Valid California Durable Power of Attorney Template

In California, a Durable Power of Attorney (DPOA) is a crucial legal document that allows individuals to appoint someone they trust to make financial and legal decisions on their behalf. This arrangement can be particularly important in situations where a person becomes incapacitated or unable to manage their affairs. The DPOA remains effective even if the principal becomes mentally or physically unable to make decisions. This form can cover a wide range of powers, from managing bank accounts and paying bills to handling real estate transactions. It's essential for individuals to clearly outline the specific powers granted to their agent, ensuring that their wishes are respected. Additionally, the DPOA can be tailored to be effective immediately or only upon the principal's incapacitation. Understanding the nuances of this form can help individuals make informed choices about their future and ensure their financial and legal matters are handled according to their preferences.

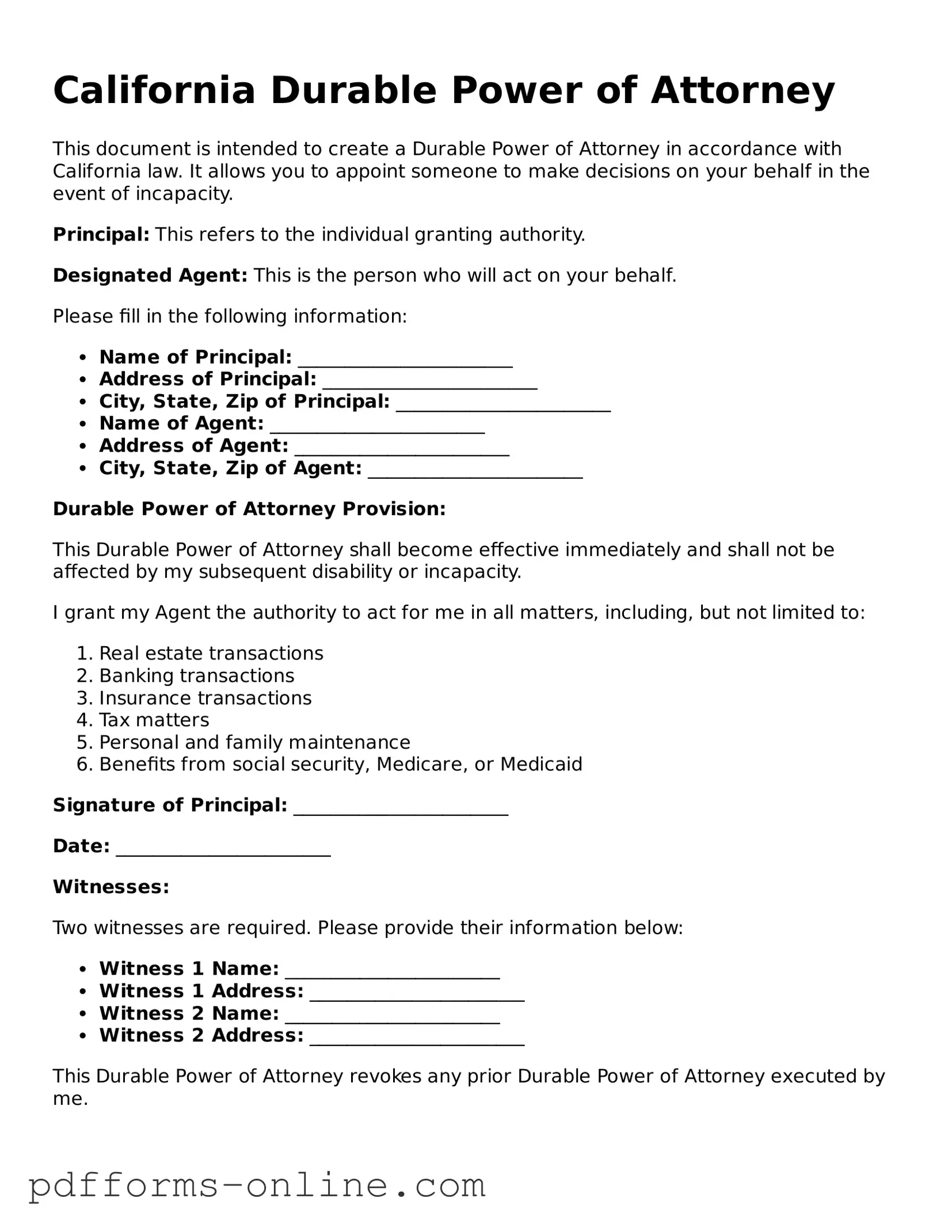

Document Example

California Durable Power of Attorney

This document is intended to create a Durable Power of Attorney in accordance with California law. It allows you to appoint someone to make decisions on your behalf in the event of incapacity.

Principal: This refers to the individual granting authority.

Designated Agent: This is the person who will act on your behalf.

Please fill in the following information:

- Name of Principal: _______________________

- Address of Principal: _______________________

- City, State, Zip of Principal: _______________________

- Name of Agent: _______________________

- Address of Agent: _______________________

- City, State, Zip of Agent: _______________________

Durable Power of Attorney Provision:

This Durable Power of Attorney shall become effective immediately and shall not be affected by my subsequent disability or incapacity.

I grant my Agent the authority to act for me in all matters, including, but not limited to:

- Real estate transactions

- Banking transactions

- Insurance transactions

- Tax matters

- Personal and family maintenance

- Benefits from social security, Medicare, or Medicaid

Signature of Principal: _______________________

Date: _______________________

Witnesses:

Two witnesses are required. Please provide their information below:

- Witness 1 Name: _______________________

- Witness 1 Address: _______________________

- Witness 2 Name: _______________________

- Witness 2 Address: _______________________

This Durable Power of Attorney revokes any prior Durable Power of Attorney executed by me.

Frequently Asked Questions

-

What is a Durable Power of Attorney in California?

A Durable Power of Attorney (DPOA) is a legal document that allows you to appoint someone to make financial and legal decisions on your behalf. The term "durable" means that this authority continues even if you become incapacitated.

-

Why should I consider creating a Durable Power of Attorney?

Creating a DPOA can provide peace of mind. It ensures that someone you trust can manage your affairs if you are unable to do so. This can include paying bills, managing investments, and making other important financial decisions.

-

Who can be appointed as an agent in a Durable Power of Attorney?

You can appoint anyone you trust as your agent. This could be a family member, friend, or a professional, such as an attorney. It’s important to choose someone who understands your wishes and will act in your best interest.

-

How does a Durable Power of Attorney differ from a regular Power of Attorney?

The main difference lies in durability. A regular Power of Attorney may become invalid if you become incapacitated, while a Durable Power of Attorney remains effective in such situations. This makes the DPOA a more reliable option for long-term planning.

-

Do I need to have a lawyer to create a Durable Power of Attorney?

No, you do not need a lawyer to create a DPOA in California. However, consulting with a legal professional can help ensure that the document meets all legal requirements and accurately reflects your wishes.

-

What should be included in a Durable Power of Attorney?

A DPOA should clearly state your name, the name of your agent, and the powers you are granting. You may specify particular financial matters or decisions that your agent can handle. Additionally, including a statement about the document's durability is crucial.

-

How do I revoke a Durable Power of Attorney?

You can revoke a DPOA at any time as long as you are mentally competent. To do this, you should create a written revocation document and notify your agent and any institutions that may have a copy of the original DPOA.

-

Is a Durable Power of Attorney valid in other states?

While a DPOA created in California is valid in other states, laws can vary. It’s advisable to check the specific requirements of the state where you plan to use the document to ensure it is recognized.

-

What happens if I don’t have a Durable Power of Attorney?

If you become incapacitated without a DPOA, your family may have to go through a court process to obtain guardianship or conservatorship. This can be time-consuming and costly, making it beneficial to have a DPOA in place.

Misconceptions

Understanding the California Durable Power of Attorney form is essential for effective estate planning. However, several misconceptions can lead to confusion. Here are eight common misunderstandings:

- It only applies to financial matters. Many believe that a Durable Power of Attorney (DPOA) is limited to financial decisions. In reality, it can also cover healthcare decisions if specified.

- It is the same as a regular Power of Attorney. A regular Power of Attorney may become invalid if the principal becomes incapacitated. In contrast, a Durable Power of Attorney remains effective even in such circumstances.

- Anyone can be appointed as an agent. While you can choose almost anyone, the person you appoint must be trustworthy and capable of handling your affairs responsibly.

- It expires after a certain period. A Durable Power of Attorney does not have a set expiration date unless you specify one. It remains in effect until you revoke it or pass away.

- It can be used without the principal's consent. A Durable Power of Attorney is only valid when the principal is mentally competent. The principal must willingly sign the document.

- It overrides all other legal documents. While a DPOA is powerful, it does not automatically override other legal documents, such as a will or trust, unless specified.

- It cannot be revoked. A Durable Power of Attorney can be revoked at any time, as long as the principal is mentally competent. A written notice of revocation should be provided to the agent.

- It is only necessary for the elderly. People of all ages can benefit from a Durable Power of Attorney. Unexpected situations can arise at any time, making it a wise choice for everyone.

By understanding these misconceptions, you can make informed decisions regarding your Durable Power of Attorney in California.

Common mistakes

-

Not naming an agent. One of the most critical mistakes is failing to designate a trusted person as an agent. Without an agent, the document loses its purpose.

-

Choosing the wrong agent. Selecting someone who may not act in your best interest can lead to complications. It’s essential to choose someone who is responsible and trustworthy.

-

Not specifying powers clearly. Vague language can lead to confusion. Clearly outline the powers you are granting to your agent to avoid misunderstandings.

-

Failing to sign and date the document. A Durable Power of Attorney is not valid unless you sign and date it. Without these, the document cannot be enforced.

-

Not having witnesses or notarization. In California, certain requirements must be met for the document to be valid. Failing to have the necessary witnesses or notarization can invalidate the form.

-

Not updating the document. Life circumstances change. It’s important to review and update your Durable Power of Attorney regularly to reflect your current wishes.

-

Ignoring state-specific requirements. Each state has its own laws regarding Durable Power of Attorney. Not adhering to California’s specific requirements can lead to issues.

-

Overlooking alternate agents. It’s wise to name an alternate agent in case the primary agent is unavailable. This ensures that someone can still act on your behalf.

-

Not discussing the document with the agent. Having a conversation with your chosen agent about your wishes and the powers granted is crucial. This prepares them for their responsibilities.

-

Failing to keep copies. After completing the form, it’s essential to keep copies in a safe place and share them with relevant parties. This ensures that your agent can access the document when needed.

Find Some Other Durable Power of Attorney Forms for Specific States

How to Notarize a Power of Attorney in Ohio - Choosing the right person for this role is crucial; they will hold significant responsibility over your financial affairs.

How to Get Power of Attorney in Nc - This document remains valid even if you become incapacitated.

PDF Attributes

| Fact Name | Details |

|---|---|

| Definition | A California Durable Power of Attorney allows an individual to appoint someone to make financial decisions on their behalf. |

| Durability | This document remains effective even if the principal becomes incapacitated. |

| Governing Law | The form is governed by the California Probate Code, specifically sections 4000-4545. |

| Principal | The person who creates the Durable Power of Attorney is known as the principal. |

| Agent | The individual appointed to act on behalf of the principal is referred to as the agent or attorney-in-fact. |

| Signing Requirements | The form must be signed by the principal and, in some cases, witnessed or notarized. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are competent. |

Similar forms

The California Durable Power of Attorney form shares similarities with the General Power of Attorney. Both documents allow an individual to appoint someone else to make decisions on their behalf. However, the General Power of Attorney typically becomes invalid if the principal becomes incapacitated, while the Durable Power of Attorney remains effective despite such circumstances. This distinction is crucial for individuals who want their appointed agent to continue managing their affairs during periods of incapacity.

Another document similar to the Durable Power of Attorney is the Medical Power of Attorney. This form specifically designates an individual to make healthcare decisions for the principal if they are unable to do so. Like the Durable Power of Attorney, the Medical Power of Attorney remains effective during periods of incapacity. This allows a trusted person to ensure that the principal's medical preferences are honored when they cannot communicate their wishes.

The Living Will, or Advance Healthcare Directive, also shares characteristics with the Durable Power of Attorney. While the Durable Power of Attorney appoints an agent to make decisions, the Living Will outlines the principal's wishes regarding medical treatment in specific situations. Both documents work together to provide comprehensive guidance on healthcare decisions, ensuring that the principal's preferences are respected even when they are incapacitated.

A Revocable Living Trust is another document that serves a similar purpose. It allows individuals to manage their assets during their lifetime and designate beneficiaries for after their death. While the Durable Power of Attorney focuses on decision-making authority, the Revocable Living Trust centers on asset management. Both documents can help avoid probate and ensure that an individual's wishes are followed, but they do so through different mechanisms.

The Healthcare Proxy is akin to the Medical Power of Attorney but is often used interchangeably. This document appoints someone to make medical decisions on behalf of the principal. Like the Durable Power of Attorney, it remains effective during incapacity. The key difference lies in the specific focus on healthcare decisions, while the Durable Power of Attorney may cover a broader range of financial and legal matters.

Financial Power of Attorney forms are also similar, as they allow an individual to appoint someone to manage their financial affairs. While the Durable Power of Attorney can encompass financial decisions, a Financial Power of Attorney may be more limited in scope, focusing solely on financial matters. Both documents empower an agent to act on behalf of the principal, ensuring that their financial interests are managed effectively.

The Springing Power of Attorney is another related document. It becomes effective only under certain conditions, typically when the principal becomes incapacitated. This is different from the Durable Power of Attorney, which is effective immediately upon signing. However, both documents allow for the appointment of an agent to handle the principal's affairs, providing a means to manage decisions when the principal is unable to do so.

Joint Power of Attorney forms are also comparable. These forms allow multiple individuals to act as agents simultaneously. Like the Durable Power of Attorney, they provide authority to manage the principal's affairs. However, the Joint Power of Attorney can create complexities, as all agents must agree on decisions, which may not always align with the principal's intentions.

Lastly, the Guardianship document can be considered similar in that it involves the appointment of someone to make decisions for another person. However, Guardianship is typically established through a court process and is often used for minors or individuals deemed legally incompetent. In contrast, the Durable Power of Attorney is a voluntary agreement made by the principal, allowing them to retain more control over who makes decisions on their behalf.