Blank Deed in Lieu of Foreclosure Form

A Deed in Lieu of Foreclosure is a legal document that offers a homeowner an alternative to the lengthy and often stressful foreclosure process. This option allows a borrower to voluntarily transfer the title of their property to the lender in exchange for the cancellation of their mortgage debt. By choosing this route, homeowners can avoid the negative consequences associated with foreclosure, such as damage to their credit score and the potential for legal complications. The form itself typically includes essential information such as the names of the parties involved, a description of the property, and the terms of the agreement. It is crucial for both parties to understand their rights and obligations outlined in the document. Additionally, the lender may agree to release the homeowner from any further liability related to the mortgage, providing a fresh start for individuals facing financial difficulties. Overall, a Deed in Lieu of Foreclosure can be a beneficial solution for those looking to mitigate the impacts of financial hardship while simplifying the transition away from homeownership.

Document Example

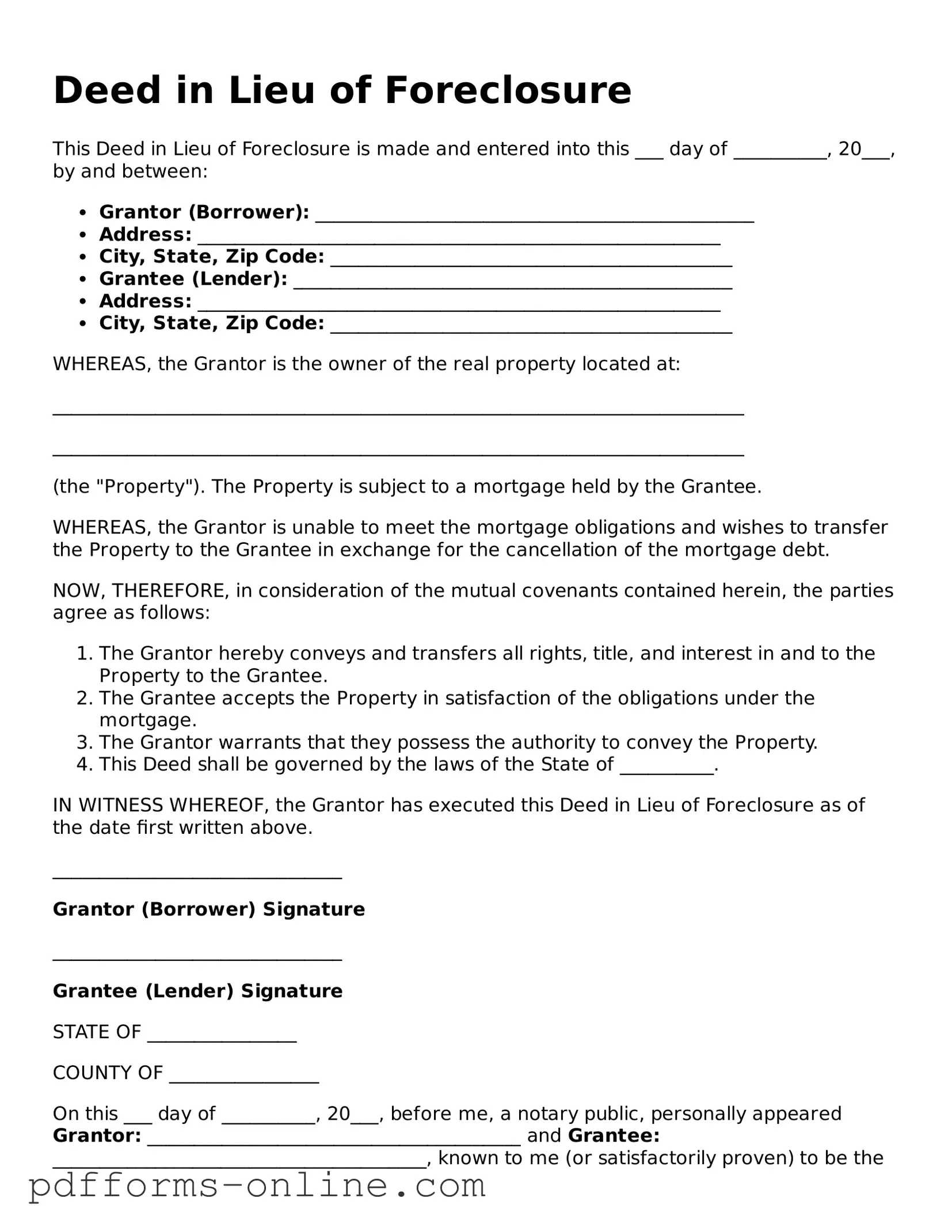

Deed in Lieu of Foreclosure

This Deed in Lieu of Foreclosure is made and entered into this ___ day of __________, 20___, by and between:

- Grantor (Borrower): _______________________________________________

- Address: ________________________________________________________

- City, State, Zip Code: ___________________________________________

- Grantee (Lender): _______________________________________________

- Address: ________________________________________________________

- City, State, Zip Code: ___________________________________________

WHEREAS, the Grantor is the owner of the real property located at:

__________________________________________________________________________

__________________________________________________________________________

(the "Property"). The Property is subject to a mortgage held by the Grantee.

WHEREAS, the Grantor is unable to meet the mortgage obligations and wishes to transfer the Property to the Grantee in exchange for the cancellation of the mortgage debt.

NOW, THEREFORE, in consideration of the mutual covenants contained herein, the parties agree as follows:

- The Grantor hereby conveys and transfers all rights, title, and interest in and to the Property to the Grantee.

- The Grantee accepts the Property in satisfaction of the obligations under the mortgage.

- The Grantor warrants that they possess the authority to convey the Property.

- This Deed shall be governed by the laws of the State of __________.

IN WITNESS WHEREOF, the Grantor has executed this Deed in Lieu of Foreclosure as of the date first written above.

_______________________________

Grantor (Borrower) Signature

_______________________________

Grantee (Lender) Signature

STATE OF ________________

COUNTY OF ________________

On this ___ day of __________, 20___, before me, a notary public, personally appeared Grantor: ________________________________________ and Grantee: ________________________________________, known to me (or satisfactorily proven) to be the persons whose names are subscribed to the within instrument, and acknowledged that they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

_______________________________

Notary Public Signature

My commission expires: ________________

State-specific Guides for Deed in Lieu of Foreclosure Documents

Frequently Asked Questions

-

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is an agreement where a homeowner voluntarily transfers the title of their property to the lender to avoid foreclosure. This process allows the homeowner to relinquish their property and, in return, the lender agrees to forgive the remaining mortgage debt.

-

What are the benefits of a Deed in Lieu of Foreclosure?

There are several benefits to consider:

- It can be less damaging to your credit score compared to a foreclosure.

- You may avoid the lengthy and stressful foreclosure process.

- The lender may waive the remaining debt, relieving you of financial obligations.

-

Are there any drawbacks to a Deed in Lieu of Foreclosure?

Yes, there are potential drawbacks:

- You may still face tax implications if the lender forgives a portion of the debt.

- Not all lenders accept Deeds in Lieu, so you may need to negotiate.

- You will lose your home and any equity you may have built up.

-

Who qualifies for a Deed in Lieu of Foreclosure?

Typically, homeowners who are facing financial hardship and unable to keep up with mortgage payments may qualify. However, specific requirements can vary by lender, so it's important to check with your mortgage company.

-

How do I initiate a Deed in Lieu of Foreclosure?

To start the process, contact your lender as soon as you realize you may not be able to make your mortgage payments. Provide them with details about your financial situation. They will guide you through the necessary steps and documentation.

-

What documentation is required for a Deed in Lieu of Foreclosure?

You will generally need to provide:

- Proof of income and financial hardship.

- Details about the property, including the mortgage statement.

- A completed application form from your lender.

-

What happens after I sign the Deed in Lieu of Foreclosure?

Once you sign the deed, the lender will take ownership of the property. They will typically handle the sale of the property. You should receive confirmation that your mortgage debt has been satisfied, but ensure you keep all documentation for your records.

-

Can I still buy another home after a Deed in Lieu of Foreclosure?

Yes, you can buy another home after a Deed in Lieu, but it may take some time. Most lenders will require a waiting period, which can vary. During this time, focus on rebuilding your credit and improving your financial situation.

Misconceptions

When it comes to the Deed in Lieu of Foreclosure, many people hold misconceptions that can lead to confusion. Understanding the facts can help homeowners make informed decisions. Here are four common misconceptions:

- It completely erases all debt. Many believe that signing a Deed in Lieu of Foreclosure wipes away all financial obligations. In reality, it typically only addresses the mortgage debt. Other debts, such as second mortgages or personal loans, may still remain.

- It guarantees a smooth process. Some think that opting for a Deed in Lieu of Foreclosure will always lead to a quick and easy resolution. However, the process can still be complicated and may involve negotiations with the lender, which can take time.

- It has no impact on credit scores. A common belief is that a Deed in Lieu of Foreclosure won't affect credit ratings. In truth, it can still negatively impact credit scores, although it may be less severe than a foreclosure.

- It is the best option for everyone facing foreclosure. Some homeowners assume that a Deed in Lieu of Foreclosure is the best choice for anyone struggling with mortgage payments. However, this option may not be suitable for everyone, and alternatives like loan modifications or short sales might be better in certain situations.

By clarifying these misconceptions, homeowners can better navigate their options and make decisions that align with their financial goals.

Common mistakes

-

Failing to provide accurate property information. Ensure that the property address and legal description are correct.

-

Not including all necessary parties. All owners of the property must sign the deed to make it valid.

-

Ignoring the lender's requirements. Each lender may have specific instructions or additional forms needed for the deed.

-

Overlooking potential tax implications. Consult a tax professional to understand any tax consequences of the deed.

-

Not obtaining a notary signature. The deed must be notarized to be legally binding.

-

Failing to retain copies of the document. Keep a copy for your records to prove the transfer of ownership.

-

Rushing the process. Take the time to review all details before submitting the form to avoid mistakes.

-

Not seeking legal advice when needed. If unsure about any part of the process, consult with a legal professional.

Fill out Common Types of Deed in Lieu of Foreclosure Forms

Correction Deed California - This document assists in refreshing title records for lenders and future buyers.

Does California Have a Transfer on Death Deed - The Transfer-on-Death Deed can be a part of a comprehensive estate plan tailored to individual needs.

When entering into a rental agreement in Ohio, it is essential to understand the terms outlined in the Ohio Lease Agreement form, which helps prevent any ambiguities. This legal document includes critical details such as rent, duration, and the responsibilities of both the landlord and tenant. For more guidance on creating an effective lease, you can refer to the resources available at documentonline.org/blank-ohio-lease-agreement, ensuring you are well-informed to protect the interests of all parties involved.

Lady Bird Deed Michigan Form - Property owners should consider discussing the deed with an attorney for guidance.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal document where a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure proceedings. |

| Purpose | This option helps borrowers avoid the lengthy and costly foreclosure process, while allowing lenders to recover their losses more quickly. |

| Eligibility | Typically, borrowers must demonstrate financial hardship and have no other viable options to repay their mortgage to qualify. |

| State-Specific Forms | Each state may have its own specific form and requirements. For example, in California, the governing law is found in the California Civil Code. |

| Impact on Credit Score | A deed in lieu of foreclosure can negatively affect a borrower's credit score, but it may be less damaging than a foreclosure. |

| Tax Implications | Borrowers may face tax consequences if the lender forgives any portion of the debt. It is advisable to consult a tax professional. |

| Legal Assistance | Seeking legal advice before signing a deed in lieu of foreclosure is recommended to understand the implications fully. |

| Alternatives | Other options include loan modification, short sale, or bankruptcy, which may be more favorable depending on the borrower's situation. |

| Process | The process typically involves negotiation with the lender, completing the necessary documentation, and transferring the deed. |

Similar forms

A Short Sale Agreement is similar to a Deed in Lieu of Foreclosure because both involve the homeowner relinquishing their property to avoid foreclosure. In a short sale, the lender agrees to accept less than the full amount owed on the mortgage. The homeowner sells the property and uses the proceeds to pay off the lender. This process can help the homeowner mitigate damage to their credit score while allowing the lender to recover some of their losses.

A Mortgage Modification Agreement also shares similarities with a Deed in Lieu of Foreclosure. In this case, the lender agrees to change the terms of the mortgage to make it more affordable for the borrower. This might include lowering the interest rate or extending the loan term. Both options aim to prevent foreclosure by keeping the homeowner in their property while addressing their financial difficulties.

A Forbearance Agreement is another document related to the Deed in Lieu of Foreclosure. This agreement allows the borrower to temporarily pause or reduce mortgage payments without facing immediate foreclosure. The lender and borrower agree on a plan to resume payments later. Both documents serve as alternatives to foreclosure, offering the homeowner a chance to regain financial stability.

The Quitclaim Deed can also be associated with the Deed in Lieu of Foreclosure. This document transfers ownership of a property without warranties. In situations where a homeowner is in peril of foreclosure, a quitclaim deed may be utilized to quickly transfer ownership to a nonprofit or another party. Both document types aim to facilitate smoother transitions, minimizing negative impact for the parties involved. For more details on this process, you can visit OnlineLawDocs.com.

A Repayment Plan is similar as it outlines a structured approach for the borrower to catch up on missed payments. The lender agrees to allow the borrower to pay back overdue amounts over time. Like a Deed in Lieu of Foreclosure, this plan aims to help the homeowner retain their property while addressing financial issues.

A Bankruptcy Filing can also relate to a Deed in Lieu of Foreclosure. While bankruptcy is a legal process that can help individuals eliminate or reorganize debt, it may also lead to a foreclosure situation. In some cases, homeowners may choose to file for bankruptcy to protect their assets, including their home, while negotiating with creditors. Both processes aim to provide relief from overwhelming debt, though the outcomes differ significantly.

A Loan Assumption Agreement is another document that bears similarities. In this scenario, a third party agrees to take over the existing mortgage from the original borrower. This can be beneficial for the homeowner who wants to avoid foreclosure. It allows someone else to take responsibility for the mortgage payments, helping both parties avoid the negative consequences of foreclosure.

Lastly, a Quitclaim Deed can be compared to a Deed in Lieu of Foreclosure. This document allows a property owner to transfer their interest in the property to another party without any guarantees about the title. While a Quitclaim Deed is often used in family transfers or to clear up title issues, it can also serve as a way for homeowners to relinquish their property to avoid foreclosure, though it may not involve the lender's consent.