Valid California Last Will and Testament Template

Creating a Last Will and Testament is an essential step in ensuring that your wishes are honored after your passing. In California, this legal document serves as a formal declaration of how you would like your assets distributed and who will be responsible for managing your estate. The form typically includes key components such as the identification of beneficiaries, the appointment of an executor, and specific instructions for the care of any minor children or dependents. Additionally, it may outline any funeral arrangements you desire. By utilizing the California Last Will and Testament form, individuals can provide clarity and direction for their loved ones during a difficult time, minimizing potential disputes and confusion. Understanding the structure and requirements of this form is crucial for anyone looking to secure their legacy and ensure their final wishes are respected.

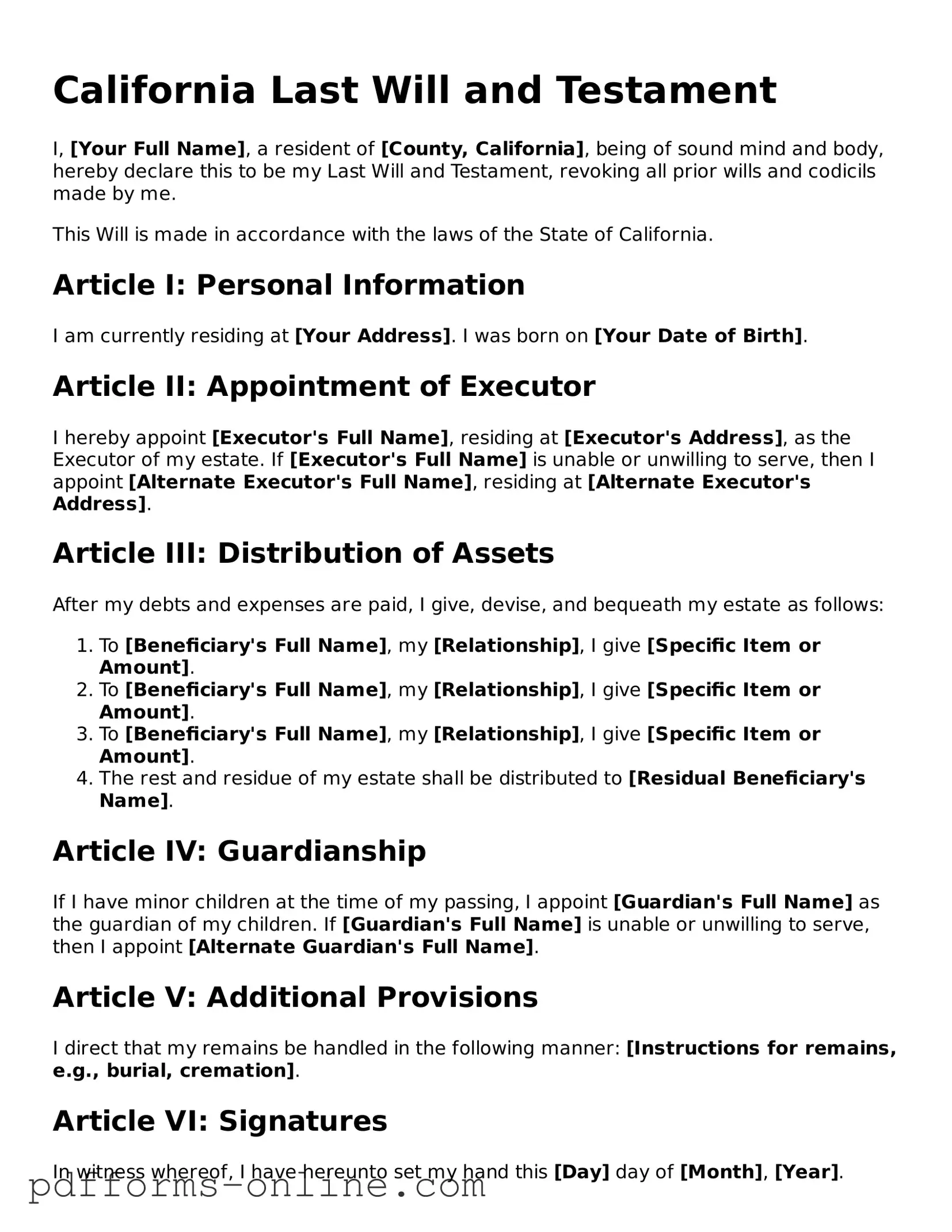

Document Example

California Last Will and Testament

I, [Your Full Name], a resident of [County, California], being of sound mind and body, hereby declare this to be my Last Will and Testament, revoking all prior wills and codicils made by me.

This Will is made in accordance with the laws of the State of California.

Article I: Personal Information

I am currently residing at [Your Address]. I was born on [Your Date of Birth].

Article II: Appointment of Executor

I hereby appoint [Executor's Full Name], residing at [Executor's Address], as the Executor of my estate. If [Executor's Full Name] is unable or unwilling to serve, then I appoint [Alternate Executor's Full Name], residing at [Alternate Executor's Address].

Article III: Distribution of Assets

After my debts and expenses are paid, I give, devise, and bequeath my estate as follows:

- To [Beneficiary's Full Name], my [Relationship], I give [Specific Item or Amount].

- To [Beneficiary's Full Name], my [Relationship], I give [Specific Item or Amount].

- To [Beneficiary's Full Name], my [Relationship], I give [Specific Item or Amount].

- The rest and residue of my estate shall be distributed to [Residual Beneficiary's Name].

Article IV: Guardianship

If I have minor children at the time of my passing, I appoint [Guardian's Full Name] as the guardian of my children. If [Guardian's Full Name] is unable or unwilling to serve, then I appoint [Alternate Guardian's Full Name].

Article V: Additional Provisions

I direct that my remains be handled in the following manner: [Instructions for remains, e.g., burial, cremation].

Article VI: Signatures

In witness whereof, I have hereunto set my hand this [Day] day of [Month], [Year].

__________________________________

[Your Signature]

[Your Printed Name]

Witnesses

We, the undersigned witnesses, do hereby attest that [Your Full Name] appeared to be of sound mind and under no duress when signing this Last Will and Testament, and we hereby witness the signing of this document.

-

__________________________________

[Witness 1's Signature]

[Witness 1's Printed Name] -

__________________________________

[Witness 2's Signature]

[Witness 2's Printed Name]

Frequently Asked Questions

-

What is a Last Will and Testament in California?

A Last Will and Testament is a legal document that outlines how a person wants their assets distributed after their death. In California, this document can also name guardians for minor children and appoint an executor to manage the estate. It is crucial for ensuring that your wishes are honored and can help prevent disputes among family members.

-

Do I need a lawyer to create a Last Will and Testament in California?

No, you do not necessarily need a lawyer to create a Last Will and Testament in California. Many people choose to use online templates or forms. However, consulting with a legal professional can provide peace of mind. A lawyer can help ensure that the will meets all legal requirements and accurately reflects your intentions.

-

What are the requirements for a valid Last Will and Testament in California?

In California, a valid Last Will and Testament must be in writing and signed by the person making the will (the testator). The testator must be at least 18 years old and of sound mind. Additionally, the will should be witnessed by at least two individuals who are not beneficiaries of the will. These witnesses must also sign the document.

-

Can I change my Last Will and Testament after it is created?

Yes, you can change your Last Will and Testament at any time while you are still alive. This can be done by creating a new will or adding a codicil, which is an amendment to the existing will. It is important to follow the same legal requirements for signing and witnessing when making changes to ensure the validity of the document.

-

What happens if I die without a Last Will and Testament in California?

If you die without a Last Will and Testament, you are considered to have died "intestate." In this case, California law will determine how your assets are distributed. Generally, the estate will be divided among your closest relatives, which may not align with your wishes. To avoid this situation, it is advisable to create a will that clearly states your preferences.

Misconceptions

Understanding the California Last Will and Testament can be challenging, and misconceptions often lead to confusion. Here are five common misconceptions about this important legal document:

-

My will must be notarized to be valid. Many people believe that a will must be notarized to be legally binding in California. However, this is not true. A will can be valid without a notary if it is signed by the testator and witnessed by at least two individuals who are not beneficiaries of the will.

-

Only wealthy individuals need a will. Some think that wills are only for those with significant assets. In reality, everyone can benefit from having a will, regardless of their financial situation. A will allows you to dictate how your possessions and responsibilities will be handled after your passing, ensuring your wishes are honored.

-

I can write my will on a napkin and it will be valid. While California does recognize holographic wills (handwritten wills), they must meet specific criteria to be valid. A will written on a napkin may not clearly express your intentions or be properly witnessed, which could lead to disputes among heirs.

-

Once I create a will, I can’t change it. This is a common myth. In fact, you can modify your will at any time, as long as you follow the proper legal procedures. Creating a new will or adding a codicil (an amendment to the will) allows you to update your wishes as your life circumstances change.

-

Having a will avoids probate entirely. While a will is essential for outlining your wishes, it does not prevent your estate from going through probate. Probate is the legal process of validating a will and distributing assets. However, having a will can simplify the process and make your intentions clear, which can help reduce conflicts among heirs.

By dispelling these misconceptions, individuals can better prepare for the future and ensure their wishes are respected. A well-crafted will is a vital tool for anyone looking to take control of their legacy.

Common mistakes

-

Not naming an executor: Many people forget to designate an executor. This is the person responsible for carrying out the wishes in the will. Without an executor, the court will appoint someone, which may not align with your preferences.

-

Failing to sign the document: A will must be signed by the person creating it. If you don’t sign, the will is not valid. Ensure you sign in the presence of witnesses if required.

-

Inadequate witness requirements: California law requires at least two witnesses. Some individuals overlook this requirement, which can lead to the will being contested.

-

Not updating the will: Life changes such as marriage, divorce, or the birth of children can affect your wishes. Failing to update the will can result in unintended distributions of your assets.

-

Vague language: Using unclear terms can create confusion. Be specific about who gets what. Ambiguities can lead to disputes among beneficiaries.

-

Omitting debts and taxes: Not addressing how debts and taxes will be paid can complicate the distribution of your estate. Make sure to outline how these obligations will be handled.

-

Not considering digital assets: In today’s digital age, many people overlook their online accounts and digital assets. Include instructions for managing these assets in your will.

Find Some Other Last Will and Testament Forms for Specific States

Last Will and Testament Template Texas - Assists in ensuring that medical wishes and powers of attorney are clearly defined.

For anyone looking to navigate their way through the nuances of ownership transfer, understanding the Florida Tractor Bill of Sale form is paramount. This document not only confirms the sale but also ensures that both the buyer and seller are protected and informed throughout the process.

Illinois Will Template - Helps clarify intentions and provides guidance for personal representatives.

PDF Attributes

| Fact Name | Description |

|---|---|

| Legal Requirement | In California, a valid Last Will and Testament must be in writing and signed by the testator, or by another person in their presence and at their direction. |

| Witnesses | The will must be witnessed by at least two individuals who are present at the same time and who are not beneficiaries of the will. |

| Revocation | A will can be revoked by the testator at any time before their death, typically through a new will or by physically destroying the existing will. |

| Governing Law | The California Probate Code governs the creation and execution of Last Wills and Testaments in the state. |

Similar forms

The California Last Will and Testament is often compared to a Living Will. While a Last Will and Testament outlines how a person’s assets will be distributed after their death, a Living Will focuses on medical decisions made while the individual is still alive but unable to communicate their wishes. Both documents serve to express personal preferences, but they operate in different contexts—one dealing with property and the other with healthcare. A Living Will allows individuals to specify their desires regarding life-sustaining treatments, ensuring that their medical care aligns with their values and beliefs.

Another document similar to the Last Will and Testament is the Trust. A Trust allows a person to place their assets into a legal entity that can manage those assets for the benefit of designated beneficiaries. Unlike a Last Will, which takes effect after death, a Trust can be active during a person’s lifetime, providing more control over asset distribution. Trusts can also help avoid probate, making the transfer of assets smoother and often quicker for beneficiaries. This flexibility makes Trusts a popular choice for estate planning.

The Arizona Mobile Home Bill of Sale form is an essential document for anyone looking to buy or sell a mobile home in Arizona. It includes crucial information such as the buyer’s and seller’s details, a comprehensive description of the mobile home, and the agreed sale price. To avoid any issues during your transaction, it's important to fill out this form accurately and completely. For your convenience, you can find resources that help streamline this process by visiting All Arizona Forms to ensure your transaction is properly documented.

The Durable Power of Attorney (DPOA) also shares similarities with the Last Will and Testament. While a Last Will becomes effective after death, a DPOA allows an individual to designate someone to make financial or legal decisions on their behalf while they are still alive. This document ensures that if a person becomes incapacitated, their affairs can still be managed according to their wishes. Both documents are vital in planning for future uncertainties, but they address different aspects of an individual’s life.

A Health Care Proxy is another document that parallels the Last Will and Testament. This legal document designates an individual to make medical decisions on behalf of another person if they are unable to do so themselves. Like a Last Will, a Health Care Proxy reflects personal choices and values, ensuring that a person’s healthcare preferences are honored. While the Last Will focuses on the distribution of assets, the Health Care Proxy is concerned with medical care, making both essential components of a comprehensive estate plan.

Lastly, the Letter of Instruction is akin to the Last Will and Testament in that it provides guidance to loved ones about a person’s wishes. However, it is not a legally binding document like a will. Instead, it serves as a supplementary tool that can clarify intentions regarding personal matters, funeral arrangements, and other final wishes. While a Last Will addresses the legal distribution of assets, a Letter of Instruction can offer emotional support and context, helping family members navigate the complexities of loss.