Valid California Gift Deed Template

In the realm of property transfer, the California Gift Deed form serves as a vital tool for individuals wishing to convey ownership of real estate without the exchange of money. This legal document allows a property owner, known as the donor, to transfer their interest in a property to another person, referred to as the recipient or donee, as a gift. One of the key aspects of the Gift Deed is its simplicity; it typically requires minimal information, such as the names of the parties involved, a description of the property, and the intent to make a gift. Importantly, the form must be signed by the donor and notarized to ensure its validity and prevent disputes. Additionally, the Gift Deed may also include language that clarifies any conditions attached to the gift, though it is often executed without strings attached. Understanding the implications of this form is crucial, as it can affect tax liabilities and future ownership rights. By utilizing the California Gift Deed, individuals can facilitate a seamless transfer of property, fostering generosity and strengthening familial ties while navigating the complexities of real estate law.

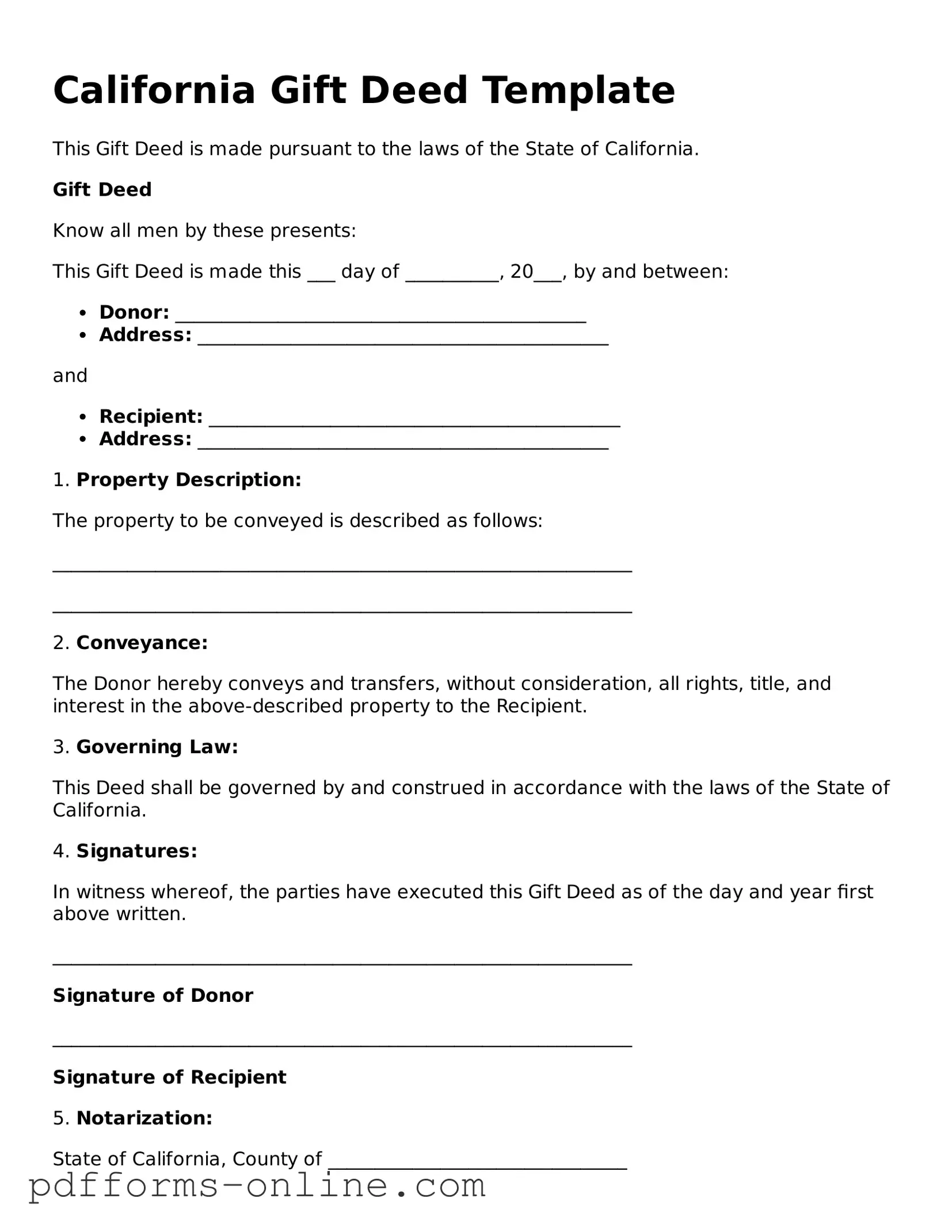

Document Example

California Gift Deed Template

This Gift Deed is made pursuant to the laws of the State of California.

Gift Deed

Know all men by these presents:

This Gift Deed is made this ___ day of __________, 20___, by and between:

- Donor: ____________________________________________

- Address: ____________________________________________

and

- Recipient: ____________________________________________

- Address: ____________________________________________

1. Property Description:

The property to be conveyed is described as follows:

______________________________________________________________

______________________________________________________________

2. Conveyance:

The Donor hereby conveys and transfers, without consideration, all rights, title, and interest in the above-described property to the Recipient.

3. Governing Law:

This Deed shall be governed by and construed in accordance with the laws of the State of California.

4. Signatures:

In witness whereof, the parties have executed this Gift Deed as of the day and year first above written.

______________________________________________________________

Signature of Donor

______________________________________________________________

Signature of Recipient

5. Notarization:

State of California, County of ________________________________

Subscribed and sworn to before me this ___ day of __________, 20___.

______________________________________________________________

Notary Public

My Commission Expires: ____________________

Please complete all blanks with accurate information.

Frequently Asked Questions

-

What is a California Gift Deed?

A California Gift Deed is a legal document used to transfer ownership of real property as a gift. This means that the property is given without any exchange of money or consideration. The deed must be signed by the person giving the gift (the donor) and typically must be notarized to be valid.

-

Who can use a Gift Deed in California?

Any property owner in California can use a Gift Deed to transfer property to another individual. This is commonly used among family members, such as parents giving property to their children. However, it can also be used between friends or other parties as long as the intent is to give the property without compensation.

-

Are there any tax implications when using a Gift Deed?

Yes, there can be tax implications. The donor may be subject to gift tax if the value of the property exceeds the annual exclusion limit set by the IRS. It’s important to consult with a tax professional to understand how this may affect both the donor and the recipient.

-

How do I complete a Gift Deed?

To complete a Gift Deed, you will need to fill out the form with the required information, including the names of the donor and recipient, a description of the property, and any necessary legal descriptions. After signing the deed, it must be notarized and then recorded with the county recorder's office where the property is located.

-

Can a Gift Deed be revoked?

Once a Gift Deed is executed and recorded, it generally cannot be revoked. The transfer of property is considered final. If there are concerns about the gift, it is wise to consult with a legal professional before completing the deed.

-

What happens if the recipient of the Gift Deed dies?

If the recipient of the Gift Deed dies, the property will typically become part of their estate. How the property is handled will depend on whether the recipient had a will or if they were subject to intestate succession laws. It's advisable to consult with an estate planning attorney to understand the best course of action.

Misconceptions

Many people have misunderstandings about the California Gift Deed form. These misconceptions can lead to confusion when individuals consider transferring property as a gift. Here are seven common misconceptions:

- A Gift Deed is the same as a Sale Deed. A Gift Deed transfers property without any exchange of money, while a Sale Deed involves a financial transaction.

- All gifts of property require a Gift Deed. Not all transfers of property as gifts necessitate a Gift Deed. Informal gifts, such as personal items, do not require this formal document.

- A Gift Deed must be notarized to be valid. While notarization is recommended for legal purposes, it is not strictly required for the validity of a Gift Deed in California.

- Gift Deeds are only for family members. While many people use Gift Deeds to transfer property to family, they can be used for friends or charitable organizations as well.

- Once a Gift Deed is signed, the giver cannot change their mind. A Gift Deed can be revoked before it is delivered to the recipient. Once delivered, however, the transfer is generally irreversible.

- Gift Deeds do not have tax implications. Transferring property as a gift may have tax consequences, including potential gift taxes. It is advisable to consult a tax professional.

- Using a Gift Deed avoids all legal issues. While a Gift Deed can simplify the transfer process, it does not protect against potential disputes or claims from creditors or other parties.

Understanding these misconceptions can help individuals make informed decisions when considering the use of a Gift Deed in California.

Common mistakes

-

Not Including a Legal Description of the Property: One common mistake is failing to provide a detailed legal description of the property being gifted. This description should include the parcel number and any relevant boundaries to avoid confusion.

-

Omitting the Donor and Recipient's Information: It is essential to clearly state the full names and addresses of both the donor (the person giving the gift) and the recipient (the person receiving the gift). Missing this information can lead to complications.

-

Not Signing the Form: A Gift Deed must be signed by the donor. Forgetting to sign the document renders it invalid. Ensure that the signature is dated as well.

-

Using Incorrect Notarization: The Gift Deed must be notarized to be legally binding. Some individuals mistakenly skip this step or use an unqualified notary, which can invalidate the deed.

-

Failing to Understand Tax Implications: People often overlook the potential tax consequences of gifting property. It is advisable to consult with a tax professional to understand any gift tax liabilities.

-

Not Keeping Copies of the Deed: After completing the Gift Deed, it is crucial to keep copies for personal records. Losing the document can create issues in the future, especially if disputes arise.

-

Neglecting to Check for Existing Liens: Before transferring property, it is vital to ensure that there are no outstanding liens or encumbrances on the property. Failing to do so can complicate the transfer process.

-

Not Consulting an Attorney: Some individuals fill out the Gift Deed without seeking legal advice. Consulting an attorney can help clarify the process and ensure that all legal requirements are met.

-

Ignoring State-Specific Requirements: Each state has its own rules regarding Gift Deeds. It is important to be aware of California's specific requirements to avoid errors that could invalidate the deed.

Find Some Other Gift Deed Forms for Specific States

What Is a Gift Deed - The form should specify if any conditions or limitations apply to the gift.

The New York Operating Agreement form is a legal document that outlines the management and operational procedures of a limited liability company (LLC) in New York. This agreement is crucial for defining the roles and responsibilities of members, ensuring clarity and protection for all parties involved. Business owners can find a template for this important document at documentonline.org/blank-new-york-operating-agreement/, which can help them navigate the complexities of LLC operations effectively.

Transfer Deed - Gifting property can be a strategic estate planning tool for many individuals.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | A California Gift Deed is a legal document used to transfer property ownership as a gift without any exchange of money. |

| Governing Law | The California Gift Deed is governed by California Civil Code Section 11911. |

| Requirements | The deed must be signed by the donor and must include a legal description of the property. |

| Tax Implications | Gifts may have tax implications, and it is advisable to consult a tax professional when completing a Gift Deed. |

Similar forms

A Quitclaim Deed is a legal document used to transfer ownership of property from one party to another without any warranties. Like a Gift Deed, it allows for the transfer of property without consideration, meaning no money is exchanged. The primary difference lies in the intent; a Quitclaim Deed does not necessarily imply a gift, as it can be used to clear up title issues or transfer property among family members, but it does not guarantee that the property is free of liens or other claims.

A Warranty Deed is another document that serves to transfer property ownership. Unlike a Gift Deed, a Warranty Deed provides a guarantee that the seller holds clear title to the property and has the right to sell it. This means that if any issues arise regarding ownership, the seller is responsible for resolving them. While both documents facilitate property transfers, a Warranty Deed offers more protection to the buyer compared to a Gift Deed.

A Deed of Trust is a document that involves three parties: the borrower, the lender, and a trustee. This document is used to secure a loan with real estate. While it does not transfer ownership like a Gift Deed, it does involve property and can be used in financial transactions. Both documents relate to property rights, but a Deed of Trust is primarily concerned with securing a loan rather than gifting property.

A Lease Agreement, while not a deed, also involves property and can sometimes resemble a Gift Deed in terms of intent. A landlord may offer a lease at a reduced rate or even for free, similar to a gift. However, a Lease Agreement establishes a temporary arrangement where the tenant pays rent, whereas a Gift Deed permanently transfers ownership without any payment involved.

In the realm of property transfer, understanding the nuances of various documents is essential, just as when dealing with the intricacies of the Texas Durable Power of Attorney form. For instance, while a Gift Deed transfers property without the promise of title guarantees, having a legal framework like the Durable Power of Attorney empowers individuals to manage their financial affairs confidently. By designating a trusted agent, one can ensure that their interests are safeguarded, much like how the detailed stipulations of a Gift Deed provide clarity in property transactions. For more comprehensive information on creating a legal document that protects your wishes, visit OnlineLawDocs.com.

An Easement is a legal right to use someone else's property for a specific purpose. While it does not transfer ownership like a Gift Deed, it can be granted as a gift. For instance, a property owner may give an easement to a neighbor, allowing them access to a portion of their land. Both documents can involve goodwill and neighborly relations, but an Easement does not change ownership of the property.

A Power of Attorney can also relate to property transactions. It allows one person to act on behalf of another in legal matters, including transferring property. If someone wishes to gift property but cannot be present, they may use a Power of Attorney to authorize someone else to sign a Gift Deed on their behalf. While the Gift Deed transfers ownership, the Power of Attorney facilitates the process.

A Living Trust is a legal arrangement where a person places their assets into a trust during their lifetime. This can include real estate, and property can be gifted to beneficiaries through the trust. While a Gift Deed transfers property directly, a Living Trust allows for more control over how and when the property is distributed, providing a different approach to gifting property.

Finally, a Bill of Sale is a document that records the transfer of personal property. Although it is typically used for movable items rather than real estate, it shares similarities with a Gift Deed in that it can transfer ownership without payment. Both documents signify a transfer of ownership, but a Bill of Sale is usually more focused on personal property transactions.