Blank Employee Loan Agreement Form

When employees face financial challenges, an Employee Loan Agreement can provide a helpful solution, allowing them to borrow funds from their employer under specific terms. This agreement typically outlines the loan amount, repayment schedule, and interest rates, ensuring that both parties understand their obligations. It may also include provisions for late payments and consequences for defaulting on the loan. By clearly defining the terms, the agreement fosters transparency and trust between the employer and employee. Additionally, it serves to protect the employer’s interests while providing necessary support to employees during difficult times. Understanding the nuances of this agreement is crucial for both employers and employees, as it can help mitigate misunderstandings and promote a healthy workplace environment.

Document Example

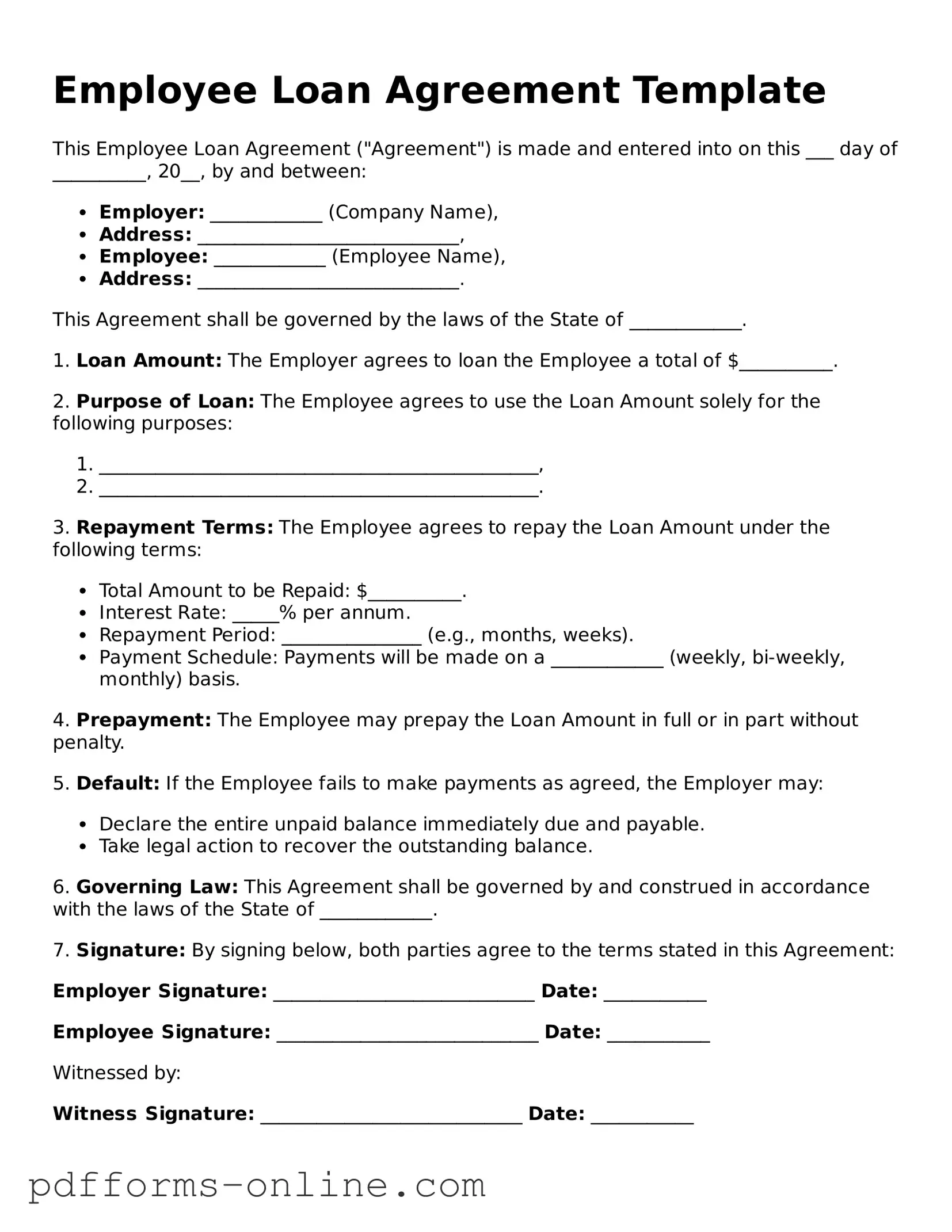

Employee Loan Agreement Template

This Employee Loan Agreement ("Agreement") is made and entered into on this ___ day of __________, 20__, by and between:

- Employer: ____________ (Company Name),

- Address: ____________________________,

- Employee: ____________ (Employee Name),

- Address: ____________________________.

This Agreement shall be governed by the laws of the State of ____________.

1. Loan Amount: The Employer agrees to loan the Employee a total of $__________.

2. Purpose of Loan: The Employee agrees to use the Loan Amount solely for the following purposes:

- _______________________________________________,

- _______________________________________________.

3. Repayment Terms: The Employee agrees to repay the Loan Amount under the following terms:

- Total Amount to be Repaid: $__________.

- Interest Rate: _____% per annum.

- Repayment Period: _______________ (e.g., months, weeks).

- Payment Schedule: Payments will be made on a ____________ (weekly, bi-weekly, monthly) basis.

4. Prepayment: The Employee may prepay the Loan Amount in full or in part without penalty.

5. Default: If the Employee fails to make payments as agreed, the Employer may:

- Declare the entire unpaid balance immediately due and payable.

- Take legal action to recover the outstanding balance.

6. Governing Law: This Agreement shall be governed by and construed in accordance with the laws of the State of ____________.

7. Signature: By signing below, both parties agree to the terms stated in this Agreement:

Employer Signature: ____________________________ Date: ___________

Employee Signature: ____________________________ Date: ___________

Witnessed by:

Witness Signature: ____________________________ Date: ___________

Frequently Asked Questions

-

What is an Employee Loan Agreement?

An Employee Loan Agreement is a formal document that outlines the terms and conditions under which an employer provides a loan to an employee. This agreement specifies the loan amount, interest rate (if applicable), repayment schedule, and any other relevant terms. It serves to protect both parties by clearly defining their rights and obligations.

-

Why would an employer offer loans to employees?

Employers may offer loans to employees for various reasons. These can include assisting employees in times of financial need, promoting employee retention, or improving morale. Such loans can also serve as an incentive, helping to create a supportive work environment where employees feel valued and cared for.

-

What should be included in the Employee Loan Agreement?

The Employee Loan Agreement should include several key components:

- Loan amount

- Interest rate (if any)

- Repayment terms, including the schedule and method of payment

- Consequences of default

- Any fees associated with the loan

- Confidentiality provisions

Including these elements helps ensure that both the employer and employee have a clear understanding of the loan's terms.

-

What happens if an employee cannot repay the loan?

If an employee is unable to repay the loan as agreed, the consequences will depend on the terms outlined in the Employee Loan Agreement. Potential outcomes may include additional fees, adjustments to the repayment schedule, or, in some cases, deductions from the employee's paycheck. It is essential for both parties to communicate openly about any financial difficulties to explore possible solutions.

-

Is an Employee Loan Agreement legally binding?

Yes, an Employee Loan Agreement is a legally binding contract, provided it meets the necessary legal requirements. Both the employer and the employee must sign the agreement, indicating their consent to the terms. It is advisable for both parties to review the agreement carefully and, if needed, seek legal advice before signing to ensure they fully understand their rights and obligations.

Misconceptions

Misconceptions about the Employee Loan Agreement form can lead to confusion and mismanagement. Understanding these misconceptions is essential for both employers and employees. Below is a list of ten common misconceptions along with clarifications.

- Employee Loan Agreements are only for large companies. Many small and medium-sized businesses also utilize these agreements to formalize loan arrangements with employees.

- These agreements are only for financial emergencies. While they can assist in emergencies, they may also be used for planned expenses such as education or home purchases.

- All employee loans are interest-free. Interest rates can vary based on company policy and the specifics of the loan, and some may include interest.

- Once signed, the terms cannot be changed. Terms can be renegotiated if both parties agree, provided it is documented properly.

- Loan agreements are the same as payroll deductions. While payroll deductions may be involved, a loan agreement is a separate document that outlines the terms of repayment.

- Only full-time employees can receive loans. Part-time employees may also be eligible, depending on company policy.

- Employee Loan Agreements are not legally binding. These agreements can be legally enforceable if they meet the necessary requirements.

- There is no need for documentation. Proper documentation is essential for clarity and to protect both the employer and employee.

- All loans must be paid back immediately. Repayment terms can vary, and many agreements allow for structured repayment over time.

- Loan agreements are only beneficial to employees. Employers can also benefit by fostering goodwill and loyalty among staff through financial support.

Clarifying these misconceptions can lead to better communication and understanding regarding Employee Loan Agreements. It is important for both parties to be informed and to approach these agreements with clear expectations.

Common mistakes

-

Incomplete Information: Failing to provide all required personal details such as name, address, and employee ID can delay the loan process.

-

Incorrect Loan Amount: Entering an amount that exceeds the approved limit or is less than the intended amount can lead to confusion and potential denial.

-

Missing Signatures: Not signing the agreement or having the necessary witnesses sign can render the document invalid.

-

Ignoring Repayment Terms: Overlooking the repayment schedule and terms can result in misunderstandings about when payments are due.

-

Failure to Read the Agreement: Not reviewing the entire document can lead to overlooking important clauses and responsibilities.

-

Incorrect Date: Filling in the wrong date can create issues with the loan’s validity and repayment timeline.

-

Neglecting to Include Co-Signer Information: If a co-signer is required, failing to provide their details can cause delays.

-

Providing Inaccurate Employment Status: Misrepresenting employment status or job title can lead to issues with loan eligibility.

-

Not Keeping a Copy: Failing to retain a copy of the signed agreement can complicate future reference or disputes.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | An Employee Loan Agreement is a legal document outlining the terms under which an employer lends money to an employee. |

| Purpose | The agreement serves to clarify the repayment terms, interest rates, and consequences of default. |

| Loan Amount | The document specifies the total amount of money being loaned to the employee. |

| Repayment Terms | It includes details about the repayment schedule, including due dates and payment methods. |

| Interest Rate | The agreement may state whether the loan will accrue interest and at what rate, if applicable. |

| Governing Law | Each state may have specific laws governing employee loans; for example, California law may apply to loans made within that state. |

| Default Consequences | The document outlines the consequences if the employee fails to repay the loan, which may include wage deductions. |

| Confidentiality | Many agreements include a clause ensuring that the terms of the loan remain confidential between the employer and employee. |

| Signatures | Both the employer and employee must sign the agreement to make it legally binding. |

| Modification | The agreement can often be modified, but any changes must be documented in writing and signed by both parties. |

Similar forms

The Employee Loan Agreement is similar to a Personal Loan Agreement. Both documents outline the terms of a loan between a lender and a borrower. They specify the amount borrowed, interest rates, repayment schedules, and any penalties for late payments. Personal Loan Agreements are typically used for loans between individuals or financial institutions, while the Employee Loan Agreement is specifically tailored for loans between an employer and an employee.

Another document that resembles the Employee Loan Agreement is the Promissory Note. This is a legal document in which the borrower promises to pay back the loan under specific terms. Like the Employee Loan Agreement, a Promissory Note includes details such as the loan amount, interest rate, and repayment schedule. However, a Promissory Note is often more straightforward and may not include the employer-employee relationship aspect found in an Employee Loan Agreement.

In navigating the various financial agreements within employment, it is essential to consider relevant forms, such as the Employee Loan Agreement, which outlines the specific terms unique to borrower and lender relationships in a workplace setting. Additionally, for those seeking comprehensive documentation related to these agreements, resources like All California Forms offer valuable templates and insights to ensure clarity and compliance in all financial dealings.

The Loan Repayment Plan is also similar to the Employee Loan Agreement. This document outlines the schedule and terms for repaying a loan. It details how much the borrower needs to pay each month and when payments are due. While the Employee Loan Agreement focuses on the initial loan terms, the Loan Repayment Plan provides a clear roadmap for fulfilling those terms.

A Credit Agreement shares similarities with the Employee Loan Agreement as well. This document sets the terms for borrowing money or using credit. Both agreements specify the loan amount, interest rates, and repayment conditions. However, Credit Agreements often involve larger sums and may apply to businesses or individuals seeking credit from financial institutions rather than an employer-employee context.

The Mortgage Agreement is another document that has similarities to the Employee Loan Agreement. Both involve borrowing money with a promise to repay it. A Mortgage Agreement specifically relates to real estate, where the property serves as collateral for the loan. In contrast, the Employee Loan Agreement does not require collateral and is often used for smaller amounts.

The Lease Agreement can also be compared to the Employee Loan Agreement. While primarily used for renting property, a Lease Agreement outlines terms similar to those in a loan agreement, such as payment amounts and schedules. Both documents establish a financial obligation, though the Lease Agreement focuses on rental payments rather than loans.

The Business Loan Agreement is another related document. This agreement is used when a business borrows money from a lender. Like the Employee Loan Agreement, it details the loan amount, interest rates, and repayment terms. However, the Business Loan Agreement typically involves larger sums and different types of collateral compared to loans made to employees.

The Installment Agreement is also comparable to the Employee Loan Agreement. This document allows a borrower to repay a loan in regular installments over time. It includes similar terms regarding the payment schedule and interest rates. Both agreements aim to make repayment manageable for the borrower.

Lastly, the Debt Settlement Agreement bears some resemblance to the Employee Loan Agreement. This document is used when a borrower negotiates a reduced amount to pay off a debt. Both agreements involve financial obligations, but a Debt Settlement Agreement focuses on resolving outstanding debts, while the Employee Loan Agreement establishes the terms for a new loan.