Valid California Transfer-on-Death Deed Template

In California, the Transfer-on-Death Deed (TOD) form offers a practical solution for individuals looking to streamline the process of transferring real estate upon their passing. This legal tool allows property owners to designate one or more beneficiaries who will automatically inherit the property, bypassing the often lengthy and costly probate process. By filling out and recording this deed, individuals can retain full control over their property during their lifetime while ensuring a smooth transition to their chosen heirs. Importantly, the TOD deed can be revoked or modified at any time before the owner's death, providing flexibility and peace of mind. Additionally, the form must be executed in accordance with specific state requirements to ensure its validity, including the need for notarization. Understanding the nuances of the Transfer-on-Death Deed can empower property owners to make informed decisions about their estate planning, ultimately safeguarding their loved ones from unnecessary complications in the future.

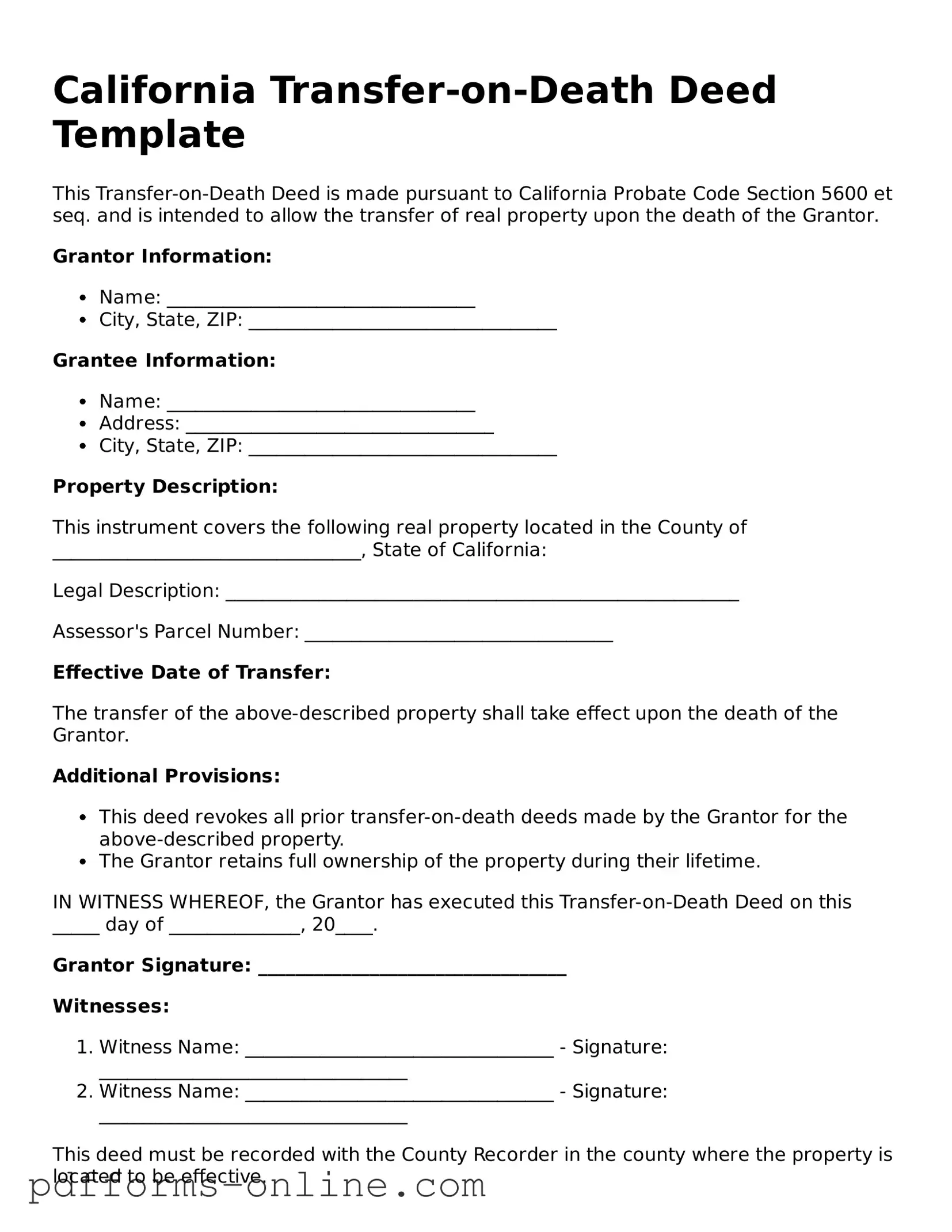

Document Example

California Transfer-on-Death Deed Template

This Transfer-on-Death Deed is made pursuant to California Probate Code Section 5600 et seq. and is intended to allow the transfer of real property upon the death of the Grantor.

Grantor Information:

- Name: _________________________________

- City, State, ZIP: _________________________________

Grantee Information:

- Name: _________________________________

- Address: _________________________________

- City, State, ZIP: _________________________________

Property Description:

This instrument covers the following real property located in the County of _________________________________, State of California:

Legal Description: _______________________________________________________

Assessor's Parcel Number: _________________________________

Effective Date of Transfer:

The transfer of the above-described property shall take effect upon the death of the Grantor.

Additional Provisions:

- This deed revokes all prior transfer-on-death deeds made by the Grantor for the above-described property.

- The Grantor retains full ownership of the property during their lifetime.

IN WITNESS WHEREOF, the Grantor has executed this Transfer-on-Death Deed on this _____ day of ______________, 20____.

Grantor Signature: _________________________________

Witnesses:

- Witness Name: _________________________________ - Signature: _________________________________

- Witness Name: _________________________________ - Signature: _________________________________

This deed must be recorded with the County Recorder in the county where the property is located to be effective.

Frequently Asked Questions

-

What is a Transfer-on-Death Deed?

A Transfer-on-Death Deed (TODD) is a legal document that allows property owners in California to transfer their real estate to a designated beneficiary upon their death. This deed enables the property owner to retain full control over the property during their lifetime, while also simplifying the transfer process after death, avoiding probate.

-

Who can use a Transfer-on-Death Deed?

Any individual who owns real estate in California can use a Transfer-on-Death Deed. It is particularly beneficial for homeowners who wish to ensure their property passes directly to their chosen beneficiaries without the complexities and costs associated with probate.

-

How do I create a Transfer-on-Death Deed?

To create a TODD, you must complete a specific form provided by the state of California. This form requires you to identify the property, the beneficiary, and your signature. It is crucial to have the deed properly executed and recorded with the county recorder's office where the property is located to ensure its validity.

-

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a Transfer-on-Death Deed at any time during your lifetime. To do this, you must create a new deed that explicitly states the changes or file a revocation form with the county recorder. It’s essential to ensure that any changes are properly recorded to avoid confusion later.

-

What happens if I do not name a beneficiary?

If you do not name a beneficiary in your Transfer-on-Death Deed, the property will not transfer as intended. Instead, it will be treated as part of your estate and will go through the probate process. This can lead to delays and additional costs for your heirs.

-

Is a Transfer-on-Death Deed the same as a will?

No, a Transfer-on-Death Deed is not the same as a will. While both documents deal with the distribution of property after death, a TODD specifically transfers property directly to a beneficiary without going through probate. A will, on the other hand, must be validated through probate court, which can be a lengthy process.

-

Are there any tax implications with a Transfer-on-Death Deed?

Generally, transferring property through a Transfer-on-Death Deed does not trigger immediate tax implications. However, beneficiaries may be responsible for property taxes and capital gains taxes when they inherit the property. Consulting a tax professional is advisable to understand any potential tax consequences fully.

-

What types of property can be transferred using a Transfer-on-Death Deed?

In California, a Transfer-on-Death Deed can be used to transfer residential real estate, including single-family homes, condominiums, and certain multi-family properties. However, it cannot be used for commercial properties or personal property such as vehicles or bank accounts.

-

Do I need a lawyer to create a Transfer-on-Death Deed?

While it is not legally required to have a lawyer to create a Transfer-on-Death Deed, seeking legal advice can be beneficial. A legal professional can help ensure that the deed is completed correctly and complies with all state requirements, ultimately providing peace of mind for you and your beneficiaries.

Misconceptions

Many people have misunderstandings about the California Transfer-on-Death Deed (TODD). Here are six common misconceptions:

- The TODD is only for wealthy individuals. This is not true. The Transfer-on-Death Deed can be beneficial for anyone who wants to simplify the transfer of their property to heirs without going through probate.

- Using a TODD means you lose control of your property. This misconception is incorrect. The property owner retains full control over the property during their lifetime. They can sell, rent, or change the deed as they wish.

- A TODD is a will. While both documents deal with property transfer, they serve different purposes. A TODD specifically allows for the transfer of real estate outside of probate, whereas a will covers all assets and goes through probate.

- The TODD automatically takes effect upon signing. This is misleading. The deed must be recorded with the county recorder's office to be effective. Until that happens, it has no legal standing.

- All property types can be transferred using a TODD. This is not entirely accurate. A TODD can only be used for real property, such as land and buildings, and not for personal property or financial accounts.

- The TODD eliminates the need for an estate plan. This is a common misconception. While a TODD can simplify property transfer, it should be part of a broader estate plan that addresses all aspects of an individual's assets and wishes.

Common mistakes

-

Failing to include the full legal description of the property. This information is crucial for identifying the property accurately.

-

Not signing the deed in front of a notary public. A signature without notarization can render the deed invalid.

-

Incorrectly identifying the beneficiaries. Ensure that names are spelled correctly and that the relationship to the property owner is clear.

-

Neglecting to check for existing liens or encumbrances on the property. This oversight can complicate the transfer process.

-

Not recording the deed with the county recorder’s office. Failing to do so can lead to disputes over the property after the owner’s death.

-

Using outdated forms or templates. Always use the most current version of the Transfer-on-Death Deed form to avoid legal issues.

-

Overlooking tax implications. Understanding how the transfer affects property taxes is essential for both the owner and the beneficiaries.

-

Assuming that a Transfer-on-Death Deed is the only estate planning tool needed. It’s important to consider other documents, such as wills or trusts, for comprehensive planning.

Find Some Other Transfer-on-Death Deed Forms for Specific States

Transfer on Death Instrument - A Transfer-on-Death Deed should be considered as part of any comprehensive estate planning strategy.

Utilizing a Power of Attorney form is crucial for anyone who wants to ensure their decisions are made according to their wishes when they cannot speak for themselves. This can include critical situations such as serious illness or unexpected travel. For comprehensive guidance on how to create this important document in Texas, you can visit OnlineLawDocs.com, which offers useful resources to help you navigate the process effectively.

Ladybird Deed Texas Form - This tool enables a clean transfer of property, removing many administrative burdens.

Can a Transfer on Death Account Be Contested - A Transfer-on-Death Deed is not effective until recorded with the county recorder’s office.

How to Avoid Probate in Pa - It provides a clear legal path for asset transfer without court intervention.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death (TOD) deed allows property owners in California to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The TOD deed is governed by California Probate Code Sections 5600-5693. |

| Eligibility | Any individual who owns real property in California can create a TOD deed. |

| Beneficiary Designation | Property owners can name one or more beneficiaries to receive the property after their death. |

| Revocation | A TOD deed can be revoked or changed at any time during the owner's lifetime, as long as they are competent. |

| Filing Requirements | The deed must be signed and notarized, and it should be recorded with the county recorder's office to be effective. |

| Tax Implications | Transfer-on-Death deeds do not trigger property tax reassessment in California, allowing beneficiaries to inherit property at its original value. |

Similar forms

The California Transfer-on-Death Deed (TOD) is similar to a will in that both documents allow individuals to dictate how their property will be distributed after their death. A will requires probate, which can be a lengthy and costly process. In contrast, the TOD deed allows for the direct transfer of property to beneficiaries without the need for probate, making it a more efficient option for property transfer upon death.

For those looking to properly document the ownership transfer of their mobile home, a useful resource is the comprehensive Mobile Home Bill of Sale form available online. This document plays a vital role in clarifying the terms of the sale while ensuring all parties are informed and protected throughout the transaction process. You can find this important form at the Florida Mobile Home Bill of Sale.