Blank Cash Drawer Count Sheet Template

Managing cash flow is a critical aspect of any retail operation, and the Cash Drawer Count Sheet form serves as an essential tool in this process. This form provides a systematic way to track and verify the amount of cash present in a cash drawer at the end of a shift or business day. By documenting the starting balance, recording each transaction, and noting the final cash amount, this sheet helps ensure accuracy and accountability. It not only aids in identifying discrepancies but also streamlines the reconciliation process, making it easier for managers to maintain financial integrity. Additionally, the form can serve as a valuable resource for training new employees, as it outlines the necessary steps for cash handling and promotes best practices in cash management. Ultimately, the Cash Drawer Count Sheet form is more than just a piece of paper; it is a vital component of effective financial oversight in any retail environment.

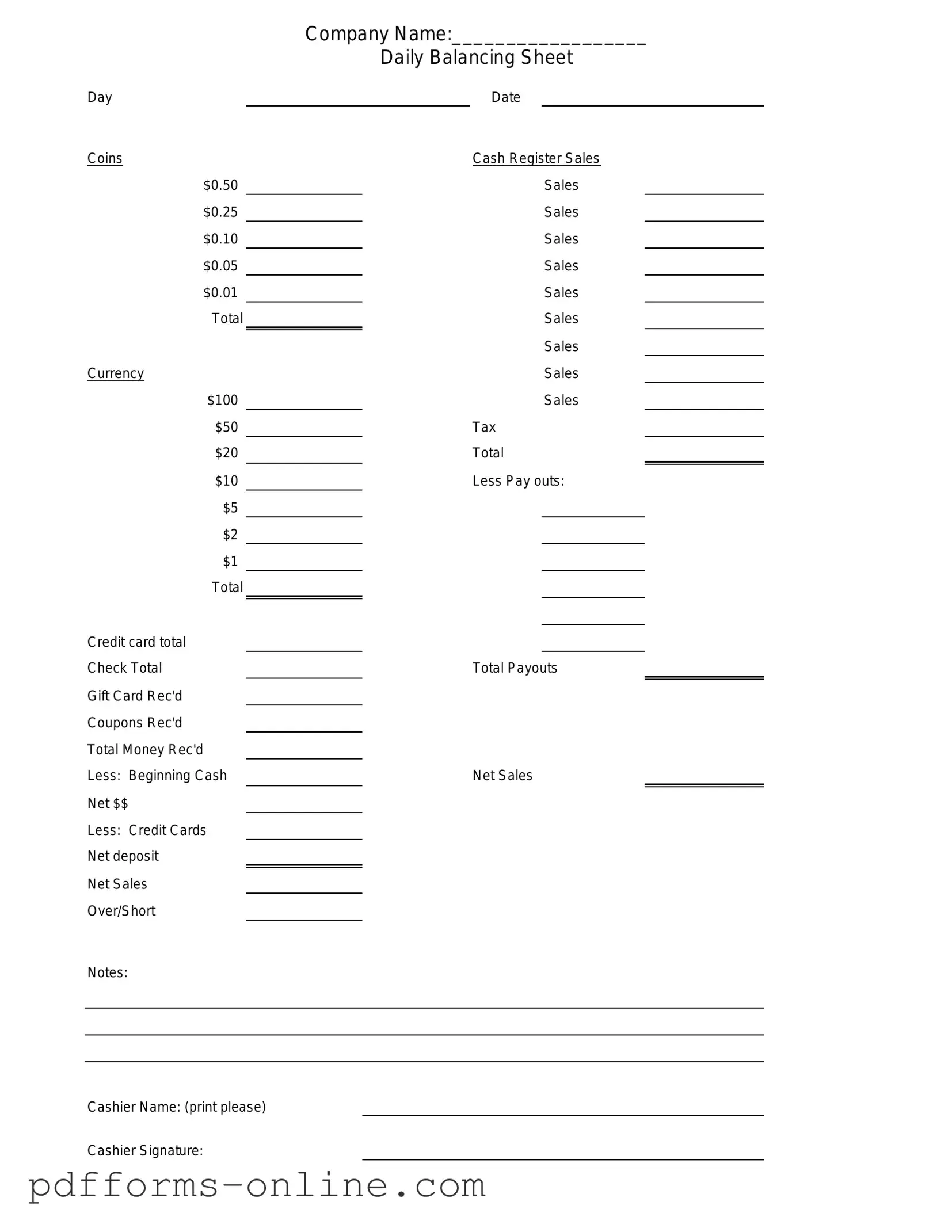

Document Example

|

Company Name:__________________ |

|||||

|

|

Daily Balancing Sheet |

||||

Day |

|

|

Date |

|

||

Coins |

|

|

Cash Register Sales |

|||

$0.50 |

|

|

|

Sales |

|

|

$0.25 |

|

|

|

Sales |

|

|

$0.10 |

|

|

|

Sales |

|

|

$0.05 |

|

|

|

Sales |

|

|

$0.01 |

|

|

|

Sales |

|

|

Total |

|

|

|

Sales |

|

|

|

|

|

|

Sales |

|

|

Currency |

|

|

|

Sales |

|

|

$100 |

|

|

|

Sales |

|

|

$50 |

|

|

Tax |

|

||

$20 |

|

|

Total |

|

||

$10 |

|

|

Less Pay outs: |

|||

$5 |

|

|

|

|

|

|

$2 |

|

|

|

|

|

|

$1 |

|

|

|

|

|

|

Total |

|

|

|

|

|

|

Credit card total |

|

|

|

|

|

|

|

|

|

|

|

|

|

Check Total |

|

|

Total Payouts |

|||

Gift Card Rec'd |

|

|

|

|

|

|

Coupons Rec'd |

|

|

|

|

|

|

Total Money Rec'd |

|

|

|

|

|

|

Less: Beginning Cash |

|

|

Net Sales |

|||

Net $$ |

|

|

|

|

|

|

Less: Credit Cards |

|

|

|

|

|

|

Net deposit |

|

|

|

|

|

|

Net Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

Over/Short |

|

|

|

|

|

|

Notes: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cashier Name: (print please)

Cashier Signature:

Frequently Asked Questions

-

What is a Cash Drawer Count Sheet?

A Cash Drawer Count Sheet is a document used by businesses to track the amount of cash in their cash drawers at the end of a shift or business day. It helps ensure that the cash on hand matches the sales recorded during that period.

-

Why is it important to use a Cash Drawer Count Sheet?

Using a Cash Drawer Count Sheet helps maintain accurate financial records. It can identify discrepancies between the cash collected and the cash counted. This practice aids in preventing theft, errors, and helps with accounting accuracy.

-

How do I fill out a Cash Drawer Count Sheet?

To fill out the sheet, start by entering the date and your name. Then, count the cash in the drawer, noting the amount for each denomination (e.g., $1, $5, $10, etc.). Finally, calculate the total cash and record it on the sheet.

-

What should I do if the counted cash does not match the expected amount?

If there is a discrepancy, review the sales records for the shift. Check for any errors in the transactions. If the issue persists, it may be necessary to investigate further to determine if there was a mistake or theft.

-

How often should I complete a Cash Drawer Count Sheet?

It is advisable to complete a Cash Drawer Count Sheet at the end of each shift or business day. This ensures that any discrepancies are caught promptly and helps maintain accurate financial records.

-

Can I use a digital version of the Cash Drawer Count Sheet?

Yes, many businesses opt for digital versions of the Cash Drawer Count Sheet. Software programs and applications can simplify the counting process and help with record-keeping. However, ensure that the digital format captures all necessary information.

-

Who is responsible for completing the Cash Drawer Count Sheet?

The individual closing the cash drawer at the end of their shift is typically responsible for completing the Cash Drawer Count Sheet. This person should ensure accuracy and report any discrepancies to a supervisor or manager.

-

What should I do with the completed Cash Drawer Count Sheet?

Once completed, the Cash Drawer Count Sheet should be securely stored for record-keeping. It may also be necessary to submit it to a manager or accounting department for review and reconciliation.

Misconceptions

When it comes to managing cash in a business, the Cash Drawer Count Sheet form is an essential tool. However, several misconceptions can lead to confusion about its purpose and use. Here are five common misconceptions:

- It’s only for large businesses. Many people believe that only big companies need a Cash Drawer Count Sheet. In reality, any business that handles cash, regardless of size, can benefit from this form to keep accurate records.

- It’s only necessary at the end of the day. Some think the Cash Drawer Count Sheet is only relevant during closing hours. In fact, it can be used throughout the day to track cash flow and ensure accuracy at any time.

- It’s complicated to fill out. Many assume that completing the Cash Drawer Count Sheet requires extensive training. However, it’s designed to be straightforward, making it easy for anyone to understand and use.

- It’s only about counting cash. While counting cash is a primary function, the form also helps track credit card transactions and other forms of payment, providing a complete picture of daily sales.

- It’s not necessary if you use a cash register. Some believe that having a cash register eliminates the need for a Cash Drawer Count Sheet. However, the form serves as a double-check, helping to identify discrepancies and maintain financial integrity.

Understanding these misconceptions can empower business owners and employees to utilize the Cash Drawer Count Sheet effectively, ensuring better cash management and financial accuracy.

Common mistakes

-

Failing to include the date at the top of the form. This can lead to confusion when reviewing past records.

-

Not counting the cash accurately. Double-checking the amount is essential to avoid discrepancies.

-

Omitting the signatures of the person counting the cash and the supervisor. Signatures provide accountability.

-

Forgetting to record the starting balance. This is crucial for tracking changes throughout the day.

-

Using incorrect denominations when counting bills. Ensure that each bill type is correctly identified.

-

Neglecting to document any discrepancies found during the count. Reporting these issues is important for financial integrity.

-

Not filling out the form completely. Every section should be addressed to maintain thorough records.

-

Failing to store the completed form securely. Proper storage protects sensitive financial information.

-

Rushing through the process. Taking time to complete the count carefully can prevent mistakes.

Additional PDF Templates

Vehicle/vessel Transfer and Reassignment Form - The seller must accurately complete the bill of sale section, identifying both parties.

Creating a comprehensive Residential Lease Agreement form is crucial for both landlords and tenants to establish a clear and enforceable rental relationship. The document not only defines the terms of the lease but also safeguards the interests of both parties. For more information and resources regarding this essential document, you can visit onlinelawdocs.com/.

Da 31 Example - It aids in ensuring personnel maintain readiness while managing personal time.

Document Data

| Fact Name | Details |

|---|---|

| Purpose | The Cash Drawer Count Sheet is used to document the cash balance in a drawer at the beginning and end of a shift. |

| Importance | Accurate cash counts help prevent discrepancies and ensure financial accountability. |

| Frequency of Use | This form is typically used daily or at the start and end of each shift. |

| Components | The form usually includes sections for cash totals, coin counts, and any discrepancies noted. |

| Record Keeping | Completed forms should be stored securely for auditing and reconciliation purposes. |

| Signature Requirement | Often, the form requires signatures from the employee counting the cash and a supervisor for verification. |

| State-Specific Variations | Some states may have specific guidelines for cash handling that influence the form's design. |

| Governing Laws | In states like California, cash handling practices may be governed by labor laws and regulations. |

| Digital vs. Paper | Organizations may choose between digital forms for ease of access or paper forms for traditional record-keeping. |

Similar forms

The Cash Register Reconciliation Form serves a similar purpose by tracking the cash flow within a register. Like the Cash Drawer Count Sheet, it documents the amount of cash at the beginning and end of a shift, allowing for easy comparison. This form also includes sections for noting discrepancies, which can help identify errors or theft. Both documents are essential for maintaining accurate financial records and ensuring accountability in cash handling.

The Daily Sales Report is another document that shares similarities with the Cash Drawer Count Sheet. It summarizes the total sales for a specific day, including cash, credit, and other payment methods. While the Cash Drawer Count Sheet focuses primarily on cash, the Daily Sales Report provides a broader view of overall sales performance. Both documents help businesses track their financial health and make informed decisions based on sales trends.

The Bank Deposit Slip is also comparable to the Cash Drawer Count Sheet, as it records the amount of cash being deposited into a bank account. This slip includes details such as the date, total cash amount, and any checks being deposited. Like the Cash Drawer Count Sheet, it is essential for ensuring that the cash recorded matches what is actually deposited, helping to prevent discrepancies and maintain accurate financial records.

The Petty Cash Log serves a similar function by tracking small cash expenditures. This document records each transaction made from a petty cash fund, including the date, amount, and purpose of the expense. Both the Petty Cash Log and the Cash Drawer Count Sheet require meticulous record-keeping to ensure that all cash transactions are accounted for, promoting transparency and accountability in financial management.

The Expense Report is another document that parallels the Cash Drawer Count Sheet. It details the expenses incurred by employees for business purposes, including receipts for cash spent. While the Cash Drawer Count Sheet focuses on cash intake and outflow, the Expense Report emphasizes the outflow of cash. Both documents are crucial for budgeting and financial oversight, ensuring that funds are used appropriately.

The Inventory Count Sheet is similar in that it tracks the quantity of products available in stock. While it does not directly deal with cash, it is essential for understanding the financial aspects of inventory management. Accurate inventory records can influence cash flow, as overstocking or stockouts can lead to financial losses. Both documents require careful attention to detail to maintain accuracy in financial reporting.

The Time Sheet, while primarily focused on labor hours, shares a common goal with the Cash Drawer Count Sheet: accurate record-keeping. It tracks the hours worked by employees, which directly impacts payroll and overall business expenses. Both documents must be meticulously maintained to ensure that financial records reflect true business performance, contributing to effective budgeting and resource allocation.

When dealing with property ownership changes, it's essential to have the correct documentation, such as an Arizona Deed form, which facilitates the transfer process and safeguards the interests of the new owner. For individuals in need of various essential documents for property transactions, All Arizona Forms can be a valuable resource to ensure everything is filled out accurately and securely.

Lastly, the Profit and Loss Statement provides an overview of a business's financial performance over a specific period. It summarizes revenues, costs, and expenses, leading to the net profit or loss. While the Cash Drawer Count Sheet focuses on cash transactions, the Profit and Loss Statement encompasses all financial activities, making both vital for assessing the financial health of a business. Together, they provide a comprehensive view of a company's financial standing.