corporation, while a business license is required to operate legally in your local area.

- Filing is a one-time process. Many believe that once they file their Articles, they are done. In fact, corporations must file annual reports and maintain compliance with state regulations to keep their status active.

- All information in the Articles is private. This is misleading. Certain details, such as the names of the directors and the registered agent, are public information and can be accessed by anyone.

Understanding these misconceptions can help you navigate the process of incorporating your business in Florida more effectively.

Common mistakes

-

Incorrect Business Name: Choosing a name that is not unique or does not comply with Florida naming requirements can lead to rejection. Ensure the name is distinguishable from existing businesses and includes the appropriate designation, like "Inc." or "Corporation."

-

Missing Registered Agent Information: Failing to provide accurate details for the registered agent can delay the incorporation process. The registered agent must have a physical address in Florida and be available during business hours.

-

Inaccurate Number of Shares: Misstating the number of shares the corporation is authorized to issue can create problems later. Be clear about the total number of shares and their par value, if applicable.

-

Omitting Initial Directors: Not listing the initial directors can result in your application being returned. Include the names and addresses of all initial directors to ensure compliance.

Find Some Other Articles of Incorporation Forms for Specific States

Llc Application Ohio - Can define limitations on the corporate powers granted.

Pa Division of Corporations - Articles of Incorporation outline the basic details of a corporation.

Lara Michigan Llc Application - It may outline procedures for dissolution of the corporation.

PDF Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Florida Articles of Incorporation form is used to officially create a corporation in the state of Florida. |

| Governing Law | This form is governed by the Florida Business Corporation Act, specifically Chapter 607 of the Florida Statutes. |

| Filing Requirement | To file the Articles of Incorporation, you must submit the form to the Florida Division of Corporations along with the required filing fee. |

| Information Needed | Essential details such as the corporation's name, principal office address, and the names of the initial directors must be included in the form. |

| Processing Time | Typically, the processing time for the Articles of Incorporation is around 3 to 5 business days, but expedited services are available for an additional fee. |

Similar forms

The Florida Articles of Incorporation form is similar to the Certificate of Incorporation used in many states. Both documents serve as the foundational paperwork for establishing a corporation. They typically include essential information such as the corporation's name, purpose, registered agent, and the number of shares authorized. This document is filed with the state to legally recognize the corporation, making it a critical step in the business formation process.

Another document that resembles the Florida Articles of Incorporation is the Bylaws. While the Articles of Incorporation establish the corporation's existence, the Bylaws outline the internal rules governing the corporation's operations. They detail the responsibilities of directors and officers, how meetings are conducted, and the process for making decisions. Both documents are essential for corporate governance, but they serve different purposes within the corporate structure.

The Operating Agreement is similar to the Articles of Incorporation in that it is used for forming a Limited Liability Company (LLC). Like the Articles, the Operating Agreement lays out the structure of the business, including ownership percentages and management responsibilities. It is crucial for defining how the LLC will operate and protect the interests of its members, although it is specifically tailored for LLCs rather than corporations.

The Partnership Agreement is another document that shares similarities with the Florida Articles of Incorporation. This agreement outlines the terms of a partnership, including each partner's contributions, responsibilities, and profit-sharing arrangements. While the Articles create a corporation, the Partnership Agreement establishes a different type of business entity, yet both documents are foundational for their respective business structures.

The Certificate of Formation, often used in various states for LLCs, is akin to the Articles of Incorporation. This document serves a similar purpose by officially registering the LLC with the state. It typically includes the LLC's name, address, and the name of its registered agent. Both the Certificate of Formation and Articles of Incorporation are vital for legal recognition and protection under state law.

The Statement of Information is comparable to the Florida Articles of Incorporation, especially for corporations. This document is often required after the Articles are filed and provides updated information about the corporation, such as the names and addresses of directors and officers. While the Articles establish the entity, the Statement of Information helps maintain transparency and compliance with state regulations.

The Application for Employer Identification Number (EIN) is another document that businesses often file alongside the Articles of Incorporation. While the Articles create the corporation, the EIN application is necessary for tax purposes. This number is essential for opening bank accounts, hiring employees, and filing taxes. Both documents are crucial for the operational aspects of a new business.

The Business License Application is similar in that it is often required after incorporation. While the Articles of Incorporation establish the legal entity, the business license allows the corporation to operate legally within a specific jurisdiction. This document ensures compliance with local regulations and is essential for conducting business activities.

The Shareholder Agreement can also be seen as similar to the Articles of Incorporation. This agreement outlines the rights and responsibilities of shareholders within a corporation. While the Articles of Incorporation create the corporation, the Shareholder Agreement governs the relationships among shareholders, addressing issues like voting rights and share transfers. Both documents are vital for the structure and governance of a corporation.

Lastly, the Annual Report is another document that parallels the Articles of Incorporation. After a corporation is formed, it is often required to file an Annual Report to maintain its good standing with the state. This report updates the state on the corporation's current status, including any changes in directors or registered agents. While the Articles of Incorporation establish the corporation, the Annual Report ensures ongoing compliance with state requirements.