Blank Childcare Receipt Template

The Childcare Receipt form serves as an essential document for parents and guardians seeking to keep accurate records of childcare expenses. It provides a clear and organized way to track payments made to childcare providers. Each receipt includes critical information such as the date of service, the amount paid, and the name of the child or children receiving care. Additionally, the form specifies the period during which the childcare services were rendered, allowing for easy reference during tax season or when applying for financial assistance. A signature from the childcare provider adds an extra layer of authenticity, confirming that the transaction took place. This straightforward form not only aids in personal budgeting but also ensures compliance with any necessary tax deductions related to childcare expenses.

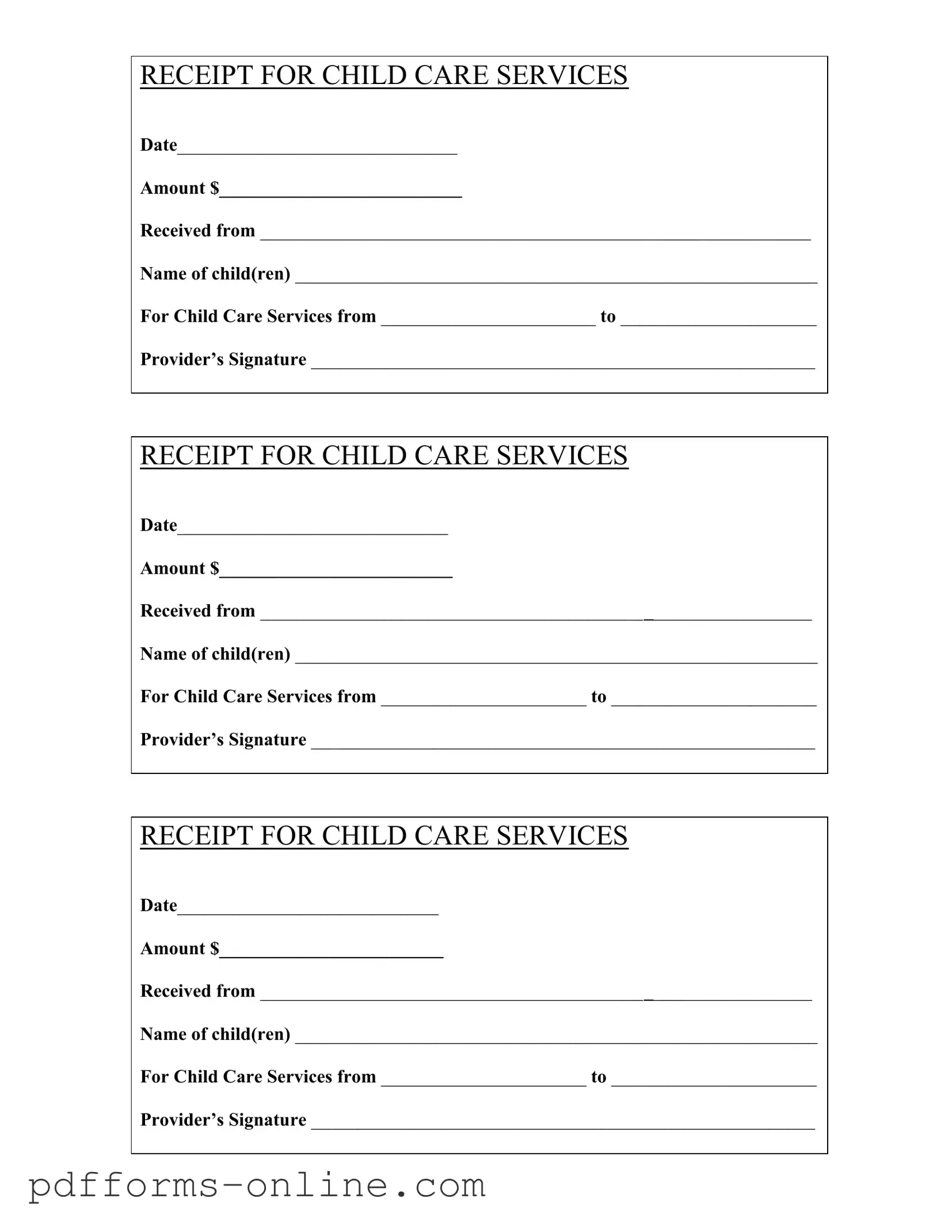

Document Example

RECEIPT FOR CHILD CARE SERVICES

Date______________________________

Amount $__________________________

Received from ___________________________________________________________

Name of child(ren) ________________________________________________________

For Child Care Services from _______________________ to _____________________

Provider’s Signature ______________________________________________________

RECEIPT FOR CHILD CARE SERVICES

Date_____________________________

Amount $_________________________

Received from ___________________________________________________________

Name of child(ren) ________________________________________________________

For Child Care Services from ______________________ to ______________________

Provider’s Signature ______________________________________________________

RECEIPT FOR CHILD CARE SERVICES

Date____________________________

Amount $________________________

Received from ___________________________________________________________

Name of child(ren) ________________________________________________________

For Child Care Services from ______________________ to ______________________

Provider’s Signature ______________________________________________________

Frequently Asked Questions

-

What is the purpose of the Childcare Receipt form?

The Childcare Receipt form serves as proof of payment for childcare services. Parents or guardians receive this receipt from the childcare provider after making a payment. It is essential for record-keeping, tax purposes, and any potential reimbursement claims.

-

What information is required on the Childcare Receipt form?

The form must include several key details:

- The date of the transaction.

- The amount paid for the childcare services.

- The name of the person making the payment.

- The names of the child(ren) receiving care.

- The dates of the childcare services provided.

- The signature of the childcare provider.

All this information ensures clarity and accuracy for both parties involved.

-

How can I obtain a Childcare Receipt?

To get a Childcare Receipt, simply ask your childcare provider for one after you make a payment. Most providers will have a standard form ready to fill out. Ensure that all necessary information is included before you leave, so you have a complete record of your transaction.

-

Can I use the Childcare Receipt for tax deductions?

Yes, you can use the Childcare Receipt when filing your taxes. It serves as documentation of your childcare expenses, which may qualify you for tax credits or deductions. Make sure to keep these receipts organized and accessible, as you will need them when preparing your tax return.

Misconceptions

Here are four common misconceptions about the Childcare Receipt form:

- Misconception 1: The form is only needed for tax purposes.

- Misconception 2: The receipt must be filled out in a specific way.

- Misconception 3: Only licensed providers can issue a receipt.

- Misconception 4: Receipts are only necessary for full-time care.

While the Childcare Receipt form is useful for tax documentation, it serves a broader purpose. It provides a clear record of childcare services rendered, which can be important for both parents and providers.

The form is flexible. As long as all required information is included, it can be filled out in a manner that works best for the provider and the parent. Clarity is key.

Any childcare provider, whether licensed or not, can issue a receipt. The important factor is that the services were provided and documented accurately.

Receipts are important regardless of the duration of care. Whether it's part-time, full-time, or occasional care, having a receipt helps maintain transparency and accountability.

Common mistakes

-

Neglecting to fill in the date: It’s crucial to write the date of service on the form. Without it, you may face difficulties in tracking payments or verifying services later.

-

Leaving out the amount: Always include the total amount paid for childcare services. Omitting this can lead to confusion or disputes over payment.

-

Not specifying the recipient: Clearly write the name of the person or entity that made the payment. This ensures that records are accurate and can be easily verified.

-

Failing to list the names of children: Make sure to include the names of all children receiving care. This is essential for clarity and proper record-keeping.

-

Omitting the service dates: Indicate the start and end dates of the childcare services. This helps in establishing the timeframe for which the payment was made.

-

Not obtaining the provider’s signature: The signature of the childcare provider is vital. Without it, the receipt may not be considered valid.

-

Using unclear handwriting: Ensure that all information is legible. Illegible writing can create misunderstandings and complicate future inquiries.

-

Not keeping a copy: Always retain a copy of the completed receipt for your records. This can be helpful for tax purposes or in case of disputes.

-

Ignoring local requirements: Be aware of any specific local or state requirements for childcare receipts. Following these can prevent issues with tax deductions or reimbursements.

Additional PDF Templates

Dh 680 Form - Failure to complete this form may hinder school enrollment for children.

What Does a Roof Warranty Cover - MCS Roofing commits to quality workmanship with a clear agenda to rectify any issues for the duration of the warranty.

To streamline the rental process, landlords often rely on the comprehensive Florida Rental Application for gathering timely and essential information about potential tenants. This document ensures that property owners can assess rental history and financial stability before making commitments. For further guidance, explore our resource on the streamlined Rental Application process.

Bf Application Google Form - Adventurer at heart, always ready for the next thrill or experience.

Document Data

| Fact Name | Description |

|---|---|

| Date | The receipt must include the date when the childcare services were provided. This helps in tracking the timeline of services rendered. |

| Amount | It is essential to specify the amount paid for the childcare services. This ensures clarity for both the provider and the parent. |

| Received From | The form requires the name of the person making the payment. This identifies the payer and confirms who is responsible for the transaction. |

| Name of Child(ren) | Listing the names of the child or children receiving care is crucial. This links the payment to specific childcare services. |

| Service Dates | The form should indicate the start and end dates for the childcare services provided. This helps in verifying the duration of care. |

| Provider's Signature | A signature from the childcare provider is necessary. This serves as proof that the services were rendered and payment was received. |

| State-Specific Forms | Some states may have specific requirements for childcare receipts. Always check local regulations to ensure compliance. |

| Record Keeping | Parents should keep a copy of the receipt for tax purposes and to track childcare expenses throughout the year. |

| Governing Laws | In many states, childcare services are governed by specific laws regarding licensing and financial transactions. Familiarity with these laws is important for both providers and parents. |

Similar forms

The Childcare Receipt form is similar to a Tuition Receipt. Both documents serve as proof of payment for services rendered. A Tuition Receipt details the amount paid for educational services, including the date and the name of the student. It often includes the institution's name and a breakdown of fees, just like the Childcare Receipt outlines the child’s name and the specific childcare services provided.

Another comparable document is the Medical Receipt. This receipt confirms payment for medical services received, including details such as the date of service, the amount paid, and the provider's signature. Just as the Childcare Receipt specifies the child’s name and service dates, a Medical Receipt includes the patient's name and the treatment period, ensuring clarity and accountability for both parties.

A Rental Receipt also shares similarities with the Childcare Receipt. It records payment for renting property or equipment. This document includes the date, amount paid, and the name of the renter. Like the Childcare Receipt, it serves as proof of payment and can be used for record-keeping or tax purposes.

The Payment Receipt for Services is another document that resembles the Childcare Receipt. It confirms payment for various services, such as repairs or consulting. It typically includes the date, amount, and the service recipient's name. Both receipts function as evidence of payment and can be essential for financial tracking.

For those managing the nuances of company policies, familiarizing oneself with the All Arizona Forms can be invaluable, especially when considering the importance of clear communication between employers and employees. Understanding the different forms, including receipts for childcare and other services, helps ensure proper documentation is maintained, ultimately fostering a more organized workplace environment.

A Donation Receipt is similar in that it acknowledges a contribution made to a charitable organization. This document includes the date of the donation, the amount, and the donor's name. Just like the Childcare Receipt, it serves a specific purpose: providing proof for tax deductions and ensuring transparency in financial transactions.

Lastly, the Invoice serves a similar function to the Childcare Receipt by detailing services provided and payment due. An invoice lists the services rendered, the amount owed, and payment terms. While the Childcare Receipt confirms payment has been made, an invoice indicates what is owed, making both crucial for financial documentation and accountability.