Valid California Operating Agreement Template

The California Operating Agreement form serves as a vital document for Limited Liability Companies (LLCs) operating within the state. This agreement outlines the management structure, operational procedures, and ownership interests of the LLC, ensuring that all members have a clear understanding of their roles and responsibilities. It typically includes key provisions such as the distribution of profits and losses, decision-making processes, and procedures for adding or removing members. By establishing these guidelines, the Operating Agreement helps to prevent misunderstandings and disputes among members. Additionally, while California law does not mandate an Operating Agreement, having one in place is strongly recommended to protect the interests of all parties involved. This document not only acts as a framework for the LLC’s operations but also provides legal protection and clarity, fostering a more harmonious business environment.

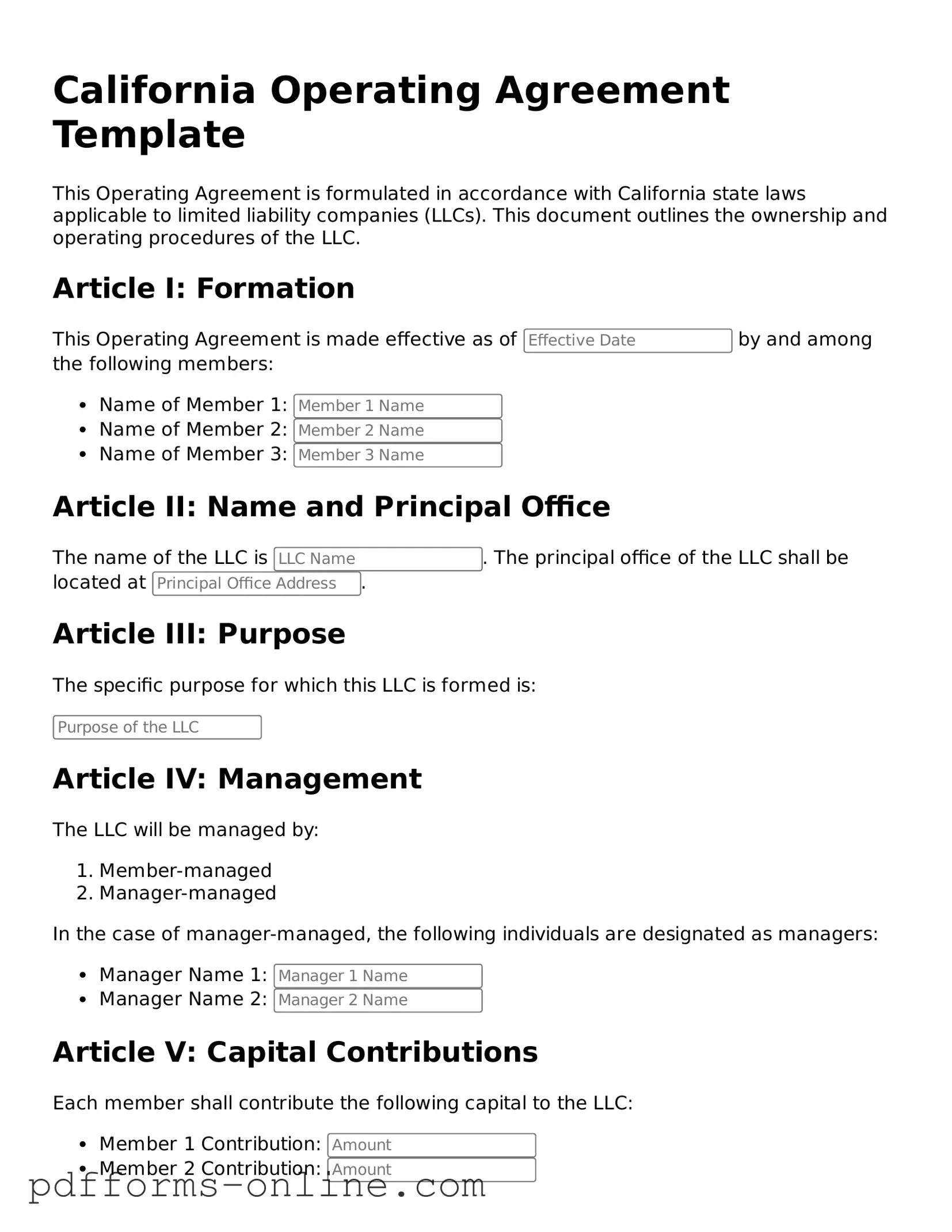

Document Example

California Operating Agreement Template

This Operating Agreement is formulated in accordance with California state laws applicable to limited liability companies (LLCs). This document outlines the ownership and operating procedures of the LLC.

Article I: Formation

This Operating Agreement is made effective as of by and among the following members:

- Name of Member 1:

- Name of Member 2:

- Name of Member 3:

Article II: Name and Principal Office

The name of the LLC is . The principal office of the LLC shall be located at .

Article III: Purpose

The specific purpose for which this LLC is formed is:

Article IV: Management

The LLC will be managed by:

- Member-managed

- Manager-managed

In the case of manager-managed, the following individuals are designated as managers:

- Manager Name 1:

- Manager Name 2:

Article V: Capital Contributions

Each member shall contribute the following capital to the LLC:

- Member 1 Contribution:

- Member 2 Contribution:

- Member 3 Contribution:

Article VI: Distributions

Distributions to the members shall be made in accordance with their respective ownership interests, unless otherwise agreed upon in writing. The ownership interests are as follows:

- Member 1 Interest:

- Member 2 Interest:

- Member 3 Interest:

Article VII: Indemnification

The LLC shall indemnify its members and managers to the fullest extent permitted by California law. This indemnification shall cover all costs incurred in connection with legal disputes arising from the member's position.

Article VIII: Amendments

This Operating Agreement may be amended only by a written agreement signed by all members of the LLC. Any changes to this Agreement must be documented clearly and attached as amendments.

Signatures

IN WITNESS WHEREOF, the undersigned members have executed this Operating Agreement as of the date first written above:

- Signature of Member 1: _________________________ Date: ________________

- Signature of Member 2: _________________________ Date: ________________

- Signature of Member 3: _________________________ Date: ________________

Frequently Asked Questions

-

What is a California Operating Agreement?

A California Operating Agreement is a legal document that outlines the management structure and operating procedures of a limited liability company (LLC) in California. It serves as an internal guideline for the members of the LLC, detailing their rights, responsibilities, and the distribution of profits and losses.

-

Is an Operating Agreement required in California?

While California law does not mandate that LLCs have an Operating Agreement, it is highly recommended. Having this document can help clarify the roles of members and managers, reduce misunderstandings, and provide a framework for resolving disputes.

-

What should be included in a California Operating Agreement?

A comprehensive Operating Agreement typically includes:

- The name and purpose of the LLC

- The names of the members and their ownership percentages

- The management structure (member-managed or manager-managed)

- Procedures for admitting new members

- Voting rights and decision-making processes

- Distribution of profits and losses

- Procedures for dissolving the LLC

-

Can members modify the Operating Agreement?

Yes, members can modify the Operating Agreement. Changes should be documented in writing and agreed upon by all members. It is advisable to keep a record of any amendments to ensure clarity and compliance.

-

How is an Operating Agreement executed?

To execute an Operating Agreement, all members should review the document thoroughly. Once everyone agrees to the terms, members can sign the agreement. While notarization is not required, it can add an extra layer of authenticity.

-

What happens if there is no Operating Agreement?

If an LLC does not have an Operating Agreement, California's default LLC laws will govern the operations of the business. This may not align with the members' intentions and could lead to disputes or misunderstandings.

-

How can I ensure my Operating Agreement is legally binding?

To ensure that an Operating Agreement is legally binding, it should be in writing, signed by all members, and comply with California law. Consulting with a legal professional can also help confirm that the document meets all necessary legal standards.

-

Are there any costs associated with creating an Operating Agreement?

Creating an Operating Agreement can incur costs, especially if legal assistance is sought. However, many templates are available online for free or at a low cost. The complexity of the LLC's structure may also influence the overall cost.

-

Can an Operating Agreement be used in disputes?

Yes, an Operating Agreement can serve as a reference point in disputes among members. It outlines the agreed-upon terms and can help resolve conflicts by providing a clear framework for decision-making and responsibilities.

-

Where should I keep my Operating Agreement?

The Operating Agreement should be kept in a safe and accessible location. All members should have a copy, and it is advisable to store the original document in a secure place, such as a safe or a secure digital file storage system.

Misconceptions

When it comes to the California Operating Agreement form, there are several misconceptions that can lead to confusion for business owners. Understanding these misconceptions is crucial for ensuring that your business operates smoothly and in compliance with state laws. Here are four common misunderstandings:

- It is not necessary to have an Operating Agreement. Many people believe that because California does not require LLCs to have an Operating Agreement, they can operate without one. However, having an Operating Agreement is essential. It outlines the management structure and operational procedures of the business, which can help prevent disputes among members and clarify each member's responsibilities.

- Operating Agreements are only for multi-member LLCs. Some individuals think that only LLCs with multiple members need an Operating Agreement. This is not true. Even single-member LLCs benefit from having an Operating Agreement. It serves to establish the legitimacy of the business and can help protect personal assets in case of legal issues.

- Once created, the Operating Agreement cannot be changed. There is a misconception that an Operating Agreement is a permanent document that cannot be modified. In reality, Operating Agreements can be amended as the business evolves. Members can agree to changes, and it is advisable to document any amendments to maintain clarity and legal standing.

- All Operating Agreements are the same. Some individuals assume that a standard Operating Agreement will suffice for any LLC. However, each business is unique, and the Operating Agreement should reflect the specific needs and goals of the LLC. Customizing the agreement ensures that it addresses the particular circumstances of the business and its members.

Being aware of these misconceptions can help you make informed decisions regarding your LLC's Operating Agreement. Taking the time to create a comprehensive and tailored agreement can provide significant benefits for your business in the long run.

Common mistakes

-

Not including all members: It's crucial to list all members of the LLC. Leaving someone out can lead to disputes later on.

-

Vague descriptions: Be specific when describing each member's role and responsibilities. Ambiguity can create confusion.

-

Ignoring state requirements: California has specific rules regarding Operating Agreements. Failing to adhere to these can result in legal issues.

-

Forgetting to update the agreement: As circumstances change, so should the Operating Agreement. Regular updates are essential to keep it relevant.

-

Not addressing profit and loss distribution: Clearly outline how profits and losses will be shared among members. This prevents misunderstandings.

-

Neglecting to include a dispute resolution process: Having a plan for resolving conflicts can save time and money in the future.

-

Skipping the signature section: All members must sign the agreement. Without signatures, the document may not be legally binding.

-

Using outdated templates: Relying on old templates can lead to missing important updates in the law. Always use the most current version.

-

Not consulting a professional: While it may seem straightforward, having a lawyer review the agreement can prevent costly mistakes.

Find Some Other Operating Agreement Forms for Specific States

How to Make an Operating Agreement - It is a flexible document that can be customized to fit the needs of the business.

When engaging in the sale of a mobile home in Arizona, it's essential to have a properly executed Mobile Home Bill of Sale. This document not only serves as proof of the transaction but also helps to clarify the agreement between the buyer and seller regarding the sale details. To ensure compliance and safeguard your investment, it is beneficial to take advantage of resources that provide guidance on these forms, such as All Arizona Forms.

How to Make an Operating Agreement - Developing an Operating Agreement encourages active participation and investment in the company’s success.

Llc Operating Agreement Florida - This document serves as a critical reference point for resolving future disputes.

PDF Attributes

| Fact Name | Description |

|---|---|

| Purpose | The California Operating Agreement outlines the management structure and operational procedures for a limited liability company (LLC) in California. |

| Governing Law | This agreement is governed by the California Corporations Code, specifically sections 17300 to 17306. |

| Flexibility | Members of the LLC have the freedom to customize the agreement to suit their specific needs, including profit distribution and decision-making processes. |

| Legal Requirement | While not legally required, having an Operating Agreement is highly recommended for LLCs to clarify member roles and protect personal assets. |

Similar forms

The California Partnership Agreement is similar to the Operating Agreement in that both documents outline the structure and rules governing a business entity. While the Operating Agreement is specific to limited liability companies (LLCs), the Partnership Agreement serves partnerships. Both agreements define the roles of members or partners, their contributions, profit distribution, and procedures for resolving disputes. This ensures that all parties understand their responsibilities and rights within the business relationship.

The Bylaws of a corporation share similarities with the Operating Agreement, as both documents provide a framework for internal governance. Bylaws detail the management structure, including the roles of directors and officers, and outline procedures for meetings and decision-making. Like an Operating Agreement, Bylaws help ensure that all members or shareholders are on the same page regarding the operation of the business.

A Shareholder Agreement is another document akin to the Operating Agreement. This agreement is used in corporations and sets forth the rights and obligations of shareholders. It covers issues such as share transfers, voting rights, and how to handle disputes. Both documents aim to protect the interests of the parties involved and provide clarity on how the business will operate.

The LLC Membership Agreement is closely related to the Operating Agreement, as it serves a similar purpose for LLCs. This document outlines the rights and responsibilities of each member, including their ownership percentages, voting rights, and profit-sharing arrangements. Both agreements help establish a clear understanding of how the LLC will function and how decisions will be made.

The Joint Venture Agreement is another comparable document. It governs the relationship between two or more parties who come together for a specific project or business purpose. Like the Operating Agreement, it outlines the contributions of each party, profit-sharing, and the management structure. This helps ensure that all parties are aligned and understand their roles in the joint venture.

The Operating Agreement can also be compared to a Non-Disclosure Agreement (NDA) in terms of protecting business interests. While an NDA focuses on confidentiality, an Operating Agreement protects the operational aspects of a business. Both documents help safeguard sensitive information and ensure that all parties are aware of their obligations, thus fostering trust and cooperation.

Obtaining a General Power of Attorney form template can streamline the process of assigning someone to make important decisions on your behalf. This form is crucial for individuals who want to ensure their wishes are clearly communicated and legally recognized.

The Employment Agreement is another document that serves a specific purpose in the business context. While the Operating Agreement governs the relationship between members of an LLC, the Employment Agreement outlines the terms of employment for individuals working within the company. It details job responsibilities, compensation, and termination procedures, ensuring clarity in the employer-employee relationship.

A Franchise Agreement is similar in that it establishes the terms between a franchisor and a franchisee. This document outlines the rights and responsibilities of both parties, including fees, operational guidelines, and support provided by the franchisor. Like the Operating Agreement, it aims to create a clear understanding of the business relationship and expectations.

The Loan Agreement is another relevant document, particularly when financing is involved in a business venture. It outlines the terms of the loan, including repayment schedules, interest rates, and collateral. While the Operating Agreement focuses on the internal workings of a business, both documents are essential for defining financial relationships and obligations.

Finally, the Purchase Agreement is similar in that it outlines the terms of a transaction involving the sale of a business or its assets. This document specifies the purchase price, payment terms, and conditions of the sale. While the Operating Agreement governs the ongoing operations of a business, both documents are crucial for establishing clear terms and protecting the interests of all parties involved.