Blank Employee Advance Template

The Employee Advance form plays a crucial role in managing financial support for employees who may need assistance with business-related expenses. This form streamlines the process for requesting advances, ensuring that employees can access funds in a timely manner while maintaining accountability for their use. Key aspects of the form include the employee's personal information, the purpose of the advance, and the anticipated amount needed. Additionally, the form often requires a clear outline of how the funds will be utilized, which helps in tracking expenditures and ensuring compliance with company policies. By utilizing this form, organizations can foster a transparent and efficient system for handling employee financial requests, ultimately contributing to a more supportive workplace environment.

Document Example

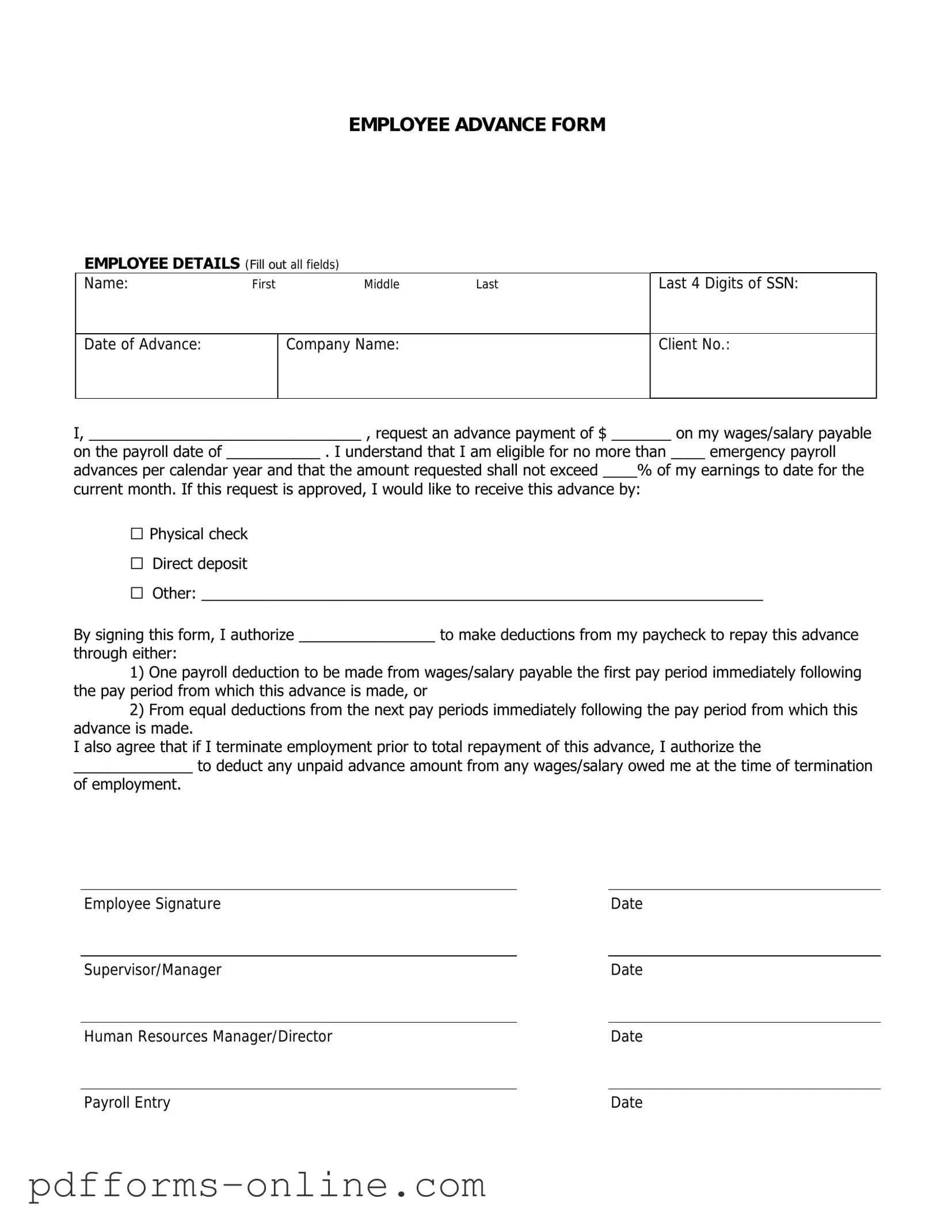

EMPLOYEE ADVANCE FORM

EMPLOYEE DETAILS (Fill out all fields)

Name: |

First |

Middle |

Last |

|

|

|

|

Date of Advance: |

|

Company Name: |

|

|

|

|

|

Last 4 Digits of SSN:

Client No.:

I, ________________________________ , request an advance payment of $ _______ on my wages/salary payable

on the payroll date of ___________ . I understand that I am eligible for no more than ____ emergency payroll

advances per calendar year and that the amount requested shall not exceed ____% of my earnings to date for the

current month. If this request is approved, I would like to receive this advance by:

□Physical check

□Direct deposit

□Other: __________________________________________________________________

By signing this form, I authorize ________________ to make deductions from my paycheck to repay this advance

through either:

1)One payroll deduction to be made from wages/salary payable the first pay period immediately following the pay period from which this advance is made, or

2)From equal deductions from the next pay periods immediately following the pay period from which this advance is made.

I also agree that if I terminate employment prior to total repayment of this advance, I authorize the

______________ to deduct any unpaid advance amount from any wages/salary owed me at the time of termination of employment.

Employee Signature |

|

Date |

|

|

|

Supervisor/Manager |

|

Date |

|

|

|

Human Resources Manager/Director |

|

Date |

Payroll Entry |

Date |

Frequently Asked Questions

-

What is the Employee Advance form?

The Employee Advance form is a document that allows employees to request an advance on their salary or wages. This advance can help cover unexpected expenses or financial emergencies before the regular payday.

-

Who is eligible to request an advance?

Generally, all employees who have completed a probationary period may be eligible to request an advance. However, specific eligibility criteria may vary by organization, so it’s important to check with your HR department for details.

-

How do I fill out the Employee Advance form?

To fill out the form, provide your personal information, including your name, employee ID, and department. Clearly state the amount you are requesting and the reason for the advance. Ensure that all sections are completed accurately to avoid delays in processing.

-

What supporting documents do I need to provide?

Supporting documents may vary depending on the reason for the advance. Common documents include receipts, bills, or any other relevant information that justifies your request. Check with your HR department for specific requirements.

-

How long does it take to process the request?

The processing time for an Employee Advance request can vary. Typically, it takes anywhere from a few days to a week. Factors such as the completeness of your application and the current workload of the HR department can affect this timeline.

-

Will the advance be deducted from my future paychecks?

Yes, the amount of the advance will usually be deducted from your future paychecks. The specific repayment terms, including the amount and duration of the deductions, will be outlined in the approval notice you receive.

-

What happens if my request is denied?

If your request for an advance is denied, you will receive a notification explaining the reasons for the denial. You may have the option to appeal the decision or to submit a revised request if you believe additional information could support your case.

-

Can I request multiple advances?

Requesting multiple advances may be possible, but it often depends on your employer's policies. Each request will typically be evaluated on its own merits. Frequent requests may raise concerns about financial management, so be prepared to provide a strong justification for each request.

-

Where do I submit the completed Employee Advance form?

You should submit the completed form to your HR department or the designated person responsible for processing advance requests. Be sure to keep a copy for your records and follow up to confirm receipt of your application.

Misconceptions

Understanding the Employee Advance form is essential for both employees and employers. However, several misconceptions can lead to confusion. Here are ten common misunderstandings:

- Only management can request an advance. Many believe that only upper management is eligible to request an employee advance. In reality, any employee can submit a request, provided they follow the appropriate procedures.

- Employee advances are loans. Some people think that an advance is a loan that must be paid back with interest. However, advances are typically deducted from future paychecks without any interest charges.

- Advances are automatically approved. There is a misconception that all requests for advances will be granted. Approval depends on the company's policies and the employee's circumstances.

- There is no limit on the amount of advance. Employees may assume they can request any amount. Most companies set a cap on the amount that can be advanced, which varies by organization.

- Advances affect tax withholdings. Some employees worry that receiving an advance will change their tax withholdings. In most cases, advances are treated as regular income and do not alter tax calculations.

- Only emergencies qualify for an advance. While emergencies are a common reason for requesting an advance, other situations, such as unexpected expenses or travel, may also qualify.

- Advances must be repaid immediately. There is a belief that employees must repay advances in the next paycheck. Typically, repayment terms are outlined in the company policy and may extend over several pay periods.

- Submitting a request is a lengthy process. Many think that the approval process for an advance takes a long time. In reality, most companies aim to process requests quickly to assist employees in need.

- All advances are taxable. Some employees are under the impression that all advances are subject to taxes. However, if an advance is repaid within the same tax year, it may not be taxable.

- Documentation is not required. Lastly, there is a misconception that no documentation is needed to support a request for an advance. Most companies require some form of justification or documentation to process the request.

By clearing up these misconceptions, employees can navigate the Employee Advance form process more effectively and understand their rights and responsibilities.

Common mistakes

-

Inaccurate Information: Many individuals fail to provide correct personal details, such as their name, employee ID, or department. This can lead to delays in processing the advance.

-

Missing Signatures: Some employees forget to sign the form. Without a signature, the request may not be considered valid.

-

Insufficient Justification: A common mistake is not providing a clear reason for the advance. Lacking a solid justification can result in denial of the request.

-

Incorrect Amount Requested: Employees sometimes request an amount that exceeds the allowable limit. This can lead to immediate rejection of the application.

-

Failure to Attach Required Documentation: Some forms require supporting documents. Not including these can cause delays or denials.

-

Not Following Submission Procedures: Each organization has specific submission guidelines. Ignoring these can result in the form being overlooked or misplaced.

Additional PDF Templates

Chicago Title Lien Waiver - It mandates transparency about payments and project financing throughout the project.

The New York Operating Agreement form is a legal document that outlines the management and operational procedures of a limited liability company (LLC) in New York. This agreement is crucial for defining the roles and responsibilities of members, ensuring clarity and protection for all parties involved. Business owners can access a template for this essential document at https://documentonline.org/blank-new-york-operating-agreement, which can help them navigate the complexities of LLC operations effectively.

Designing a Family Crest - This form is essential for anyone looking to create meaningful connections to their ancestry through visual art.

Document Data

| Fact Name | Details |

|---|---|

| Purpose | The Employee Advance form is used to request an advance on salary or wages. |

| Eligibility | Typically, all employees who have been with the company for a specified period can apply. |

| Repayment Terms | Advances are usually repaid through payroll deductions over a set period. |

| State-Specific Requirements | Some states may have specific laws governing payroll advances. For example, California requires written agreements. |

| Approval Process | Managers or HR typically review and approve the requests based on company policy. |

| Impact on Taxes | Employee advances may be considered taxable income, affecting withholding amounts. |

| Documentation | Employees may need to provide supporting documents, such as a reason for the advance. |

| Confidentiality | Details of the advance request are generally kept confidential within HR and management. |

Similar forms

The Employee Advance form shares similarities with the Expense Reimbursement form. Both documents facilitate the management of financial transactions within an organization. Employees utilize the Expense Reimbursement form to seek reimbursement for costs incurred during work-related activities. Similarly, the Employee Advance form allows employees to request funds in advance for anticipated expenses. Both forms require detailed documentation and approval processes to ensure transparency and accountability in financial dealings.

When navigating the complexities of financial responsibilities in the workplace, understanding various forms is essential, particularly the Texas Durable Power of Attorney form, which allows individuals to delegate authority for managing their affairs. For further guidance on legal protocols regarding this form, one can visit OnlineLawDocs.com to ensure they are fully informed about the process and its implications.

Another document that resembles the Employee Advance form is the Travel Authorization form. Employees often complete this form to obtain permission for business travel and associated costs. Like the Employee Advance form, the Travel Authorization form outlines the purpose of the trip, expected expenses, and the duration of travel. Both forms aim to ensure that employees are prepared for their financial commitments while also allowing the organization to manage budgets effectively.

Lastly, the Payroll Advance form is closely related to the Employee Advance form. Employees may use the Payroll Advance form to request an early release of their wages for various reasons. This document, like the Employee Advance form, is intended to assist employees in managing their finances during times of need. Both forms require a clear explanation of the request and typically necessitate supervisory approval, ensuring that the organization maintains control over its financial resources.