Valid California Quitclaim Deed Template

The California Quitclaim Deed form is a vital legal document that facilitates the transfer of property ownership from one party to another without the guarantee of a clear title. This form is particularly useful in situations where the transferor, or seller, wishes to relinquish their interest in a property without making any warranties about the title's condition. It serves as a straightforward means for individuals to convey their rights, whether in cases of family transfers, divorce settlements, or settling an estate. Importantly, the Quitclaim Deed does not ensure that the property is free from liens or other encumbrances, which distinguishes it from other types of deeds. Understanding the specific requirements for completing this form is essential, as it must be properly executed, notarized, and recorded with the county recorder's office to ensure legal validity. Additionally, the form typically includes important details such as the names of the parties involved, a description of the property, and the date of transfer. By grasping the nuances of the Quitclaim Deed, individuals can navigate property transfers with greater confidence and clarity.

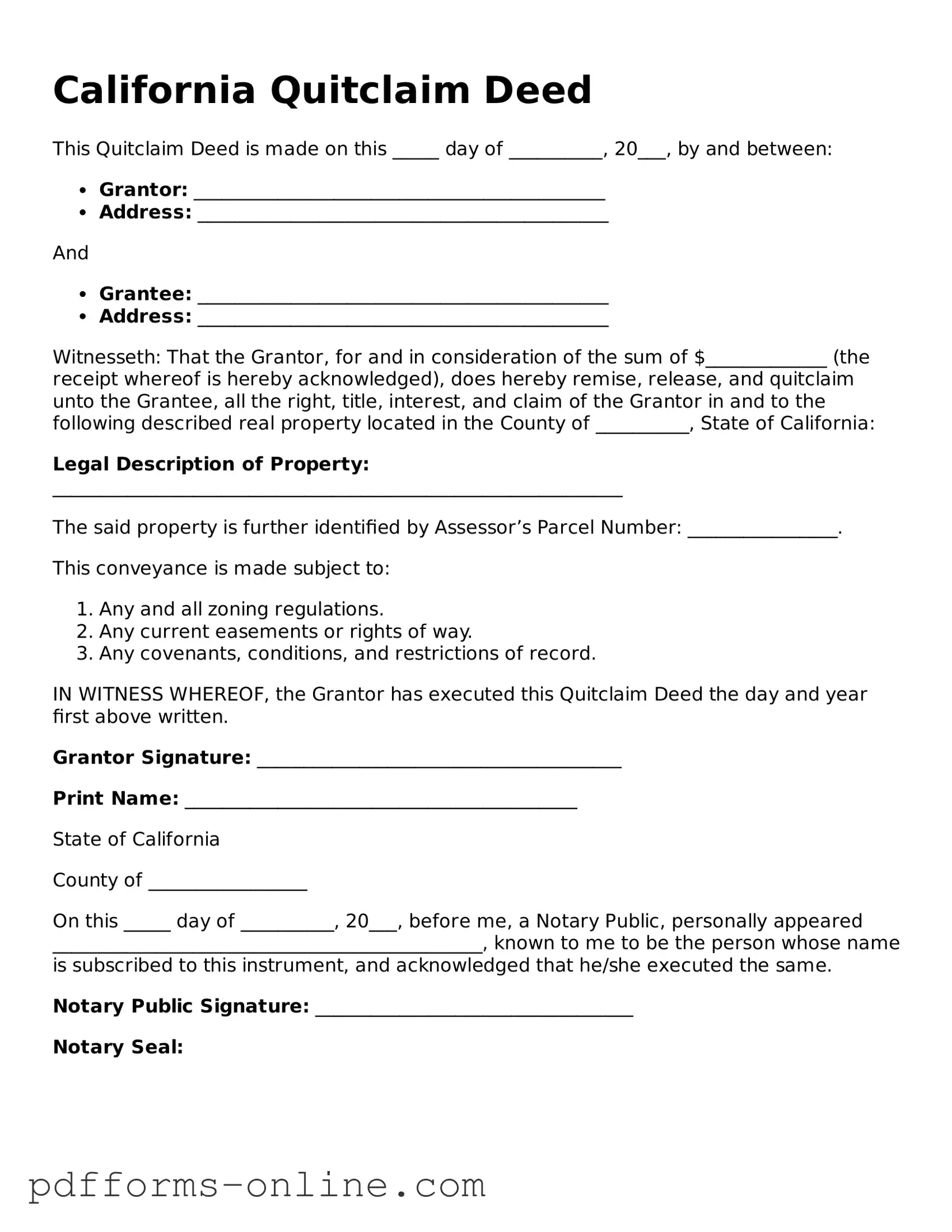

Document Example

California Quitclaim Deed

This Quitclaim Deed is made on this _____ day of __________, 20___, by and between:

- Grantor: ____________________________________________

- Address: ____________________________________________

And

- Grantee: ____________________________________________

- Address: ____________________________________________

Witnesseth: That the Grantor, for and in consideration of the sum of $_____________ (the receipt whereof is hereby acknowledged), does hereby remise, release, and quitclaim unto the Grantee, all the right, title, interest, and claim of the Grantor in and to the following described real property located in the County of __________, State of California:

Legal Description of Property: _____________________________________________________________

The said property is further identified by Assessor’s Parcel Number: ________________.

This conveyance is made subject to:

- Any and all zoning regulations.

- Any current easements or rights of way.

- Any covenants, conditions, and restrictions of record.

IN WITNESS WHEREOF, the Grantor has executed this Quitclaim Deed the day and year first above written.

Grantor Signature: _______________________________________

Print Name: __________________________________________

State of California

County of _________________

On this _____ day of __________, 20___, before me, a Notary Public, personally appeared ______________________________________________, known to me to be the person whose name is subscribed to this instrument, and acknowledged that he/she executed the same.

Notary Public Signature: __________________________________

Notary Seal:

Frequently Asked Questions

-

What is a Quitclaim Deed?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another. Unlike a warranty deed, it does not guarantee that the property is free of liens or other claims. The grantor (the person transferring the property) simply relinquishes any interest they may have in the property to the grantee (the person receiving the property).

-

When should I use a Quitclaim Deed?

This type of deed is commonly used in situations where the transfer of property is between family members, such as in divorce settlements or when adding a spouse to a title. It is also useful for clearing up title issues or transferring property into a trust.

-

How do I complete a Quitclaim Deed in California?

To complete a Quitclaim Deed in California, you need to fill out the form with the necessary information, including the names of the grantor and grantee, a description of the property, and the date of the transfer. It is essential to sign the deed in front of a notary public to make it legally binding.

-

Do I need to record the Quitclaim Deed?

Yes, recording the Quitclaim Deed with the county recorder's office is highly recommended. This action provides public notice of the transfer and protects the rights of the new owner. Failure to record may lead to disputes regarding property ownership in the future.

-

Are there any fees associated with a Quitclaim Deed?

There may be fees for recording the Quitclaim Deed, which vary by county. Additionally, if the property is being transferred as part of a sale, there may be other costs involved, such as transfer taxes. It is advisable to check with your local county recorder's office for specific fee information.

-

Can a Quitclaim Deed be revoked?

Once a Quitclaim Deed is executed and recorded, it cannot be unilaterally revoked by the grantor. However, the grantor may create a new deed to reverse the transfer or establish different terms. Legal advice may be necessary in such cases.

-

What are the risks of using a Quitclaim Deed?

The primary risk associated with a Quitclaim Deed is that it does not provide any guarantees about the property title. If there are existing liens or claims, the grantee may inherit those issues. Therefore, it is crucial to conduct a title search before proceeding with a Quitclaim Deed.

-

Do I need an attorney to create a Quitclaim Deed?

While it is possible to create a Quitclaim Deed without an attorney, seeking legal counsel is advisable, especially if the property has complications or if the transfer involves significant assets. An attorney can help ensure that the deed is completed correctly and that all legal requirements are met.

-

Is a Quitclaim Deed the same as a Warranty Deed?

No, a Quitclaim Deed and a Warranty Deed are not the same. A Warranty Deed provides a guarantee that the grantor holds clear title to the property and has the right to sell it. In contrast, a Quitclaim Deed offers no such assurances, making it a more straightforward but riskier option for transferring property.

Misconceptions

When it comes to the California Quitclaim Deed, many people have misconceptions that can lead to confusion or mistakes. Understanding these misconceptions is crucial for anyone considering using this form. Here are five common misunderstandings:

-

A Quitclaim Deed transfers ownership completely.

This is partially true. A Quitclaim Deed transfers whatever interest the grantor has in the property, but it does not guarantee that the grantor has full ownership. If there are liens or other claims against the property, the new owner may still face these issues.

-

Quitclaim Deeds are only for gifts between family members.

While it’s common to use Quitclaim Deeds for transferring property between family members, they can be used in various situations. This includes transferring property in divorce settlements or between business partners.

-

A Quitclaim Deed is the same as a Warranty Deed.

This is a significant misconception. A Warranty Deed provides a guarantee of clear title and full ownership. In contrast, a Quitclaim Deed offers no such assurances, making it a riskier option for buyers.

-

You don’t need to record a Quitclaim Deed.

While it’s not legally required to record a Quitclaim Deed, doing so is highly recommended. Recording the deed protects your ownership rights and provides public notice of the property transfer.

-

A Quitclaim Deed can resolve all property disputes.

This is a misconception that can lead to further complications. A Quitclaim Deed does not settle disputes over property boundaries or ownership claims. Legal advice may be necessary to resolve such issues.

Understanding these misconceptions can help you navigate property transfers more effectively. Always consider seeking professional guidance to ensure that your transaction is handled properly.

Common mistakes

-

Incorrect Names: People often misspell names or use nicknames instead of legal names. This can lead to confusion and legal issues later.

-

Missing Signatures: All parties involved must sign the deed. Failing to include a signature can invalidate the document.

-

Improper Notarization: The deed must be notarized correctly. Not having a notary public witness the signatures can cause problems.

-

Incorrect Property Description: A detailed and accurate description of the property is essential. Omitting details or providing incorrect information can create disputes.

-

Neglecting to Date the Document: A date is necessary for the deed to be valid. Forgetting to include it can lead to questions about the timing of the transfer.

-

Failing to Record the Deed: After filling out the deed, it must be filed with the county recorder. Not doing this means the transfer may not be legally recognized.

-

Ignoring Local Laws: Each county may have specific requirements. Not checking local regulations can result in a rejected deed.

-

Inaccurate Tax Information: Some people forget to include information about property taxes. This can lead to unexpected tax liabilities.

Find Some Other Quitclaim Deed Forms for Specific States

Quit Claim Deed Pa - A Quitclaim Deed is quick and easy to complete in most situations.

The USCIS I-134 form, commonly known as the Affidavit of Support, plays a crucial role in the United States immigration process. It serves as a formal agreement where a sponsor pledges financial support to a foreign visitor, ensuring that the visitor will not become a public charge. This form is vital for individuals seeking to support someone's visit or immigration to the United States, and more details can be found at OnlineLawDocs.com.

Quitclaim Deed Form Ohio - It can resolve questions about shared property among divorced couples.

Quit Claim Deed Form Michigan Pdf - A Quitclaim Deed can serve to remove a co-owner from a property, simplifying joint ownership arrangements.

Quit Claim Deed Sample - It is advisable to consult a legal professional when drafting a Quitclaim Deed.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document that transfers ownership of property from one person to another without any warranties or guarantees. |

| Governing Law | In California, quitclaim deeds are governed by the California Civil Code, particularly sections 1010-1030. |

| Use Cases | Commonly used in transfers between family members, divorces, or when clearing up title issues. |

| Requirements | The deed must be signed by the grantor (the person transferring the property) and notarized to be valid. |

| Recording | To protect the interests of the new owner, the quitclaim deed should be recorded with the county recorder's office. |

| Limitations | Since a quitclaim deed offers no warranties, the grantee assumes the risk of any claims against the property. |

Similar forms

A Grant Deed is often compared to a Quitclaim Deed. Both documents transfer ownership of property from one party to another. However, a Grant Deed provides a guarantee that the seller holds clear title to the property and has the right to sell it. In contrast, a Quitclaim Deed does not offer any such assurances, making it a less secure option for the buyer.

When engaging in the sale of a vehicle in Ohio, it is crucial to utilize the Ohio Motor Vehicle Bill of Sale, as this legal document ensures a clear record of the ownership transfer. By completing this form, both the seller and buyer can protect their interests, simplifying the transaction process. For those in need of a template, the Ohio Motor Vehicle Bill of Sale can be accessed at https://documentonline.org/blank-ohio-motor-vehicle-bill-of-sale.

A Warranty Deed is another document that serves a similar purpose. Like a Grant Deed, it guarantees that the seller has full ownership rights and that the property is free from any liens or claims. The key difference is that a Warranty Deed provides stronger protection for the buyer, as it includes warranties against future claims. This makes it a preferred choice in many real estate transactions.

An Easement Agreement is somewhat different but still related to property rights. This document allows one party to use a portion of another party's property for a specific purpose, such as accessing a road or utility lines. While a Quitclaim Deed transfers ownership, an Easement Agreement merely grants usage rights without transferring ownership.

A Life Estate Deed allows an individual to retain ownership of a property for their lifetime while transferring the remainder interest to another party. This document is similar to a Quitclaim Deed in that it transfers property rights, but it does so with specific conditions that allow the original owner to continue living in the property until their death.

A Trust Transfer Deed is used when property is transferred into a trust. This document is similar to a Quitclaim Deed because it involves the transfer of property rights. However, a Trust Transfer Deed often includes specific instructions on how the property should be managed and distributed, which a Quitclaim Deed does not provide.

A Deed of Trust is a security instrument that involves three parties: the borrower, the lender, and the trustee. This document is similar to a Quitclaim Deed in that it involves property transfer, but it serves a different purpose. A Deed of Trust secures a loan by placing the property as collateral, while a Quitclaim Deed simply transfers ownership without any financial obligations attached.

An Affidavit of Death can also be related to property transfers. When a property owner passes away, this document can be used to confirm their death and facilitate the transfer of property to heirs. While a Quitclaim Deed directly transfers ownership, an Affidavit of Death serves as a supporting document in the estate settlement process.

Finally, a Partition Deed is used when co-owners of a property decide to divide their interests. This document is similar to a Quitclaim Deed because it involves the transfer of property rights, but it specifically addresses the division of shared ownership, allowing each party to claim their portion of the property.