Valid California Loan Agreement Template

The California Loan Agreement form serves as a crucial document in the lending process, outlining the terms and conditions agreed upon by both the lender and the borrower. This form typically includes essential elements such as the loan amount, interest rate, repayment schedule, and any collateral involved. Additionally, it specifies the rights and obligations of each party, ensuring clarity and mutual understanding. Provisions regarding default and remedies are also included, which protect the interests of the lender while providing the borrower with an understanding of the consequences of non-compliance. Furthermore, the form may address prepayment options, late fees, and governing law, making it a comprehensive tool for facilitating financial transactions. By clearly delineating the expectations and responsibilities of both parties, the California Loan Agreement form minimizes the potential for disputes and fosters a transparent lending environment.

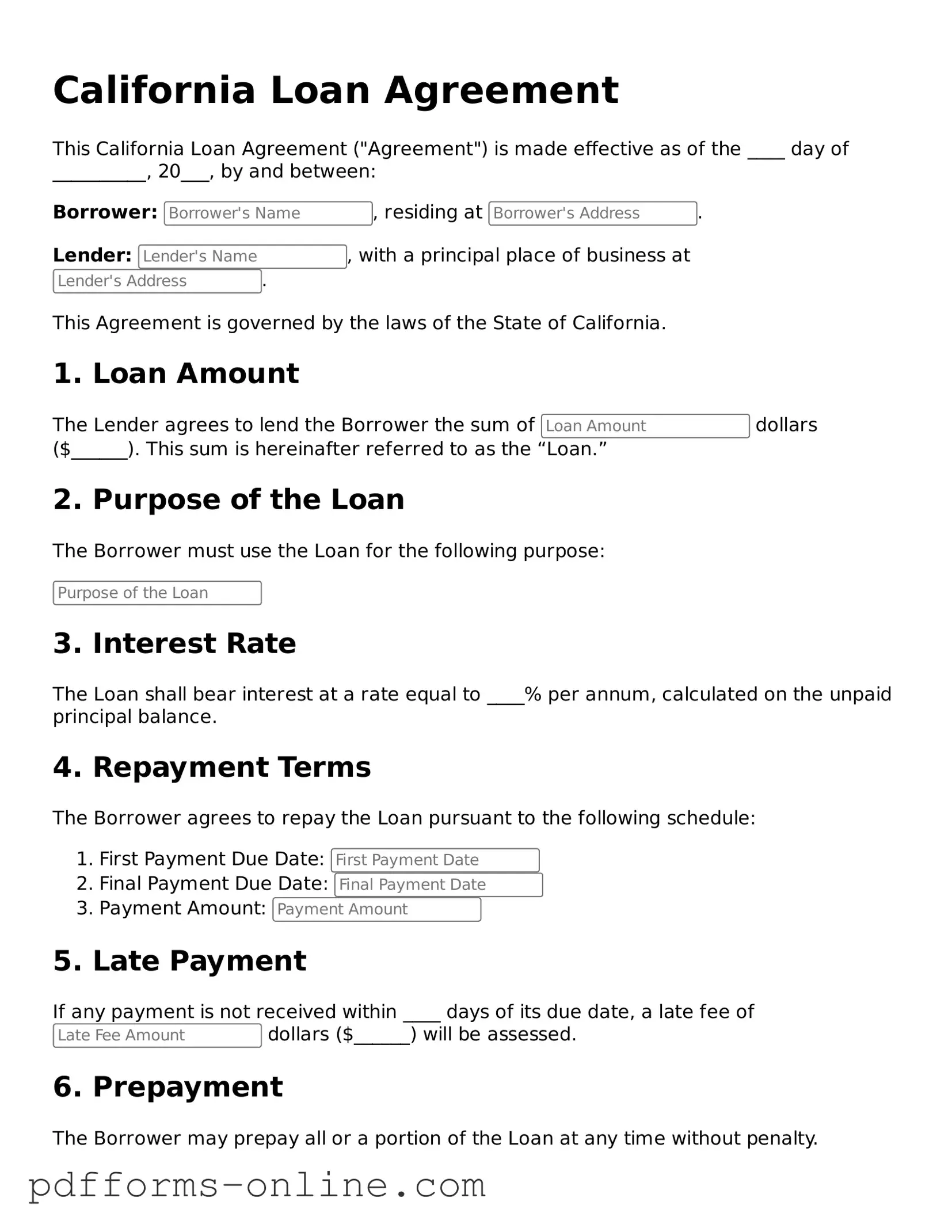

Document Example

California Loan Agreement

This California Loan Agreement ("Agreement") is made effective as of the ____ day of __________, 20___, by and between:

Borrower: , residing at .

Lender: , with a principal place of business at .

This Agreement is governed by the laws of the State of California.

1. Loan Amount

The Lender agrees to lend the Borrower the sum of dollars ($______). This sum is hereinafter referred to as the “Loan.”

2. Purpose of the Loan

The Borrower must use the Loan for the following purpose:

3. Interest Rate

The Loan shall bear interest at a rate equal to ____% per annum, calculated on the unpaid principal balance.

4. Repayment Terms

The Borrower agrees to repay the Loan pursuant to the following schedule:

- First Payment Due Date:

- Final Payment Due Date:

- Payment Amount:

5. Late Payment

If any payment is not received within ____ days of its due date, a late fee of dollars ($______) will be assessed.

6. Prepayment

The Borrower may prepay all or a portion of the Loan at any time without penalty.

7. Default

In the event of default, the Lender may declare the entire remaining balance due and payable immediately. Default occurs if:

- The Borrower fails to make a payment when due.

- The Borrower declares bankruptcy.

- The Borrower breaches any other terms of this Agreement.

8. Governing Law

This Agreement shall be governed and interpreted under the laws of the State of California.

9. Signatures

In witness whereof, the parties hereto have executed this Loan Agreement as of the date first above written.

Borrower Signature: ____________________________________ Date: _______________

Lender Signature: _____________________________________ Date: _______________

Frequently Asked Questions

-

What is a California Loan Agreement?

A California Loan Agreement is a legal document that outlines the terms and conditions under which a borrower receives money from a lender. This agreement specifies the amount borrowed, interest rates, repayment terms, and any collateral involved.

-

Who should use a Loan Agreement?

Both individuals and businesses can use a Loan Agreement. It is essential for anyone lending or borrowing money to have a written agreement to protect their interests and clarify expectations.

-

What are the key components of a Loan Agreement?

A typical Loan Agreement includes:

- The names and addresses of the borrower and lender

- The loan amount

- The interest rate

- The repayment schedule

- Any collateral securing the loan

- Consequences of default

-

Is it necessary to have a Loan Agreement in writing?

Yes, it is advisable to have a Loan Agreement in writing. A written document provides clear evidence of the terms agreed upon, which can be crucial in the event of a dispute.

-

Can a Loan Agreement be modified?

Yes, a Loan Agreement can be modified if both parties agree to the changes. It is best to document any modifications in writing and have both parties sign the updated agreement.

-

What happens if the borrower defaults on the loan?

If the borrower defaults, the lender may take legal action to recover the owed amount. The Loan Agreement typically outlines the specific consequences of default, which may include late fees or the seizure of collateral.

-

Are there any restrictions on interest rates in California?

Yes, California has laws that limit the amount of interest that can be charged on loans. It is important to ensure that the interest rate specified in the Loan Agreement complies with state regulations.

-

Do I need a lawyer to create a Loan Agreement?

While it is not required to have a lawyer, consulting with one can help ensure that the Loan Agreement is legally sound and meets all necessary requirements. This can be especially important for larger loans or complex agreements.

-

How can I enforce a Loan Agreement?

To enforce a Loan Agreement, the lender may need to take legal action if the borrower fails to repay. This may involve filing a lawsuit in a court of law to recover the owed amount.

-

Where can I find a California Loan Agreement template?

Templates for California Loan Agreements can be found online through legal document websites or local legal aid organizations. It is important to choose a template that complies with California laws.

Misconceptions

Understanding the California Loan Agreement form is crucial for both lenders and borrowers. However, several misconceptions can lead to confusion. Below is a list of common misunderstandings about this form.

- All loan agreements must be in writing. While it is highly recommended to have a written agreement for clarity and legal protection, not all verbal agreements are unenforceable.

- The form is only for large loans. The California Loan Agreement can be used for any amount, whether small or large, providing flexibility for various lending situations.

- Only banks can issue loans using this form. Individuals, private lenders, and businesses can also use the California Loan Agreement to formalize loans.

- There is a standard interest rate that must be used. Interest rates can vary significantly and are typically negotiated between the borrower and lender, as long as they comply with state usury laws.

- Loan agreements are only for personal loans. This form can be used for business loans, real estate transactions, and other types of financing, not just personal loans.

- Once signed, the terms cannot be changed. Parties can amend the agreement if both agree to the changes, but such amendments should also be documented in writing.

- California Loan Agreements are only valid within California. While the form is designed for use in California, it can also be used for transactions involving parties outside the state, as long as California law applies.

- Legal advice is not necessary when using this form. Although the form can be straightforward, seeking legal advice is advisable to ensure all terms are understood and compliant with laws.

Common mistakes

-

Incorrect Borrower Information: Many individuals fail to provide accurate personal details, such as their full name, address, or Social Security number. This can lead to delays or complications in processing the loan.

-

Missing Signatures: A common oversight is neglecting to sign the form. Without a signature, the agreement is not legally binding.

-

Inaccurate Loan Amount: Some borrowers enter the wrong loan amount. This mistake can affect repayment terms and interest rates.

-

Failure to Read Terms: Skimming over the loan terms can lead to misunderstandings. Borrowers should fully understand interest rates, fees, and repayment schedules.

-

Ignoring Disclosure Requirements: The form may require specific disclosures about the loan. Omitting this information can result in legal issues later.

-

Not Providing Supporting Documents: Many lenders require additional documentation, such as proof of income or credit history. Failing to include these can slow down the approval process.

-

Choosing the Wrong Loan Type: Selecting an inappropriate loan type for your needs can lead to financial strain. Borrowers should evaluate their options carefully.

-

Not Keeping Copies: After submission, some individuals forget to keep a copy of the signed agreement. This can create problems if disputes arise in the future.

Find Some Other Loan Agreement Forms for Specific States

Promissory Note Template Georgia - Specifies the purpose of the loan, if required.

This informative Mobile Home Bill of Sale document serves as a crucial record when transferring ownership of a mobile home, ensuring all parties are aware of their obligations and rights during the transaction process.

Promissory Note Template New York - The Loan Agreement ensures both parties understand their obligations and rights.

PDF Attributes

| Fact Name | Details |

|---|---|

| Definition | The California Loan Agreement form is a legal document outlining the terms and conditions of a loan between a lender and a borrower. |

| Governing Law | This agreement is governed by California state law, specifically the California Civil Code. |

| Parties Involved | The form identifies the lender and borrower, including their legal names and contact information. |

| Loan Amount | The specific amount of money being loaned is clearly stated in the agreement. |

| Interest Rate | The agreement specifies the interest rate applicable to the loan, which can be fixed or variable. |

| Repayment Terms | It outlines the repayment schedule, including due dates and payment methods. |

| Default Conditions | The form details what constitutes a default and the consequences for the borrower if a default occurs. |

| Prepayment Options | Borrowers may have the option to prepay the loan without penalty, which is addressed in the agreement. |

| Governing Law Clause | A clause is included that specifies California law as the governing law for resolving disputes. |

| Signatures | The document requires signatures from both parties to validate the agreement and make it legally binding. |

Similar forms

The California Loan Agreement form shares similarities with a Promissory Note. Both documents outline the terms of a loan, including the amount borrowed, interest rate, and repayment schedule. A Promissory Note is typically a simpler document that serves as a written promise to repay the loan, while the Loan Agreement may include more detailed terms and conditions, such as collateral requirements and default provisions. However, both documents are legally binding and serve to protect the interests of the lender.

Another document akin to the California Loan Agreement is the Security Agreement. This document is used when a borrower pledges collateral to secure a loan. Like the Loan Agreement, it details the obligations of the borrower and the rights of the lender. The Security Agreement specifically focuses on the collateral aspect, outlining what assets are at risk if the borrower defaults. Both documents work together to create a comprehensive framework for the loan transaction.

The California Loan Agreement is also similar to a Mortgage Agreement. A Mortgage Agreement is a specific type of loan agreement that involves real estate as collateral. It outlines the terms of the loan, including the principal amount, interest rate, and payment schedule, just like the Loan Agreement. However, the Mortgage Agreement also includes provisions related to the property itself, such as foreclosure rights in case of default. Both documents establish the legal relationship between the borrower and lender.

Additionally, the Loan Agreement is comparable to a Line of Credit Agreement. This document allows borrowers to access funds up to a specified limit, rather than a fixed loan amount. Similar to the Loan Agreement, it includes terms regarding interest rates and repayment. However, a Line of Credit Agreement provides more flexibility, allowing borrowers to withdraw and repay funds as needed. Both agreements aim to facilitate borrowing while protecting the lender's interests.

A further document that resembles the California Loan Agreement is the Loan Modification Agreement. This document is used to change the terms of an existing loan, often due to financial hardship. Like the Loan Agreement, it details the new terms, such as adjusted interest rates or extended repayment periods. Both documents aim to clarify the responsibilities of the borrower and lender, ensuring that both parties understand the modified terms of the loan.

Understanding the importance of various legal documents can greatly enhance the process of asset transactions, such as when dealing with the New York Trailer Bill of Sale. This form is essential for ensuring a smooth transfer of ownership and is particularly beneficial for establishing clear terms between the buyer and the seller. For more information on this crucial document, visit documentonline.org/blank-new-york-trailer-bill-of-sale/, which provides a comprehensive overview and template required for the process.

Finally, the California Loan Agreement can be compared to a Personal Loan Agreement. This type of agreement is often used for unsecured loans between individuals or small businesses. Similar to the Loan Agreement, it specifies the loan amount, interest rate, and repayment terms. However, a Personal Loan Agreement may not require collateral, making it riskier for the lender. Both documents serve to formalize the borrowing relationship and protect the rights of the lender.