Valid California Articles of Incorporation Template

When embarking on the journey of establishing a corporation in California, one of the first and most crucial steps involves the completion of the Articles of Incorporation form. This essential document serves as the foundation of your corporation, laying out key details that will shape its identity and governance. Among the significant aspects included in the form are the corporation's name, which must be unique and distinguishable from existing entities, and its purpose, outlining the nature of the business activities it will engage in. Additionally, the form requires information about the initial agent for service of process, who will act as the point of contact for legal documents. The Articles also mandate the inclusion of the corporation's address and the number of shares it is authorized to issue, which are vital for understanding the structure of ownership. Furthermore, it’s important to note that this document must be filed with the California Secretary of State, and it plays a pivotal role in determining the corporation's legal status and responsibilities. Understanding these components not only aids in compliance but also sets the stage for future growth and success.

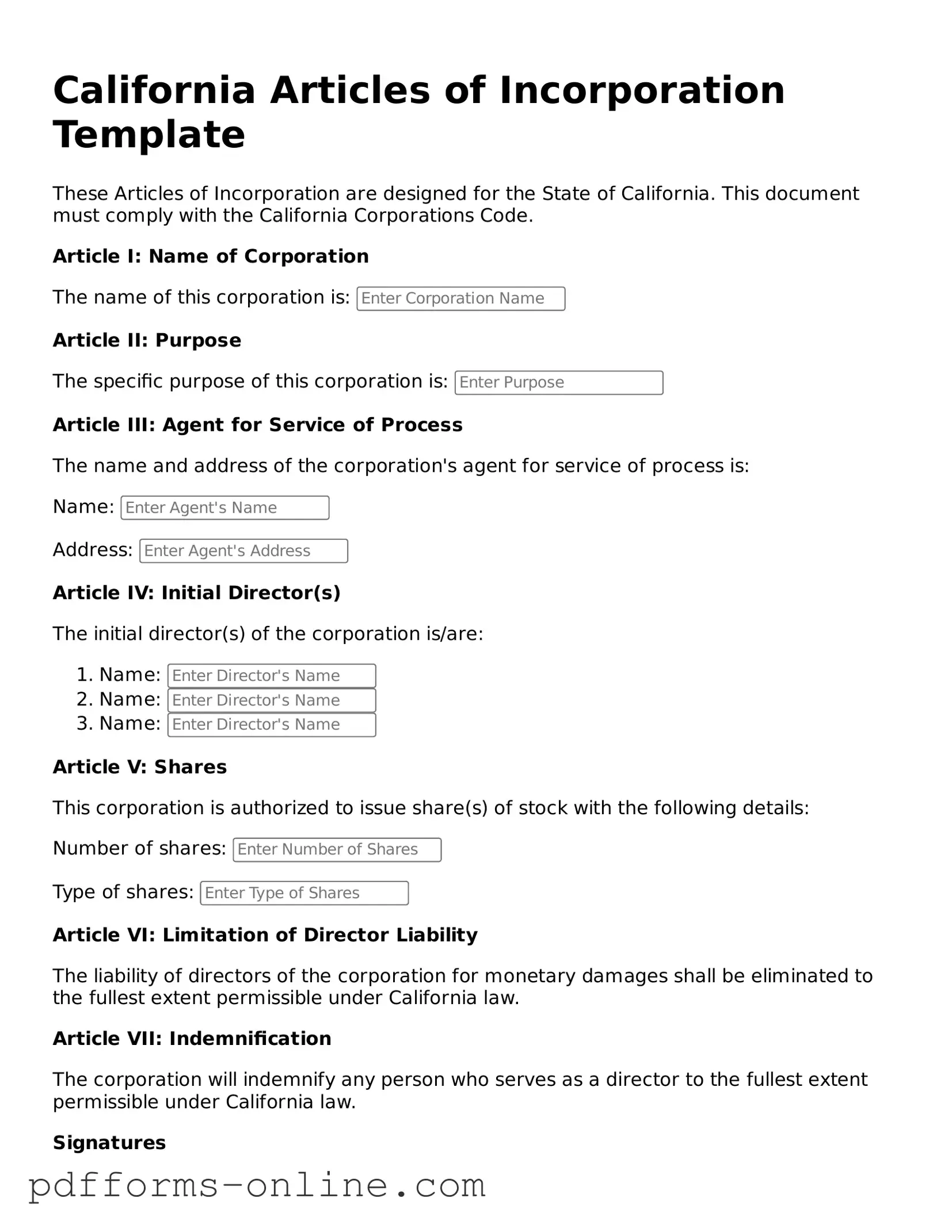

Document Example

California Articles of Incorporation Template

These Articles of Incorporation are designed for the State of California. This document must comply with the California Corporations Code.

Article I: Name of Corporation

The name of this corporation is:

Article II: Purpose

The specific purpose of this corporation is:

Article III: Agent for Service of Process

The name and address of the corporation's agent for service of process is:

Name:

Address:

Article IV: Initial Director(s)

The initial director(s) of the corporation is/are:

- Name:

- Name:

- Name:

Article V: Shares

This corporation is authorized to issue share(s) of stock with the following details:

Number of shares:

Type of shares:

Article VI: Limitation of Director Liability

The liability of directors of the corporation for monetary damages shall be eliminated to the fullest extent permissible under California law.

Article VII: Indemnification

The corporation will indemnify any person who serves as a director to the fullest extent permissible under California law.

Signatures

The undersigned incorporator(s) is/are signing these Articles of Incorporation on this date:

Incorporator's Name:

Date:

Frequently Asked Questions

-

What are the California Articles of Incorporation?

The California Articles of Incorporation is a legal document that establishes a corporation in the state of California. It outlines essential information about the corporation, including its name, purpose, address, and details about its initial directors and stock. Filing this document is a crucial step in the process of forming a corporation, as it provides the state with necessary information to recognize the corporation as a legal entity.

-

Who needs to file Articles of Incorporation?

Any individual or group looking to create a corporation in California must file Articles of Incorporation. This includes businesses intending to operate as a corporation, whether for profit or nonprofit purposes. It is important for the founders to understand that this document is required for the legal formation of the corporation and to gain the benefits of limited liability.

-

What information is required in the Articles of Incorporation?

The Articles of Incorporation must include several key pieces of information:

- The name of the corporation, which must be unique and not already in use by another entity in California.

- The purpose of the corporation, which can be general or specific.

- The address of the corporation's initial registered office and the name of the registered agent.

- The number of shares the corporation is authorized to issue, if applicable.

- The names and addresses of the initial directors.

-

How do I file the Articles of Incorporation?

To file the Articles of Incorporation in California, you must complete the form and submit it to the California Secretary of State. This can be done online, by mail, or in person. Along with the completed form, a filing fee is required. It is advisable to check the Secretary of State’s website for the most current fee schedule and any additional requirements that may apply.

-

What happens after filing the Articles of Incorporation?

Once the Articles of Incorporation are filed and accepted, the corporation is officially formed. The Secretary of State will issue a certificate of incorporation, which serves as proof of the corporation's legal existence. Following this, the corporation must comply with ongoing requirements, such as obtaining necessary licenses, holding initial meetings, and filing annual reports.

Misconceptions

When dealing with the California Articles of Incorporation form, several misconceptions often arise. Understanding these misconceptions can help clarify the process of forming a corporation in California. Here are eight common misunderstandings:

- Incorporation is only for large businesses. Many believe that only large companies can benefit from incorporation. In reality, any business, regardless of size, can incorporate to gain legal protection and credibility.

- Filing Articles of Incorporation guarantees business success. Incorporating does not automatically lead to success. While it provides legal structure and protection, success still depends on effective management and strategy.

- You can use a generic form for Articles of Incorporation. Some think that a generic form will suffice. However, California has specific requirements that must be met, and using the correct form is essential.

- All corporations must have a board of directors. While most corporations do require a board, certain small corporations can operate without one, depending on their structure.

- Incorporation is a one-time process. Many people assume that once they file Articles of Incorporation, they are done. In reality, ongoing compliance and annual filings are necessary to maintain good standing.

- You cannot change your Articles of Incorporation once filed. Some believe that changes are impossible after filing. However, amendments can be made to update or modify the Articles as needed.

- Incorporation protects personal assets from all liabilities. While incorporation provides significant protection, it does not shield personal assets from all types of liabilities, such as personal guarantees or illegal activities.

- Only for-profit entities can incorporate. A common misconception is that only for-profit businesses can file Articles of Incorporation. Nonprofits can also incorporate in California, providing them with legal recognition and protection.

Common mistakes

-

Incorrect Business Name: One common mistake is failing to choose a unique name for the corporation. The name must not be identical or too similar to existing entities registered in California. It’s crucial to check the California Secretary of State’s database to ensure the desired name is available.

-

Missing or Incorrect Address: Applicants often neglect to provide a complete and accurate address for the corporation's principal office. This address is essential for official correspondence and must be a physical location, not a P.O. Box.

-

Improper Designation of Agent for Service of Process: Individuals filling out the form sometimes fail to designate a registered agent. This agent is responsible for receiving legal documents on behalf of the corporation. Not specifying this agent or providing incorrect information can lead to complications in legal matters.

-

Inaccurate Purpose Statement: The purpose of the corporation must be clearly stated. Many people make the mistake of using vague language. A well-defined purpose helps clarify the corporation’s activities and can prevent future legal issues.

Find Some Other Articles of Incorporation Forms for Specific States

Nys Department of State Division of Corporations - The Articles create a clear boundary for corporate activities.

Incorporate Nc - The articles may clarify dissolution procedures for the corporation.

PDF Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Articles of Incorporation establish a corporation as a legal entity in California. |

| Governing Law | The California Corporations Code governs the formation and operation of corporations in the state. |

| Filing Requirement | Corporations must file the Articles of Incorporation with the California Secretary of State to be recognized. |

| Information Required | The form requires basic information, including the corporation's name, address, and purpose. |

| Fees | A filing fee is required when submitting the Articles of Incorporation, which varies based on the type of corporation. |

| Amendments | Changes to the Articles of Incorporation can be made by filing an amendment with the Secretary of State. |

Similar forms

The California Articles of Incorporation form is similar to the Certificate of Incorporation used in other states. Both documents serve the primary purpose of officially establishing a corporation. They require basic information such as the corporation's name, address, and purpose. While the terminology may differ slightly, the underlying goal remains the same: to create a legal entity recognized by the state.

Another related document is the Bylaws of a corporation. Bylaws outline the internal rules and procedures for managing the corporation. While the Articles of Incorporation focus on the formation of the entity, Bylaws provide detailed guidance on how the corporation operates, including the roles of officers and directors, meeting protocols, and voting procedures.

The Certificate of Formation, often used in limited liability companies (LLCs), is akin to the Articles of Incorporation. Both documents are essential for establishing a business entity. However, while the Articles create a corporation, the Certificate of Formation establishes an LLC. The information required in both documents is similar, including the name and purpose of the entity.

The Operating Agreement is another document that parallels the Articles of Incorporation, specifically for LLCs. This agreement outlines the management structure and operational guidelines for the LLC. Like Bylaws for corporations, the Operating Agreement governs the internal workings of the LLC, detailing member responsibilities and profit distribution.

The Statement of Information is also comparable to the Articles of Incorporation. This document is typically filed after the corporation is formed and provides updated information about the business. It includes details such as the names of directors and officers, the business address, and the type of business. While the Articles establish the corporation, the Statement of Information keeps the state informed about its current status.

Another similar document is the Amendment to Articles of Incorporation. This form is used when a corporation needs to make changes to its original Articles. Whether it's changing the name, purpose, or structure, this amendment process ensures that the corporation's information remains accurate and up-to-date, similar to how the original Articles were filed.

Lastly, the Dissolution Certificate is related to the Articles of Incorporation in that it formally ends a corporation's existence. Just as the Articles create a corporation, the Dissolution Certificate serves to notify the state that the corporation has ceased operations. This document ensures that all legal obligations are fulfilled before the corporation is officially dissolved.