Blank Cg 20 10 07 04 Liability Endorsement Template

The CG 20 10 07 04 Liability Endorsement form is an essential document for businesses seeking to protect themselves from potential liabilities that may arise during their operations. It specifically addresses the inclusion of additional insured parties, such as owners, lessees, or contractors, under a commercial general liability insurance policy. This endorsement modifies the existing coverage by extending liability protection to the specified individuals or organizations listed in the schedule. The form outlines critical aspects, including the nature of coverage for bodily injury, property damage, and personal and advertising injury, which may result from the actions of the insured or their representatives. It is important to note that this coverage is limited to the extent permitted by law and must align with any contractual obligations that the insured has agreed to. Furthermore, the endorsement clarifies that the coverage does not apply once the work has been completed or when the project has been put to its intended use, ensuring that both parties understand the limitations of the insurance. By comprehensively detailing these provisions, the CG 20 10 07 04 form aims to provide clarity and reassurance to businesses navigating their liability risks.

Document Example

POLICY NUMBER: |

COMMERCIAL GENERAL LIABILITY |

|

CG 20 10 12 19 |

THIS ENDORSEMENT CHANGES THE POLICY. PLEASE READ IT CAREFULLY.

ADDITIONAL INSURED – OWNERS, LESSEES OR

CONTRACTORS – SCHEDULED PERSON OR

ORGANIZATION

This endorsement modifies insurance provided under the following:

COMMERCIAL GENERAL LIABILITY COVERAGE PART

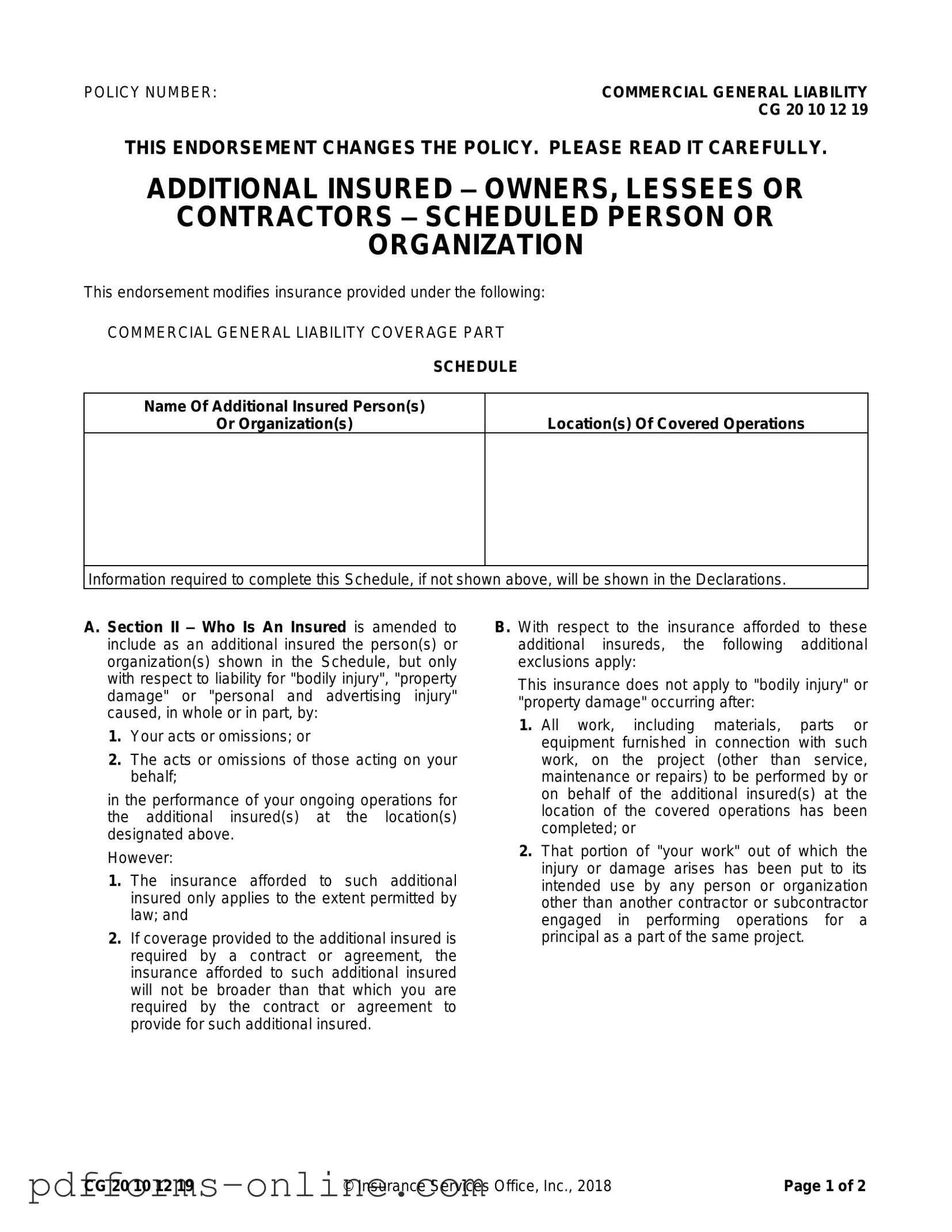

SCHEDULE

Name Of Additional Insured Person(s)

Or Organization(s)

Location(s) Of Covered Operations

Information required to complete this Schedule, if not shown above, will be shown in the Declarations.

A. Section II – Who Is An Insured is amended to include as an additional insured the person(s) or organization(s) shown in the Schedule, but only with respect to liability for "bodily injury", "property damage" or "personal and advertising injury" caused, in whole or in part, by:

1.Your acts or omissions; or

2.The acts or omissions of those acting on your behalf;

in the performance of your ongoing operations for the additional insured(s) at the location(s) designated above.

However:

1.The insurance afforded to such additional insured only applies to the extent permitted by law; and

2.If coverage provided to the additional insured is required by a contract or agreement, the insurance afforded to such additional insured will not be broader than that which you are required by the contract or agreement to provide for such additional insured.

B. With respect to the insurance afforded to these additional insureds, the following additional exclusions apply:

This insurance does not apply to "bodily injury" or "property damage" occurring after:

1.All work, including materials, parts or equipment furnished in connection with such work, on the project (other than service, maintenance or repairs) to be performed by or on behalf of the additional insured(s) at the location of the covered operations has been completed; or

2.That portion of "your work" out of which the injury or damage arises has been put to its intended use by any person or organization other than another contractor or subcontractor engaged in performing operations for a principal as a part of the same project.

CG 20 10 12 19 |

© Insurance Services Office, Inc., 2018 |

Page 1 of 2 |

C. With respect to the insurance afforded to these additional insureds, the following is added to

Section III – Limits Of Insurance:

If coverage provided to the additional insured is required by a contract or agreement, the most we will pay on behalf of the additional insured is the amount of insurance:

1.Required by the contract or agreement; or

2.Available under the applicable limits of insurance;

whichever is less.

This endorsement shall not increase the applicable limits of insurance.

Page 2 of 2 |

© Insurance Services Office, Inc., 2018 |

CG 20 10 12 19 |

Frequently Asked Questions

-

What is the purpose of the CG 20 10 07 04 Liability Endorsement?

This endorsement is designed to add specific individuals or organizations as additional insureds under a Commercial General Liability policy. It helps protect these additional insureds from liability arising from bodily injury, property damage, or personal and advertising injury that may occur during the performance of ongoing operations.

-

Who qualifies as an additional insured under this endorsement?

The endorsement specifically names individuals or organizations in a schedule. These additional insureds are covered for liabilities that arise from your acts or omissions, or those of others acting on your behalf, while performing operations for them at designated locations.

-

Are there any limitations on the coverage provided to additional insureds?

Yes, coverage is limited. It only applies to the extent permitted by law and cannot exceed what is required by any contract or agreement. If a contract specifies a certain level of coverage, the endorsement will not provide broader coverage than what is stipulated.

-

What exclusions apply to this endorsement?

There are specific exclusions to be aware of. Coverage does not apply to bodily injury or property damage occurring after the completion of all work related to the project, or if the work has been put to its intended use by someone other than a contractor or subcontractor working on the same project.

-

How does this endorsement affect the limits of insurance?

The endorsement does not increase the overall limits of insurance. If coverage for the additional insured is required by a contract, the maximum amount payable will be the lesser of the contractually required limit or the applicable limits of insurance available under the policy.

-

What types of injuries or damages are covered?

The endorsement covers "bodily injury," "property damage," and "personal and advertising injury" that occurs as a result of your operations for the additional insured. This ensures that the additional insureds are protected from claims related to these types of incidents.

-

Is there a requirement for the additional insured to be named in the policy?

Yes, the additional insured must be specifically named in the endorsement's schedule. This ensures clarity regarding who is covered and under what circumstances.

-

How can I modify the schedule of additional insureds?

To modify the schedule, you would typically need to contact your insurance provider. They can assist in making the necessary changes to ensure that the correct individuals or organizations are listed as additional insureds.

-

What should I do if I have further questions about this endorsement?

If you have additional questions, it is advisable to consult with your insurance agent or a legal advisor. They can provide tailored guidance based on your specific situation and help clarify any concerns regarding coverage.

Misconceptions

Here are five common misconceptions about the CG 20 10 07 04 Liability Endorsement form:

- It automatically covers all liabilities. Many believe that this endorsement provides blanket coverage for all types of liabilities. In reality, it only covers specific liabilities related to the additional insured's operations as outlined in the endorsement.

- Any additional insured is fully covered. Some think that once a person or organization is listed as an additional insured, they have full coverage. However, the coverage is limited to what is required by law or the contract, and it only applies to specific situations.

- Coverage lasts indefinitely. There is a misconception that the coverage continues indefinitely. In fact, it only applies while the ongoing operations are being performed and does not extend after the work is completed or when the project is put to its intended use.

- The endorsement increases the policy limits. Many people assume that adding an additional insured will increase the overall policy limits. This is not true. The endorsement does not increase the limits of insurance; it only applies within the existing limits.

- All exclusions are the same for every policy. Some believe that the exclusions listed in this endorsement are standard across all policies. However, exclusions can vary based on the specific terms of the policy and the nature of the operations being performed.

Common mistakes

-

Incomplete Information: Failing to provide all necessary details about the additional insured can lead to coverage gaps. Ensure that the names and locations are fully and accurately filled out.

-

Incorrect Policy Number: Entering the wrong policy number can cause significant delays. Always double-check the policy number to ensure it matches the one on your documents.

-

Misunderstanding Coverage Limits: Not understanding the limits of coverage can lead to assumptions that are incorrect. Review the endorsement carefully to know what limits apply to additional insureds.

-

Ignoring Exclusions: Overlooking the specific exclusions listed in the endorsement can result in unexpected liabilities. Read the exclusions section thoroughly to understand what is not covered.

-

Failing to Update Information: Not updating the form when there are changes in operations or additional insureds can create issues. Keep the form current to reflect any changes in your business relationships.

-

Not Consulting Legal or Insurance Experts: Attempting to fill out the form without professional guidance can lead to errors. It's wise to consult with an expert if you have any doubts about the requirements.

Additional PDF Templates

Imm1294 Form - The application form can be accessed from Immigration, Refugees and Citizenship Canada.

To further clarify the details involved in a Residential Lease Agreement, it is essential for both parties to consult reliable resources, such as onlinelawdocs.com, which provide comprehensive templates and guidance on creating these important contracts.

Prehospital Medical Care Directive - The California Advanced Health Care Directive can offer comfort in knowing your plans are in place.

D2 Form - Applicants should read the booklet INF1D before completing the form.

Document Data

| Fact Name | Description |

|---|---|

| Policy Number | The endorsement is identified by the policy number CG 20 10 12 19. |

| Purpose | This endorsement adds additional insured status for owners, lessees, or contractors. |

| Coverage Part | It modifies the insurance provided under the Commercial General Liability Coverage Part. |

| Who is Insured | It includes persons or organizations listed in the Schedule as additional insureds. |

| Liability Scope | Covers liability for bodily injury, property damage, or personal and advertising injury. |

| Exclusions | Insurance does not apply to injuries or damages occurring after work is completed. |

| Contractual Limits | The coverage for additional insureds cannot exceed what is required by contract. |

| Applicable Laws | This endorsement is governed by state-specific laws, which may vary by jurisdiction. |

| Limit of Insurance | The endorsement does not increase the overall limits of insurance. |

| Modification Notice | The endorsement clearly states that it changes the policy and should be read carefully. |

Similar forms

The CG 20 10 07 04 Liability Endorsement form shares similarities with the CG 20 10 01 04 Additional Insured – Owners, Lessees or Contractors form. Both documents serve the purpose of extending coverage to additional insured parties, specifically owners, lessees, or contractors. They outline the conditions under which these additional insured parties are protected against liability arising from the acts or omissions of the primary insured. The key distinction lies in the specific provisions and limitations outlined in each form, which may vary based on the nature of the contractual obligations and the specific operations being performed.

Another related document is the CG 20 37 04 13 Additional Insured – Completed Operations form. This endorsement is similar in that it provides coverage to additional insured parties but focuses specifically on completed operations. It protects against liabilities that may arise after work has been completed, ensuring that additional insureds are covered for claims related to work done by the primary insured. While both endorsements aim to protect additional insureds, the CG 20 37 04 13 form emphasizes the coverage for incidents occurring post-completion, thereby addressing a different aspect of risk management.

The CG 20 33 04 13 Additional Insured – Designated Person or Organization form also bears resemblance to the CG 20 10 07 04 Liability Endorsement. This endorsement is designed to add specific individuals or organizations as additional insureds under a commercial general liability policy. It details the circumstances under which these designated parties are covered, similar to how the CG 20 10 07 04 outlines coverage for additional insureds. The main difference is that the CG 20 33 04 13 focuses on named entities rather than general categories, which can provide a more tailored coverage approach.

The Access-A-Ride NYC Application form is essential for employees looking to enroll in the City of New York Commuter Benefits Program, specifically geared towards Access-A-Ride or other paratransit plan participants. It delineates the submission process for the completed form and necessary documentation, highlighting the pre-tax benefit based on eligibility. This form serves various functions for the employee, such as enrolling, updating personal information, adjusting deductions, and cancellations, thereby ensuring that the commuting needs are effectively addressed through the MTA New York City Transit Access-A-Ride Program or other paratransit services. For further details, you can read more.

Lastly, the CG 20 10 11 85 Additional Insured – Managers or Lessors of Premises form is another document that aligns with the CG 20 10 07 04 Liability Endorsement. This form specifically extends coverage to managers or lessors of premises, protecting them from liabilities that may arise from the operations of the primary insured on their property. Both endorsements aim to provide additional protection for third parties involved in a contractual relationship with the primary insured, but the CG 20 10 11 85 focuses on premises-related risks, which can differ significantly from the broader operational risks covered by the CG 20 10 07 04.