Valid California Promissory Note Template

In California, a promissory note serves as a crucial financial instrument that outlines the terms of a loan agreement between a borrower and a lender. This written document specifies key details such as the principal amount borrowed, the interest rate applied, the repayment schedule, and any applicable late fees. It also delineates the rights and responsibilities of both parties involved. By clearly stating these terms, the promissory note helps to prevent misunderstandings and provides legal protection should any disputes arise. Additionally, it can include provisions for default, which outline the consequences if the borrower fails to meet their obligations. Understanding the nuances of this form is essential for anyone entering into a lending agreement in California, as it not only formalizes the commitment but also ensures compliance with state laws governing such transactions.

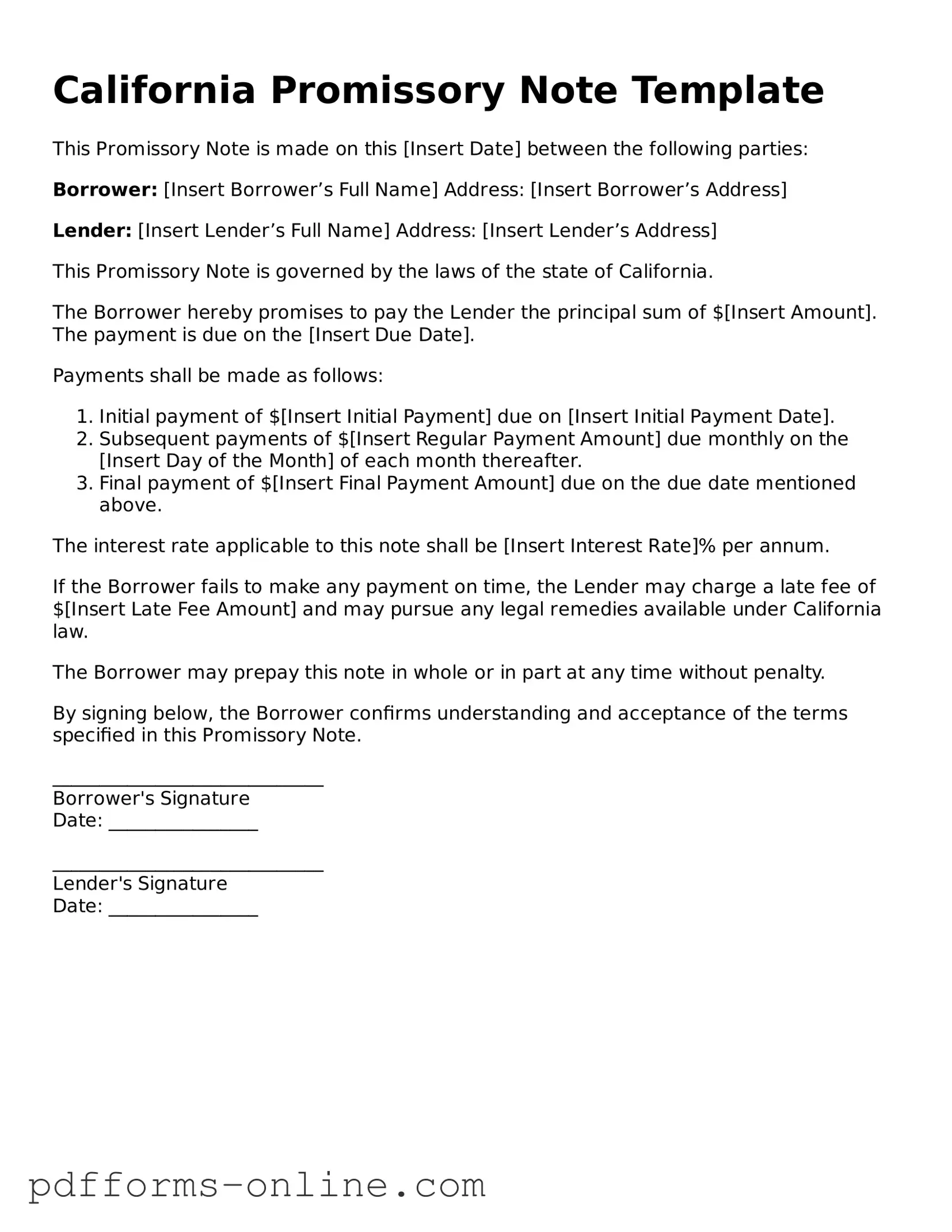

Document Example

California Promissory Note Template

This Promissory Note is made on this [Insert Date] between the following parties:

Borrower: [Insert Borrower’s Full Name] Address: [Insert Borrower’s Address]

Lender: [Insert Lender’s Full Name] Address: [Insert Lender’s Address]

This Promissory Note is governed by the laws of the state of California.

The Borrower hereby promises to pay the Lender the principal sum of $[Insert Amount]. The payment is due on the [Insert Due Date].

Payments shall be made as follows:

- Initial payment of $[Insert Initial Payment] due on [Insert Initial Payment Date].

- Subsequent payments of $[Insert Regular Payment Amount] due monthly on the [Insert Day of the Month] of each month thereafter.

- Final payment of $[Insert Final Payment Amount] due on the due date mentioned above.

The interest rate applicable to this note shall be [Insert Interest Rate]% per annum.

If the Borrower fails to make any payment on time, the Lender may charge a late fee of $[Insert Late Fee Amount] and may pursue any legal remedies available under California law.

The Borrower may prepay this note in whole or in part at any time without penalty.

By signing below, the Borrower confirms understanding and acceptance of the terms specified in this Promissory Note.

_____________________________

Borrower's Signature

Date: ________________

_____________________________

Lender's Signature

Date: ________________

Frequently Asked Questions

-

What is a California Promissory Note?

A California Promissory Note is a written financial agreement in which one party (the borrower) agrees to pay a specified amount of money to another party (the lender) under certain conditions. This document outlines the terms of the loan, including the interest rate, repayment schedule, and consequences of default.

-

Who can use a Promissory Note in California?

Any individual or entity can use a Promissory Note in California. This includes private lenders, businesses, and individuals borrowing money from family or friends. It is important that both parties understand the terms and conditions outlined in the note.

-

What are the key components of a California Promissory Note?

Key components typically include:

- The names and addresses of the borrower and lender

- The principal amount being borrowed

- The interest rate, if applicable

- The repayment schedule, including due dates

- Consequences for late payments or default

- Signatures of both parties

-

Is a Promissory Note legally binding?

Yes, a properly executed Promissory Note is legally binding in California. Both parties must agree to the terms and sign the document for it to be enforceable. If either party fails to uphold their end of the agreement, the other party may seek legal remedies.

-

Do I need a lawyer to create a Promissory Note?

While it is not legally required to have a lawyer draft a Promissory Note, it is advisable, especially for larger loans or complex agreements. A legal professional can ensure that the document complies with California laws and adequately protects the interests of both parties.

-

Can a Promissory Note be modified?

Yes, a Promissory Note can be modified if both parties agree to the changes. It is best to document any modifications in writing and have both parties sign the amended note to avoid future disputes.

-

What happens if the borrower defaults on the loan?

If the borrower defaults, the lender has the right to take legal action to recover the owed amount. This may include filing a lawsuit or pursuing other collection methods as outlined in the Promissory Note. The specific consequences of default should be clearly stated in the note itself.

-

How long is a Promissory Note valid?

The validity of a Promissory Note generally depends on the terms outlined in the document. In California, the statute of limitations for enforcing a written contract, including a Promissory Note, is typically four years from the date of default.

-

Where can I find a California Promissory Note template?

Templates for California Promissory Notes can be found online through legal document websites, or you may consult a lawyer for a customized version. Ensure that any template you use complies with California laws and fits the specific needs of your agreement.

Misconceptions

When it comes to the California Promissory Note form, several misconceptions can lead to confusion. Understanding the facts can help you navigate this important financial document more effectively. Here are seven common misconceptions:

- All promissory notes are the same. Many people believe that a promissory note is a one-size-fits-all document. In reality, the terms and conditions can vary significantly based on the agreement between the parties involved.

- A promissory note must be notarized. While notarization can add an extra layer of authenticity, it is not a legal requirement for a promissory note to be valid in California.

- Only banks can issue promissory notes. Individuals and private entities can also create and enforce promissory notes. This flexibility allows for various lending arrangements.

- Promissory notes are only for large loans. Some think that these documents are only necessary for substantial amounts. However, promissory notes can be used for any loan amount, no matter how small.

- A promissory note guarantees repayment. While a promissory note is a promise to repay, it does not guarantee that the borrower will fulfill that promise. Creditworthiness and other factors play a significant role.

- Interest rates must be included in a promissory note. Although many promissory notes do specify an interest rate, it is not mandatory. A note can be created for a zero-interest loan as well.

- Once signed, a promissory note cannot be changed. While changes to a promissory note may require mutual consent from both parties, it is possible to amend the terms if both agree.

By debunking these misconceptions, you can approach the California Promissory Note with greater clarity and confidence. Always consider seeking professional advice if you have specific questions or concerns.

Common mistakes

-

Omitting Key Information: One of the most common mistakes is leaving out essential details. This includes the names of both the borrower and the lender, the loan amount, and the date of the agreement. Each of these elements is crucial for the document's validity.

-

Incorrect Interest Rate: Failing to accurately state the interest rate can lead to confusion and disputes later. It’s important to double-check that the rate is clearly expressed, whether it’s fixed or variable, and that it complies with California’s usury laws.

-

Improper Payment Terms: Mistakes often occur in detailing the payment schedule. Whether payments are monthly, quarterly, or another frequency, clarity is key. Including the start date and the total number of payments helps prevent misunderstandings.

-

Neglecting to Sign: A promissory note is not legally binding unless it is signed by the borrower. Sometimes, people forget this crucial step. Both parties should ensure that the document is signed and dated appropriately.

-

Failure to Include Default Terms: Not specifying what happens in the event of default can create complications. It’s wise to outline the consequences of missed payments, including late fees or acceleration clauses, to protect the lender's interests.

-

Not Keeping Copies: After filling out the form, some individuals forget to make copies for their records. Keeping a copy of the signed promissory note is essential for both parties to reference in case of disputes or questions in the future.

Find Some Other Promissory Note Forms for Specific States

Loan Note Template - Both parties should keep copies of the signed note for their records and future reference.

Online Promissory Note - Being upfront about financial circumstances can benefit all parties involved.

In drafting a rental agreement, it is crucial to refer to reliable resources such as the documentonline.org/blank-ohio-residential-lease-agreement, which provides a comprehensive template for the Ohio Residential Lease Agreement. This ensures that all necessary terms are included, enabling both landlords and tenants to understand their rights and obligations clearly, thus preventing disputes and fostering a positive rental experience.

Georgia Promissory Note - Borrowers should carefully read all terms to understand their repayment obligations.

Texas Promissory Note - Interest rates on promissory notes can vary based on the agreement between the parties.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | A California promissory note is a written promise to pay a specified amount of money to a designated person or entity at a defined time. |

| Governing Law | The California Uniform Commercial Code (UCC), specifically Sections 3101-3109, governs promissory notes in California. |

| Essential Elements | For a promissory note to be valid, it must include the amount owed, the interest rate (if any), the repayment schedule, and the signatures of the involved parties. |

| Enforceability | A properly executed promissory note can be legally enforced in court, allowing the lender to recover the owed amount in case of default. |

Similar forms

The California Promissory Note form shares similarities with a Loan Agreement. Both documents outline the terms of a loan between a borrower and a lender. They specify the amount borrowed, interest rates, and repayment terms. However, a Loan Agreement typically provides a more comprehensive framework, including additional clauses regarding default, collateral, and legal remedies. While a Promissory Note is a straightforward promise to repay, a Loan Agreement offers a more detailed exploration of the obligations and rights of both parties involved.

The Profit And Loss form is a crucial financial document for businesses, similar to a promissory note, as it reflects the company's financial obligations. Understanding this form is essential for stakeholders, and for those looking to dive deeper into financial documentation, more information can be found at https://onlinelawdocs.com.

A second document akin to the California Promissory Note is a Secured Promissory Note. This variation includes a security interest in collateral to protect the lender. In essence, while both documents serve as a promise to repay, the Secured Promissory Note offers an added layer of security for the lender by allowing them to claim the specified collateral if the borrower defaults. This distinction can significantly affect the risk assessment for the lender.

The California Promissory Note is also similar to an Unsecured Promissory Note. Unlike its secured counterpart, an Unsecured Promissory Note does not involve collateral. Both documents function as a promise to repay a loan, but the lack of security in an Unsecured Promissory Note may lead to higher interest rates. Borrowers often face stricter terms due to the increased risk for lenders.

A further related document is a Demand Note. This type of note allows the lender to request repayment at any time. While the California Promissory Note typically specifies a repayment schedule, a Demand Note offers flexibility for the lender. Both documents serve to formalize a loan, but the Demand Note's immediacy can create a different dynamic in the borrower-lender relationship.

Another document that resembles the California Promissory Note is a Personal Loan Agreement. This document serves a similar function by detailing the terms of a loan between individuals. Both agreements outline the repayment schedule and interest rates. However, a Personal Loan Agreement may include unique terms reflecting the personal relationship between the borrower and lender, such as informal repayment options or special considerations based on trust and understanding.

Lastly, the California Promissory Note can be compared to a Mortgage Note. While a Mortgage Note specifically pertains to real estate transactions, both documents serve as promises to repay a loan. A Mortgage Note is secured by the property itself, providing the lender with a claim to the property in case of default. This key difference highlights the importance of the underlying asset in shaping the terms and conditions of the loan agreement.