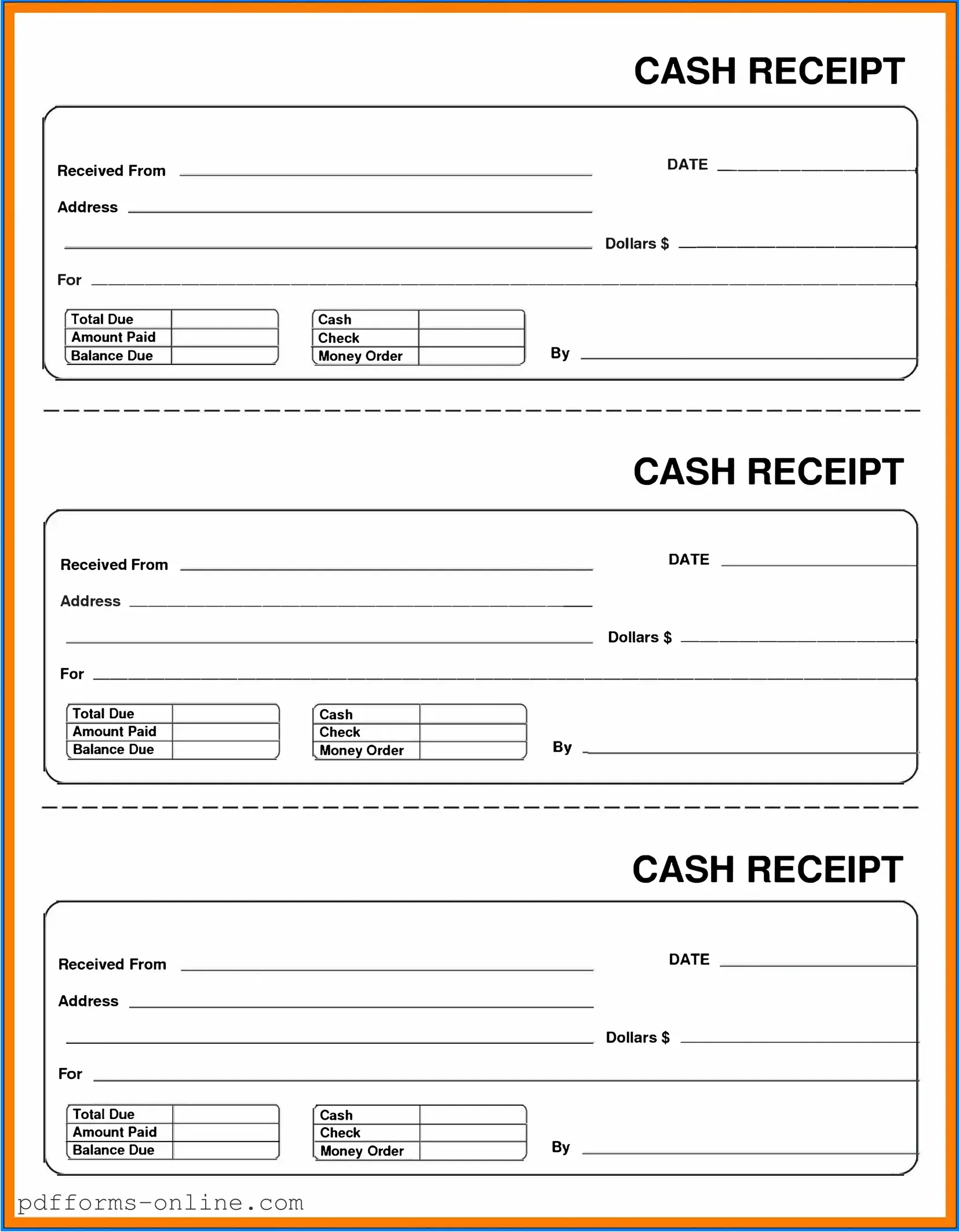

Blank Cash Receipt Template

The Cash Receipt form is an essential document used in various financial transactions, primarily to record payments received by a business or organization. This form serves multiple purposes, including providing proof of payment for customers and ensuring accurate accounting records. Typically, it includes important details such as the date of the transaction, the amount received, the method of payment (cash, check, credit card, etc.), and a description of the goods or services provided. Additionally, the form often requires signatures from both the payer and the receiver, which helps to verify the transaction's authenticity. By maintaining organized records through the Cash Receipt form, businesses can streamline their financial processes and enhance transparency in their operations. Understanding its components and significance can help individuals and organizations manage their finances more effectively.

Document Example

CASH RECEIPT

Received From |

|

� |

|||

Address |

|

|

Dollars$ |

||

|

|

|

|

||

|

� |

||||

Total Due

Amount Paid

Balance Due

Cash

Check

Money Order

By

CASH RECEIPT

Received From |

|

|

|

|

|

|

|

|

|

DATE |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||||||

Address ________________________ |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Dollars$ |

+ |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Due |

|

|

|

|

|

Cash |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Amount Paid |

|

|

|

|

|

Check |

|

|

By |

|

|

|

|

|

|

Balance Due |

|

|

|

|

|

Money Order |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH RECEIPT

Received From |

|

DATE |

|||

Address |

|

|

|

||

|

|

|

|

Dollars$ |

|

For |

|

|

|

||

Total Due

Amount Paid

Balance Due

Cash

Check

Money Order

By

Frequently Asked Questions

-

What is a Cash Receipt form?

A Cash Receipt form is a document used to record the receipt of cash payments. It serves as proof of payment for both the payer and the recipient. This form typically includes details such as the date of the transaction, the amount received, the purpose of the payment, and the names of both parties involved. By maintaining accurate records, organizations can ensure transparency and accountability in their financial transactions.

-

Who should use a Cash Receipt form?

Any individual or organization that receives cash payments can benefit from using a Cash Receipt form. This includes businesses, non-profits, and freelancers. For example, a retail store may issue a cash receipt to a customer after a purchase, while a contractor may provide one to a client after receiving a deposit. Utilizing this form helps to keep financial records organized and can assist in tax reporting and auditing processes.

-

What information is typically included on a Cash Receipt form?

A standard Cash Receipt form generally includes the following information:

- Date of payment

- Name of the payer

- Name of the recipient

- Amount received

- Purpose of the payment

- Method of payment (e.g., cash, check, credit card)

- Receipt number for tracking

This information helps to ensure that both parties have a clear understanding of the transaction and provides a reference for future inquiries.

-

How should a Cash Receipt form be stored?

It is important to store Cash Receipt forms securely to protect sensitive financial information. Organizations may choose to keep physical copies in a locked file cabinet or safe. Alternatively, electronic versions can be stored in a secure, password-protected database or cloud storage. Regular backups and proper data management practices are essential to prevent loss of information. Maintaining these records for a specified period, often dictated by tax regulations, is also advisable.

Misconceptions

Understanding the Cash Receipt form is essential for accurate financial record-keeping. However, there are several misconceptions that can lead to confusion. Below is a list of common misunderstandings about this important document.

- Cash Receipt forms are only for cash transactions. This is not true. While they are primarily used for cash payments, they can also be issued for payments made via checks or credit cards.

- All businesses use the same Cash Receipt form. In reality, different businesses may have customized forms that suit their specific needs, although the fundamental purpose remains the same.

- A Cash Receipt form is not necessary for small transactions. Regardless of the transaction size, it is good practice to issue a receipt. This ensures proper documentation and accountability.

- Once a Cash Receipt form is filled out, it cannot be changed. While it’s best to avoid alterations, corrections can be made if necessary. Just ensure that any changes are clearly documented.

- Cash Receipt forms are only for sales. This is misleading. They can also be used to acknowledge payments for services rendered or other financial transactions.

- Cash Receipt forms are only important for accounting departments. In fact, they are valuable for all departments, including sales and customer service, as they provide proof of transactions.

- All Cash Receipt forms are the same size. Cash Receipt forms come in various sizes and formats, depending on the business’s needs and preferences.

- Cash Receipt forms are outdated in the digital age. While electronic receipts are becoming more common, physical Cash Receipt forms are still widely used and accepted.

- Only the person receiving the payment needs a Cash Receipt form. Both the payer and the payee benefit from having a copy of the receipt for their records.

- Cash Receipt forms are only for internal use. This is incorrect. They can also serve as proof of payment for customers and may be required for tax purposes.

By clarifying these misconceptions, individuals and businesses can better understand the importance and functionality of Cash Receipt forms in their financial processes.

Common mistakes

-

Incorrect Date Entry: Many individuals forget to enter the correct date or mistakenly input the wrong date. This can lead to confusion regarding the timing of the transaction.

-

Missing Payee Information: It's common for people to overlook filling in the payee's name. Without this crucial detail, tracking the transaction becomes difficult.

-

Improper Amounts: Errors in the amount being recorded often occur. Double-checking the figures can prevent discrepancies later on.

-

Omitting Payment Method: Some individuals forget to specify how the payment was made, whether by cash, check, or credit card. This information is vital for accounting purposes.

-

Neglecting Signatures: Failing to sign the form can render it invalid. Always ensure that the necessary signatures are present to authenticate the transaction.

-

Using Incomplete Descriptions: Providing vague or incomplete descriptions of the transaction can lead to misunderstandings. Clear and detailed descriptions help clarify the purpose of the payment.

-

Not Keeping Copies: Some individuals forget to keep a copy of the completed Cash Receipt form. Retaining a copy is essential for personal records and future reference.

Additional PDF Templates

Baseball Player Evaluation Form - Coaches can record player feedback on this form during tryouts.

Puppy Health Record - Make informed decisions for your pet by keeping this document updated.

For those considering renting a room, understanding the key elements of a well-structured Room Rental Agreement is crucial. This document outlines essential responsibilities for both landlords and tenants, ensuring a clear understanding of rental terms. To explore a helpful resource, visit the detailed Room Rental Agreement form.

Printable:5s6uydlipco= Living Will Template - It helps you designate someone to make medical decisions on your behalf.

Document Data

| Fact Name | Description |

|---|---|

| Definition | A Cash Receipt form is a document used to record cash transactions, confirming the receipt of payment. |

| Purpose | This form serves as proof of payment for both the payer and the recipient, ensuring transparency in financial transactions. |

| Components | Typically includes the date, amount received, payer's information, and a description of the transaction. |

| Record Keeping | Organizations use Cash Receipt forms to maintain accurate financial records and facilitate audits. |

| Legal Requirement | In some states, businesses are required to issue receipts for cash transactions under specific consumer protection laws. |

| State-Specific Laws | For example, California's Business and Professions Code Section 17500 mandates that businesses provide receipts for certain transactions. |

| Digital Versions | Many businesses now use electronic Cash Receipt forms, which can streamline the process and improve record accuracy. |

Similar forms

The Cash Receipt form bears resemblance to the Invoice document, which serves as a request for payment. Both documents detail the transaction between a buyer and a seller, outlining the goods or services provided along with the corresponding amounts due. While the Cash Receipt confirms that payment has been received, the Invoice initiates the payment process, creating a clear link between the two. Each document plays a crucial role in tracking financial exchanges and maintaining accurate records for accounting purposes.

Another document similar to the Cash Receipt is the Sales Receipt. This document is issued to customers at the point of sale, providing proof of purchase. Like the Cash Receipt, it confirms that a transaction has been completed and typically includes information such as the date of purchase, items sold, and the total amount paid. Both documents serve to validate the exchange of money for goods or services, although the Sales Receipt is often used in retail settings where immediate payment occurs.

The Payment Voucher also shares characteristics with the Cash Receipt form. This document is used to authorize payments and often includes details about the transaction, such as the amount, purpose, and recipient. While the Cash Receipt confirms receipt of funds, the Payment Voucher facilitates the disbursement of funds. Both documents are essential for financial tracking and ensuring accountability in financial transactions.

In addition, the Deposit Slip is akin to the Cash Receipt, as it records the deposit of cash or checks into a bank account. Both documents are used to confirm that funds have been received, though the Deposit Slip is specifically related to banking transactions. It typically includes information about the source of the funds, similar to how a Cash Receipt details the transaction context.

The Credit Memo is another document that parallels the Cash Receipt form. Issued by sellers to inform buyers of a reduction in the amount owed, the Credit Memo often arises from returns or adjustments. While the Cash Receipt confirms payment, the Credit Memo indicates that a credit has been applied, thus affecting the overall transaction history. Both documents are vital for maintaining accurate financial records.

In addition to the documents discussed, it's important to consider the Operating Agreement for Limited Liability Companies (LLCs) in Arizona, which serves a vital role in defining the operational structure and member responsibilities within the business. A well-drafted agreement can help prevent misunderstandings and disputes among members. For those looking for comprehensive resources to assist in creating this document, All Arizona Forms can provide essential templates and guidance for ensuring compliance with state regulations.

Furthermore, the Purchase Order can be considered similar to the Cash Receipt in that it outlines the details of a transaction prior to payment. A Purchase Order is generated by the buyer to authorize a purchase, specifying quantities, prices, and terms. While the Cash Receipt serves as proof of payment received, the Purchase Order initiates the transaction, making both documents integral to the procurement process.

The Expense Report also shares similarities with the Cash Receipt form. This document is used by employees to request reimbursement for out-of-pocket expenses incurred on behalf of the company. Both documents include details about transactions and require supporting information to validate the expenses or payments made. While the Cash Receipt confirms incoming funds, the Expense Report documents outgoing funds, highlighting their interconnected nature in financial reporting.

Lastly, the Statement of Account is comparable to the Cash Receipt as it summarizes all transactions between a buyer and seller over a specific period. This document provides an overview of outstanding balances, payments received, and any credits applied. While the Cash Receipt focuses on individual transactions, the Statement of Account offers a broader perspective on the financial relationship, making both essential for comprehensive financial management.