Valid California Deed Template

The California Deed form plays a crucial role in real estate transactions throughout the state, serving as a legal document that facilitates the transfer of property ownership. This form includes essential details such as the names of the grantor (the person selling the property) and the grantee (the person buying the property), along with a clear description of the property being transferred. It also specifies the type of deed being used, which could be a grant deed, quitclaim deed, or another variation, each offering different levels of protection and rights to the new owner. Additionally, the form requires the inclusion of the property's legal description, ensuring clarity about the boundaries and specifics of the land involved. Signatures from both parties, along with a notary acknowledgment, are necessary to validate the deed and make it legally binding. Understanding the nuances of the California Deed form is essential for anyone involved in buying or selling property, as it lays the foundation for a smooth and legally sound transaction.

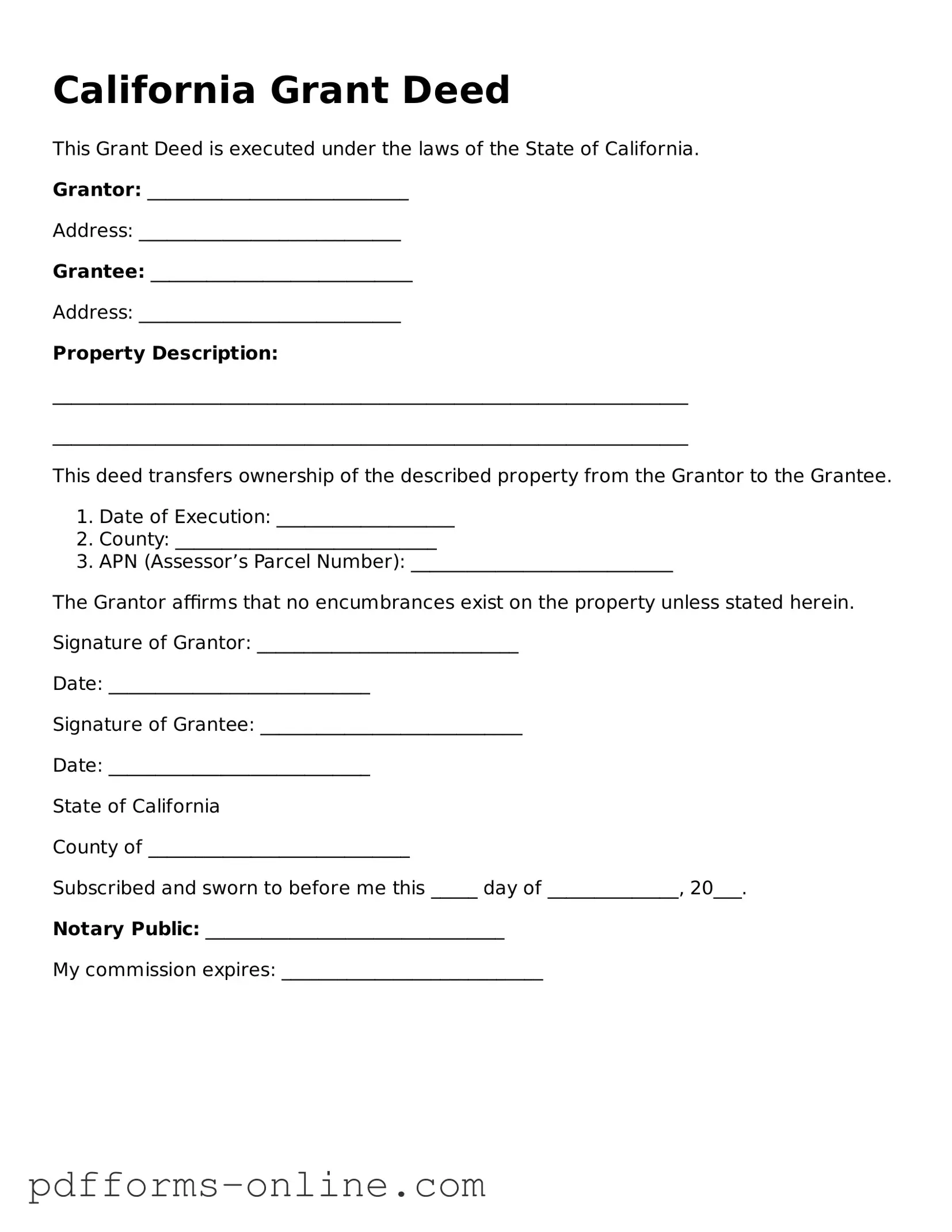

Document Example

California Grant Deed

This Grant Deed is executed under the laws of the State of California.

Grantor: ____________________________

Address: ____________________________

Grantee: ____________________________

Address: ____________________________

Property Description:

____________________________________________________________________

____________________________________________________________________

This deed transfers ownership of the described property from the Grantor to the Grantee.

- Date of Execution: ___________________

- County: ____________________________

- APN (Assessor’s Parcel Number): ____________________________

The Grantor affirms that no encumbrances exist on the property unless stated herein.

Signature of Grantor: ____________________________

Date: ____________________________

Signature of Grantee: ____________________________

Date: ____________________________

State of California

County of ____________________________

Subscribed and sworn to before me this _____ day of ______________, 20___.

Notary Public: ________________________________

My commission expires: ____________________________

Frequently Asked Questions

-

What is a California Deed form?

A California Deed form is a legal document used to transfer ownership of real property in the state of California. It serves as evidence of the transfer and outlines the details of the transaction, including the names of the parties involved, a description of the property, and any conditions attached to the transfer.

-

What types of Deeds are available in California?

California recognizes several types of Deeds, including:

- Grant Deed: Commonly used, it guarantees that the property has not been sold to anyone else and that there are no undisclosed encumbrances.

- Quitclaim Deed: Transfers whatever interest the grantor has in the property without any guarantees or warranties.

- Warranty Deed: Provides a guarantee that the grantor holds clear title to the property and has the right to transfer it.

-

How do I complete a California Deed form?

To complete a California Deed form, follow these steps:

- Identify the parties involved: Include the full names of the grantor (seller) and grantee (buyer).

- Describe the property: Provide a legal description of the property, which may include the parcel number and address.

- Sign the deed: The grantor must sign the deed in front of a notary public.

- Record the deed: Submit the completed deed to the county recorder's office where the property is located.

-

Is notarization required for a California Deed?

Yes, notarization is required for a California Deed. The grantor must sign the document in the presence of a notary public to ensure the authenticity of the signatures. This step helps prevent fraud and provides an official record of the transaction.

-

Are there any fees associated with recording a California Deed?

Yes, there are fees associated with recording a California Deed. These fees vary by county and may depend on the number of pages in the document. It is advisable to check with the local county recorder's office for specific fee schedules and payment methods.

Misconceptions

Understanding the California Deed form is crucial for anyone involved in real estate transactions. Unfortunately, several misconceptions can lead to confusion and potential legal issues. Here’s a list of common misunderstandings:

- All deeds are the same. Many people believe that all deeds serve the same purpose. In reality, there are different types of deeds, such as grant deeds and quitclaim deeds, each with its own legal implications.

- A deed must be notarized to be valid. While notarization is often recommended, it is not always required for a deed to be legally valid in California. However, having a deed notarized can help prevent disputes.

- Once a deed is signed, it cannot be changed. This is not entirely true. While a deed is a legal document, it can sometimes be amended or corrected under specific circumstances.

- Deeds are only necessary for selling property. Many people think deeds are only needed when selling property. However, deeds are also essential for transferring ownership through gifts, inheritance, or other means.

- All deeds must be recorded. While it is highly advisable to record a deed to protect your ownership rights, it is not legally required for the deed to be valid. However, unrecorded deeds may lead to complications.

- Only lawyers can prepare deeds. Although having a lawyer can be beneficial, it is not mandatory. Many individuals successfully prepare their own deeds, provided they understand the necessary legal requirements.

- Deeds are permanent and cannot be revoked. Some people believe that once a deed is executed, it is permanent. However, under certain conditions, a deed can be revoked or set aside in court.

- Property tax issues are resolved through the deed. Many assume that a deed automatically addresses property tax concerns. In reality, property taxes are separate from the deed and must be managed independently.

Being aware of these misconceptions can help you navigate the complexities of real estate transactions more effectively. Always consider consulting a professional for personalized guidance.

Common mistakes

-

Incorrect Names: One of the most common mistakes is misspelling names or using the wrong legal names. It's essential to ensure that the names of all parties involved are accurate and match their legal documents.

-

Missing Signatures: Every party listed on the deed must sign the document. Omitting a signature can lead to the deed being deemed invalid. Always double-check that all required signatures are present.

-

Improper Notarization: Deeds must be notarized to be legally binding. Failing to have the document notarized, or having it notarized incorrectly, can result in complications. Ensure that the notary public follows all necessary procedures.

-

Incorrect Property Description: The property must be described accurately. Mistakes in the legal description can create confusion and may lead to disputes. Use the most precise and detailed description available.

-

Omitting Consideration: The deed should state the consideration, or the value exchanged for the property. Leaving this out can raise questions about the legitimacy of the transaction.

-

Failure to Record: After filling out the deed, it must be recorded with the appropriate county office. Not doing so means the transaction may not be recognized legally. Always ensure that the deed is filed promptly.

Find Some Other Deed Forms for Specific States

Michigan Property Transfer Affidavit - Deeds can help simplify complex transactions involving multiple parties.

Understanding the nuances of the USCIS I-134 form is essential for potential sponsors, as it not only ensures financial safety for foreign visitors but also outlines the responsibilities embedded in this commitment; for detailed guidance on completing this form, you can visit OnlineLawDocs.com.

What Does a Deed Look Like in Illinois - May vary in format based on state requirements.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | A California Deed form is a legal document used to transfer ownership of real property from one party to another. |

| Types of Deeds | California recognizes several types of deeds, including Grant Deeds, Quitclaim Deeds, and Warranty Deeds. |

| Governing Law | The California Civil Code governs the use and execution of deeds in the state. |

| Signature Requirement | The deed must be signed by the grantor (the person transferring the property) to be valid. |

| Notarization | While notarization is not strictly required, it is highly recommended to ensure the deed is accepted by the county recorder. |

| Recording | To provide public notice of the transfer, the deed should be recorded with the county recorder’s office where the property is located. |

| Legal Description | A complete legal description of the property must be included in the deed to avoid ambiguity. |

| Tax Implications | Property transfers may trigger tax implications, such as reassessment for property tax purposes under California law. |

Similar forms

The California Deed form shares similarities with a Quitclaim Deed. Both documents transfer ownership of property from one party to another. However, the Quitclaim Deed does not guarantee that the grantor has clear title to the property. This type of deed is often used between family members or in situations where the parties know each other well. It is a straightforward way to transfer interest without a warranty, making it less formal than a standard grant deed.

The Ohio Motor Vehicle Bill of Sale is an essential document for anyone involved in the sale or purchase of a vehicle in Ohio. It serves to validate the transaction by providing detailed information about the vehicle and the parties involved, which helps to prevent any potential disputes. For those looking to create or access this form, further information can be found at documentonline.org/blank-ohio-motor-vehicle-bill-of-sale/, ensuring a smooth transfer of ownership.

Another document comparable to the California Deed is the Grant Deed. Like the California Deed, a Grant Deed conveys real property from one person to another. The key difference lies in the warranties provided. A Grant Deed assures that the property has not been sold to anyone else and that it is free from any undisclosed encumbrances. This added layer of protection makes it a more secure option for buyers compared to a Quitclaim Deed.

The Warranty Deed also has similarities with the California Deed. This document provides the highest level of protection for the grantee. It guarantees that the grantor holds clear title to the property and has the right to sell it. Additionally, it protects the buyer from any future claims against the property. While a California Deed might simply transfer ownership, a Warranty Deed ensures that the buyer can confidently claim their ownership without fear of legal disputes.

A Trust Deed, or Deed of Trust, is another document that resembles the California Deed. This document is used in real estate transactions where a borrower conveys property to a trustee as security for a loan. The Trust Deed outlines the rights and responsibilities of all parties involved, including the lender, borrower, and trustee. While it serves a different purpose than a California Deed, both documents involve the transfer of property rights and can be critical in real estate financing.

Lastly, a Leasehold Deed is similar in that it involves the transfer of property rights, but in a different context. A Leasehold Deed grants a tenant the right to use and occupy a property for a specified period, under certain conditions. While a California Deed transfers ownership, a Leasehold Deed creates a temporary interest in the property. Both documents are essential in defining property rights, but they serve different functions in real estate transactions.