Valid California Deed in Lieu of Foreclosure Template

In California, homeowners facing financial difficulties may consider a Deed in Lieu of Foreclosure as a potential solution to avoid the lengthy and often distressing foreclosure process. This legal document allows a homeowner to voluntarily transfer the title of their property back to the lender, effectively settling the mortgage debt without the need for foreclosure proceedings. By executing this form, the homeowner can mitigate the negative impact on their credit score that typically accompanies foreclosure. The process generally requires the homeowner to be current on their mortgage payments or to have a valid reason for the default, such as financial hardship. Additionally, lenders often require a thorough review of the homeowner's financial situation and may negotiate terms to ensure that the deed transfer is mutually beneficial. Understanding the implications and requirements of the Deed in Lieu of Foreclosure form is crucial for homeowners seeking a fresh start while navigating the complexities of real estate law in California.

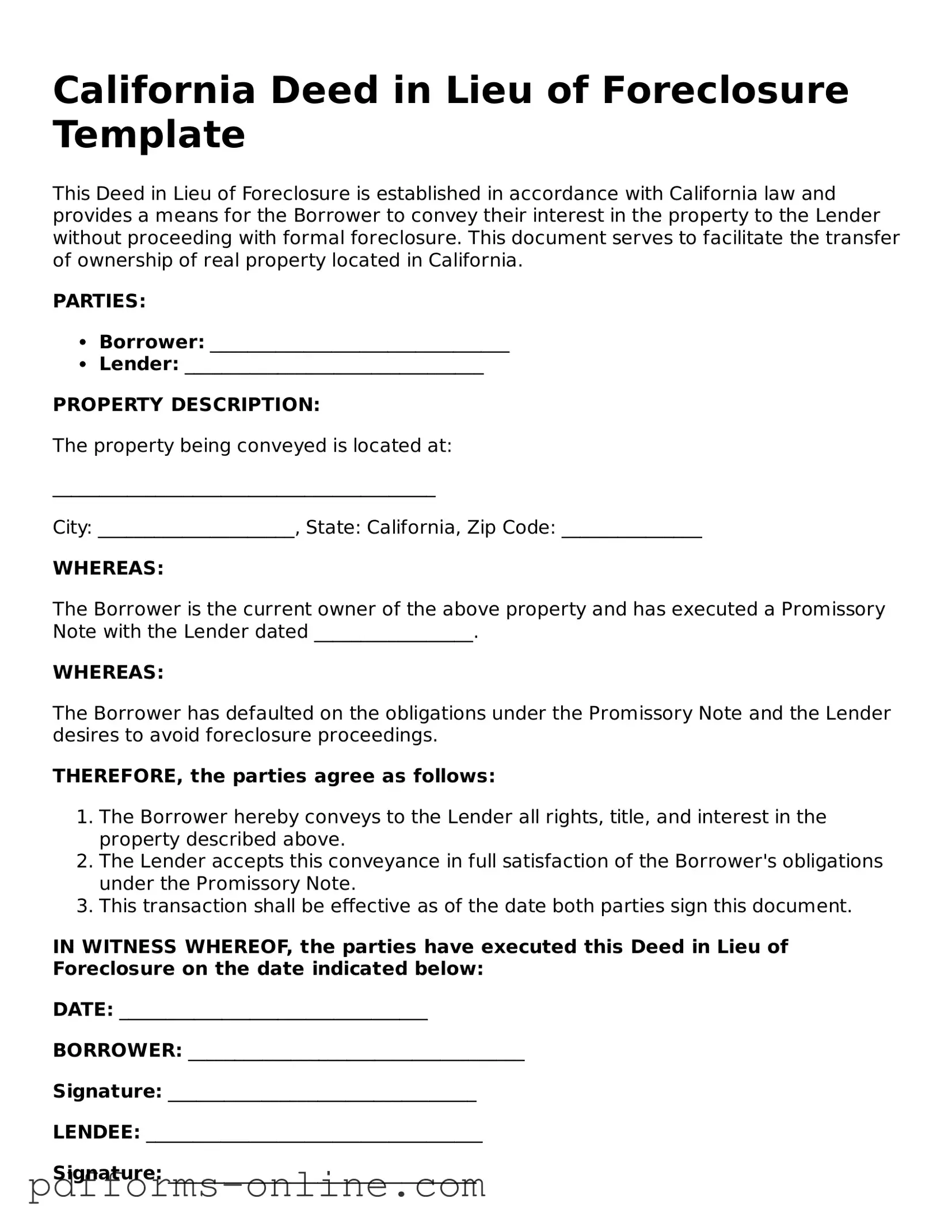

Document Example

California Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is established in accordance with California law and provides a means for the Borrower to convey their interest in the property to the Lender without proceeding with formal foreclosure. This document serves to facilitate the transfer of ownership of real property located in California.

PARTIES:

- Borrower: ________________________________

- Lender: ________________________________

PROPERTY DESCRIPTION:

The property being conveyed is located at:

_________________________________________

City: _____________________, State: California, Zip Code: _______________

WHEREAS:

The Borrower is the current owner of the above property and has executed a Promissory Note with the Lender dated _________________.

WHEREAS:

The Borrower has defaulted on the obligations under the Promissory Note and the Lender desires to avoid foreclosure proceedings.

THEREFORE, the parties agree as follows:

- The Borrower hereby conveys to the Lender all rights, title, and interest in the property described above.

- The Lender accepts this conveyance in full satisfaction of the Borrower's obligations under the Promissory Note.

- This transaction shall be effective as of the date both parties sign this document.

IN WITNESS WHEREOF, the parties have executed this Deed in Lieu of Foreclosure on the date indicated below:

DATE: _________________________________

BORROWER: ____________________________________

Signature: _________________________________

LENDEE: ____________________________________

Signature: _________________________________

This document may be recorded in the appropriate county office to provide notice of the transfer of property ownership.

Frequently Asked Questions

-

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to voluntarily transfer ownership of their property to the lender in order to avoid foreclosure. This option can be beneficial for both the homeowner and the lender, as it allows the homeowner to avoid the negative consequences of foreclosure and helps the lender recover their investment more efficiently.

-

Who is eligible for a Deed in Lieu of Foreclosure in California?

Eligibility typically depends on the homeowner's financial situation and the lender's policies. Homeowners who are struggling to make mortgage payments and facing imminent foreclosure may qualify. However, the property must be free of other liens, and the homeowner must demonstrate that they cannot continue making payments. Each lender may have specific criteria, so it is advisable to consult with them directly.

-

What are the benefits of choosing a Deed in Lieu of Foreclosure?

There are several advantages to opting for a Deed in Lieu of Foreclosure. First, it can help homeowners avoid the lengthy and stressful foreclosure process. Second, it may have a less damaging impact on the homeowner's credit score compared to a foreclosure. Additionally, homeowners may be able to negotiate a cash incentive or relocation assistance from the lender, making the transition smoother.

-

What are the potential drawbacks of a Deed in Lieu of Foreclosure?

While there are benefits, there are also potential downsides. Homeowners may still face tax implications if the lender forgives any portion of the mortgage debt. Furthermore, not all lenders may approve a Deed in Lieu, and homeowners may need to provide extensive documentation regarding their financial situation. Additionally, the process may still affect the homeowner's credit score, albeit less severely than a foreclosure.

-

How does the process work?

The process begins when the homeowner contacts their lender to express interest in a Deed in Lieu of Foreclosure. The lender will typically require a financial hardship statement and other documentation to assess eligibility. If approved, both parties will sign the Deed in Lieu, transferring ownership of the property to the lender. The lender may then release the homeowner from the mortgage obligation, though specific terms can vary.

-

Will I still owe money after signing a Deed in Lieu of Foreclosure?

In many cases, homeowners may be released from their mortgage debt after signing a Deed in Lieu of Foreclosure. However, this is not guaranteed. Homeowners should clarify with their lender whether they will be held liable for any remaining balance or if the lender will forgive the debt entirely. It is crucial to have this discussion before finalizing the agreement.

-

Can I negotiate the terms of a Deed in Lieu of Foreclosure?

Yes, homeowners can negotiate certain terms with their lender. This may include requesting relocation assistance or discussing the timeline for vacating the property. It is essential to communicate openly with the lender and understand all terms before signing the document. Homeowners may also benefit from consulting with a legal professional or housing counselor during this process.

-

What should I do if I am considering a Deed in Lieu of Foreclosure?

If you are contemplating this option, start by gathering your financial documents and assessing your current situation. Reach out to your lender to discuss your options and express your interest in a Deed in Lieu of Foreclosure. Additionally, consider seeking advice from a housing counselor or legal professional who can provide guidance tailored to your specific circumstances.

Misconceptions

Understanding the California Deed in Lieu of Foreclosure can be complex, and several misconceptions often arise. Here are seven common misunderstandings about this legal process:

- It eliminates all debt associated with the property. Many believe that signing a deed in lieu of foreclosure wipes out all debts. In reality, while it can relieve the homeowner from the mortgage, it may not address other debts, such as second mortgages or liens.

- It is a quick and easy solution. Some think that a deed in lieu is a fast track to resolving their financial issues. However, the process can take time, as it involves negotiations with the lender and may require extensive documentation.

- Homeowners can choose to keep the property after signing. There is a misconception that homeowners can retain ownership of the property once they sign the deed. In fact, signing the deed transfers ownership to the lender, meaning the homeowner will no longer have any rights to the property.

- It has no impact on credit scores. Some individuals believe that a deed in lieu will not affect their credit. Unfortunately, it can still have a negative impact, similar to a foreclosure, as it indicates financial distress to credit reporting agencies.

- All lenders accept deeds in lieu of foreclosure. Not every lender is willing to accept this option. Some may prefer to go through the foreclosure process, so it’s important for homeowners to check with their specific lender.

- It is the same as a short sale. While both options involve giving up the property to avoid foreclosure, they are not the same. A short sale requires selling the home for less than the owed mortgage amount, while a deed in lieu involves transferring ownership back to the lender without a sale.

- Homeowners can negotiate any terms they want. Many think they have complete control over the terms of the deed in lieu. In reality, lenders often have strict guidelines, and homeowners may find their negotiating power limited.

By addressing these misconceptions, homeowners can better understand their options and make informed decisions regarding their financial situations.

Common mistakes

-

Incorrect Property Description: Failing to provide a complete and accurate description of the property can lead to delays. Ensure you include the correct address and legal description.

-

Missing Signatures: All required parties must sign the document. Missing a signature can invalidate the deed.

-

Not Notarizing the Document: The deed must be notarized to be legally binding. Without a notary's signature, the document may not be accepted.

-

Incorrect Date: Ensure that the date of signing is accurate. An incorrect date can create confusion and potential legal issues.

-

Failure to Review Lender Requirements: Each lender may have specific requirements for the deed. Not adhering to these can result in rejection of the document.

-

Omitting Additional Documentation: Sometimes, additional documents are required. Check with your lender to ensure you include everything needed.

-

Not Understanding Tax Implications: Failing to consider potential tax consequences can lead to unexpected financial burdens after the deed is executed.

-

Ignoring Local Laws: Each county may have different rules regarding deeds in lieu of foreclosure. Be sure to comply with local regulations.

-

Not Keeping Copies: After submitting the deed, keep copies for your records. This can help in case of future disputes or questions.

Find Some Other Deed in Lieu of Foreclosure Forms for Specific States

What Does an Arizona Homeowner Lose When Choosing to Use Deed in Lieu of Foreclosure? - It is important for homeowners to understand local laws surrounding Deeds in Lieu of Foreclosure.

What Does an Arizona Homeowner Lose When Choosing to Use Deed in Lieu of Foreclosure? - The deed must be recorded with the local government to be effective.

A prenuptial agreement is an essential tool for couples planning their future, as it not only clarifies asset division but also sets clear expectations for each partner. Understanding the importance of this document can be instrumental in fostering a harmonious relationship. For further assistance, you can find templates and resources for creating a solid agreement at All Arizona Forms.

Deed in Lieu of Foreclosure New York - The lender may offer incentives or assistance to homeowners agreeing to a Deed in Lieu.

Foreclosure Process in Georgia - This solution often comes with fewer fees and faster completion than traditional foreclosure methods.

PDF Attributes

| Fact Name | Details |

|---|---|

| Definition | A Deed in Lieu of Foreclosure allows a homeowner to transfer ownership of their property to the lender to avoid foreclosure. |

| Governing Law | This process is governed by California Civil Code Sections 2924-2924h. |

| Eligibility | Homeowners facing financial hardship may qualify, but they must demonstrate an inability to continue mortgage payments. |

| Benefits | It can help homeowners avoid the lengthy foreclosure process and minimize damage to their credit score. |

| Risks | Homeowners may still be liable for any remaining mortgage debt after the deed transfer, depending on the lender's policies. |

| Process | Homeowners must submit a request to the lender, who will evaluate the situation before accepting the deed. |

| Legal Advice | Consulting with a legal professional is recommended to understand the implications and ensure all documents are correctly prepared. |

Similar forms

The California Deed in Lieu of Foreclosure is similar to a Short Sale Agreement. In a short sale, the homeowner sells the property for less than the amount owed on the mortgage, with the lender's approval. Both documents aim to avoid foreclosure. However, in a short sale, the homeowner retains some control over the sale process and may receive funds from the sale, while a deed in lieu transfers ownership directly to the lender without a sale transaction.

Another document that shares similarities is the Loan Modification Agreement. This agreement allows homeowners to modify the terms of their existing mortgage to make payments more manageable. Like a deed in lieu, a loan modification is a solution to prevent foreclosure. However, in a loan modification, the homeowner remains the owner of the property and continues to make payments, whereas a deed in lieu results in the homeowner relinquishing ownership entirely.

For those navigating the complexities of various financial documents, understanding the nuances of a Non-disclosure Agreement form is crucial. This legal contract serves to protect sensitive information during negotiations, ensuring that parties can share necessary details without the fear of premature disclosure. Resources such as OnlineLawDocs.com can provide further insights and templates to facilitate these agreements effectively.

The Forebearance Agreement is also comparable. This document allows a borrower to temporarily reduce or suspend mortgage payments due to financial hardship. Both the forbearance agreement and the deed in lieu are methods to avoid foreclosure. However, a forbearance allows the homeowner to keep the property while working through financial issues, while a deed in lieu requires the homeowner to give up the property altogether.

A Bankruptcy Filing can also be considered similar. Filing for bankruptcy can halt foreclosure proceedings and allow the homeowner to reorganize debts. Both options provide relief from foreclosure. However, bankruptcy involves legal proceedings and can impact credit for years, while a deed in lieu is a more straightforward process that directly transfers property ownership to the lender.

The Mortgage Release or Satisfaction of Mortgage document is another related form. This document indicates that a mortgage has been paid off or released. In a deed in lieu, the lender accepts the property in exchange for releasing the borrower from the mortgage obligation. Both documents signify the end of the borrower's financial responsibility, but a mortgage release occurs after full payment, whereas a deed in lieu occurs when the borrower can no longer meet payment obligations.

Lastly, a Quitclaim Deed is similar in that it transfers property ownership. In a quitclaim deed, the owner relinquishes any claim to the property without guaranteeing clear title. While both documents transfer ownership, a deed in lieu is specifically designed to address foreclosure and typically involves a lender accepting the property in lieu of a foreclosure process. A quitclaim deed does not necessarily involve a lender and can be used for various purposes, including transferring property between family members.