Valid California Real Estate Purchase Agreement Template

The California Real Estate Purchase Agreement (REPA) is a crucial document in the home buying process, serving as a binding contract between the buyer and seller. This form outlines the terms and conditions of the sale, including the purchase price, financing details, and the timeline for closing. It also specifies the property being sold, including its legal description and any fixtures or personal property included in the sale. Contingencies play a significant role in the agreement, allowing buyers to conduct inspections, secure financing, and assess the property's condition before finalizing the purchase. Additionally, the REPA addresses important aspects such as disclosures, title insurance, and the allocation of closing costs. Understanding the components of this form is essential for both parties to ensure a smooth transaction and to protect their interests throughout the process.

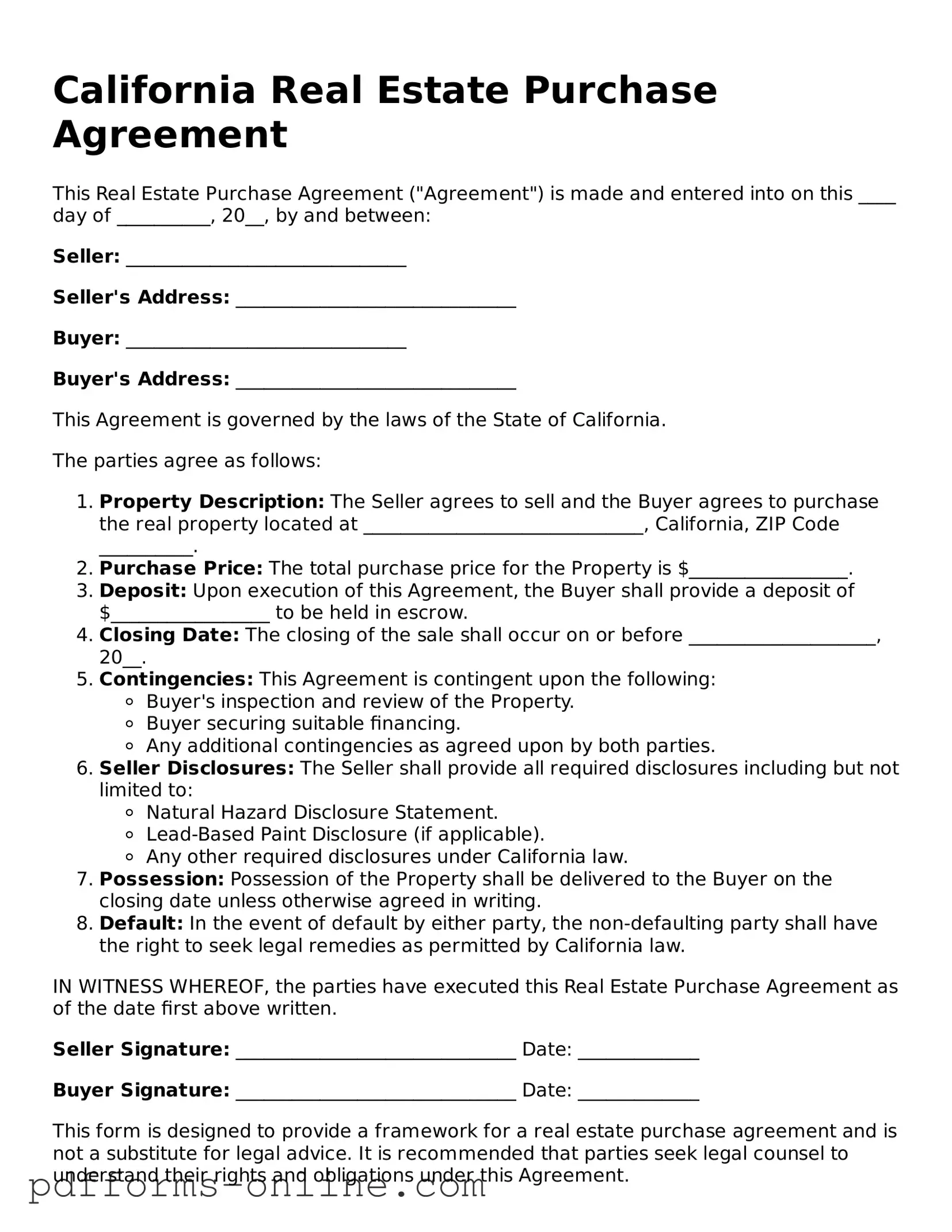

Document Example

California Real Estate Purchase Agreement

This Real Estate Purchase Agreement ("Agreement") is made and entered into on this ____ day of __________, 20__, by and between:

Seller: ______________________________

Seller's Address: ______________________________

Buyer: ______________________________

Buyer's Address: ______________________________

This Agreement is governed by the laws of the State of California.

The parties agree as follows:

- Property Description: The Seller agrees to sell and the Buyer agrees to purchase the real property located at ______________________________, California, ZIP Code __________.

- Purchase Price: The total purchase price for the Property is $_________________.

- Deposit: Upon execution of this Agreement, the Buyer shall provide a deposit of $_________________ to be held in escrow.

- Closing Date: The closing of the sale shall occur on or before ____________________, 20__.

- Contingencies: This Agreement is contingent upon the following:

- Buyer's inspection and review of the Property.

- Buyer securing suitable financing.

- Any additional contingencies as agreed upon by both parties.

- Seller Disclosures: The Seller shall provide all required disclosures including but not limited to:

- Natural Hazard Disclosure Statement.

- Lead-Based Paint Disclosure (if applicable).

- Any other required disclosures under California law.

- Possession: Possession of the Property shall be delivered to the Buyer on the closing date unless otherwise agreed in writing.

- Default: In the event of default by either party, the non-defaulting party shall have the right to seek legal remedies as permitted by California law.

IN WITNESS WHEREOF, the parties have executed this Real Estate Purchase Agreement as of the date first above written.

Seller Signature: ______________________________ Date: _____________

Buyer Signature: ______________________________ Date: _____________

This form is designed to provide a framework for a real estate purchase agreement and is not a substitute for legal advice. It is recommended that parties seek legal counsel to understand their rights and obligations under this Agreement.

Frequently Asked Questions

-

What is a California Real Estate Purchase Agreement?

The California Real Estate Purchase Agreement is a legally binding document used when buying or selling property in California. It outlines the terms and conditions of the sale, including the purchase price, financing details, and any contingencies that must be met before the sale can proceed. This agreement is essential for protecting the interests of both the buyer and the seller, ensuring clarity and mutual understanding throughout the transaction.

-

What key elements should be included in the agreement?

A well-crafted Real Estate Purchase Agreement typically includes several important components:

- Parties Involved: The names and contact information of the buyer and seller.

- Property Description: A detailed description of the property being sold, including the address and any legal descriptions.

- Purchase Price: The agreed-upon price for the property.

- Contingencies: Conditions that must be met for the sale to proceed, such as financing approval or home inspections.

- Closing Date: The date when the transaction will be finalized and ownership transferred.

Including these elements helps to minimize misunderstandings and ensures that both parties are on the same page.

-

Can the agreement be modified after it is signed?

Yes, the California Real Estate Purchase Agreement can be modified after it is signed, but both parties must agree to any changes. Modifications should be documented in writing and signed by both the buyer and seller to ensure they are legally enforceable. This could include changes to the closing date, purchase price adjustments, or alterations to contingencies. Communication is key; keeping an open dialogue can facilitate any necessary adjustments.

-

What happens if one party breaches the agreement?

If one party fails to uphold their obligations under the agreement, it is considered a breach. The non-breaching party has several options, including:

- Negotiation: Attempting to resolve the issue through discussion.

- Specific Performance: Seeking a court order requiring the breaching party to fulfill their obligations.

- Damages: Pursuing financial compensation for losses incurred due to the breach.

Understanding these options can help both buyers and sellers navigate the complexities of real estate transactions more effectively.

Misconceptions

Understanding the California Real Estate Purchase Agreement (RPA) is crucial for anyone involved in real estate transactions in the state. However, several misconceptions can lead to confusion. Here are seven common misunderstandings:

- All terms are negotiable. While many terms can be negotiated, some aspects, like certain legal requirements, are fixed. Buyers and sellers should know which elements are flexible and which are not.

- The RPA is a standard form that doesn't need customization. This form serves as a template, but it often requires adjustments to fit the specific needs of the transaction. Personalizing the agreement is essential to address unique circumstances.

- Signing the RPA means the deal is final. Signing the agreement does not mean that the transaction is complete. There are still contingencies and conditions that must be met before closing.

- Only real estate agents can fill out the RPA. While agents are experienced in completing the form, buyers and sellers can also fill it out. However, it's advisable to seek guidance to ensure accuracy.

- The RPA protects only the seller's interests. This is a misconception. The RPA is designed to protect both parties by outlining rights, responsibilities, and contingencies for both buyers and sellers.

- Once submitted, the RPA cannot be changed. Changes can be made to the agreement as long as both parties agree to the modifications. It’s important to document any changes in writing.

- The RPA is the only document needed for a real estate transaction. The RPA is an important document, but it is not the only one required. Additional disclosures, inspections, and financing documents are also necessary for a complete transaction.

Being informed about these misconceptions can help buyers and sellers navigate the real estate process more effectively.

Common mistakes

-

Not including all necessary parties. Ensure that all individuals involved in the transaction are named in the agreement. This includes all buyers and sellers. Omitting a party can lead to legal complications later on.

-

Failing to specify the purchase price. Clearly state the agreed-upon price for the property. Ambiguities in this area can cause disputes and misunderstandings.

-

Ignoring contingencies. Include any necessary contingencies, such as financing or inspection requirements. Without these, you may find yourself in a difficult position if issues arise.

-

Not outlining the closing date. Specify when the transaction will be finalized. A clear timeline helps all parties stay on track and avoid delays.

-

Overlooking disclosures. Make sure to include any required disclosures about the property. This can include information about repairs, pest issues, or other material facts that could affect the buyer's decision.

-

Using vague language. Be clear and specific in your wording. Ambiguous terms can lead to different interpretations, which may result in disputes down the line.

-

Not consulting a professional. Many people attempt to fill out the form without expert guidance. Consulting a real estate agent or attorney can help you avoid common pitfalls and ensure the agreement is valid.

Find Some Other Real Estate Purchase Agreement Forms for Specific States

Real Estate Purchase Agreement Pdf - The document includes contingencies that must be met for the sale to proceed, such as securing financing or passing inspections.

Midland Title Toledo - It outlines obligations like repairs and maintenance before closing.

A Non-disclosure Agreement (NDA) form in New York is a legally binding contract designed to protect sensitive information from being disclosed. It is commonly used by individuals and businesses to safeguard trade secrets and other confidential data. The form lays out the terms under which proprietary information is shared, ensuring that the parties involved understand their obligations to maintain secrecy. For more information on drafting an NDA, you can refer to onlinelawdocs.com/.

New York State Residential Contract of Sale - It can be vital for securing financing, as lenders often require such agreements.

PDF Attributes

| Fact Name | Description |

|---|---|

| Purpose | The California Real Estate Purchase Agreement is used to outline the terms of a real estate transaction between a buyer and a seller. |

| Governing Law | This agreement is governed by California state law, specifically the California Civil Code. |

| Parties Involved | The agreement includes information about the buyer, the seller, and the property being sold. |

| Purchase Price | The purchase price must be clearly stated in the agreement, along with the method of payment. |

| Contingencies | Buyers can include contingencies, such as financing or inspection, which must be met for the sale to proceed. |

| Closing Date | The agreement specifies a closing date, which is when the transfer of ownership takes place. |

| Earnest Money | Buyers typically provide earnest money to show their commitment, which is held in escrow until closing. |

| Disclosures | Sellers are required to provide disclosures about the property’s condition, including any known issues. |

| Signatures | The agreement must be signed by both parties to be legally binding. |

| Amendments | Any changes to the agreement must be made in writing and signed by both parties. |

Similar forms

The California Residential Purchase Agreement is similar to the Residential Lease Agreement. Both documents outline the terms and conditions under which a property is rented or sold. They include details such as the parties involved, property description, and payment terms. While the lease agreement focuses on rental terms, the purchase agreement centers on the sale of the property, making it essential for buyers and sellers to understand the differences in their legal implications.

The Commercial Real Estate Purchase Agreement shares similarities with the California Residential Purchase Agreement in that both serve as binding contracts for property transactions. Each agreement specifies the purchase price, contingencies, and closing procedures. However, the commercial version often includes additional clauses related to zoning laws, business operations, and lease agreements, reflecting the complexities of commercial property transactions.

The Option to Purchase Agreement is another document akin to the California Residential Purchase Agreement. This agreement grants a potential buyer the right to purchase a property at a predetermined price within a specified time frame. Like the purchase agreement, it outlines the terms of the transaction but focuses on the option rather than an outright sale, allowing flexibility for the buyer.

The Seller Financing Agreement is similar in that it facilitates the sale of real estate, but it specifically details the terms under which the seller provides financing to the buyer. Both documents cover payment terms and interest rates, but the seller financing agreement includes provisions regarding default and remedies, which are crucial for protecting the seller's interests.

The Land Contract, also known as a Contract for Deed, resembles the California Residential Purchase Agreement in that it allows a buyer to make payments directly to the seller over time. Both documents outline the purchase price and payment schedule. However, the land contract allows the seller to retain legal title until the buyer completes all payments, which adds a layer of protection for the seller.

The Exclusive Listing Agreement is similar in that it involves the sale of real estate, but it focuses on the relationship between the seller and the real estate agent. It outlines the agent's responsibilities and the commission structure. While the purchase agreement finalizes the sale, the listing agreement sets the stage for the sale process, ensuring both parties understand their roles.

The Buyer Representation Agreement is another document that aligns with the California Residential Purchase Agreement. This agreement establishes a relationship between the buyer and their real estate agent, detailing the agent's duties to represent the buyer's interests. Both agreements are crucial in the real estate transaction process, but the buyer representation agreement emphasizes the agent's role in finding and negotiating the purchase of a property.

The Addendum to Purchase Agreement serves as an extension of the California Residential Purchase Agreement. It provides additional terms or conditions that may arise during the negotiation process. Like the purchase agreement, it is legally binding and must be agreed upon by both parties. This document allows for flexibility in addressing specific concerns that may not be covered in the main agreement.

The Access-A-Ride NYC Application form is essential for employees looking to participate in the City of New York Commuter Benefits Program, specifically for Access-A-Ride and other paratransit options. This form not only guides users in submitting their completed applications but also outlines necessary documentation, emphasizing the importance of pre-tax benefits based on eligibility. Participants can use this application for enrollment, updating personal information, adjusting deductions, and even cancellation, ensuring their commuting requirements are satisfied through the MTA New York City Transit Access-A-Ride Program or other supported services. For further assistance, you can download it here.

The Real Estate Disclosure Statement is similar in that it provides essential information regarding the property being sold. While the purchase agreement outlines the transaction terms, the disclosure statement ensures that buyers are aware of any issues, such as environmental hazards or structural problems. This transparency is vital for informed decision-making and helps protect both parties during the sale.

The Purchase and Sale Agreement is closely related to the California Residential Purchase Agreement, as both documents serve to finalize the sale of real estate. They detail the terms of the sale, including price, contingencies, and closing dates. The primary difference lies in the terminology and regional variations, but both agreements fulfill the same purpose of documenting the sale transaction.